Stocks are rising here in the U.S., with the S&P 500 ETF (NYSE:IVV) up about 17 bps, and the Qs up about 10 bps. We will see where this goes, but trading overseas hasn’t been particularly strong, with Hong Kong trading lower and Germany up about 30 bps.

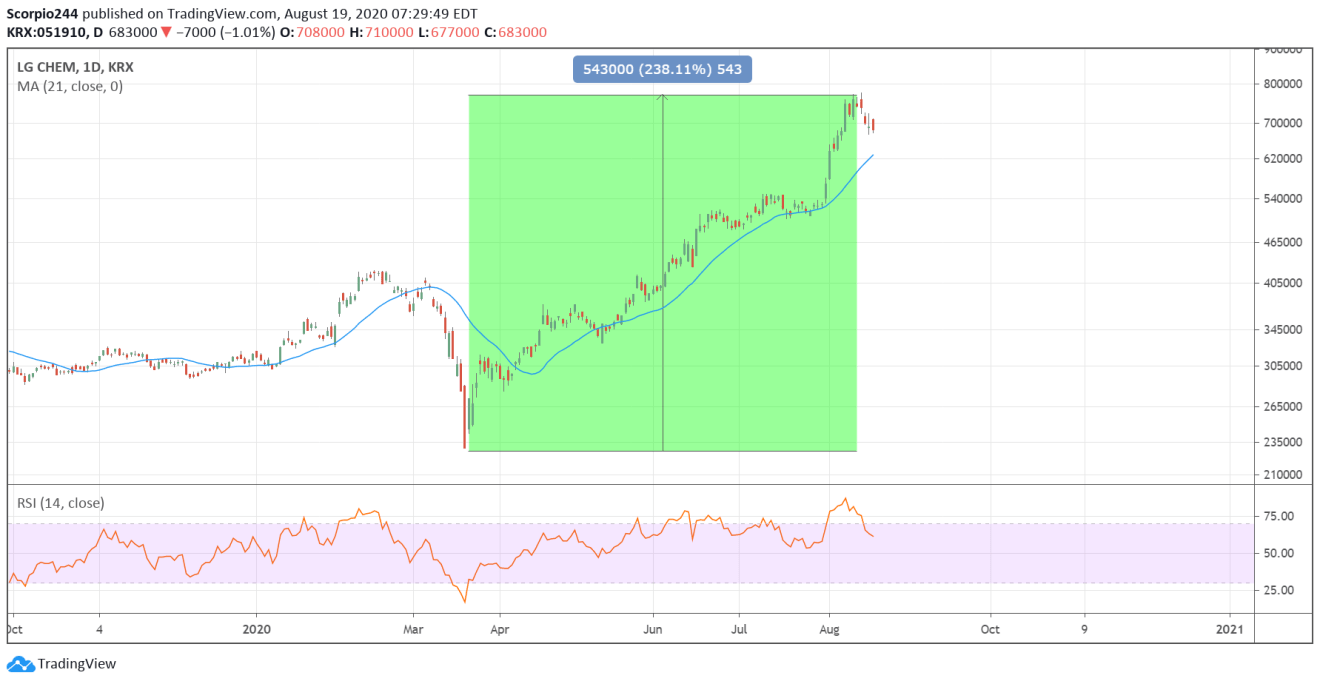

I have been particularly interested in watching LG Chemicals (KS:051910) in Korea, and Tencent Holdings Ltd (HK:0700) in Hong Kong. The chart of LG Chemical is breathtaking, but the turn lower is equally as scary. The stock could easily fall 25% from where it is and still be up tremendously. This, to me, maybe one of the critical sentiment stock that needs to be followed.

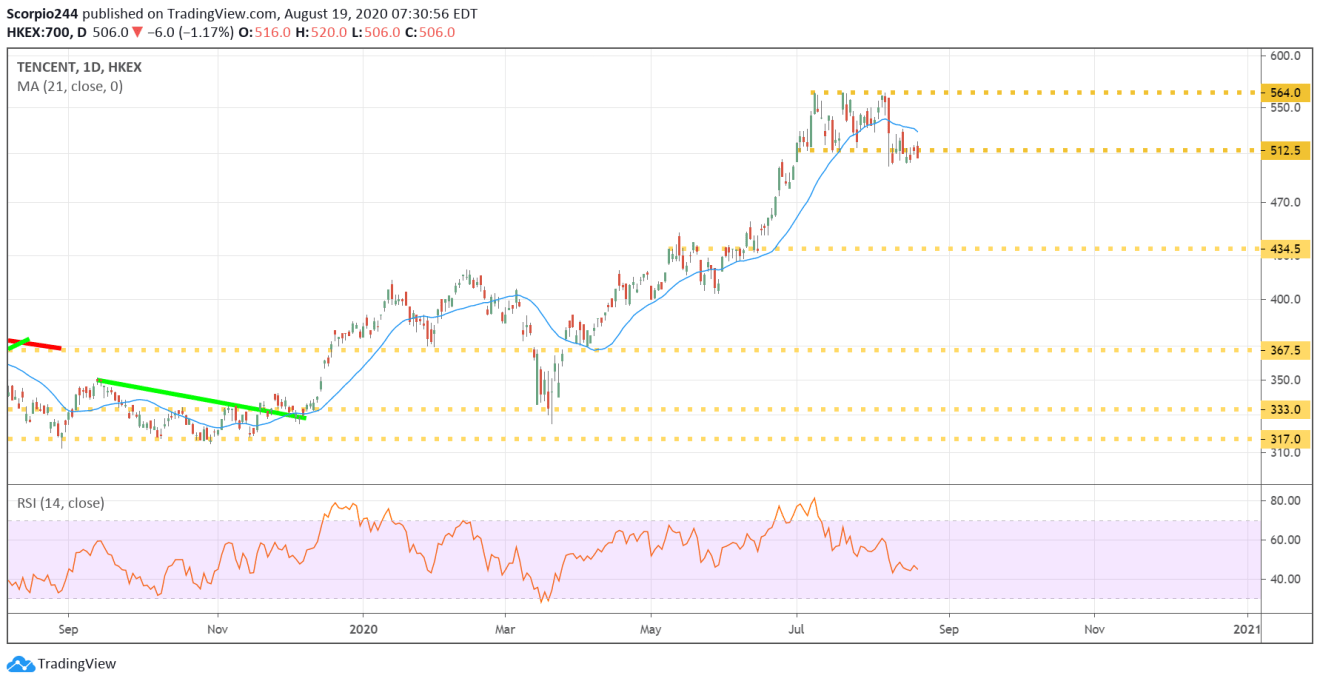

Meanwhile, Tencent continues to teatter on what could a massive decline.

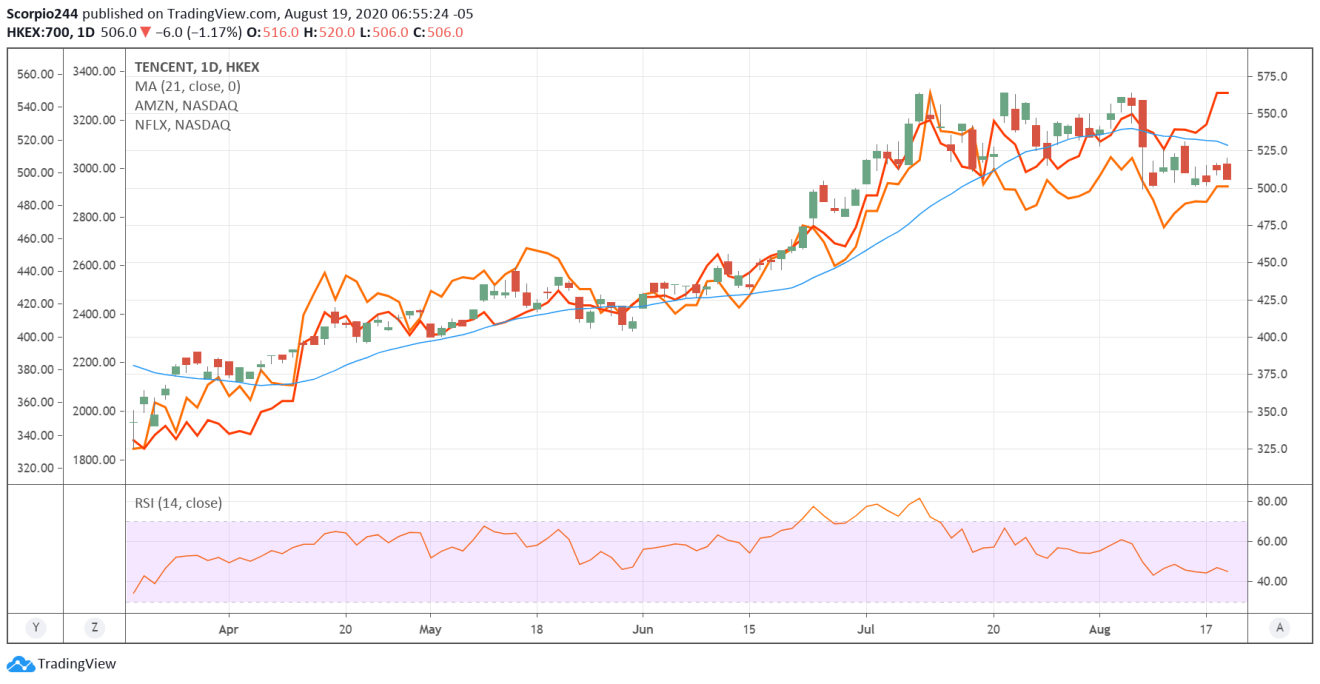

It continues to be a pretty good leading indicator for Amazon (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX).

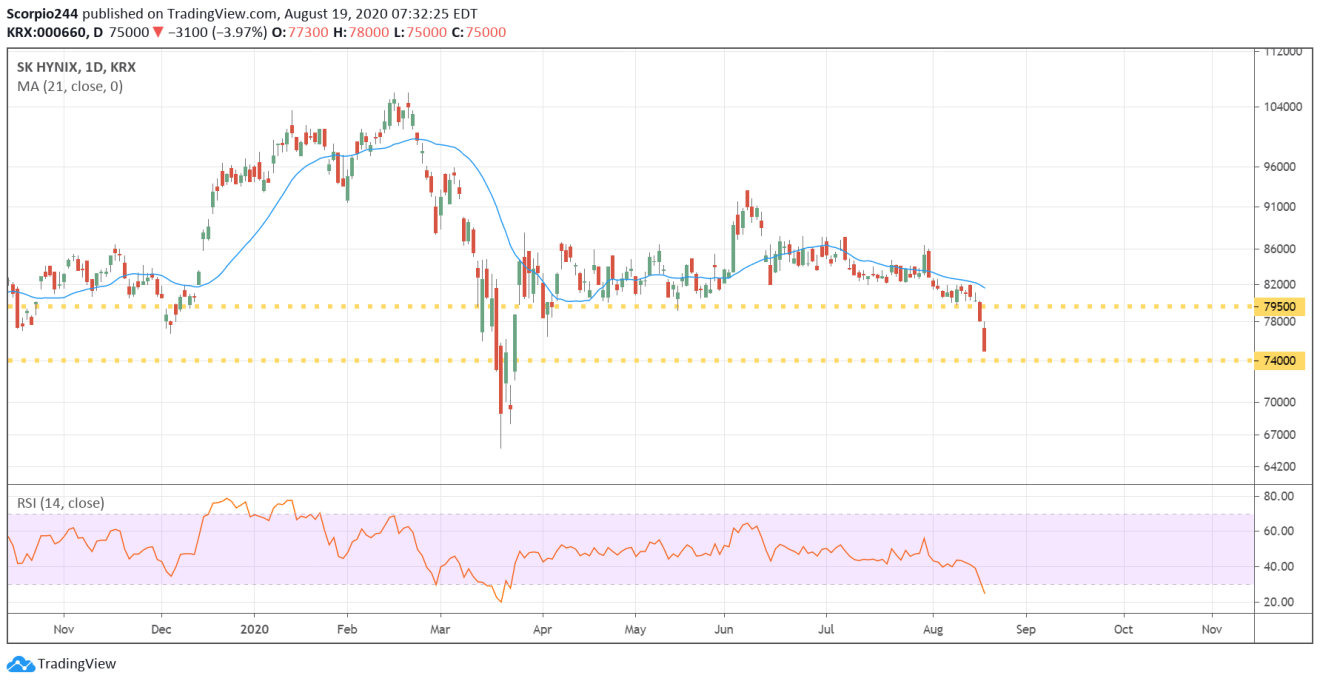

Meanwhile, the memory chip maker, Micron/Western Digi competitor, SK Hynix Inc (KS:000660), looks pretty dire.

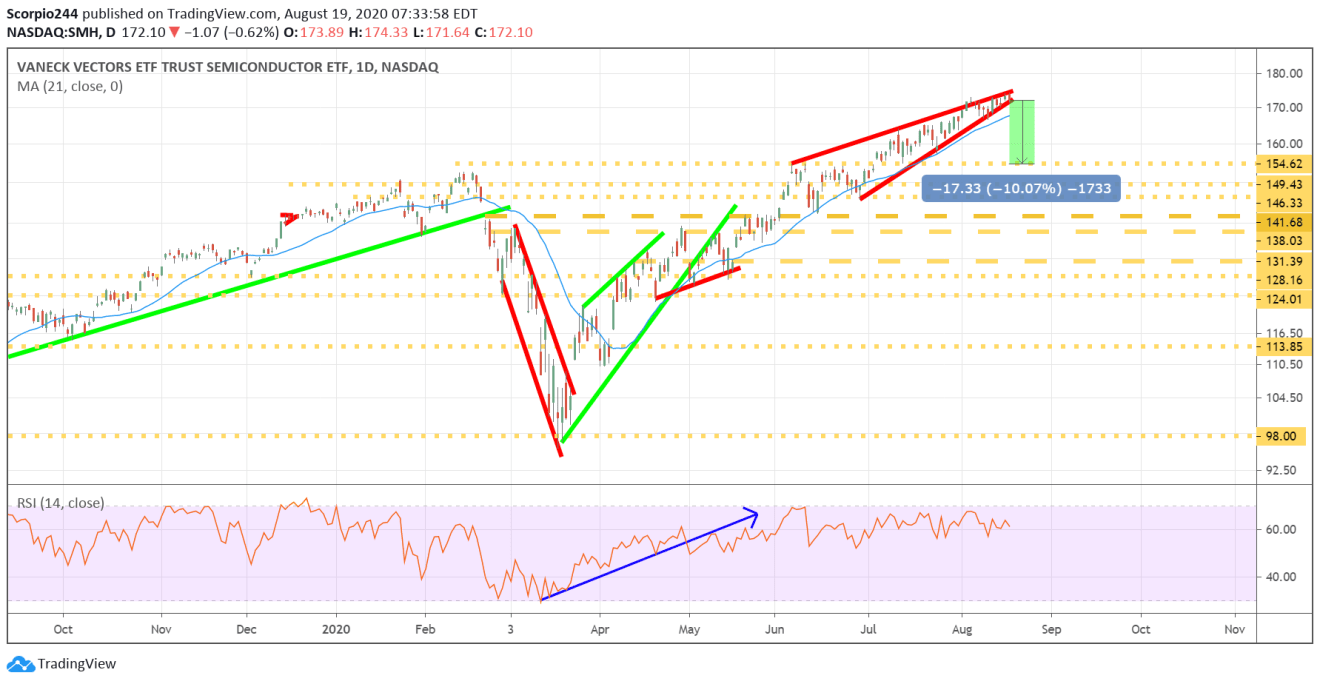

Meanwhile, the SMH is forming a large rising wedge pattern. If the memory chip guys are sending a message, then the SMH could easily fall 10% from where it is currently.

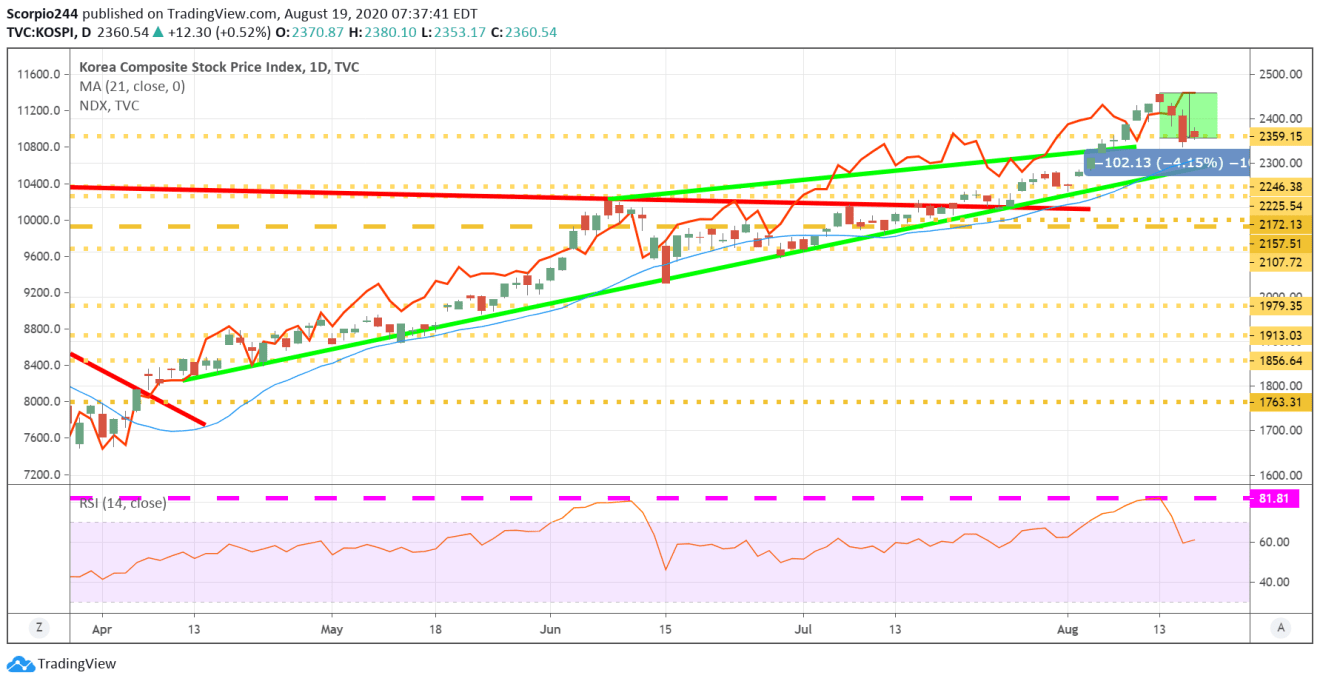

Meanwhile, the KOSPI, one market I have followed every night since February, is now 4% off its peak, and diverging from the Nasdaq 100.

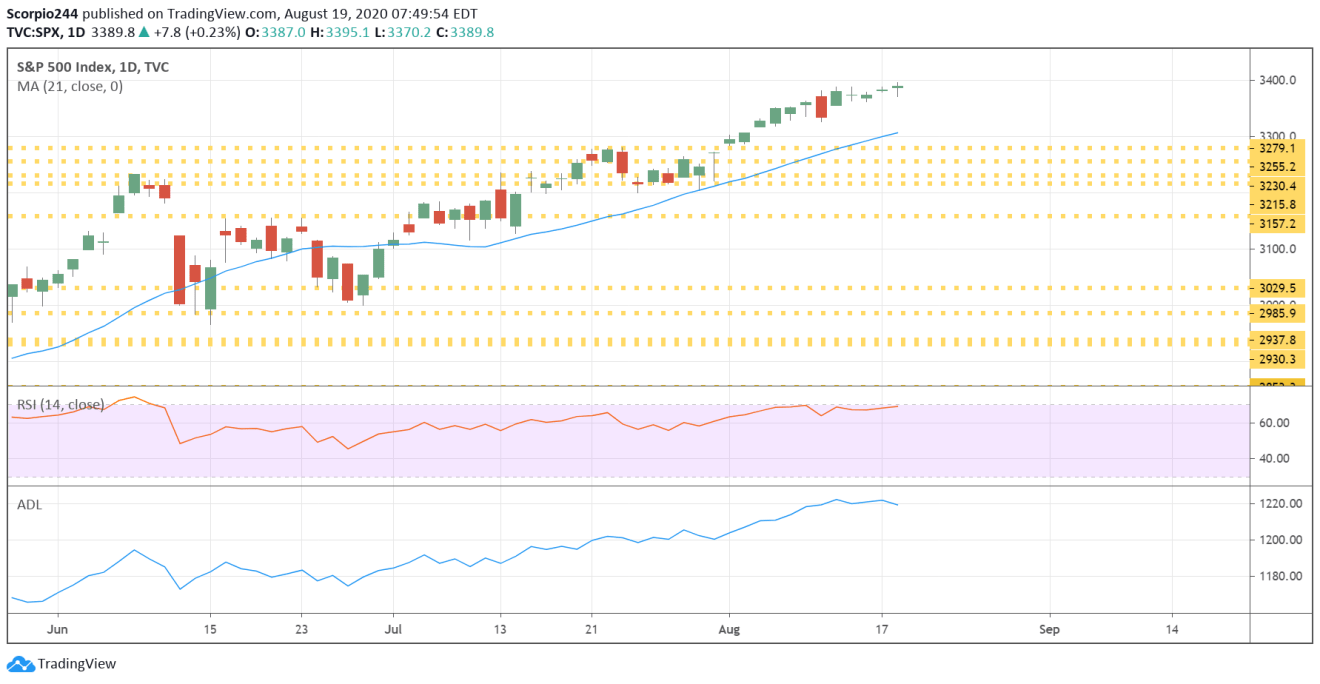

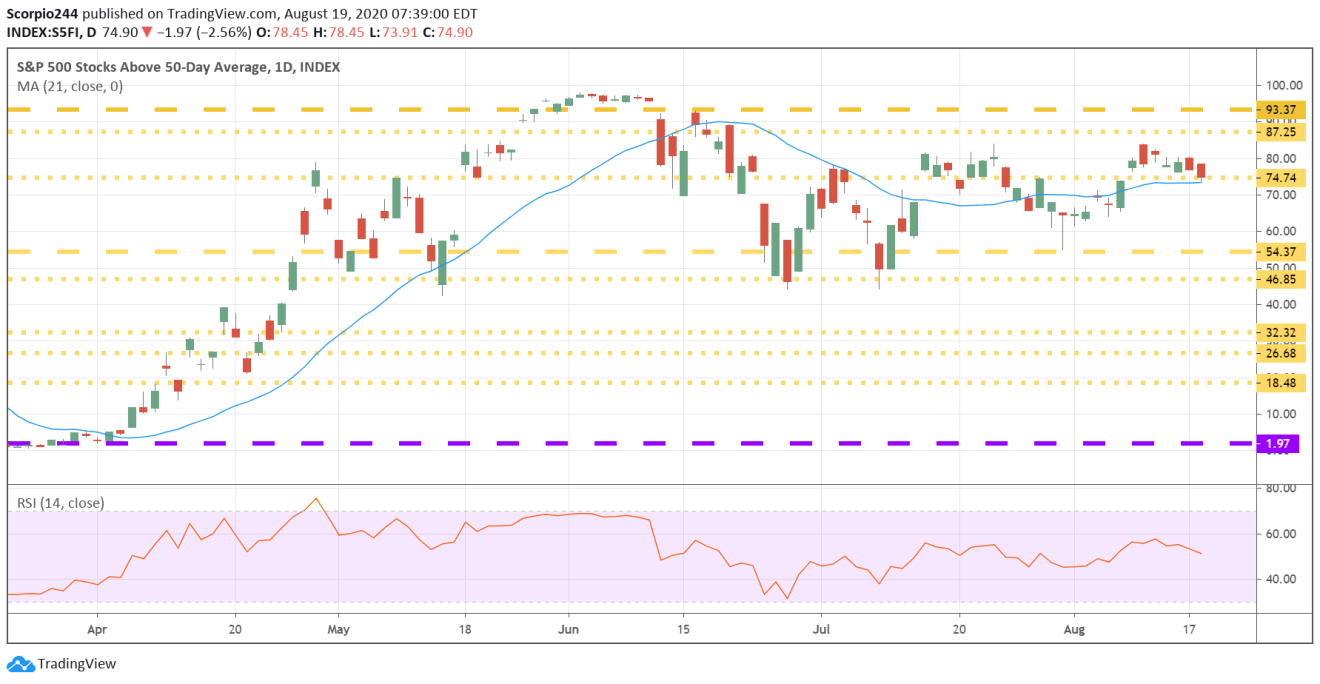

Meanwhile, the S&P 500 rose to a record close last night as the number of stocks above their 50-day moving average fell by 2% and has been trending lower.

This, as the Advance/Decline line, fell as well. The AD line hit a record high on Aug. 12 and has been trending lower since. It suggests the rally is getting narrower, and failing to confirm the record close.