Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

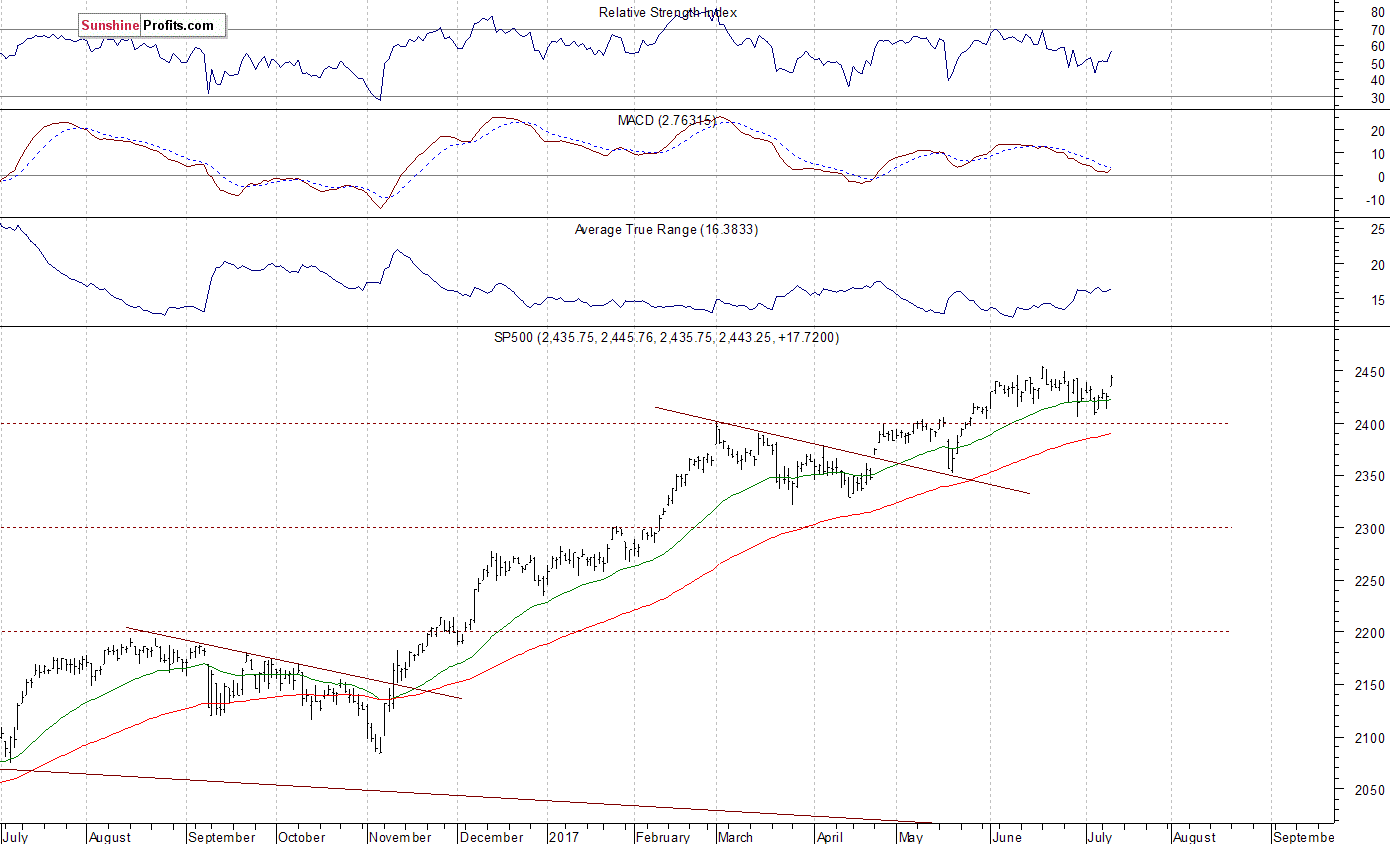

The main U.S. stock market indexes gained between 0.6% and 1.1% on Wednesday, breaking above their recent trading range, as investors' sentiment improved following economic data releases, Fed's Janet Yellen's Congressional Testimony. The S&P 500 index got close to its June 19 all-time high of 2,453.82. It trades just 0.4% below that record high. Stocks have rebounded following their early July move down. The Dow Jones Industrial Average was relatively weaker than the broad stock market yesterday, as it gained 0.6%. However, it reached new record high at the level of 21,580.8. The technology Nasdaq Composite was relatively stronger again, as it gained 1.1%. It has retraced more of its recent move down. The nearest important support level of the S&P 500 index is at around 2,430-2,435, marked by yesterday's daily gap up of 2,429.30-2,435.75. The next support level remains at 2,400-2,410, marked by the May 25 daily gap up of 2,405.58-2,408.01, among others. On the other hand, level of resistance is at 2,450-2,455, marked by all-time high. There have been no confirmed negative signals so far. However, we can see overbought conditions and negative technical divergences. The S&P 500 index is trading within its over month-long consolidation, as we can see on the daily chart:

Closer To Record High

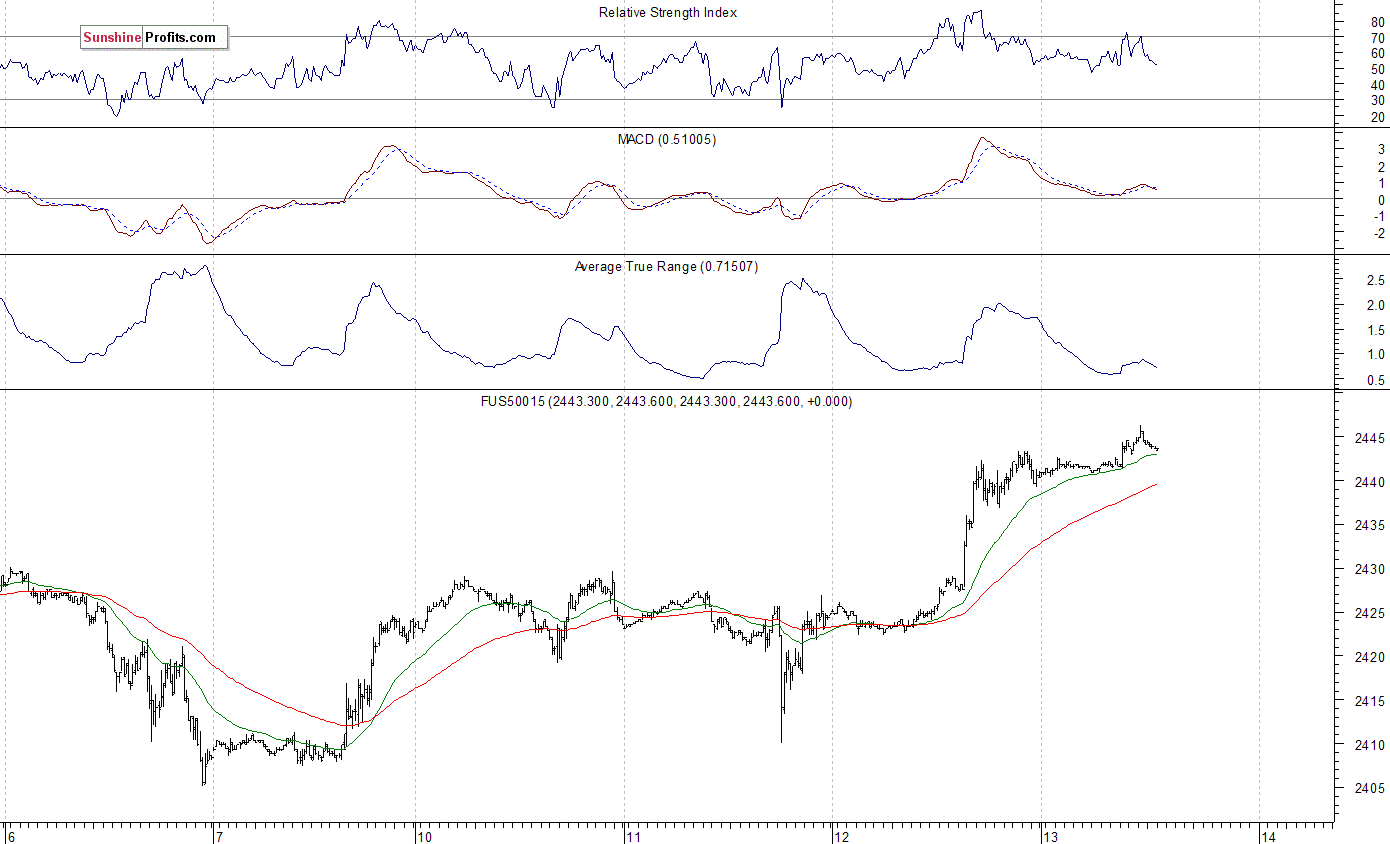

Expectations before the opening of today's trading session are positive, with index futures currently up 0.1-0.3% vs. their Wednesday's closing prices. The European stock market indexes have gained 0.1-0.6% so far. Investors will now wait for some economic data announcements: Initial Claims, Producer Price Index at 8:30 a.m. The market expects that Initial Claims were at 245,000 last week, and Producer Price Index fell 0.1% in June. The S&P 500 futures contract trades within an intraday consolidation, following an overnight move up. The market continued its yesterday's rally. The nearest important level of resistance is at around 2,445-2,450, marked by record high. On the other hand, support level is at 2,440, and the next support level is at 2,420-2,430, marked by recent consolidation. Will the market continue towards new all-time highs? Or is this some topping pattern before downward reversal?

Techs March Higher

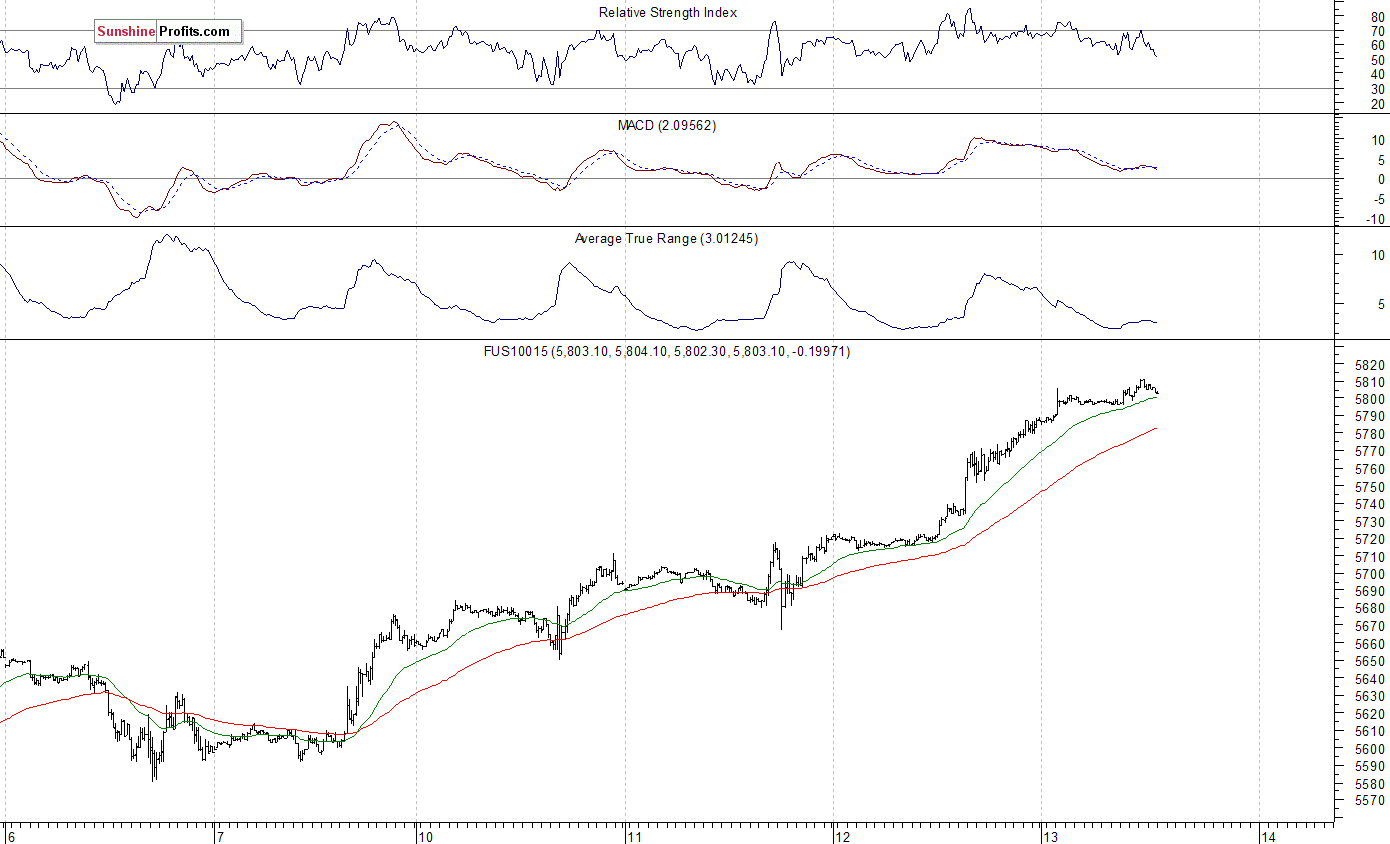

The technology Nasdaq 100 futures follows a similar path, as it trades within an intraday consolidation. The Nasdaq extends its short-term uptrend. The nearest important level of resistance is at around 5,850, marked by previous local high. On the other hand, support level is at 5,750-5,800, and the next level of support remains at 5,700-5,720, as the 15-minute chart shows:

Concluding, the S&P 500 index broke above its recent trading range yesterday, as investors' sentiment improved. Will uptrend continue towards new record highs? Or is this some topping pattern within an over-month long consolidation? There have been no confirmed negative signals so far. However, we still can see negative technical divergences, along with some medium-term overbought conditions.