Investors have been fixated on the NASDAQ and tech stocks this year. And rightfully so.

The NASDAQ has been the market leader, with stocks like Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Facebook (NASDAQ:FB), and Amazon (NASDAQ:AMZN) flying higher.

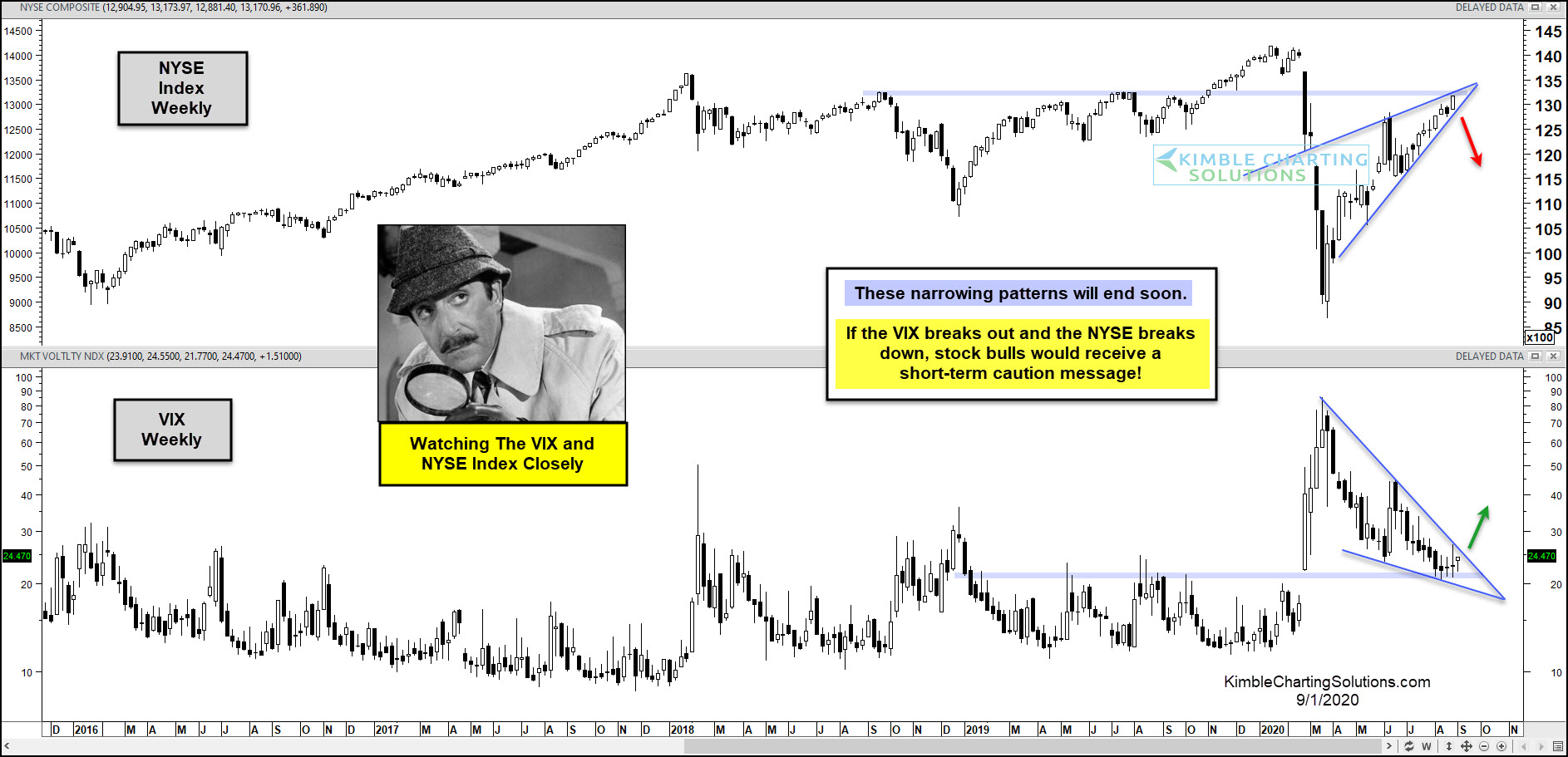

But another important index may be flashing caution: The NYSE Composite.

This broad-based index has been lagging behind the NASDAQ and S&P 500. And it’s narrowing pattern looks to resolve itself soon.

As you can see in today’s chart 2-pack, the NYSE may be on the verge of breaking down at the same time that the VIX Volatility Index is on the verge of breaking higher.

Both narrowing patterns are sure to resolve themselves soon, so it seems wise to keep an eye on them.

Should the VIX Volatility Index break out at the same time that the NYSE Composite breaks down, a short-term caution message will be sent to investors and the broader stock market.

Stock market bulls would receive a very positive message if the lagging NYSE index breaks to the upside and the VIX breaks down!