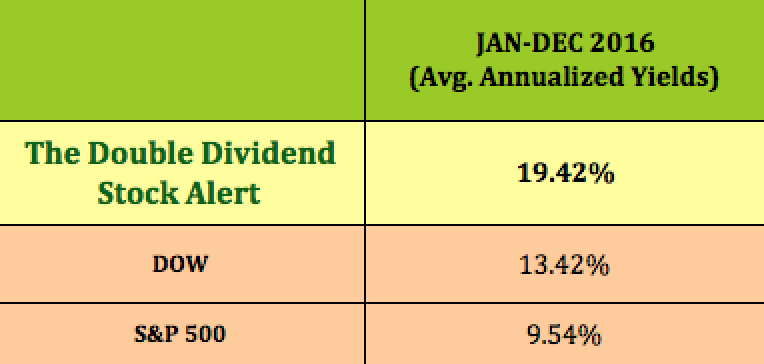

Does Your Portfolio Need Better Yields In 2017?

Check out our returns in 2016:

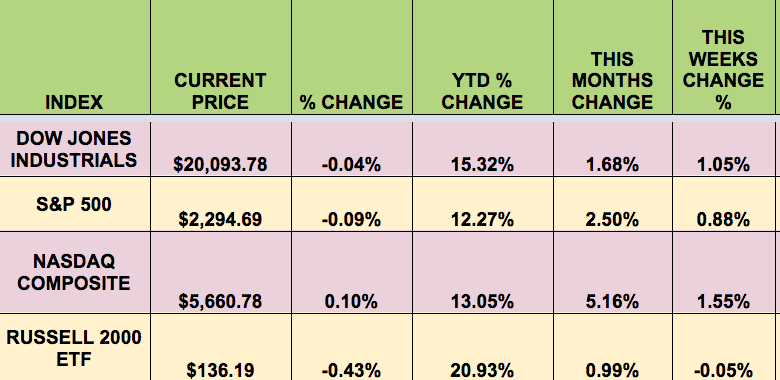

Markets: The NASDAQ continued to lead this week, which saw small caps flat, but gains in the DOW and S&P large caps. The DOW finally made it past the psychological 20,000 level.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: WES (NYSE:WES), TOO (NYSE:TOO), WSR (NYSE:WSR), CPLP (NASDAQ:CPLP),

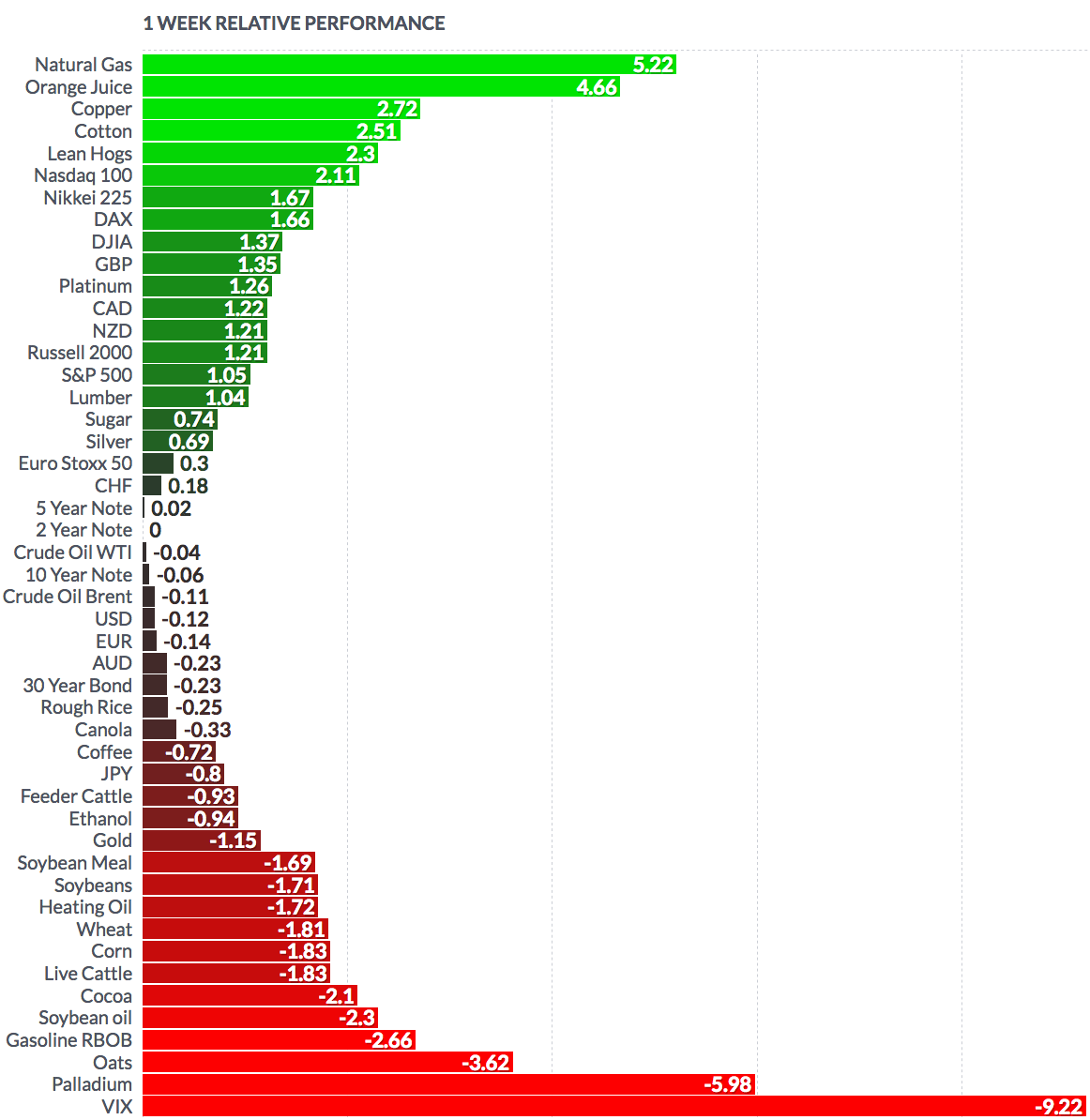

Volatility: The VIX fell 8.3% this week, finishing at $10.58, its lowest point since JUNE 2014.

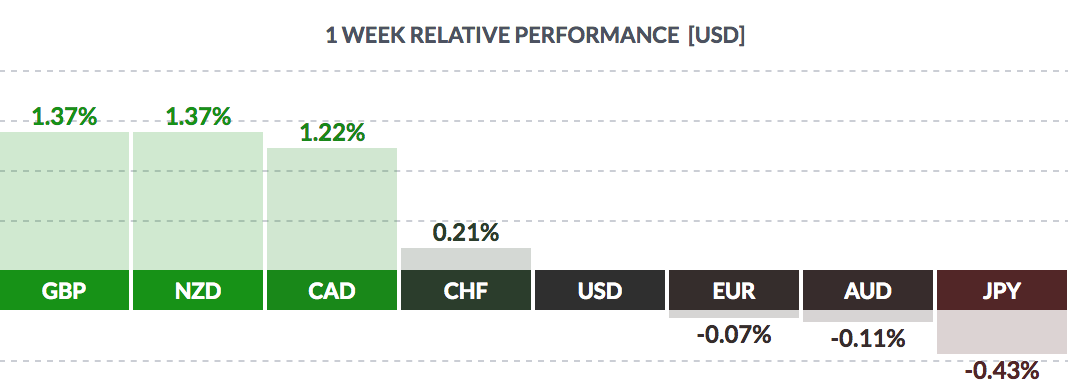

Currency: The dollar pulled back vs. the pound, and the NZ and Canadian dollar, but gained vs. the euro, the yen, and the Aussie:

Market Breadth: 18 of the DOW 30 stocks rose this week, vs. 18 last week. 63% of the S&P 500 rose, vs. 52% last week.

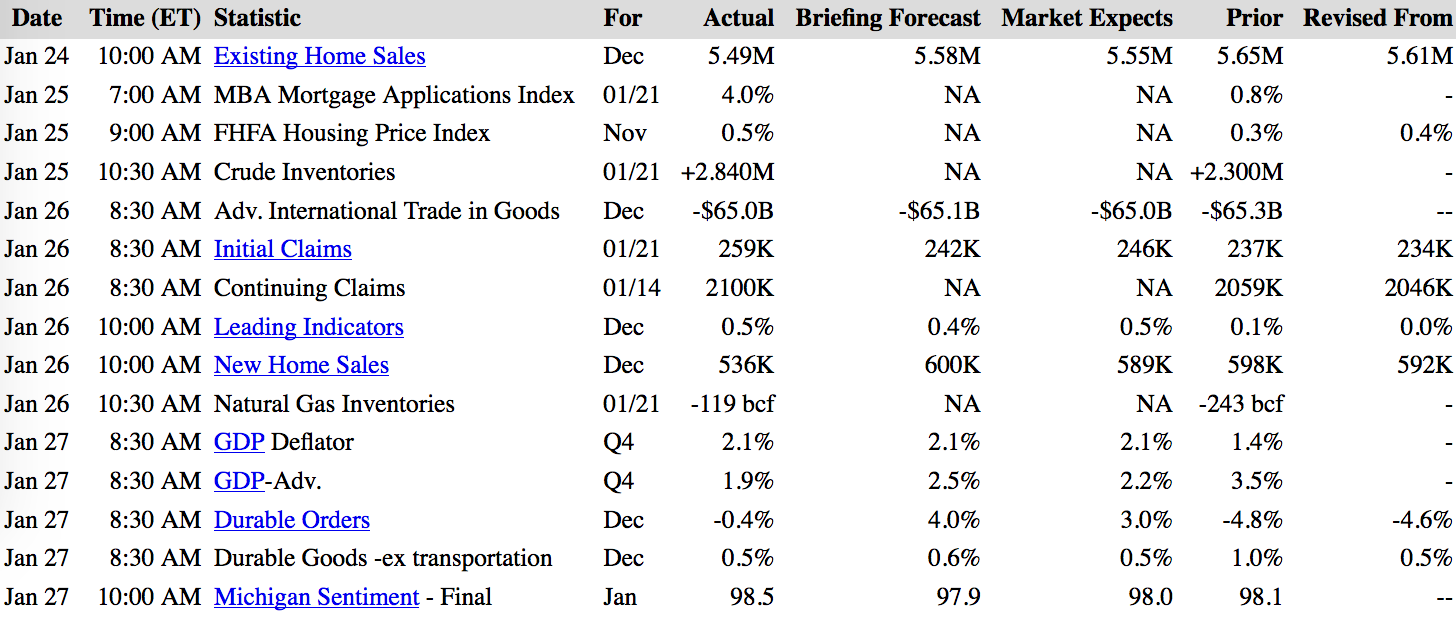

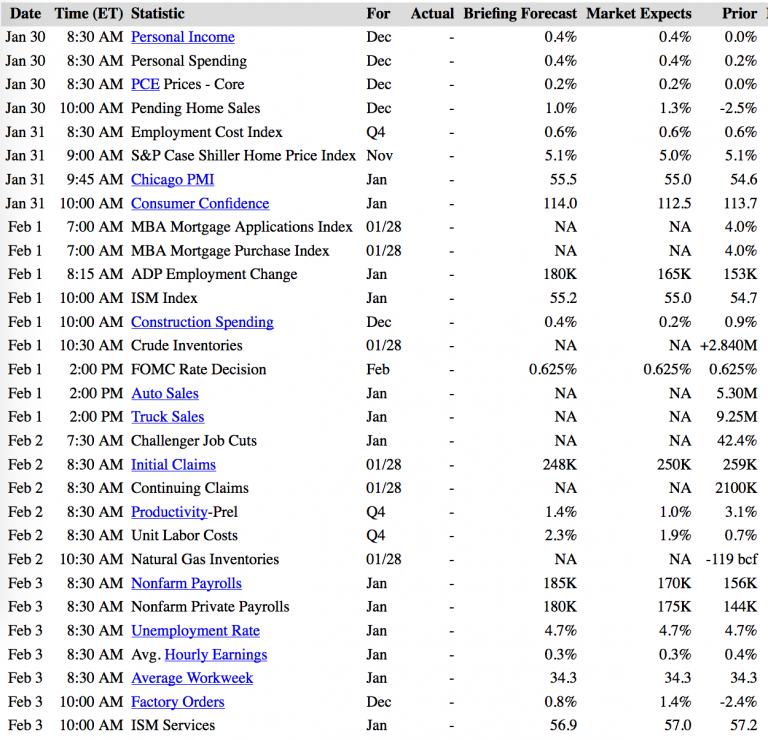

US Economic News: Q4 GDP disappointed, coming in at 1.9%, vs. the 2.2% forecast. Consumer Sentiment remained high, at 98.5. Existing and New Home Sales came in a bit short in Dec. Durable Goods orders fell -.4% unexpectedly in Dec.

Week Ahead Highlights: We’ll get a look at the Jobs situation for Jan. next Friday, when the Non-Farm Payrolls report and Unemployment number comes out. The Fed meets in mid-week, with very little expectation for a rate increase at this meeting. Q4 Earnings season rolls on.

Next Week’s US Economic Reports:

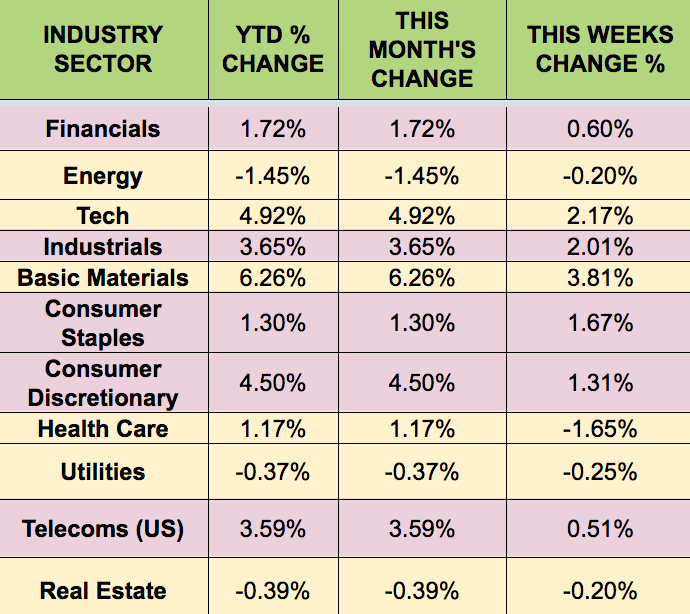

Sectors & Futures: Basic Materials had a big week, while Healthcare trailed. Basic Materials continues to be the leading sector in 2017.

Natural gas futures led this week, while palladium trailed: