Stocks are trading mostly higher today, with the SPY up about 29 bps and the Qs up 40 bps. Today is Friday, and we typically have a positive bias to Friday because investors are flooding the market to get ahead of those big Monday moves higher. There may be some volality today, with it being an options expiration date.

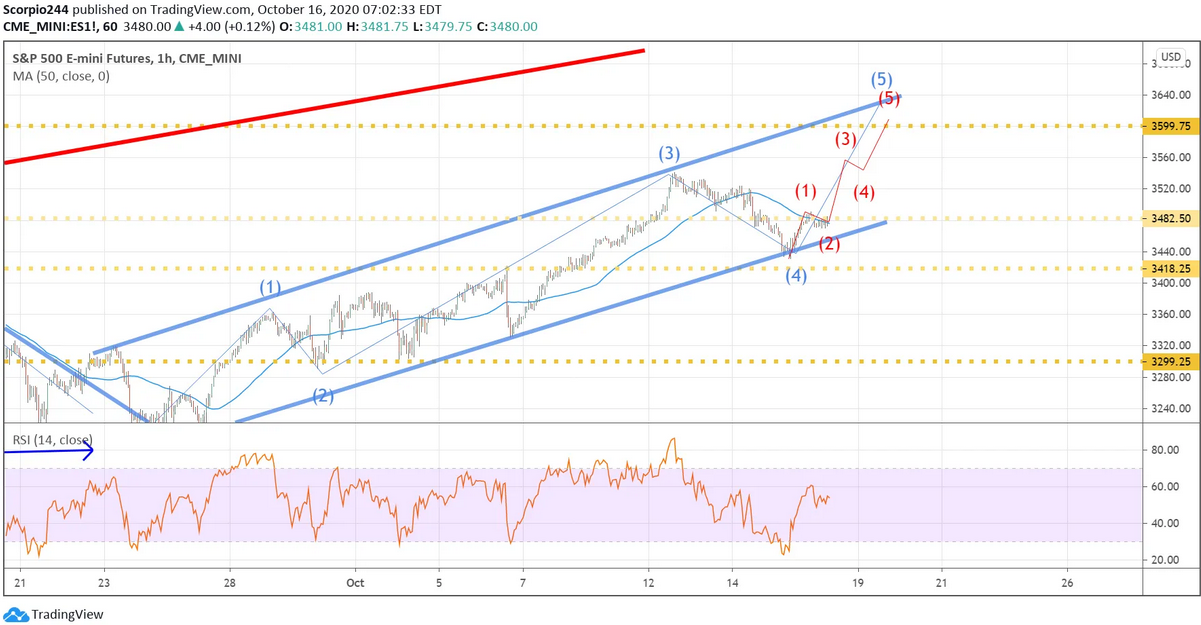

S&P 500

It seems at this point, the path higher in the S&P 500 remains in place. But again, I think this is short-term in nature, and I am growing weary of what’s to come. Whether the election is the trigger or something else, I do not like what I see taking place globally.

South Korea

The South Korean KOSPI has a sickly looking shape to it. Potentially, a triple pattern or head-and-shoulders pattern forming. Both are bearish reversal patterns, and neither are good. Until the index falls below 2,775, we don’t have to worry, but we need to watch for now.

Germany

Meanwhile, 10-year yields continue to move lower in Germany, now at negative 63 bps.

Again, these two markets are on opposite sides of the world, and neither tell a good tale. It is not unusual to see bond yields lead equity prices lower; you can see what happened during previous periods.

Pfizer

Pfizer (NYSE:PFE) is rising today as the company noted it could file for emergency use of its Covid-19 vaccine by late November. The stock really struggles to get above $39.25. At one point, I thought it could rally beyond that price; maybe this news can finally get it over.

Zoom

Zoom (NASDAQ:ZM) is heading higher again today. Maybe it is changing the world; everyone uses it. It has a $152 billion market cap, but analysts still estimate that it will generate $3.78 billion in 2023. So, where’s the disconnect? Are analysts unable to see the huge revenue opportunity for the company? Or is the market just trading the stock with no idea of what the future actually holds? Somebody is wrong somewhere; that is the only thing that is clear to me.

Uber

Uber (NYSE:UBER) is rising today, and yesterday I noted some bullish betting in the options in this free story. A move back to $38.25 doesn’t seem too far fetched.