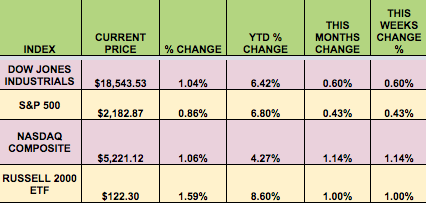

Markets: A surprisingly robust July Jobs report pushed markets higher on Friday reversing what had been a down week into a positive one. The S&P and the Dow rose to new highs again on Friday, and the NASDAQ reached a new high this week..

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Amerigas Partners LP (NYSE:APU), Fortress (NYSE:FIG), New Media Investment Group (NYSE:NEWM), Collectors Universe (NASDAQ:CLCT), Western Refining Logistics LP (NYSE:WNRL), The Carlyle Group LP (NASDAQ:CG), Fifth Street Finance Corp (NASDAQ:FSC).

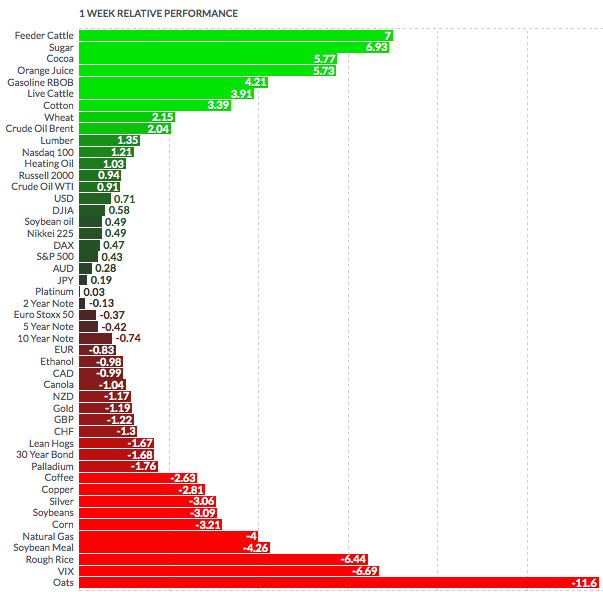

Volatility: The VIX fell -6.9% this week, finishing at $12.90.

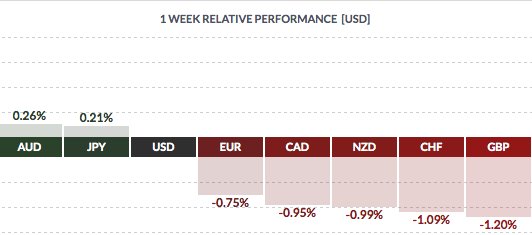

Currency: The USD rose vs. most major currencies, except the yen and the Aussie, spurred on by a strong July Jobs report.

Market Breadth: 19 of the Dow 30 stocks rose this week, vs. 11 last week. 51% of the S&P 500 rose this week, vs. 50% last week.

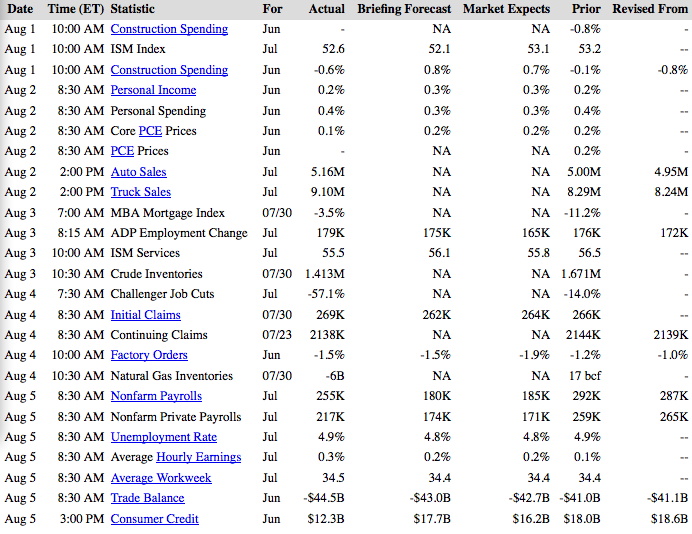

US Economic News: The July Jobs report surprised forecasters and the market, with 255K jobs added. June and May’s reports were also revised upward. The 3-month Jobs avg. is now 158K, vs. a 169K 6-month average. the Unemployment Rate stuck at 4.9%. Personal Spending inched up, at .04%, while Core PCE Prices, one of the Fed’s favorite inflation gauges, only rose .01%.

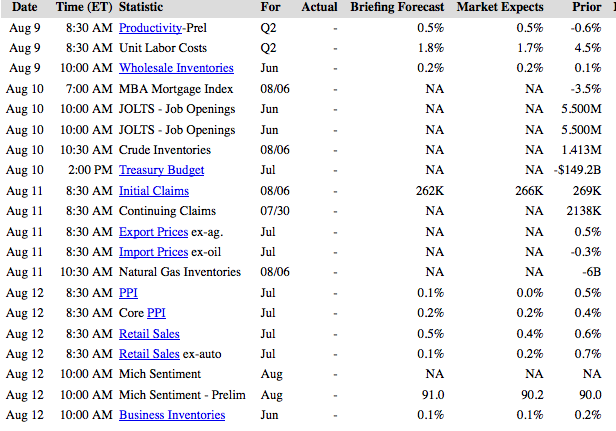

Week Ahead Highlights:

The Consumer will be in focus next week, as a number of large consumer-driven stocks report, such as Michael Kors Holdings Limited (NYSE:KORS), Walt Disney Company (NYSE:DIS), and Macy’s Inc (NYSE:M). The July Retail Sales report will also be issued on Friday. The Consumer Discretionary sector has begun to show signs of life recently, being one of the leading sectors, along with Healthcare and Tech.

Around 85% of all S&P 500 stocks already reported, with Q2 earnings now expected to have fallen -2.6%, an improvement vs. forecasts at the beginning of July. Q3 profits are forecast to be negative.

The S&P 500 is trading at 17.1 times 12-month forward earnings estimates of its component companies over the next 12 months, well above its average of 14.5 times over the past five years.

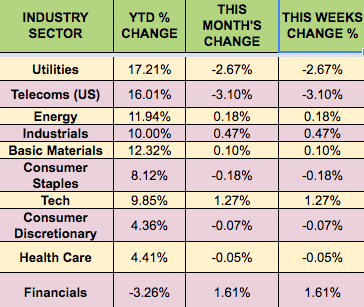

Sectors and Futures:

Tech led this week, while defensive Telecoms and Utilities lagged.

Feeder Cattle led this week, while Oats lagged: