Monday April 17: Five things the markets are talking about

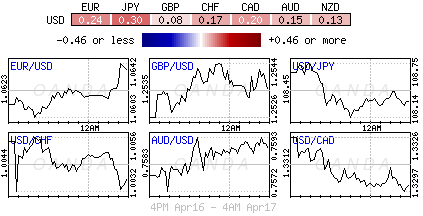

Global equities and the ‘mighty’ dollar have again dipped overnight while U.S Treasury yields have fallen to new five-month lows after soft U.S data on Friday hurts investor sentiment already in distress by worries over North Korea and upcoming French elections.

Note: U.S. retail sales dropped more than expected in March (+0.0% vs. +0.2%) while annual core inflation slowed to +2.0%, the smallest advance since November 2015, from +2.2% in Feb.

A raft of Chinese economic data (see below) beat market expectations, but did not produce a notable market reactions, as investors had been already optimistic following a recent string of positive China numbers.

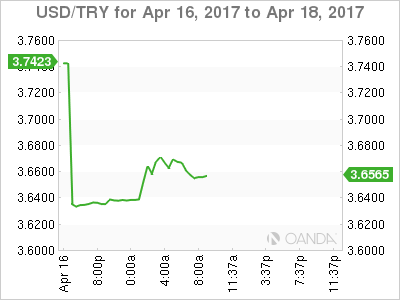

In Turkey, President Erdogan snatched a victory in a referendum Sunday to grant him sweeping powers in the biggest overhaul of modern Turkish politics.

Note: Markets in Australia, New Zealand and Hong Kong, as well as most European exchanges, are closed for Easter Monday.

1. Global equities under pressure

Stock markets across Asia ended mostly lower overnight, as China’s securities regulator urged tighter supervision of listed companies, while geopolitical tensions in Korea continued to discourage investors from buying.

Japan’s Nikkei Stock Average opened lower, but later recouped the declines to end up +0.1%, snapping a four-session losing streak – the yen (¥108.76) spiked to new yearly highs (¥108.13).

In China, investor market sentiment has worsened over an escalating regulatory crackdown on stock manipulation, despite stronger-than-expected economic data for the Q1. The Shanghai Composite Index ended down -0.7%, while the Shenzhen Composite Index lost -1.4%.

Elsewhere, Singapore’s Straits Times Index lost -0.9%, while Taiwan’s Taiex ended down -0.2%.

In Turkey, the Borsa Istanbul 100 Index climbed +0.6% – the highest level in more than two-years after President Erodgan’s referendum victory yesterday (see below).

In Europe, markets remain closed due to Easter Monday holiday.

U.S stocks are set to open in the ‘red’ (-0.1%).

2. Oil falls after failed North Korean missile test, U.S rig count gains

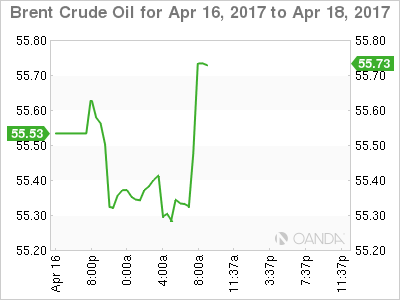

Crude oil prices are again under pressure overnight in quiet trading after the Easter break on signs that the U.S continues to add output, undermining OPEC efforts to support prices, and as the market digest North Korea’s failed missile launch yesterday.

Ahead of the U.S open, Brent crude futures are down -56c at +$55.33, while West Texas Intermediate (WTI) crude futures are down -51c at +$52.67 a barrel.

Note: Both benchmarks last week rose for a third consecutive week, with Brent adding +1.2% over the four days (Good Friday holiday) while WTI was up +1.8%.

Last Thursday’s Baker Hughes (energy services) report indicated that drillers added +11 oil rigs in the week to April 13, bringing the count up to 683, highest in about two-years.

Note: The latest EIA report shows that U.S crude oil production has climbed to +9.24m barrels per day (bpd), making it the world’s third-largest producer after Russia and Saudi Arabia.

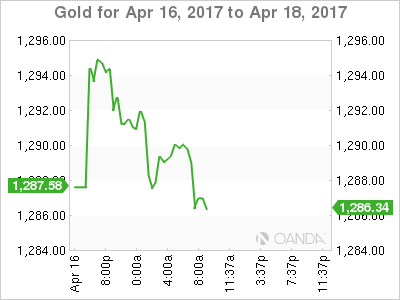

Gold prices hit a five-month high overnight (+$1,295.42 an ounce) as the dollar weakened with investors taking refuge in safe-haven assets in the wake of rising geopolitical tensions over North Korea.

The ‘yellow’ metal last week rose +2.5%, posting its biggest weekly gain in 10-months.

3. Global yield curves flatten

Last Friday’s disappointing U.S data (retails sales and CPI) has helped to drive down the U.S 10-year Treasury yield to +2.20%, its lowest level since mid-Nov.

In March, U.S 10’s were trading atop of +2.6% on expectations of a Trump stimulus package. However, with Trump expected to struggle to push any tax cuts and fiscal spending programs through Congress has supported the markets unwinding of the “Trump” trade.

Current Fed fund futures for June are now pricing in less than a +50% chance of a rate hike in its June 13-14 meeting for the first time in about a month.

Elsewhere, geopolitical and French Presidential election risks have seen the yield on 10-year Bunds fall over -33 bps from its mid-March peak of +0.51% to +0.18%.

The gap between French and German 10-year borrowing costs, an indicator of concerns over the election, is at +71.4 bps, +4 points off one-month highs hit earlier last week.

4. Dollar under geopolitical pressure

The Turkish Lira (TRY) has rallied over +2.4% outright in the wake of this weekend’s referendum to expand the executive powers of President Erdogan.

While the “Yes” vote was deemed victorious, the margin of victory at 51.3% vs. 48.7% opposed was well below the 55% mandate predicted by Erdogan and is expected to be challenged by the opposition.

Note: Under upcoming constitutional changes, the winner of next election in 2019 will “gain full control of the government, ending the current parliamentary system, which treated office of the president as a role without full executive authority.”

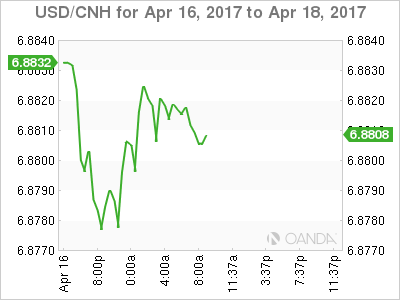

The USD is trading a tad softer across the board after last week’s release of March CPI and retail sales data both underwhelmed. Fixed income dealers are paring back the probability of another Fed rate hike in June.

The EUR is trading +0.2% higher at €1.0630 in quiet trading with most European markets remaining closed for Easter Monday holiday. USD/JPY is trading softer, down -0.3% at ¥108.32. Expect geopolitical worries to continue to support the yen’s strength.

5. China data beats expectations

Over the weekend, China economic data offered some positive surprises – GDP, industrial output, and retail sales for Q1 all topped consensus to hit multi-month rates of growth.

Note: The world’s second-biggest economy accounted for about one-third of global growth last year and, given the strong Q1, is on track to contribute at least as much this year.

Digging deeper, Q1 GDP y/y rallied to a six-quarter high of +6.9%. Consumption accounted for +77.2% of that growth, up from +64.6% in 2016. Fixed asset investment rose over +10% as property investment value rose +9%, sales value rose +25% and construction up +11%.

Industrial output growth was similarly impressive, rising at the fastest pace in three-years. Power generation was up +7%, while coal and steel output were both up +2% despite the recent production curbs. While March retail sales y/y was +10.9% vs. +9.7%e (3-month high).