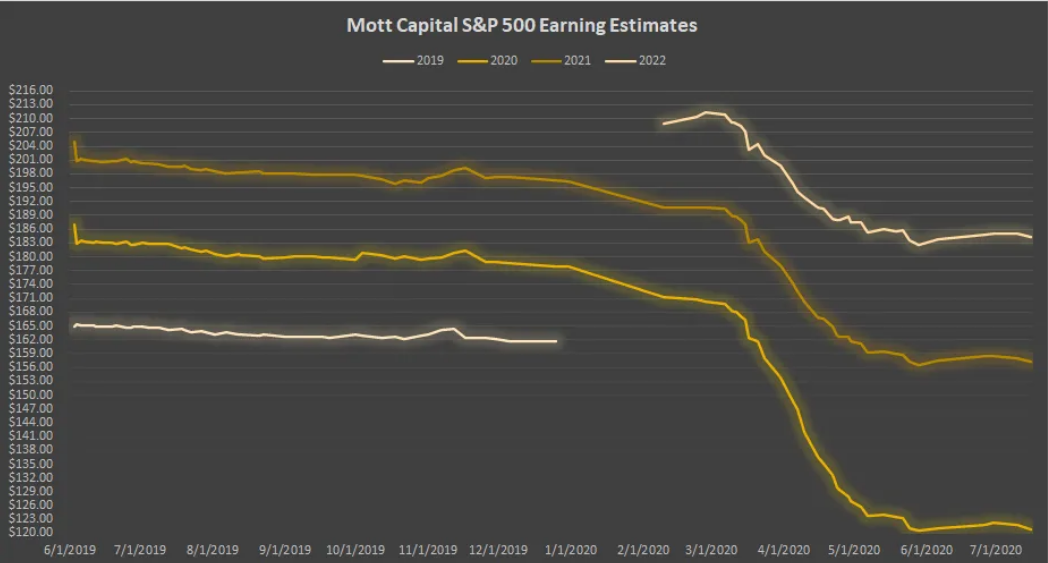

Taking a longer-term viewpoint on the market, meaning more than a year out, it seems that for stocks to continue to rise, they will have to do it without the benefit of fundamentals. It will need to all come in the form of multiple expansion, which will not be easy given multiples are already higher. Now that we have passed the mid-point of 2020, it seems appropriate to begin to focus more on 2021 and the possibilities for 2022.

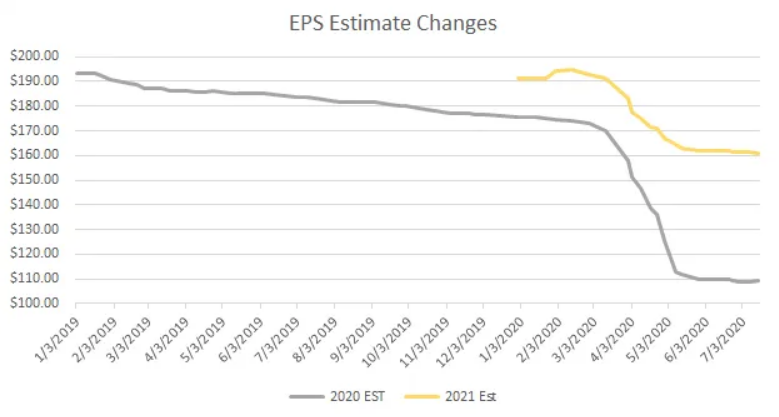

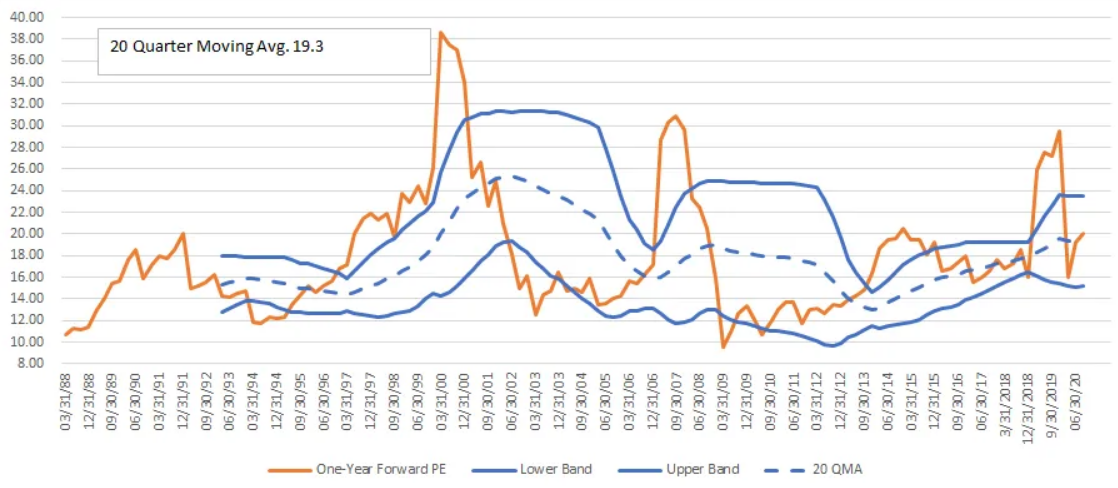

The latest estimates are out from S&P Dow Jones, and their forecasts for 2021 continue to come down. Currently, they are forecasting earnings of $160.89 per share, which would be higher than 2019’s earnings of $157.12. It means, with the S&P 500 trading at 3,224, the market already has a PE ratio of 20.0. Again, this is historically a very high multiple. Since 1988, the S&P 500 on average has traded at 17.9 times one year forward earnings. The 20 quarter moving average for the one-year forward PE ratio is 19.3.

Sales and Margins

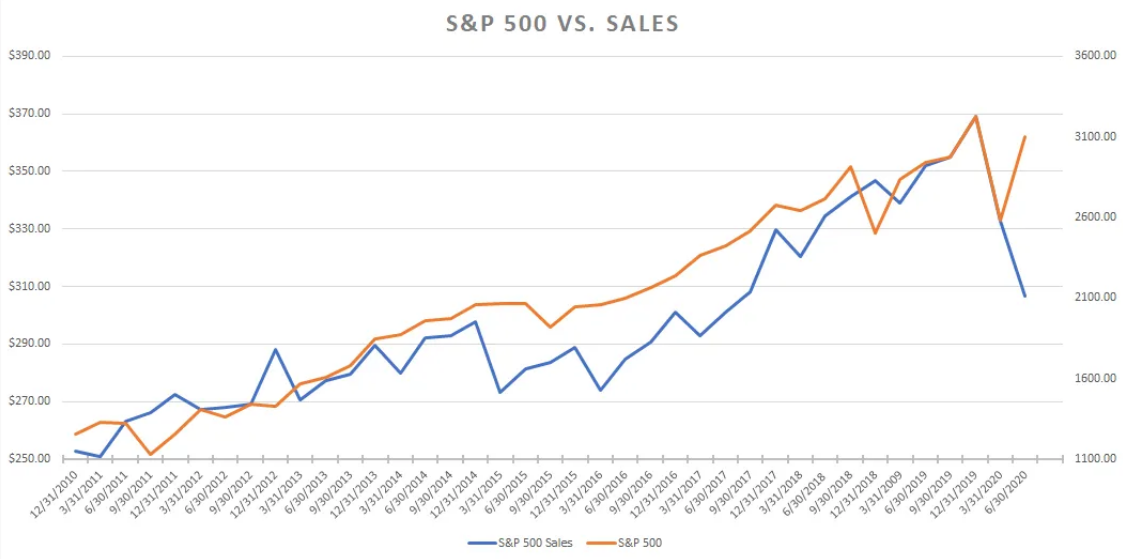

But the bigger problem for stocks will not be earning, it will be revenue. Sales took a tremendous hit in the first quarter, and so far, with 45 companies having reported, sales are estimated to have plunged to levels not seen since September 2017 at $306.56 per share, down almost 13% versus last year.

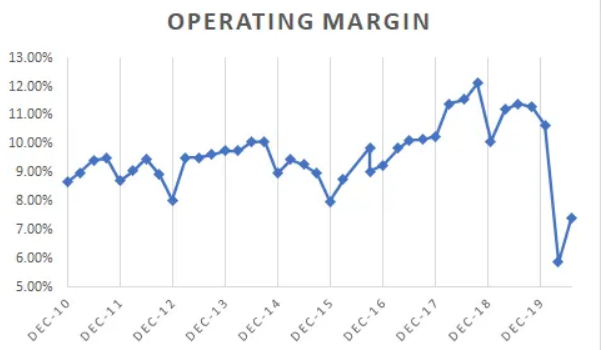

That means to get back to earnings of over $160 by the end of next year; it is going to take a tremendous rebound in sales and margin expansion. The other problem is that margins have been hit equally as hard, falling to 5.9% in the first quarter, and very early in the second quarter they have recovered to 7.4%. These are still very low; it is the weakest margins over the past decade.

Low Rates?

The huge earnings growth over the past few years came at the hands of both sales growth and margin expansion. In the absence of higher margins or higher sales, then the only way the S&P 500 can push to new highs is through multiple expansion. While some would suggest that low-interest rates provide the tailwind for multiple expansion because there is no alternative, in Germany, were the 10-year rate is negative, the data from Thomson Reuters shows that the DAX trades or 19.3 times one-year forward earnings estimates. At the same time, the Nikkei in Japan trades for 21.5 times 2021 earnings estimates, where it also has negative rates. How much more multiple expansion we can expect to see for the S&P 500 may be more limited than we think. Yes, using the multiple of Japan, at 21.5 times 2021, earnings estimates of $160.89 an S&P 500 at 3,459. That’s assuming earnings estimates for next do not continue to decline.

2022

When looking further out, I have modeled earnings for 2022, and I am estimating earnings grow to 185.12 using bottom-up analysts consensus estimates. Those estimates, like everything else, had fallen dramatically since the beginning of the year when they were well over $200 per share. It means that the S&P 500 is already trading at 17.5 times 2022 earnings estimates.

It indicates that there is very little room left for multiple expansion for 2022 estimates using the historical average of 17.9. It would bring the valuation up to around 3,332. But we usually would not expect to see the S&P 500 trading at this type of earnings multiple until entering the next calendar year. Again, this would suggest that the index is likely at the upper end of its trading range. Of course, that assumes earnings estimates do not continue to fall.

It seems that the S&P 500, at this point, is closer to being at the upper end of its trading range for some time to come with perhaps room to rise another few percentage points. However, the greater risk may be for a lower market, then a higher one.