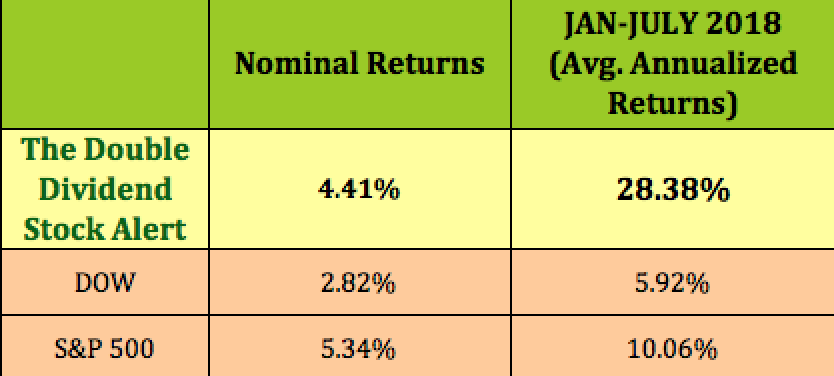

How is your portfolio handling the up and down market of 2018?

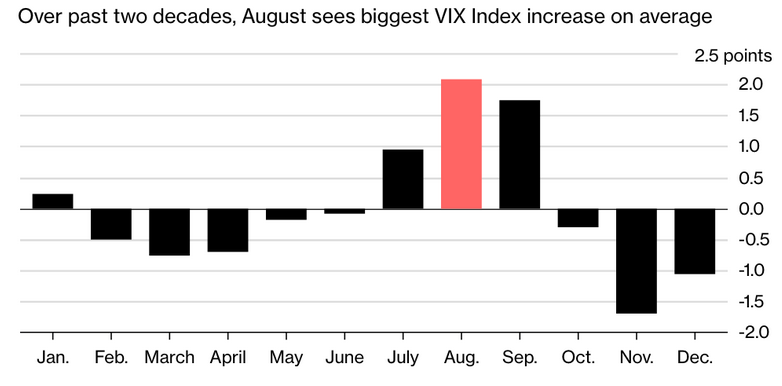

August and September are the 2 most volatile months in the market.

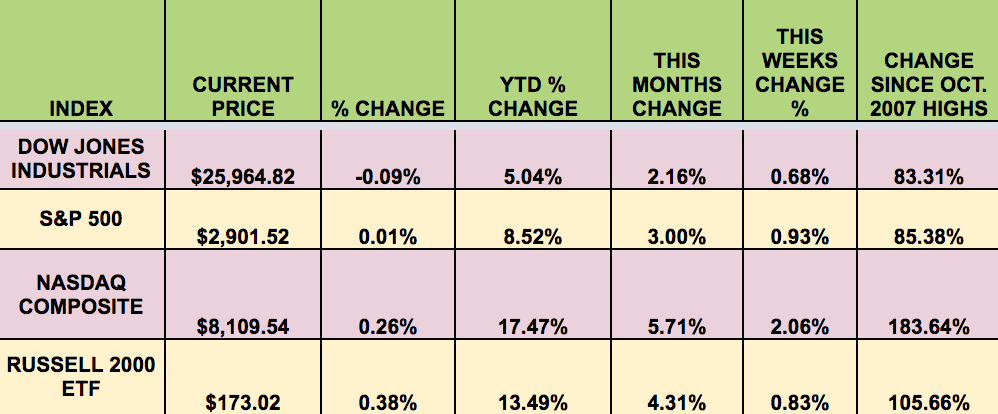

Markets: It was a big month for the market, as investors shook off tariff war jitters, and the Fed struck a moderate tone at its annual conference.

The NASDAQ Composite and Russell small caps led in August, while the Dow Jones 30 Futures and S&P 500 also logged strong gains.

The Dow and the S&P had their 3rd straight weekly gains, while the Nasdaq had its its best August return since 2000. The S&P and the NASDAQ had their best August performance since 2014.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Cedar Fair LP (NYSE:FUN), TiVo Corp (NASDAQ:TIVO), Fidus Investment Corp (NASDAQ:FDUS), Gaming & Leisure Properties (NASDAQ:GLPI), Golub Capital BDC Inc (NASDAQ:GBDC), Outfront Media Inc (NYSE:OUT), New Senior Investment Group (NYSE:SNR).

Volatility: The VIX rose 6% this week, ending the week at $12.86.

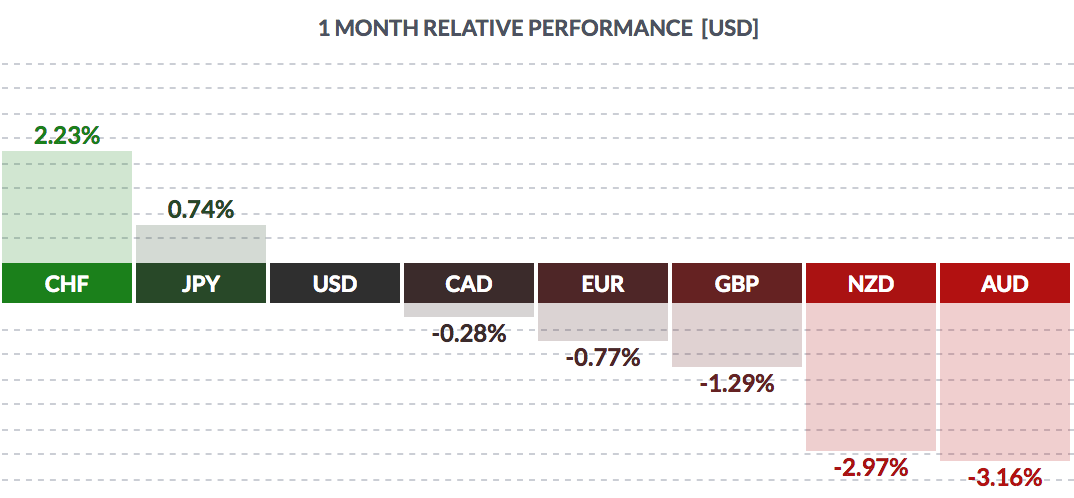

Currency: The $ rose vs. most major currencies in August, but fell vs. the Swiss Franc and the Yen.

Market Breadth: 17 of the DOW 30 stocks rose this week, vs. 17 last week. 60% of the S&P 500 rose this week, vs. 61% last week.

Economic News:

The US and Mexico reached a bi-lateral agreement on a revised NAFTA deal on Monday. As of the Friday close, Canada and the US still hadn’t reached a deal.

Q2 GDP was revised upwards to 4.2%. Pending home sales fell 0.7%. Consumer Confidence rose to 133.4, while Consumer spending rose 0.4% in July.

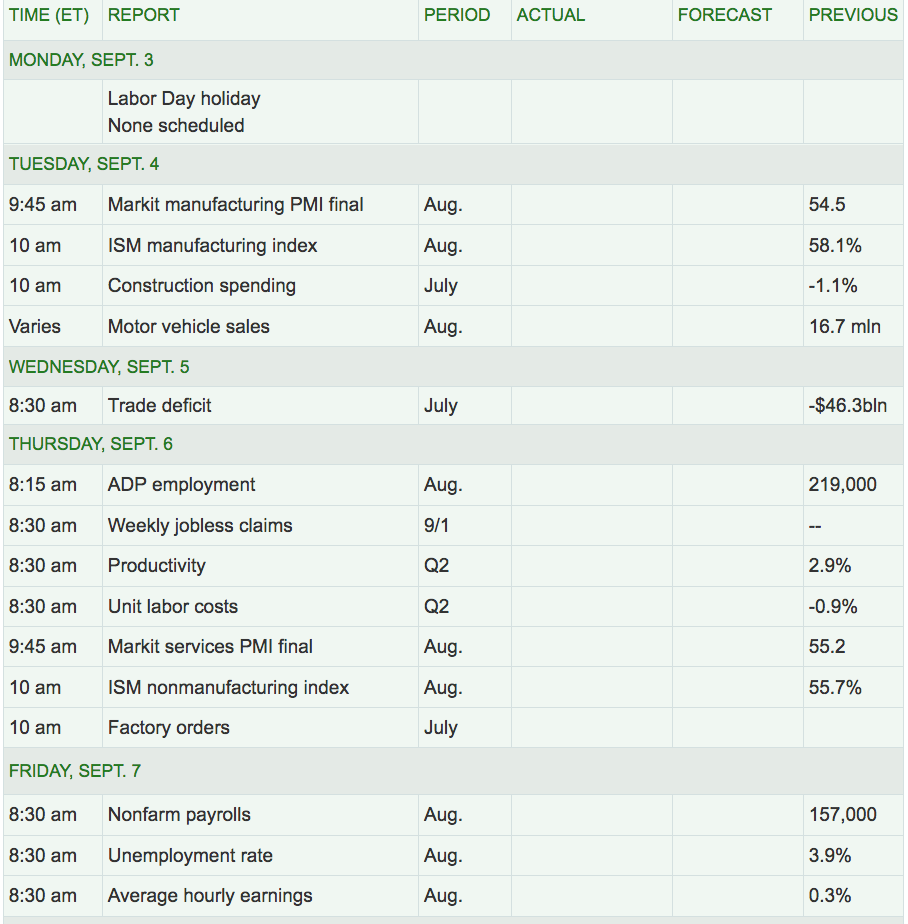

Week Ahead Highlights: It’ll be a short week, with the market closed on Monday for the Labor Day holiday. The ADP and Non-Farm Payroll reports are due out, on Thursday and Friday.

Next Week’s US Economic Reports:

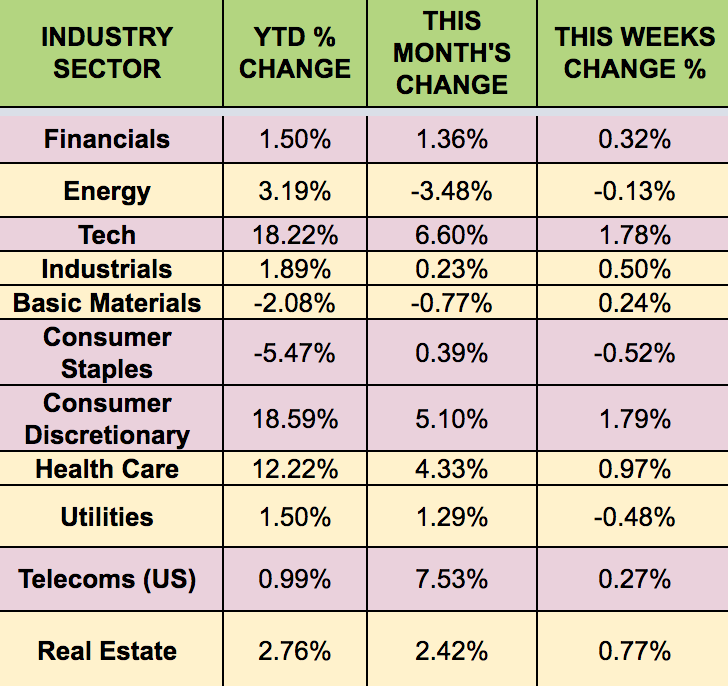

Sectors: Telecoms and Tech had a big month in August, while the Energy sector lagged.

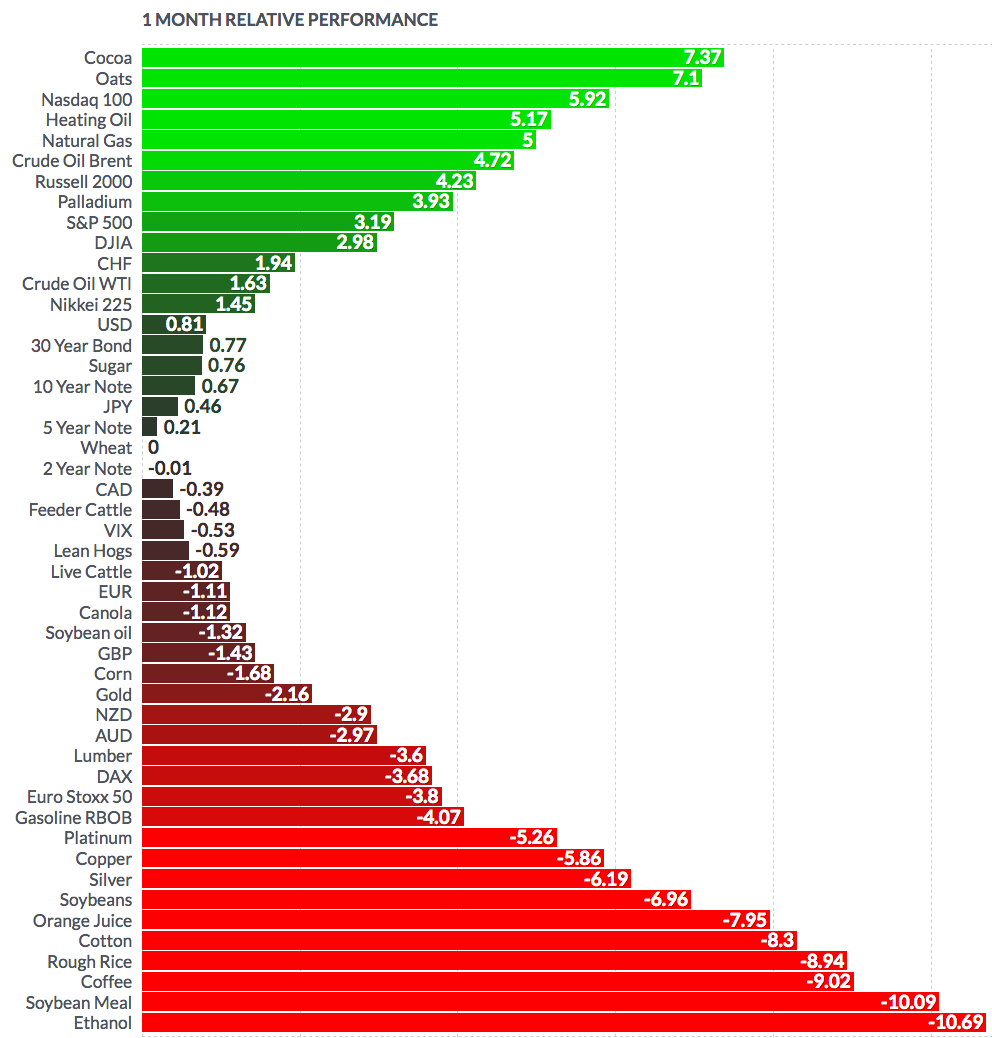

Futures:

“Brent oil prices rose to near $76 a barrel on Monday as a committee monitoring a deal on oil output curbs between OPEC and non-OPEC producers saw production rising while a U.S.-China trade dispute capped gains. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 13 cents at $68.85 a barrel. Members of an OPEC and non-OPEC monitoring committee found producers in a supply-reduction agreement cut their July output by 9 percent more than called for in their pact, two sources familiar with the matter said on Monday.” (Reuters) WTI crude ended the week at $69.88, up 1.63% in August. Natgas gained 5% for the month.