It will be a big week for earnings and economic data, likely setting the tone for the coming weeks. It feels like something has fundamentally shifted in this market, which appears to be churning at the top.

Yes, the S&P 500 has managed a gain of roughly 3% since mid-July, making a new high, but the NASDAQ has not made a new high. The technology sector and leading stocks have also struggled to advance.

Additionally, several bearish patterns have emerged in the S&P 500 over the past few weeks.

This past week, a bearish engulfing candle appeared on the weekly chart for S&P 500 futures. The body of this candle engulfs the body of the previous week’s candle, signaling a potential downside risk.

A rising wedge pattern on the weekly chart and a declining RSI trend on the same timeframe are also bearish signals.

The 10-year rate has been trending higher, and this week’s economic data will likely play a significant role in determining whether it continues to rise and heads back to 5%.

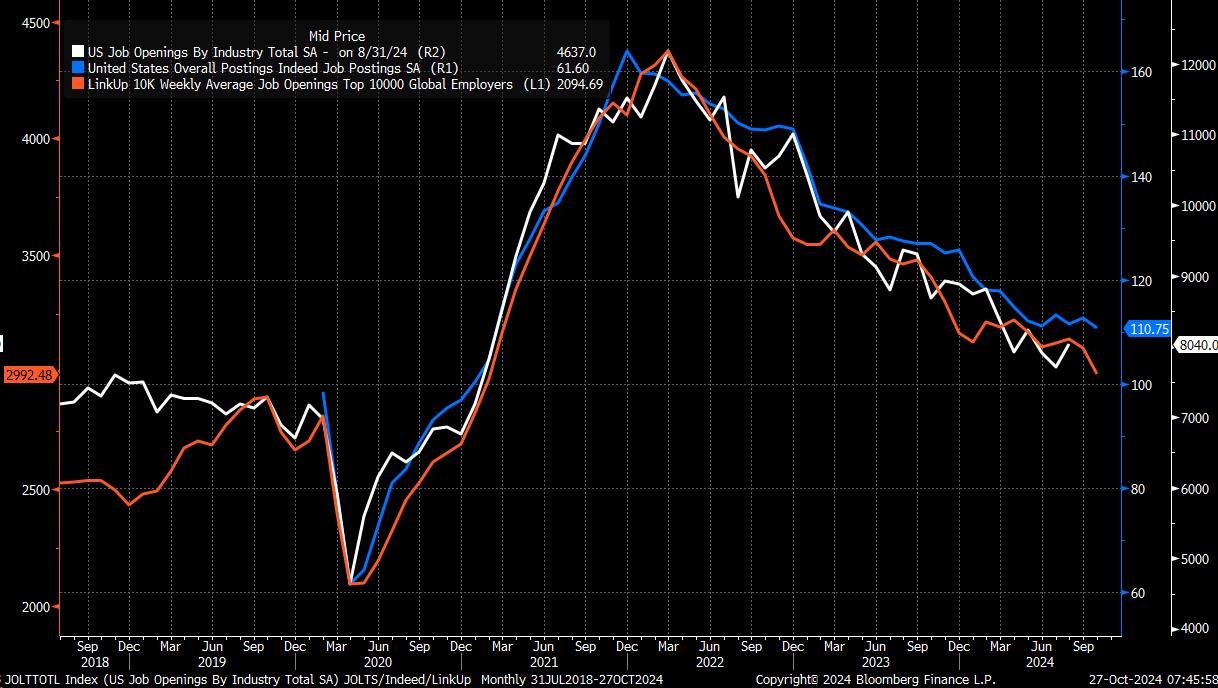

The JOLTS report will kick off this wave of news on Wednesday, with job openings expected to drop to around 7.9 million from 8.0 million.

Data from LinkUp and Indeed show that openings continued to decline in September and October, supporting the likelihood of a drop in JOLTS openings.

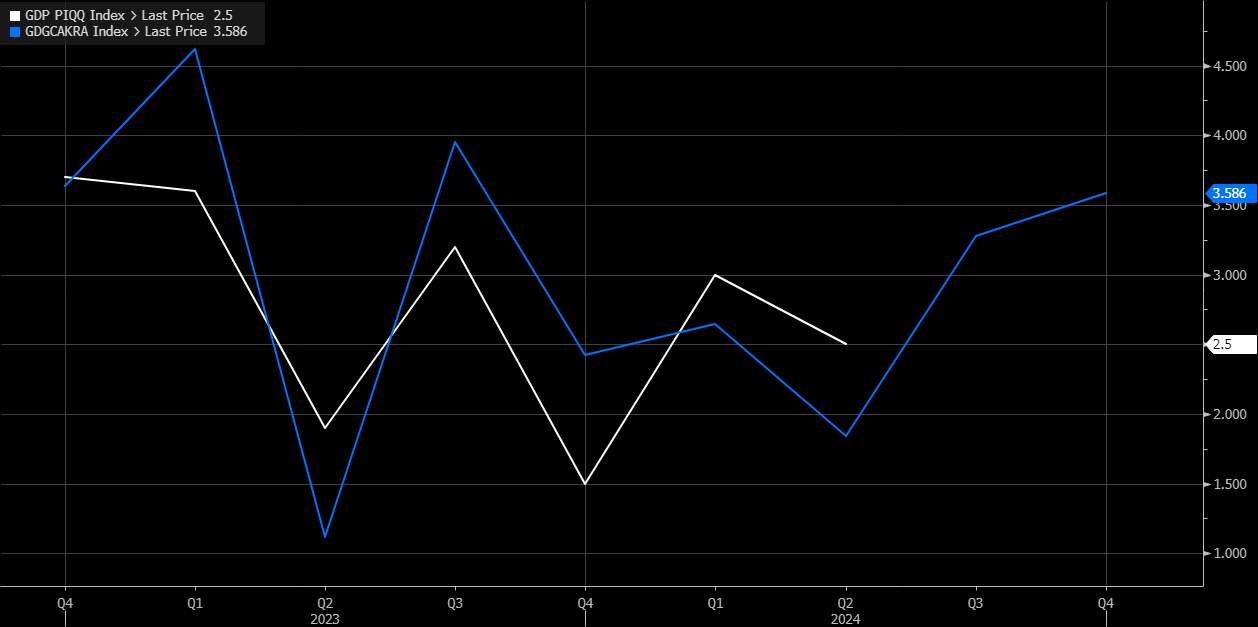

The GDP data comes out on Wednesday, with analysts forecasting 3% real growth for Q3 and a price index of just 2%. This suggests nominal growth slowed to 5% in Q3, down from 5.6% in Q2.

However, the Atlanta Fed’s GDPNow model is projecting 3.3% real growth and a PCE inflation rate of 3.6%, implying nominal growth of 6.9%.

This discrepancy raises questions about accuracy—either analysts’ estimates or the GDPNow model may be off.

A higher-than-expected price index would significantly affect nominal growth and could impact rates. I guess the analysts’ estimates for the price index are too low and may come in higher than the 2% estimate.

The jobs report is due on Friday, with estimates set low at 110,000 due to recent hurricanes and the Boeing (NYSE:BA) strike.

However, the unemployment rate is expected to remain unchanged. Given the history of revisions in these reports, it’s hard to say what the final numbers will show.

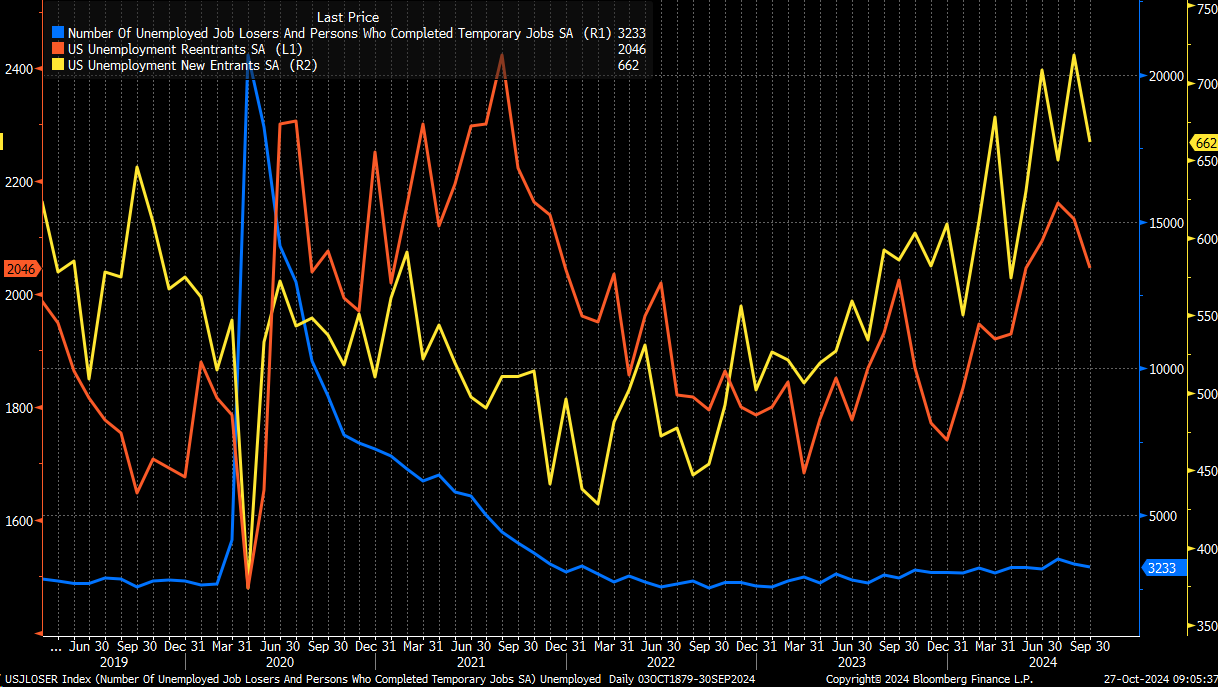

One reason the unemployment rate fell in September was a decline in the number of people losing work and a decrease in new labor force entrants.

The question is whether the number of entrants will fall again this month or increase.

In my view, as new job openings decline, it may take longer for entrants to find jobs, creating a natural bias for the unemployment rate to continue rising until a balance is reached.

There are 2.8 job openings for every entrant into the labor force—down from 3.0 openings in 2018, 2019, and early 2020 (pre-pandemic).

This suggests there are fewer job openings for new workers now than in previous years. My guess is that if the number of job openings declined in September and October based on Indeed and LinkUp data, the number of entrants into the labor force could increase.

Since JOLTS job openings dropped below 9 million, we’ve seen an increase in entrants. We may have reached a point where there aren’t enough job openings to absorb all new entrants every month. We’ll find out more when the job report is released on Friday.