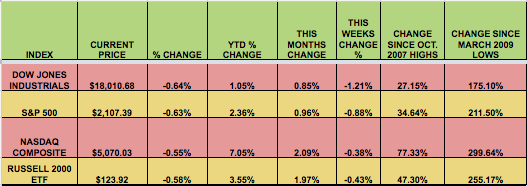

Markets: It was a down week for all 4 indexes this week. The market actually outperformed its historic May averages. The NASDAQ remains the leading index of this group by far, up over 7% year to date.

Market Breadth: Only 5 of 30 DOW stocks rose this week, vs. 14 last week. 21% of all S&P 500 stocks rose this week, vs. 53% last week.

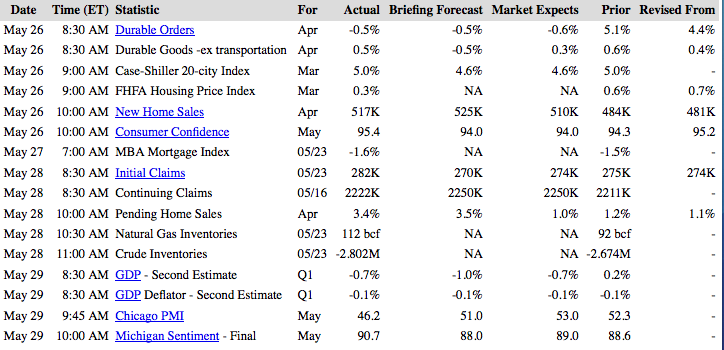

US Economic News: The Housing Recovery got more good news this week, as New and Pending Home Sales, and the Case Shiller US index all surprised to the upside. Core Durable Goods Orders also surprised to the upside, as did Consumer Confidence and Sentiment. Q1 GDP 2nd Estimate was worse than the 1st Estimate – down -0.7%, due to bad weather, and a strong dollar.

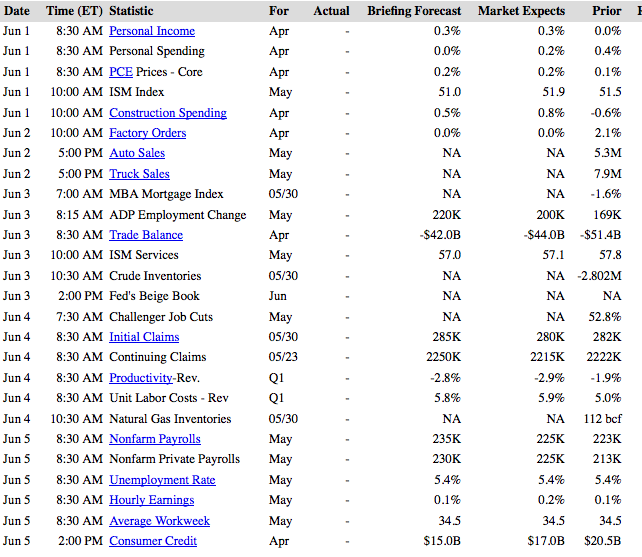

Week Ahead Highlights: It’ll be a data-heavy week, with the closely watched Non-Farm Payrolls report coming out on Friday. (Reuters) Investors are closely awaiting next week’s (comes out Tuesday) May sales data for US Auto makers, which is expected to come in near record levels. Meeting those forecasts could be enough to lift the sector – among the cheapest in the market – putting the sting of product recalls and tepid recent growth in the rear view mirror. Weak auto results contributed to flat overall retail sales in April, but May is expected to represent a rebound. Lower gas prices could boost demand for sports utility vehicles and trucks, which have higher price tags and better margins.

There is also pent-up demand for new vehicles, as consumers have been holding on to their cars for longer since the financial crisis. The average age of U.S. cars is now between 10 and 11 years.

Next Week’s US Economic Reports:

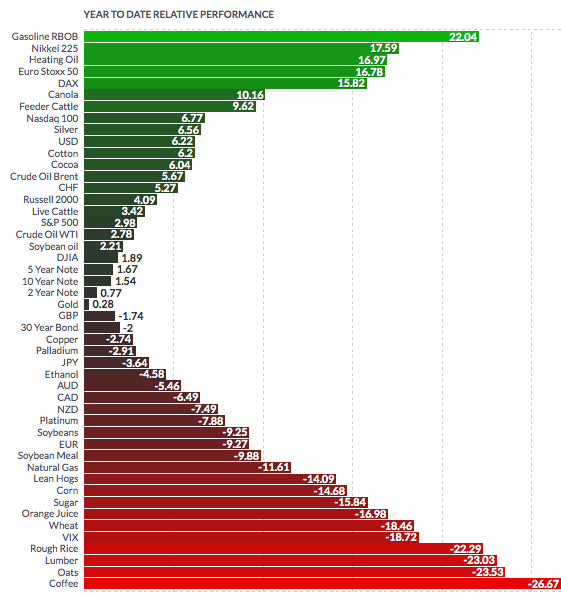

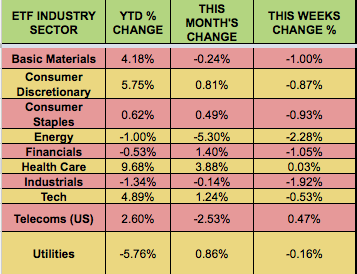

Sectors & Commodities:

Healthcare led this month, and continues to lead year to date, while Utilities trail.

Gasoline and heating oil Futures are big winners year-to-date, while crude has put together a multi-week rally.