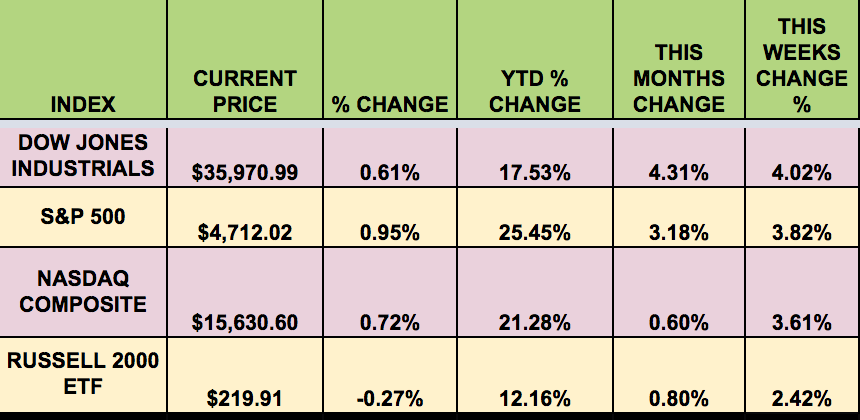

Market Indexes: It was a big rebound week, with all 4 indexes gaining, with investors shrugging off a key inflation report ahead of the Federal Reserve’s final policy-setting meeting of the year next week. The S&P set another all-time high.

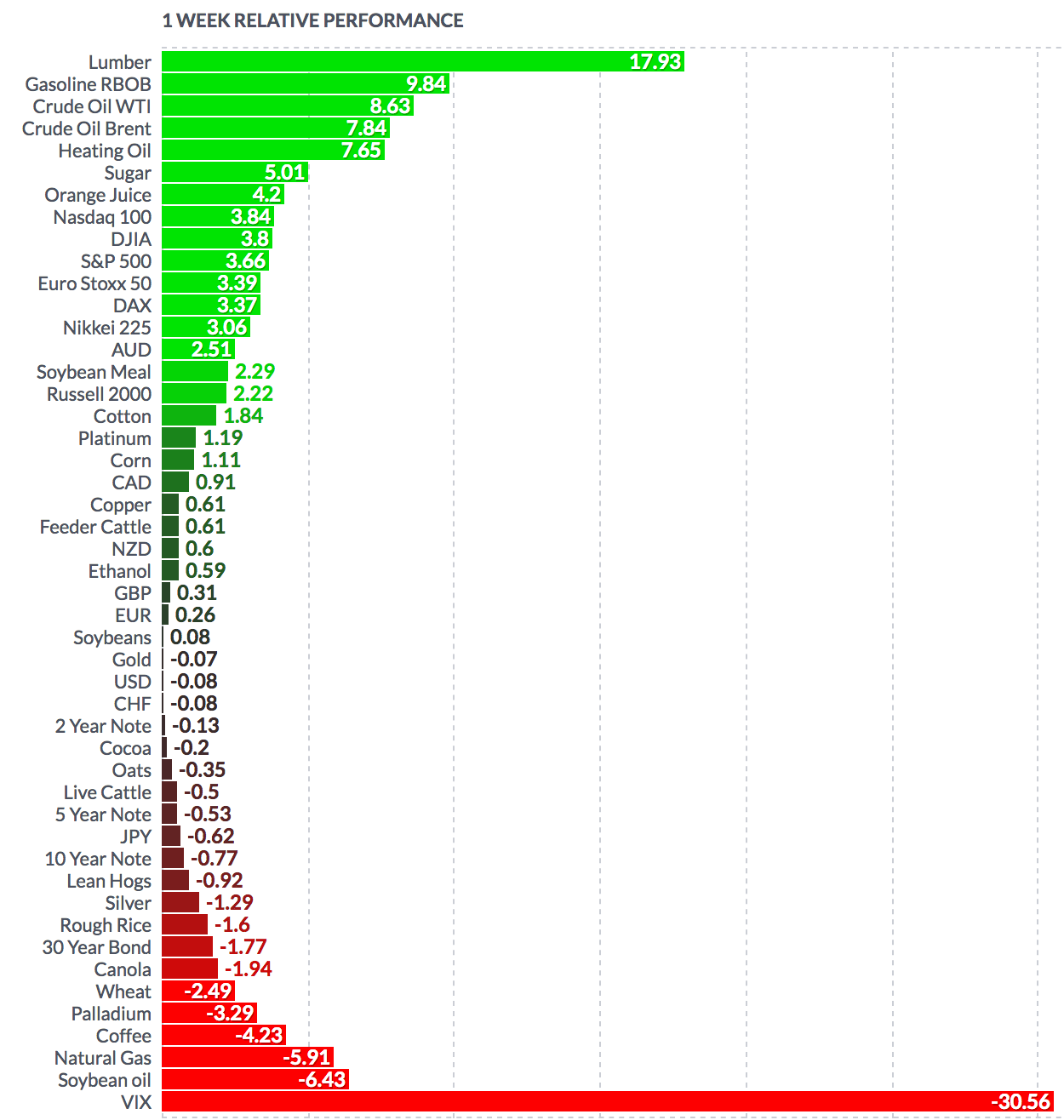

Volatility: The VIX reversed and fell 39% this week, ending the week at $18.69.

High Dividend Stocks: These high dividend stocks go ex-dividend the coming week: Ares Capital (NASDAQ:ARCC), ARMOUR Residential REIT (NYSE:ARR), Capital Southwest (NASDAQ:CSWC), First Eagle Alternative Capital BDC (NASDAQ:FCRD), Nexpoint Real Estate Finance (NYSE:NREF), Oaktree Specialty Lending (NASDAQ:OCSL), SFL Corporation (NYSE:SFL), Sixth Street Specialty Lending (NYSE:TSLX), BlackRock (NYSE:BLK) Kelso Capital (NASDAQ:BKCC), New Mountain Finance (NASDAQ:NMFC), SLR Investment Corp (NASDAQ:SLRC), SLR Senior Investment Corp (NASDAQ:SUNS), Stellus Capital Investment (NYSE:SCM), Horizon Technology Finance (NASDAQ:HRZN), Oxford Square Capital (NASDAQ:OXSQ), Apollo Investment (NASDAQ:AINV), and Newtek Business Services (NASDAQ:NEWT).

Market Breadth: 26 DJIA stocks rose this week, vs. 3 last week. 83% of the S&P 500 rose, vs. 11% last week.

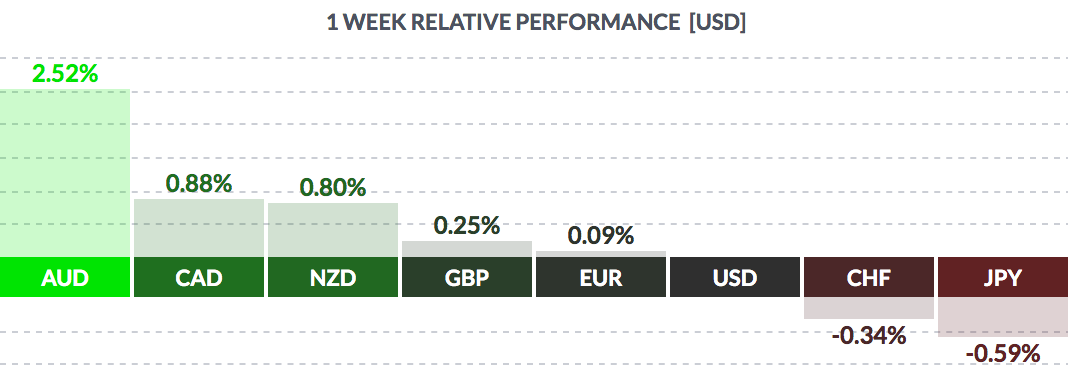

FOREX: The US $ gained vs. the yen and Swiss franc, and fell vs. the pound, the Loonie, the Aussie and NZ $, and the euro this week.

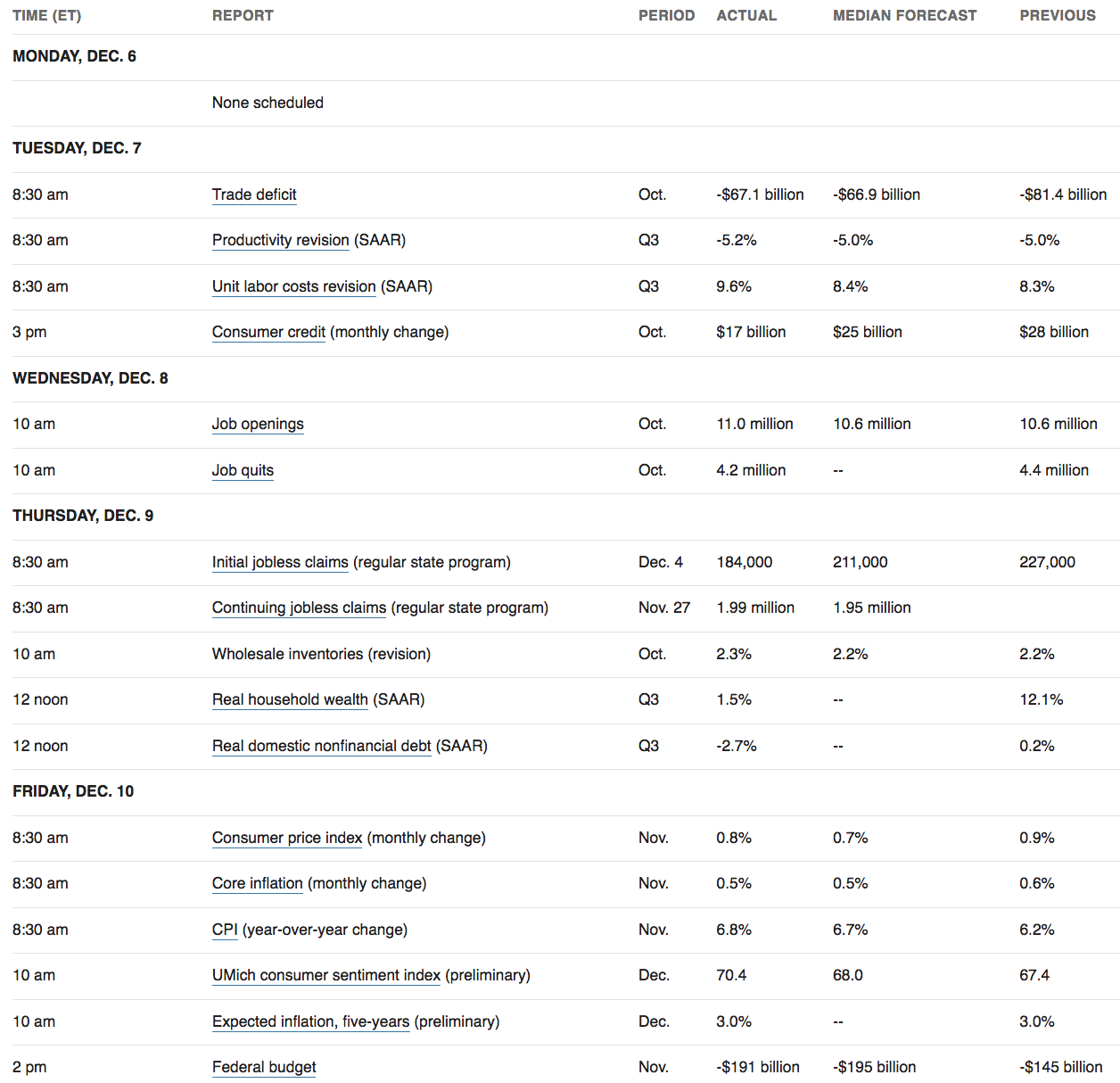

Economic News

“The consumer price index rose 0.8% last month after surging 0.9% in October. The broad-based increase was led by gasoline prices, which rose 6.1%, matching October’s gain. With crude oil prices declining recently, gasoline prices have likely peaked.

"Food prices rose 0.7%. The cost of food at home increased 0.8%, driven by increases in the price of fruits and vegetables, meat and cereals and bakery products. It also cost more to eat away from home.

"In the 12 months through November, the CPI accelerated 6.8%. That was the biggest year-on-year rise since June 1982 and followed a 6.2% advance in October.”

Other data this week showed there were 11 million job openings at the end of October and Americans quit jobs at near-record rates. The core CPI jumped 4.9% on a year-on-year basis, the largest rise since June 1991, after increasing 4.6% in the 12 months through October.

The Fed tracks the personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, for its flexible 2% inflation target. The core PCE price index surged 4.1% in the 12 months through October, the most since January 1991. Data for November will be released later this month.” (Reuters)

Also from Reuters:

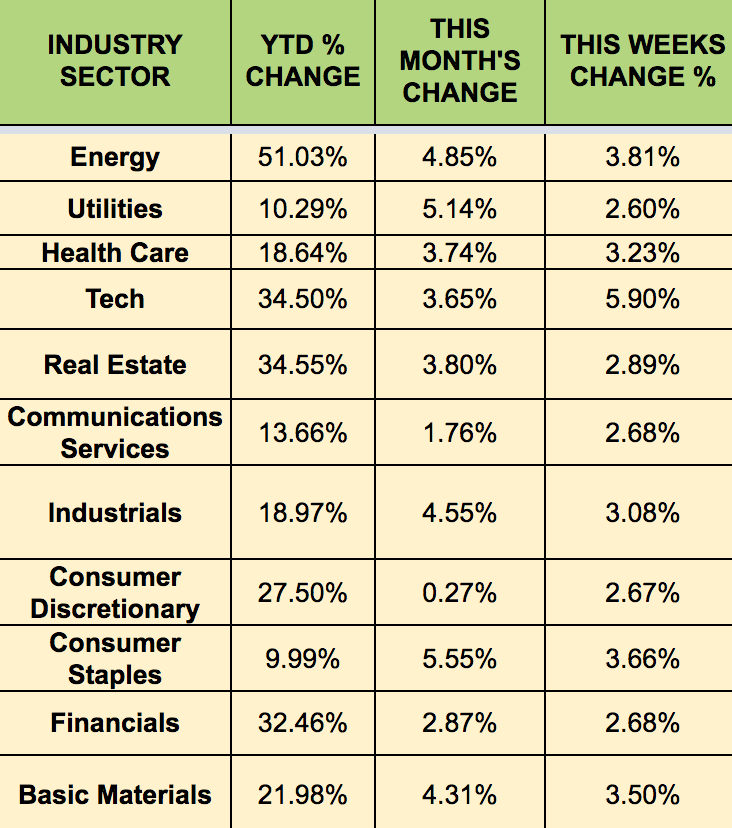

“Wall Street analysts have begun rolling out their predictions for U.S. equity markets in 2022. The benchmark S&P 500 index has risen nearly 25% so far this year. It closed at 4,701.21 on Wednesday.

Here is a summary of some analysts’ forecast for the index:

|

BROKERAGE NAME |

S&P500 TARGET @ END 2022 |

|

Morgan Stanley (NYSE:MS) |

4,400 |

|

Wells Fargo (NYSE:WFC) |

5,100-5,300 |

|

Goldman Sachs (NYSE:GS) |

5,100 |

|

RBC |

5,050 |

|

Bank of America Global Research (NYSE:BAC) |

4,600 |

|

Credit Suisse (SIX:CSGN) |

5,200 |

Morgan Stanley: “While earnings for the overall index remain durable, there will be greater dispersion of winners and losers and growth rates will slow materially… 2022 will be more about stocks than sectors or styles, in our view.”

Wells Fargo: “Persistent supply shortages and inflation pressures lead us to adjust the magnitudes of some 2022 targets, but we believe the global economy should still mark an above-average pace next year. More importantly, our tactical preferences for the next 6 to 18 months are nearly all unchanged.”

Goldman Sachs: “Decelerating economic growth, a tightening Fed, and rising real yields suggest investors should expect modestly below-average returns next year.” (Reuters)

“The holidays tend to make Americans very, very thirsty. And that’s a problem this year, with supply chain snarls hitting the beverage industry – from soda to energy drinks, booze to beer – especially hard. Things could get even tougher in the next couple months.

"While typical grocery categories are experiencing 5% to 10% of products out of stock right now, beverage shortages are higher, with around 13% missing from shelves. Shortages have been showing up in waters, iced teas and soft drinks, as well as beer, hard seltzer and canned cocktails.

"A shortage of bottles and cans is responsible for much of it, but trucking and shipping snarls, missing ingredients, labor woes and even freak weather are all contributing to shortages, leaving grocers scrambling to fill in the gaps. It’s just the latest example of ongoing food supply problems that have shown up in a variety of sectors, wreaking havoc on prices and contributing to the highest inflation in three decades.

"Freeman said the empty shelves reflect '“demand unlike what we’ve seen in recent history running headfirst into problems with access to ingredients and materials.”'

"The problems are certainly true for the world’s largest beverage company, Coca-Cola (NYSE:KO), whose chief executive James Quincey has said repeatedly that consumers will see sporadic shortages on grocery shelves through 2022.” (YahooFinance)

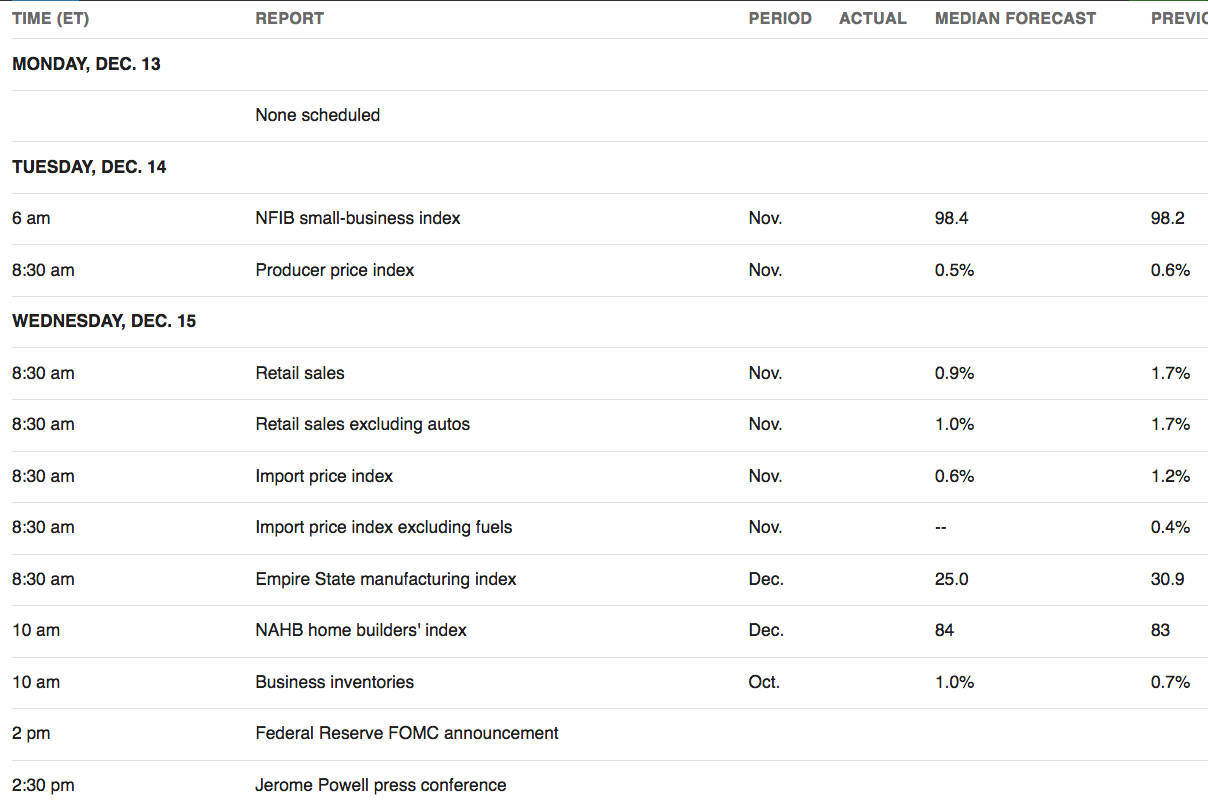

Week Ahead Highlights: The Federal Reserve’s final policy-setting meeting of the year is next week. There will also be Retail Sales and Housing reports due out.

Next Week’s US Economic Reports:

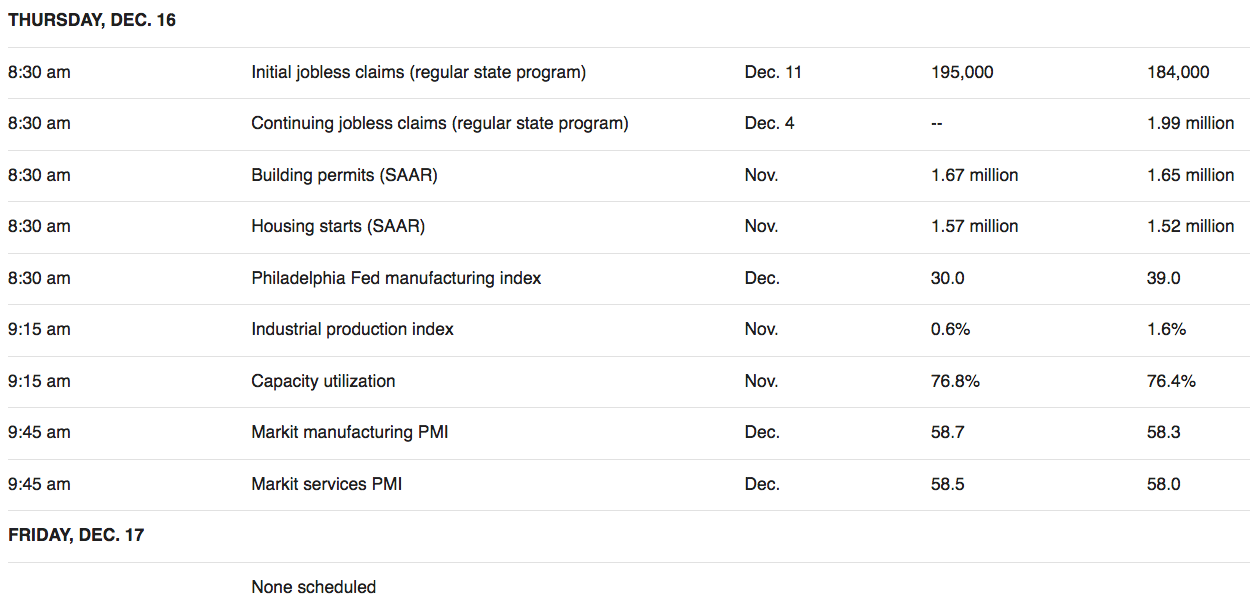

Sectors: Tech led this week by a wide margin, with Utilities lagging. Energy remains the leading sector in 2021.

Futures: WTI crude rose 8% this week, ending at $71.94.

“The EIA reported on Thursday that domestic supplies of natural gas fell by 59 billion cubic feet for the week ended Dec. 3. That compared with the average decline of 55 billion cubic feet forecast by analysts polled by S&P Global Platts . Total stocks now stand at 3.505 trillion cubic feet, down 356 billion cubic feet from a year ago and 90 billion cubic feet below the five-year average, the government said.” (MarketWatch)