US stocks were on the rise on Friday and so managed to end a week in the black for the first time this year. S&P energy sector was the top performer. It increased 4.3% amid the growth in oil prices by 9%. Compared to the start of the year, the broad market S&P 500 index is 7% lower now. The trading volume on the US exchanges was 9.1bn stocks on Friday which is 14% above the last 20 trading days’ average. Stock market growth was supported by the positive macroeconomic data. The existing home sales rose in December by the record 14.7% to 5.46mln. On November they were at the 19-month low of 4.76mln. Moreover, the preliminary January manufacturing PMI by Markit rose more than expected to 52.7. Apple (O:AAPL) stocks advanced 5.3% on the news it is planning to release new iPhone 7 in September 2016. No significant economic data is expected today in US. The quarterly earnings by Halliburton (N:HAL) oil producer will come out. The US dollar index slightly edged down but stays within the uptrend already for almost 1.5 months.

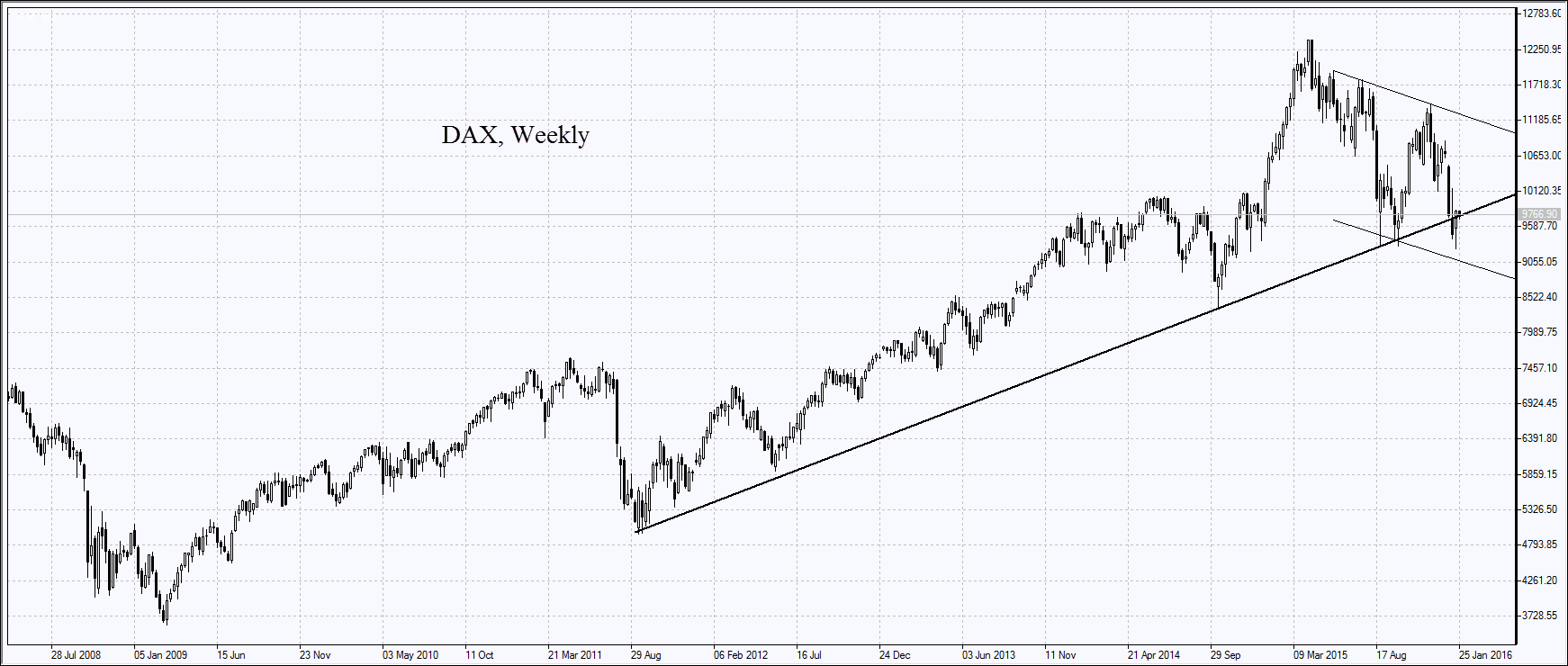

European stocks are correcting down today after the record 2-day growth on Thursday and Friday since 2011. For the first time in 2016, they have closed the last week in the black supported by the ECB comments on the possible further economic stimulus in the EU. Euro slightly edged up today after the S&P 500 rating agency raised the Greece’s credit rating to В- from ССС+. Today at 10:00 CET the IFO economic indicators will be released in Germany.

Nikkei has corrected upwards today after the significant growth on Thursday and Friday which was the strongest since November 2014. The Bank of Japan, following ECB, is planning to expand its bond-buying programme. Currently it is at 80 trn yen a year. The Toshiba (OTC:TOSYY) stocks fell 5.7% to the 7-year low after the Mainichi newspaper forecast the company’s spending to protect assets against their impairment may amount to 160 bn yens. The yen slightly strengthened on the strong foreign trade data for December. Due to the 18% fall in import volume, the positive trade balance of 140.2bn yens was formed instead of the expected deficit.

Oil price has fallen today after the strong growth on Thursday and Friday. The Iran’s oil minister said about the increased production in the central and southern parts of the country to 4.13mln barrel a day, up from 3.66mln barrels in November.

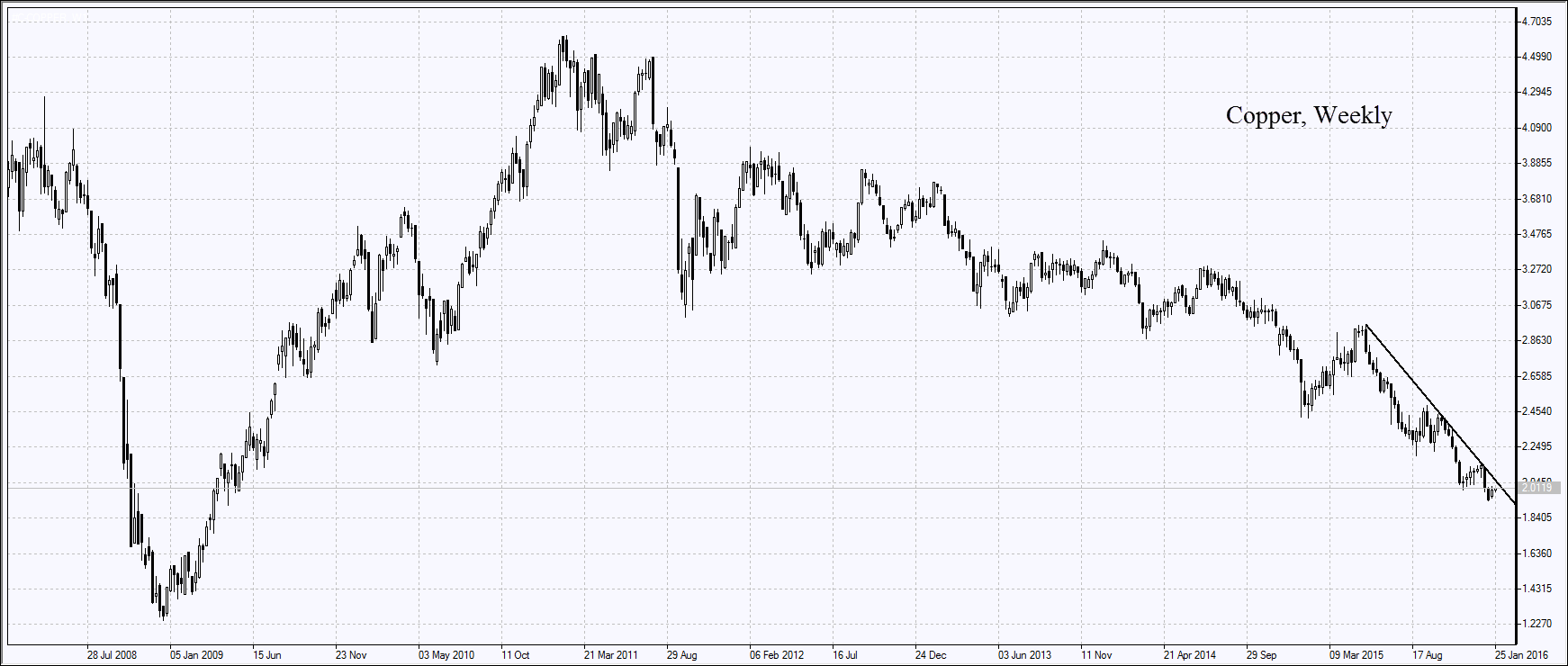

Gold is advancing on Monday. Markets become less confident in the Fed rate hike in the near future amid some signs of the global economic stagnation. The next US watchdog meeting is to take place on Wednesday. On Friday the US GDP for the 4Q will come out. It is expected to increase by 0.8%. According to the current forecasts, the US GDP is to increase by 2.5% in 2016. Some investors are doubtful of it and invest in precious metals. The net longs in gold and silver on COMEX have reached the 2-month high, according to the U.S. Commodity Futures Trading Commission. On the other hand, in copper the net short position was formed. Investors worry the demand for copper may fall amid the slowdown in the Chinese economy.

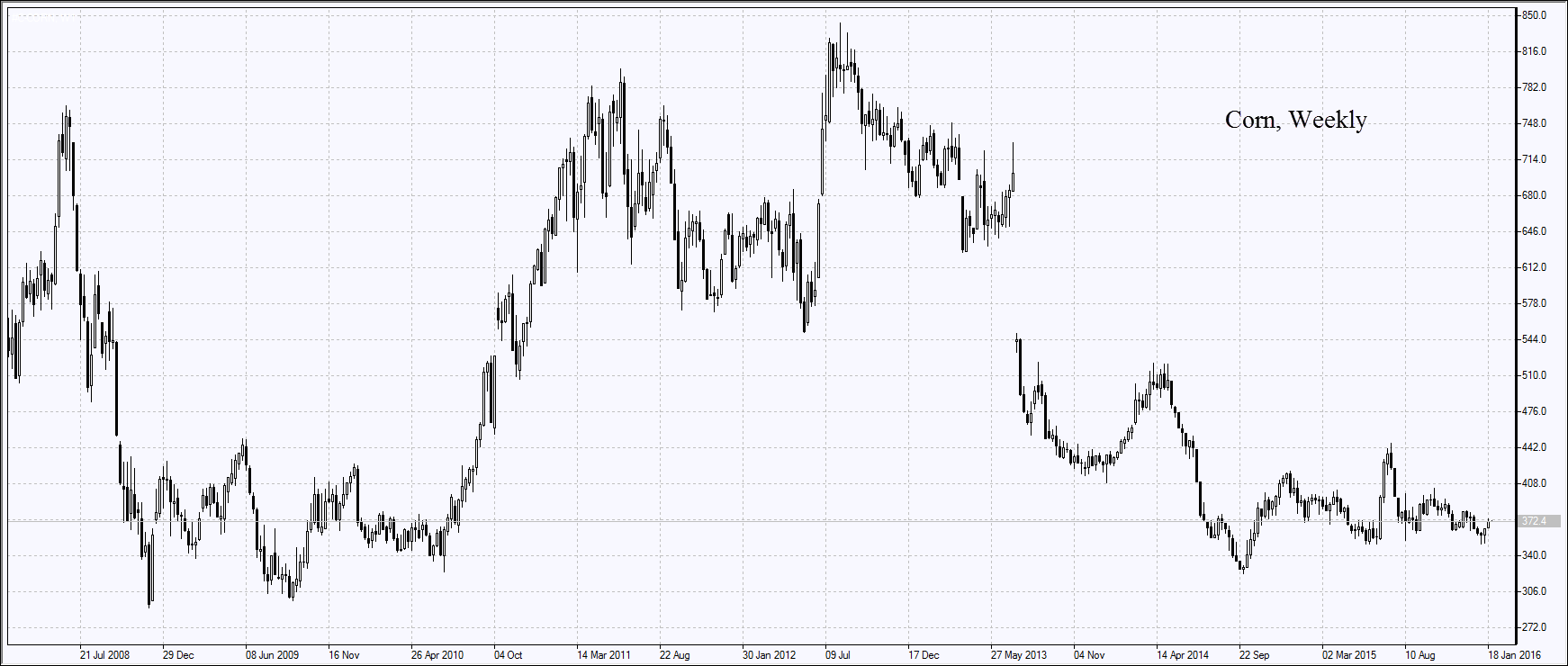

Corn prices reached the monthly axis. The USDA reported its weekly export sales of 2015/16 crops totaled 1.158mln tonnes which is the 8-week high. Moreover, 189 thousand tonnes of 2016/17 crops were realized. Wheat prices advanced as well due to the extremely cold weather in the Black Sea region which may affect the wheat crops in Ukraine and Russia. Soybeans rose in price less thanks to the favourable weather in Brazil.