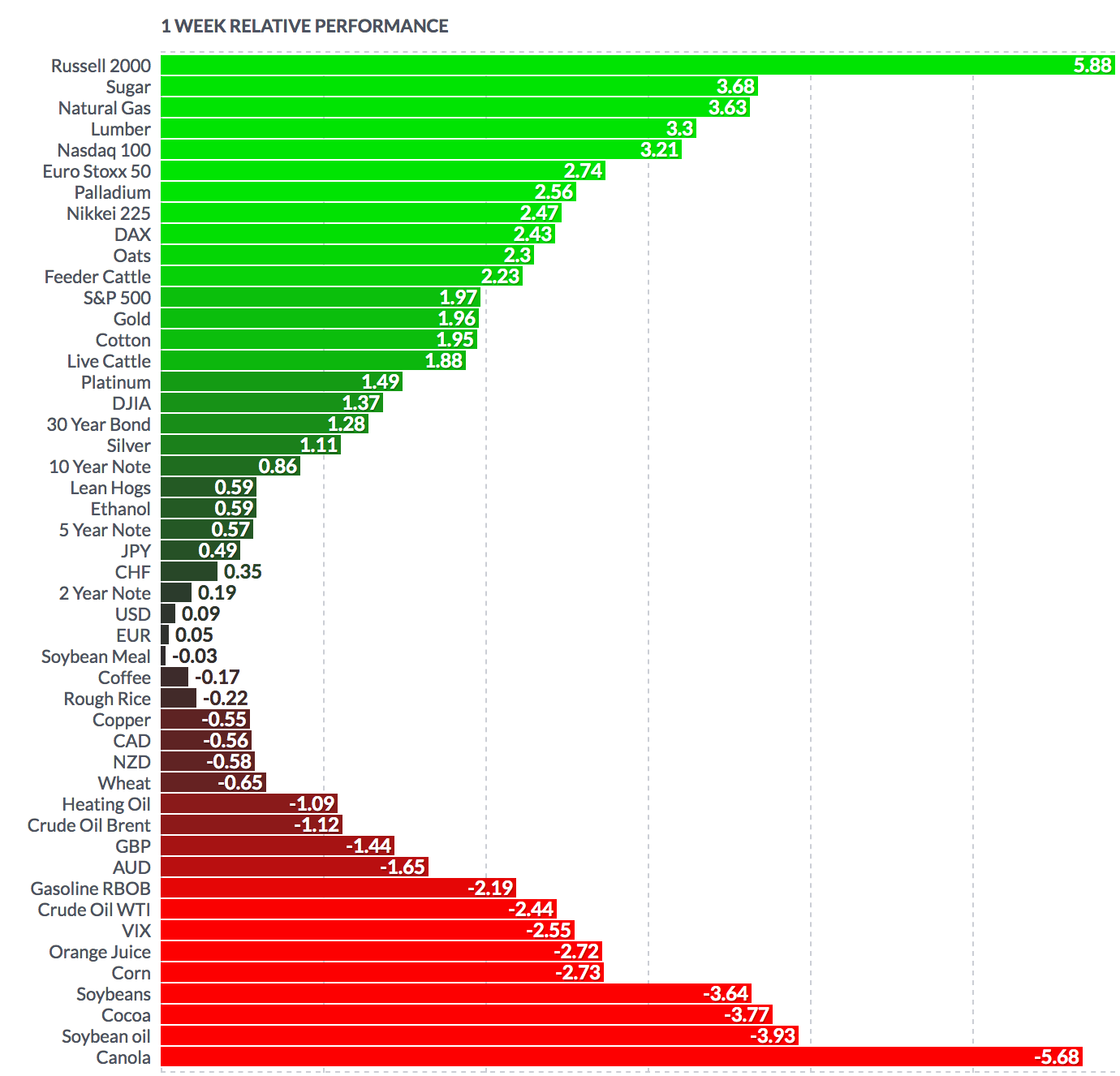

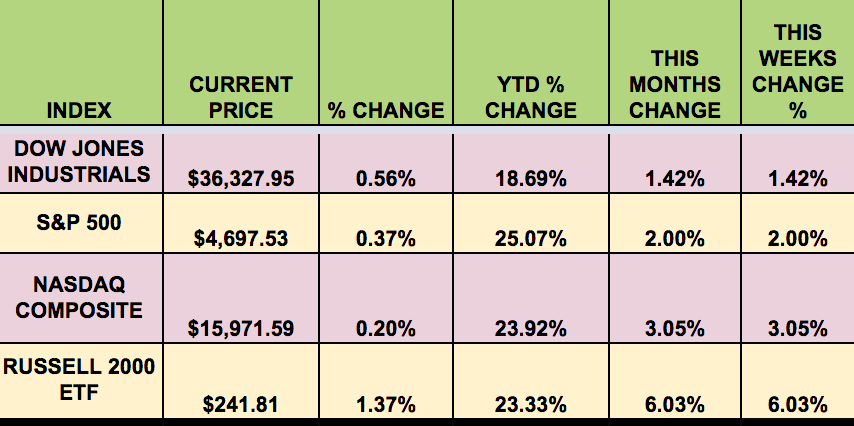

Market Indexes: All 4 indexes advanced again this past week, with the Russell 2000 leading with a 6% surge, followed by the NASDAQ, which was up 3%.

“Wall Street’s main indexes scored record closing highs on Friday and booked solid gains for the week following a strong U.S. jobs report and positive data for Pfizer’s experimental pill against COVID-19.

"The S&P 500 and the Nasdaq notched record high closes for their seventh straight sessions, while the Dow Jones Industrial Average also closed at a record. All 3 indexes posted weekly gains for their fifth straight weeks.” (Reuters)

Volatility: The VIX rose 1.4% this week, ending the week at $16.48.

High Dividend Stocks: These high dividend stocks go ex-dividend this week: Archrock (NYSE:AROC), B. Riley Financial (NASDAQ:RILY), Ciner Resources (NYSE:CINR), Hercules Capital (NYSE:HTGC), Viper Energy (NASDAQ:VNOM), Black Stone Minerals (NYSE:BSM), Exxon Mobil (NYSE:XOM), MPLX (NYSE:MPLX), PBF Logistics (NYSE:PBFX), ARMOUR Residential REIT (NYSE:ARR), and Enbridge (NYSE:ENB).

Market Breadth: 21 DJIA stocks rose the week, vs. 17 the week before last. 62% of the S&P 500 rose, vs. 53% last week.

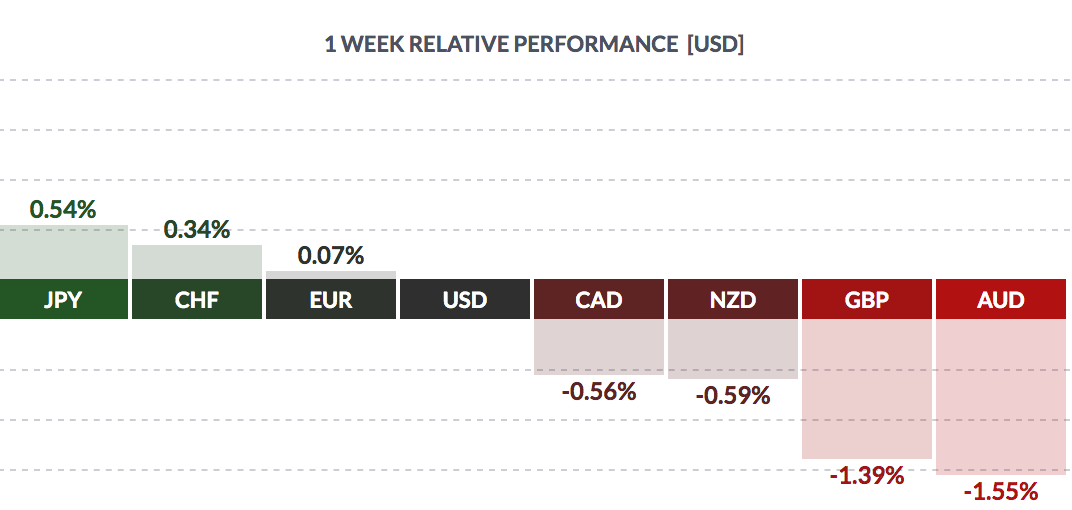

FOREX: The US $ gained vs. most other major currencies this week, except the yen, the Swiss franc, and the euro.

Economic News

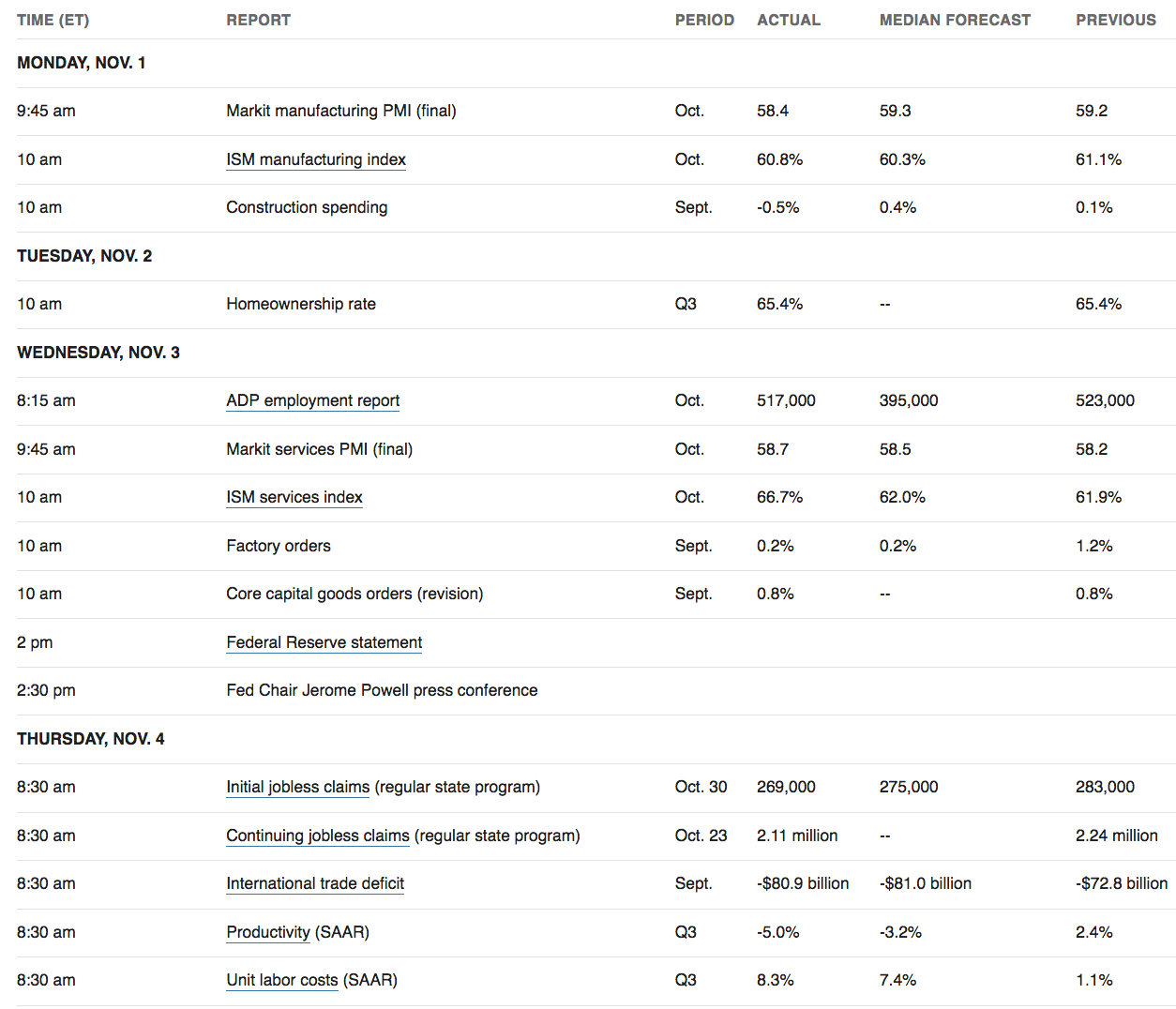

“The Federal Reserve on Wednesday said it will begin trimming its monthly bond purchases in November with plans to end them in 2022, but held to its belief that high inflation would prove “transitory” and likely not require a fast rise in interest rates.

"However, the U.S. central bank nodded to global supply difficulties as adding to inflation risks, saying that those factors 'are expected to be transitory,' but would need to ease to deliver the anticipated drop in inflation. '“s the pandemic subsides, supply-chain bottlenecks will abate and job growth will move back up,” Fed Chair Jerome Powell said in a news conference after the release of the central bank’s latest policy statement. '“And as that happens, inflation will decline from today’s elevated levels. Of course, the timing of that is highly uncertain.”

"Yet even in announcing a $15 billion monthly cut to its $120 billion in monthly purchases of Treasuries and mortgage-backed securities (MBS), the Fed did little to signal when it may begin the next phase of policy “normalization” by raising interest rates.

“Economic activity and employment have continued to strengthen,” the policy-setting Federal Open Market Committee said in the statement, but did not change its intent to leave its benchmark overnight interest rate near zero until inflation had hit 2% and was “on track to moderately exceed 2% for some time.” (Reuters)

“The American economy added 531,000 jobs in October, a sharp rebound from the prior month and a sign that employers are feeling more optimistic as the latest coronavirus surge eases. The October gain was an improvement from the 312,000 positions added in September—a number that was revised upward on Friday. The labor force participation rate—the share of the working-age population employed or looking for a job—was flat in October, while the prime age (25 to 54) rate improved slightly to 81.7%. The unemployment rate fell to 4.6% from 4.8% in September.” (NY Times)

“The Institute for Supply Management said on Wednesday its non-manufacturing activity index vaulted to a reading of 66.7 last month. That was the highest since the series started in 1997 and followed a 61.9 reading in September. A reading above 50 indicates growth in the services sector, which accounts for more than two-thirds of U.S. economic activity. The survey’s measure of new orders received by services businesses soared to a record 69.7 last month from 63.5 in September. Spending is shifting from goods to services, thanks to vaccinations against the coronavirus.

"Part of the better-than-expected services sector index reading reflected longer delivery times. The survey’s measure of supplier deliveries accelerated to a reading of 75.6 from 68.8 in September. A reading above 50 indicates slower deliveries.” (Reuters)

“Better-than-expected third-quarter earnings have helped lift sentiment for equities. With about 360 companies having reported, S&P 500 earnings are expected to have climbed 40.4% in the third quarter from a year earlier.” (Reuters)

Week Ahead Highlights

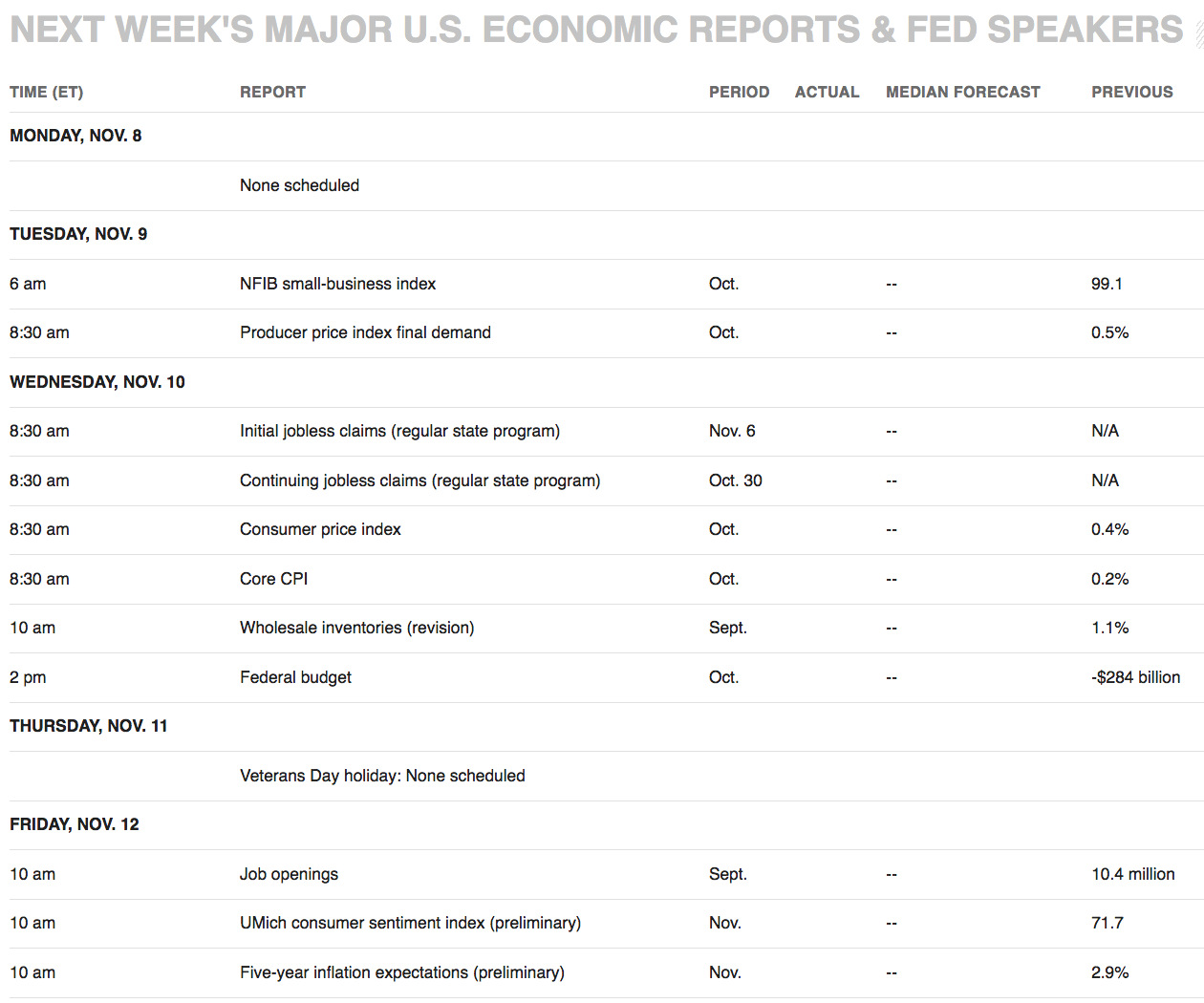

There will be several inflation-related reports due out next week, including the PPI, and the CPI, in addition to the Consumer Sentiment index.

This Week’s US Economic Reports

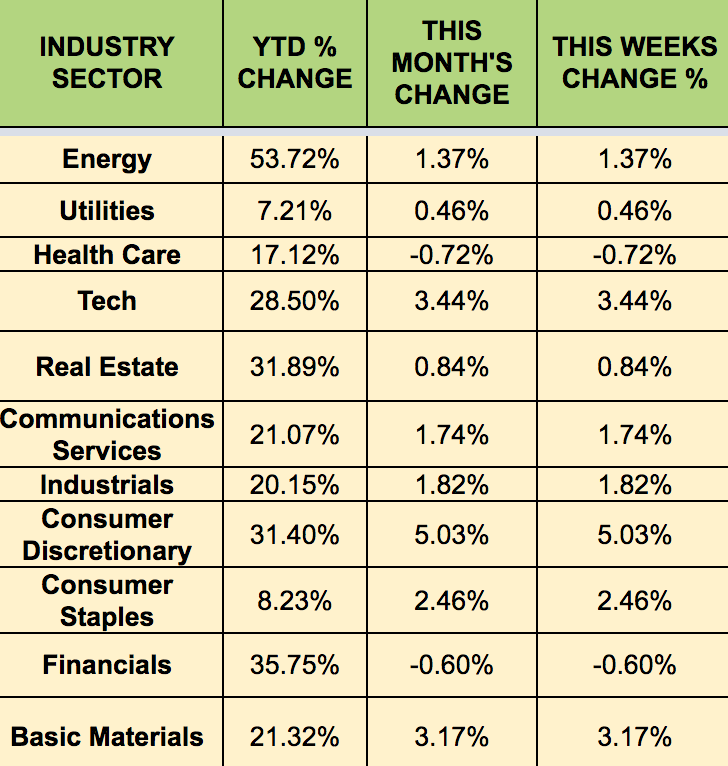

Sectors: Consumer Discretionary led again last week, with Healthcare and Financials lagging.

Futures: WTI crude fell -2.44% this past week, ending at $81.39.