Stocks had a big rally day on Friday, but most of the week was a real struggle. The rally on Friday didn’t help the equal-weight S&P 500 or Russell 2000 finish positive for the week, despite the S&P 500 and the Nasdaq 100 finishing higher by more than 1 and 2%, respectively. It appears to be more of the same, with just a handful of stocks continuing to power the major indexes higher while the rest of the market is left behind.

However, this week will feature a lot of important economic data, including the CPI, retail sales, and the PPI. Additionally, Wed morning will be the OPEX, and Friday will be the monthly OPEX, and all of this combined could leave the markets with big swings.

On top of that, on Friday, Moody’s Put the US credit rating on negative watch, which puts the US one step closer to a credit rating downgrade, which is a pretty big deal and could mean that bond yields start moving higher again. Additionally, Tuesday’s CPI report seems fairly important, given that we are going to see the health insurance component of CPI reset.

Bond yields have already shown some forms of resilience, with the 10-year rate hanging on to support at the uptrend, the 50-day moving average, and the 4.5% level. If the data this week is supportive, and the 10-year can get back above the 4.7% level, it could open the door for a further push higher back to that 5% region. Which, to this point, has been a resistance zone.

Where the 10-year and long-end rates go is important because when rates on the long-end are rising, it means that the yield curve is steepening, and when the yield curve is steepening, stocks struggle. That dynamic has not changed for months, and part of what has gotten the equity market moving higher again is that the yield curve has inverted.

We have seen this before, with bond and stock prices separating for a few days, only for them to come back together again. This happened again this week when we saw bond prices fall again and stock prices move higher. This is an important dynamic because, again, it illustrates that as rates on the back of the curve begin to rise, it will weigh heavily on stock prices, and stock will move lower in conjunction with the bond prices.

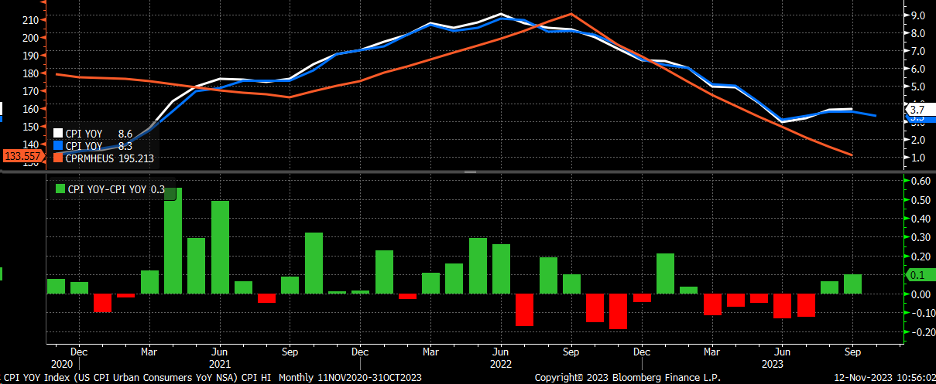

The CPI data on Tuesday is a pretty important data point. I explained in this week’s Free YouTube video and this story that October had been a month of big surprises the past 2-years, and that had been due to the rise and fall in health insurance inflation. Health Insurance inflation is expected to start rising again after falling by almost 40% last year, and the chart below shows the trend in health insurance over the past 2-year appears to be highly correlated to the direction of overall inflation.

So, as I have been saying over the past few weeks if there is a month that inflation could surprise to the upside regarding the CPI, this month’s CPI would be the report.

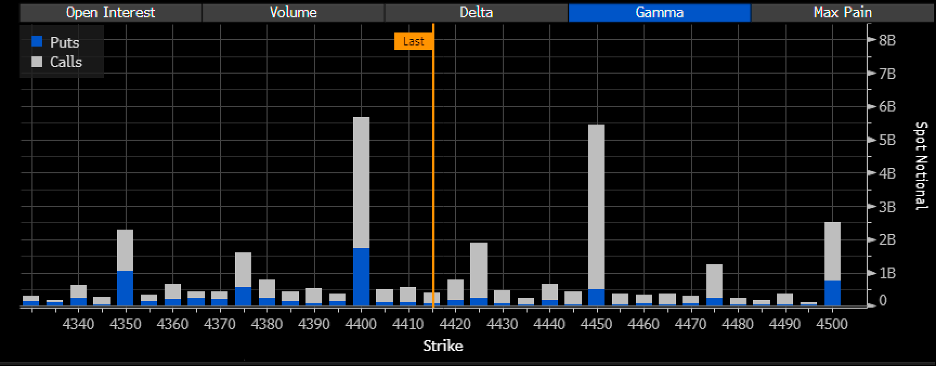

Additionally, with the OPEX this week, at least as of Friday, the big gamma level and call wall remain at 4,400, with the potential for the call wall to have shifted to 4,450. But we won’t know until open interest changes settle on Monday. Still, this is broadly in line with my expectations last week, wth the S&P 500 getting stuck around this 4,400 level.

The move higher on Friday felt more powerful than it was, mostly because of the intraday reversal on Thursday, which really made Friday’s rally rather unusual. Technically, not much changed, with the index moving higher back to the upper trend line, but the broader technical pattern remains. Additionally, Friday’s rally took the S&P 500 to the 61.8% retracement level, which is normal. My view that S&P 500 retraces lower and refills the gaps down to 4,100 doesn’t change.

SMH Rally Driven by Better-Than-Expected October Revenues

However, the rally in the SMH on Friday invalidated the 2b top I mentioned on Thursday, which just turned out to be wrong. The rally was driven by better-than-expected October revenues from Taiwan Semiconductor (NYSE:TSM), attributable to Apple’s iPhone 15.

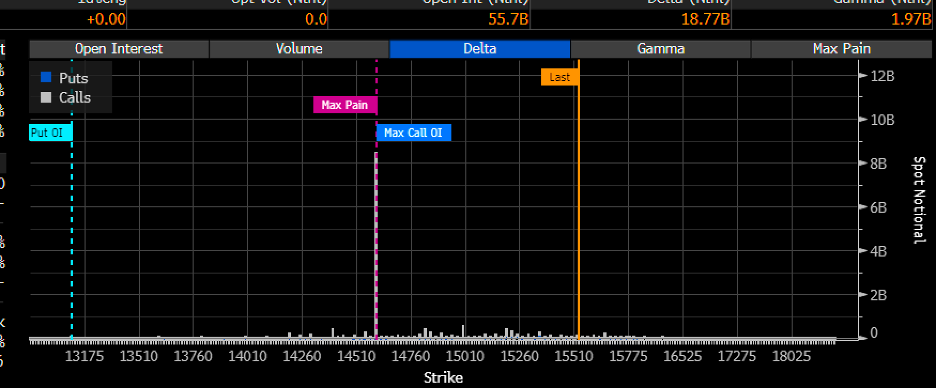

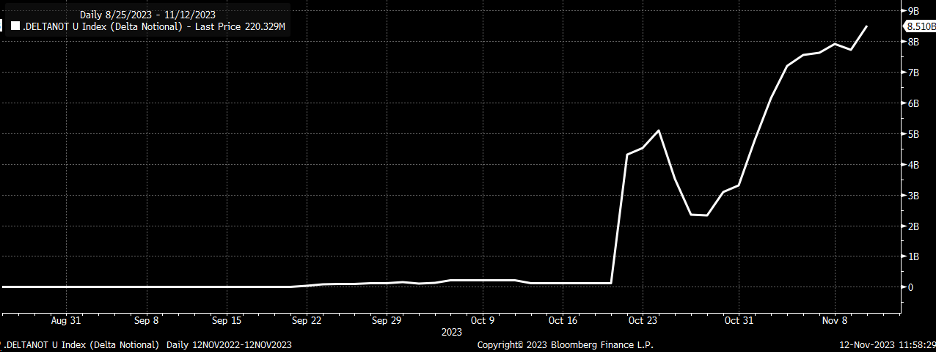

A Huge Call Option Is Set to Expire in the NDX This Week

Finally, a huge call option is set to expire in the NDX this week at the 14,600 strike price. It has an $8 billion notional value assigned to it, with the trade taking place on October 20, with an average price of about $409 per contract. It is the largest option on the NDX, expiring on Friday.

A simple Google (NASDAQ:GOOGL) search for this option shows that the Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) is short these calls. This means a market maker is long the calls and is short the NDX futures or the underlying components within the NDX to hedge their exposure. This could explain some of the strength in the NASDAQ 100 because the hedge must come off when the option is closed.

So, the market may be front-running the unwind of the position, which, according to the prospectus, comes the day before OPEX, which would be this Thursday. It also probably means the ETF will be selling another call option on Friday, which creates a new position for the market maker to hedge against and could create NDX to sell.

THIS WEEK’S FREE YOUTUBE VIDEO:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.