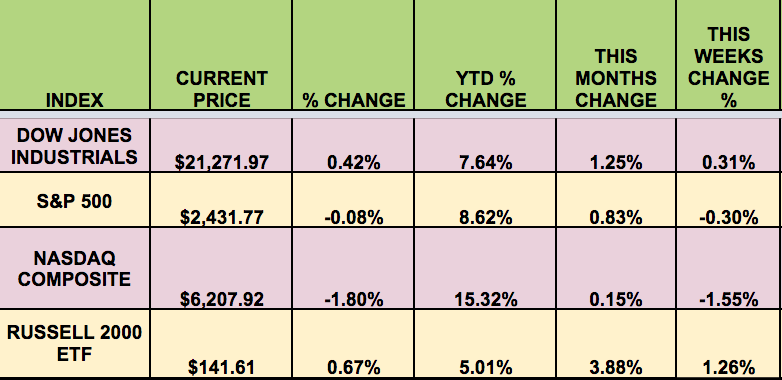

Markets: The market was split this week, with the DOW , S&P and NASDAQ hitting new all-time highs again, in spite of the DC Comey drama, and an adverse UK election result. However, the S&P and NASDAQ fell for the week, while the RUSSELL small caps and the DOW rose. Tech stocks had a big intra-day pullback on Friday, with many dropping over -4%

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ARCC (NASDAQ:ARCC), FTR (NASDAQ:FTR), FSC (NASDAQ:FSC), SOHO (NASDAQ:SOHO), TICC Capital Corp (NASDAQ:TICC), PMTS (NASDAQ:PMTS), OXLC (NASDAQ:OXLC), BKCC (NASDAQ:BKCC).

Volatility: The VIX rose 10% this week, finishing at $10.70.

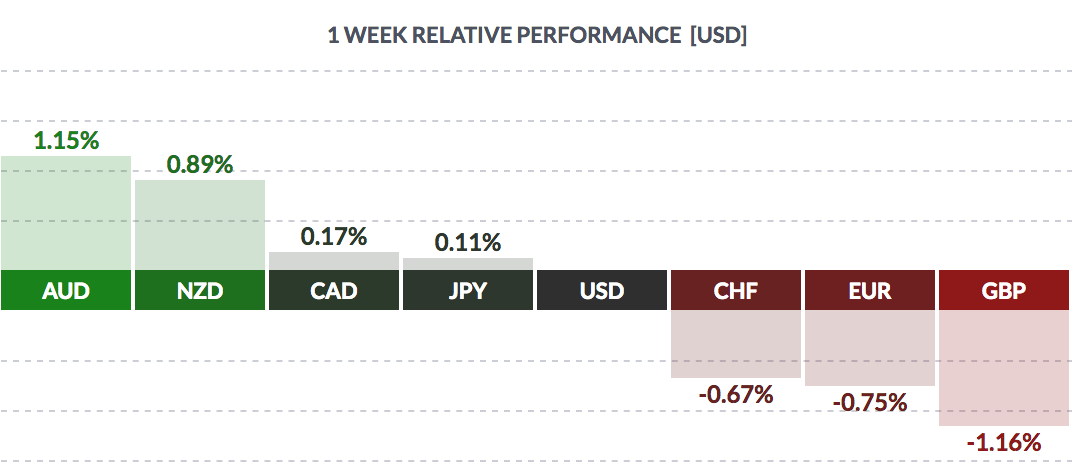

Currency: The dollar rose vs. the pound, Swiss franc, and the euro, and fell vs. most other major currencies this week:

Market Breadth: 15 of the DOW 30 stocks rose this week, vs. 22 last week, and 42% of the S&P 500 rose, vs. 73% last week.

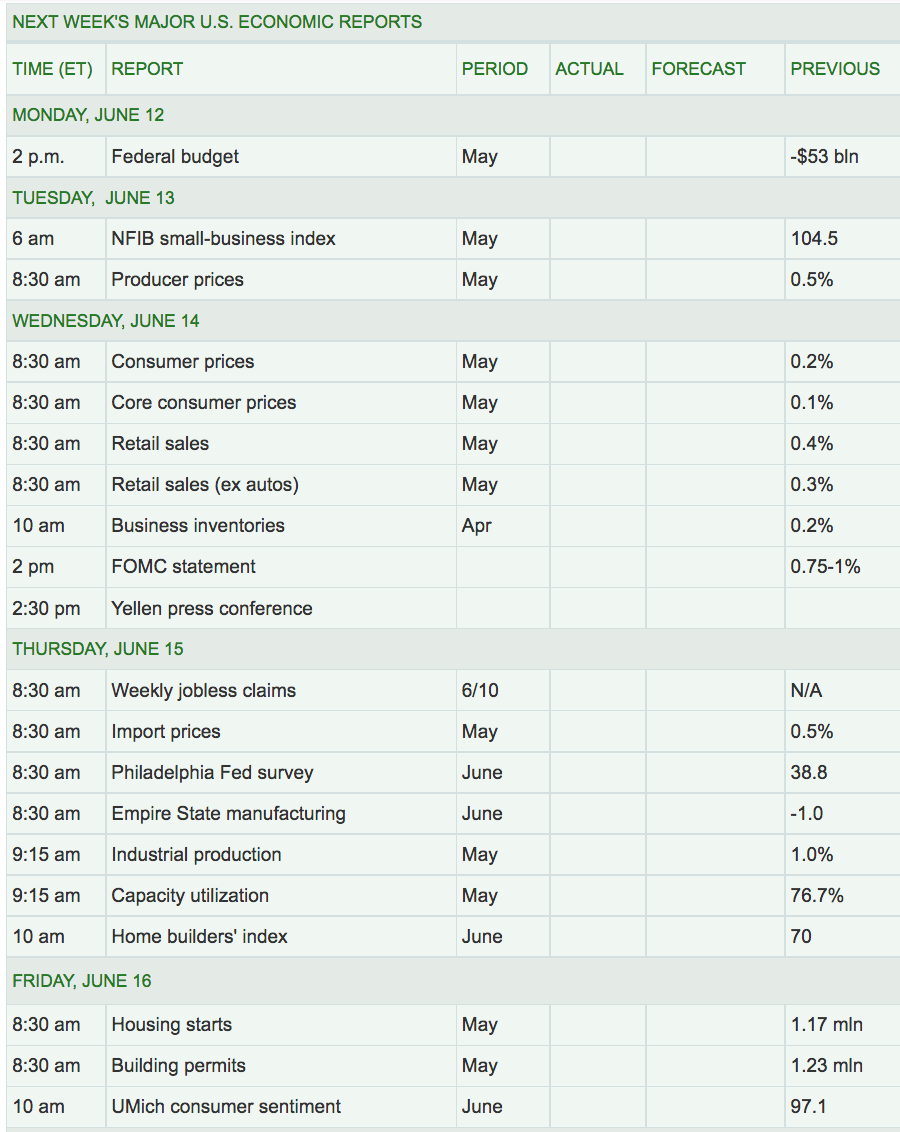

Economic News: The ECB, as expected, left interest rates unchanged Thursday, but removed language from its policy statement indicating rates could go lower in the future. The ECB said it continued to expect interest rates “to remain at present levels for an extended period of time, and well past the horizon” of its asset-buying program, which is set to run at least through December. The ECB’s refinancing rate remains 0%, while the rate paid on deposits left overnight at the central bank was held at minus 0.4%.

Eurozone economic growth in the first quarter of 2017 reached its highest rate in more than a year, according to a final reading released by Eurostat on Thursday. Gross domestic product expanded by 1.9% on a year-over-year basis, the fastest growth since the fourth quarter of 2015.

Week Ahead Highlights: All eyes will be on the Fed next Wed., as they announce interest rate decision. The Fed is expected to boost rates again next week, but probably by just a quarter of a percentage point. That would leave rates in a range of 1% to 1.25%.

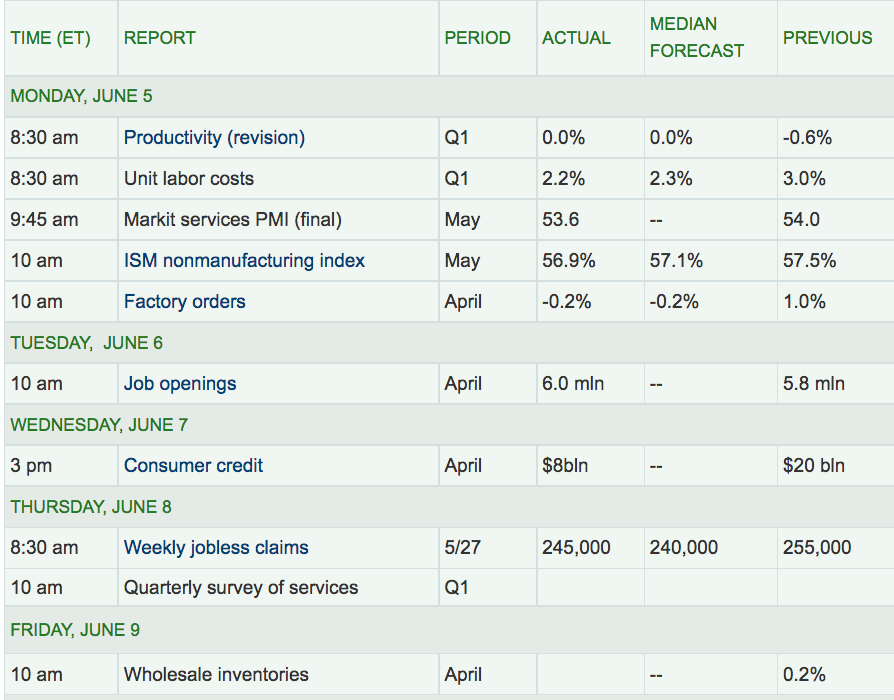

Next Week’s US Economic Reports: Housing will also be in the spotlight next week, with Building Permits, Housing Starts, and Home Builders Index reports due out. Also, several consumer-based reports are due out on Wed.

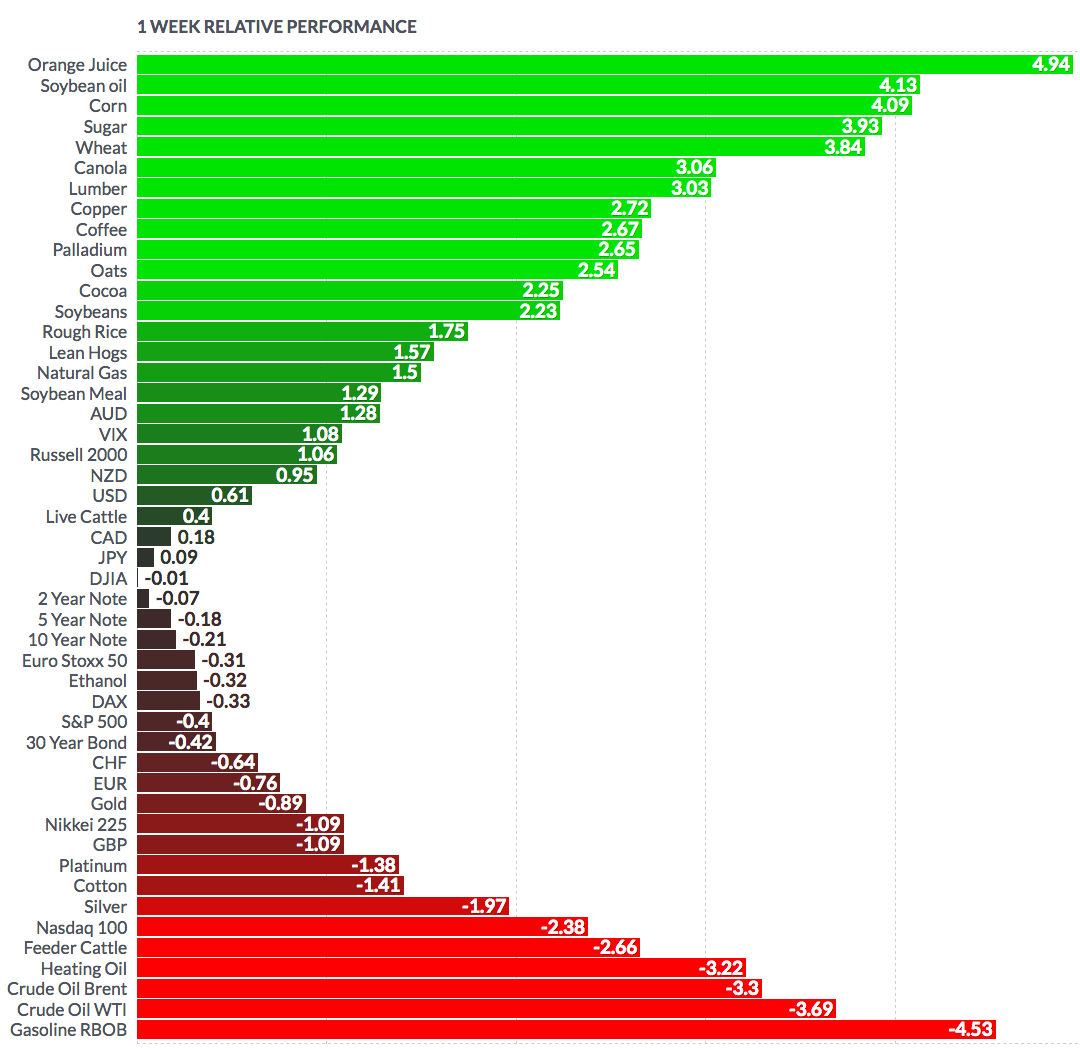

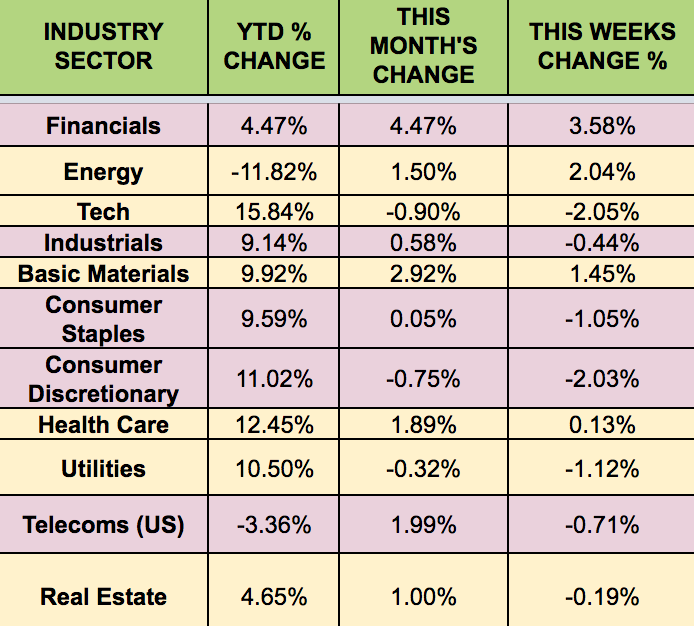

Sectors & Futures: Financials led this week, while Tech and Consumer Discretionary trailed.

WTI Crude Futures fell -3.69%, and Natural Gas futures fell -1.5% this week, after data from the U.S. Energy Information Administration showed that domestic crude supplies rose by 3.3 million barrels for the week ended June 2. The unexpected rise marked the first weekly increase in nine weeks: