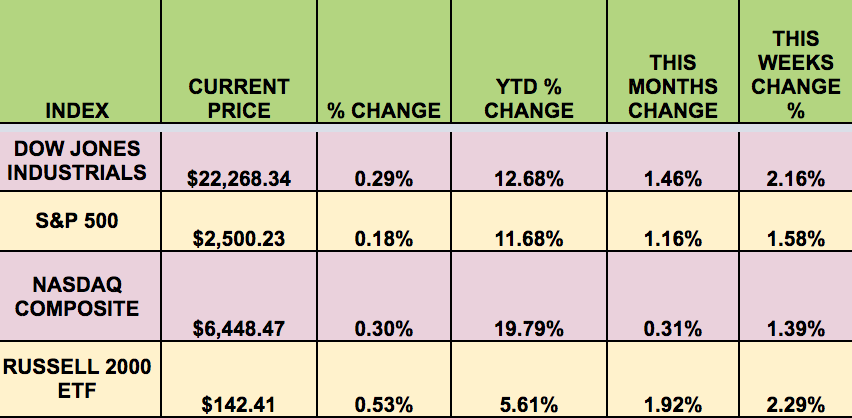

Markets: The market had big gains this week, with the DOW and the S&P 500 hitting new highs. The Russell Small Caps led, with the NASDAQ lagging.

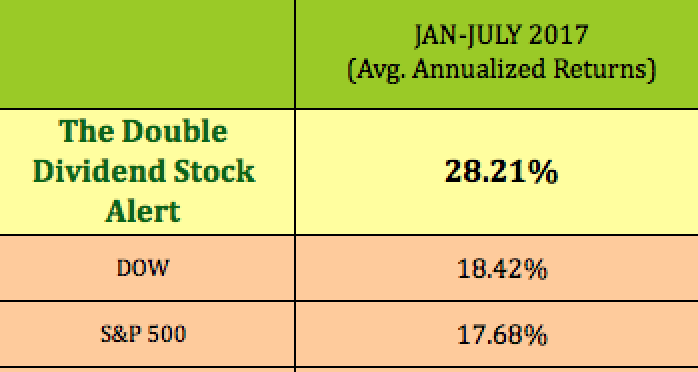

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CPTA (NASDAQ:CPTA), GAIN (NASDAQ:GAIN), GLAD (NASDAQ:GLAD), PFLT (NASDAQ:PFLT), PNNT (NASDAQ:PNNT), STX (NASDAQ:STX), VGR (NYSE:VGR), AINV(NASDAQ:AINV), HCAP (NASDAQ:HCAP), SLRC (NASDAQ:SLRC), AWP (NYSE:AWP).

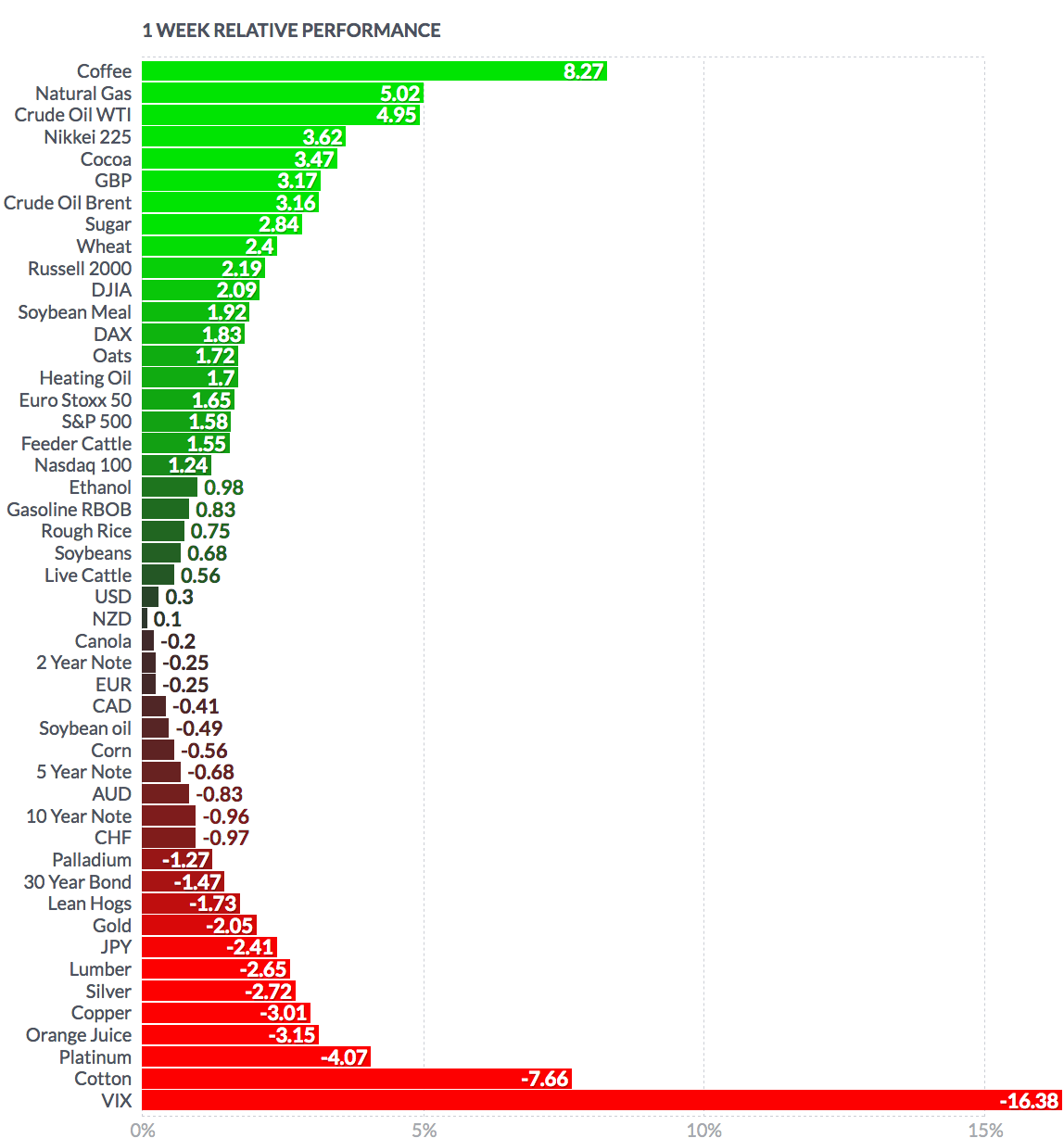

Volatility: The VIX fell 16% this week, and finished at $10.17.

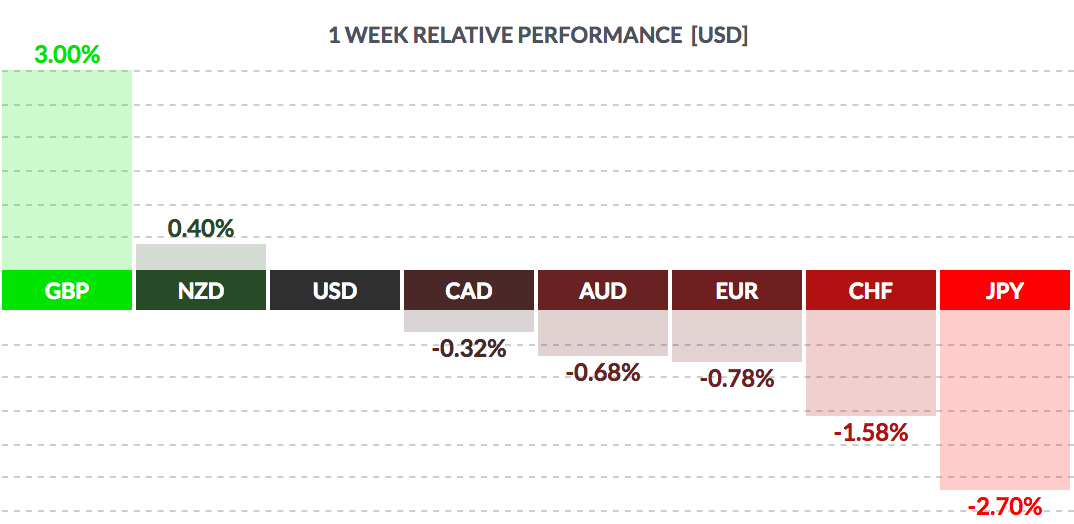

Currency: The dollar vs. most major currencies this week, except for the pound and the NZD.

Market Breadth: 27 of the DOW 30 stocks rose this week, vs. 12 last week. 74% of the S&P 500 rose, vs. 55% last week.

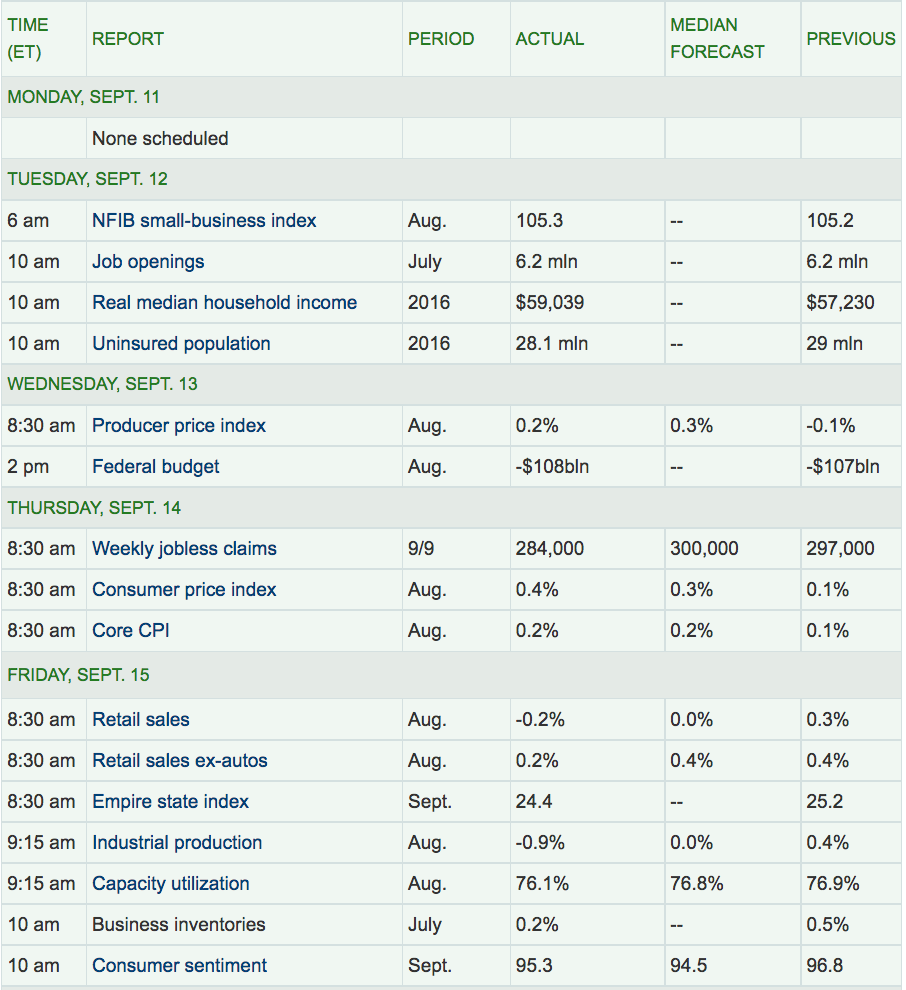

Economic News: “Higher housing costs and gas prices socked consumers in August, but the cost of medical care grew at the slowest rate since 1965, a surprising downshift that could restrain U.S. inflation in the months ahead. The consumer price index, (or cost of living), surged 0.4% last month to mark the biggest increase since January.

The rise in consumer prices in August lifted the yearly increase in inflation to 1.9% from 1.7%, just a shade below the Federal Reserves 2% target. The Fed officially targets a different but similar measure of inflation.

Medical care expenses rose just 1.8% in the past 12 months, the smallest increase since 1965. Adjusted for inflation, hourly wages for American workers fell 0.3% in August. In the past year real hourly pay has risen a scant 0.6%.” (Source: Market Watch)

Our latest monthly Dividend Stocks Blog article (AUG):

Week Ahead Highlights: “At its meeting next week, the Fed is going to pause from interest rate hikes and is widely expected to announce the start of a plan to shrink its massive $4.5 trillion balance sheet. The market is now expecting more than a 50% chance of a December rate hike, up from about a 30% chance one week ago.” (Source: Market Watch)

Next Week’s US Economic Reports: The Fed is expected to hold rates steady at its meeting next week. There will be 3 Housing-related reports out next week.

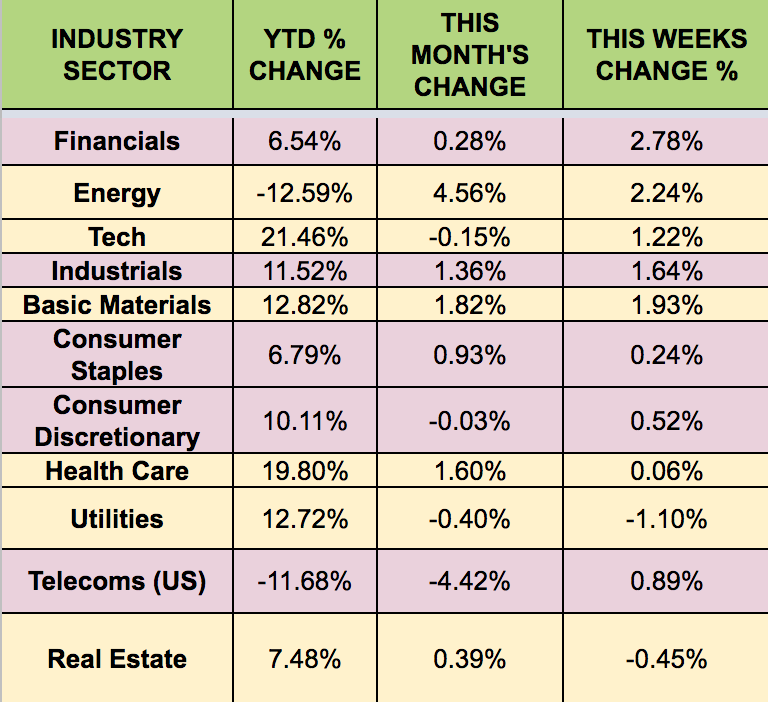

Sectors: The Financials and Energy sectors led this week, with Utilities trailing.

Futures: Natural Gas futures rose 5% this week, while WTI Crude rose 4.95%.