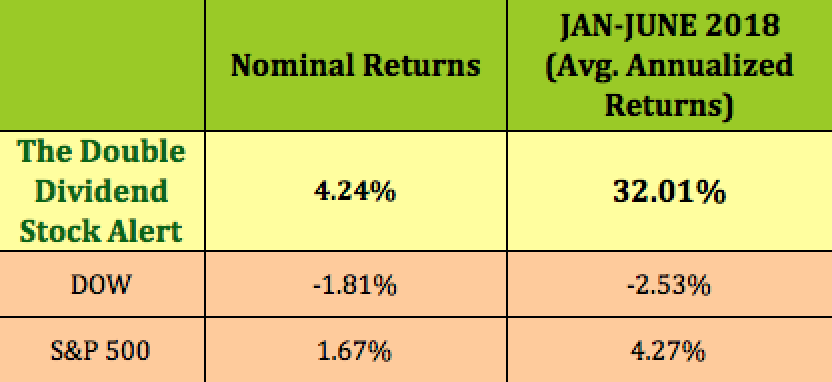

How is your portfolio handling the up and down market of 2018?

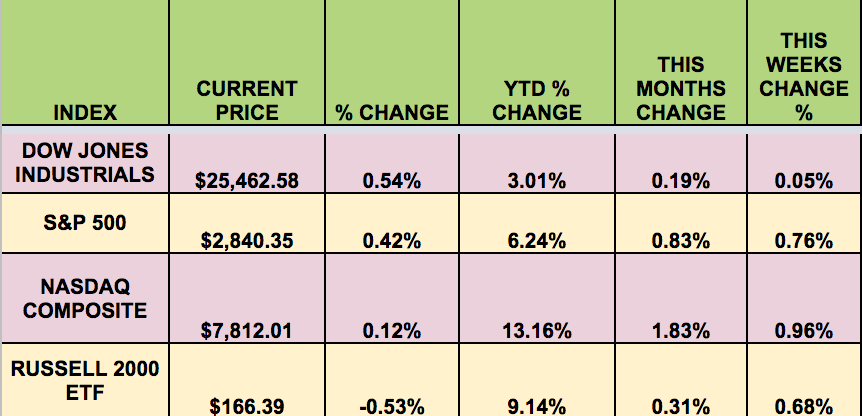

Markets: It was yet another mixed week for the market, with the Dow flat, and the S&P 500, NASDAQ, and RUSSELL small caps all up. Apple’s robust earnings helped the bulls, but the bears were aided by ongoing tariff troubles. On Friday, the market shook off a tepid jobs report.

“U.S. stocks fell on Thursday, weighed down by financials, as worries of a trade war between the United States and China were heightened after the White House proposed 25% tariffs on $200 billion worth of Chinese imports. Tthe increase is up from a previously proposed 10% duty because China has refused to meet Washington’s demands and has imposed retaliatory tariffs on U.S. goods. Beijing responded to the new threat saying it was ready to escalate the trade war.”

China on Friday announced retaliatory tariffs on $60 billion worth of U.S. goods ranging from liquefied natural gas (LNG) to some aircraft and warned of further measures, signaling that it won’t back down in a protracted trade war with Washington. China’s finance ministry unveiled new sets of additional tariffs on 5,207 goods imported from the United States, ranging from 5 to 25 percent.

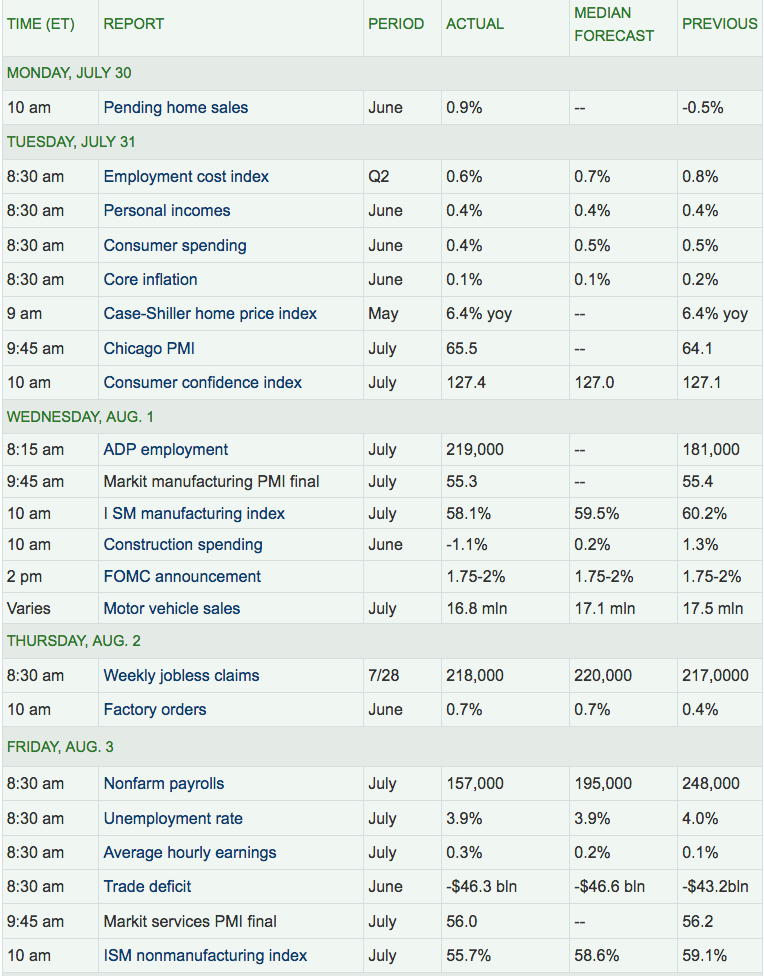

The Fed voted unanimously to keep the target range for its benchmark rate at 1.75% to 2%. The committee says “economic activity has been rising at a strong rate,” a more bullish view than the June characterization of “solid” growth.”

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CEQP, GMLP, MMLP, NGL, APU, BT.

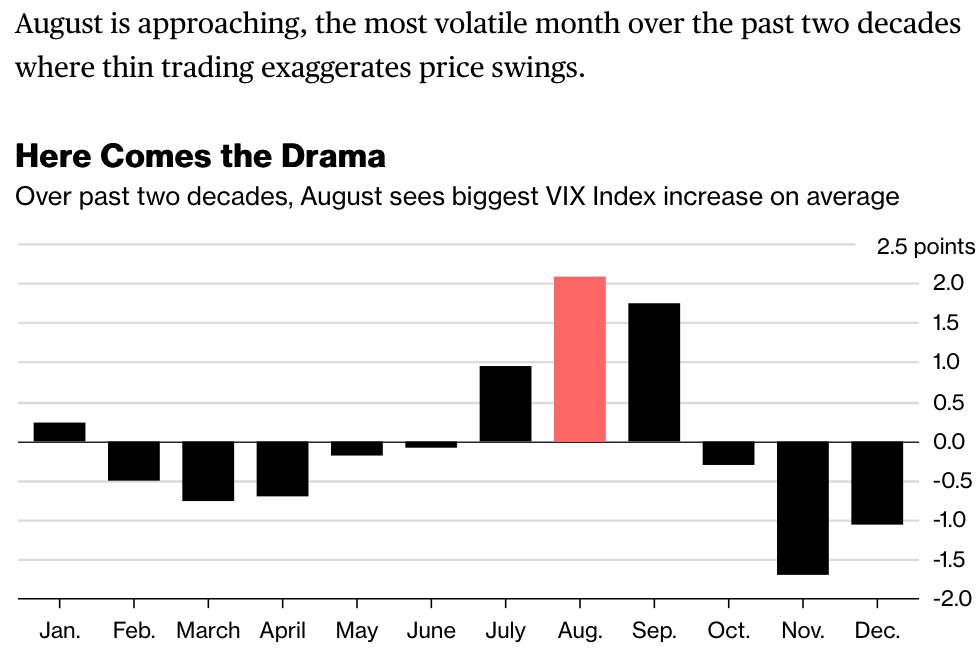

Volatility: The VIX fell 10.67%% this week, ending the week at $11.64.

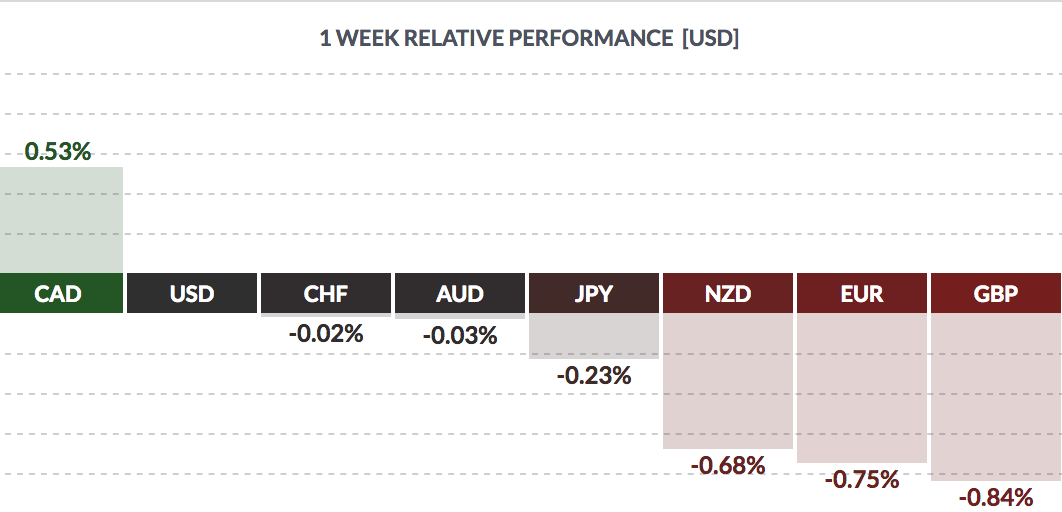

Currency: The dollar rose vs. most major currencies this week, but fell vs. the Loonie.

Market Breadth: 16 of the Dow 30 stocks rose this week, vs. 23 last week. 56% of the S&P 500 rose this week, vs. 61% last week.

Economic News:

The US economy added 157,000 jobs in July – 33,000 fewer than expected and well below the 248,000 created in June. Economists had forecast that the number of jobs created would be close to 190,000 for the month.The unemployment rate fell from 4.0% to 3.9% in July, the US Department of Labor said, near to the 18-year low it reached in May. Previous job gain estimates for May and June were revised upwardly, to 268,000 and 248,000 respectively. The Department of Labor figures also showed average hourly earnings increased by 0.3% in July to $27.05, meaning they were up 2.7% from the same month last year. (BBC)

U.S. consumer spending increased solidly in June as households spent more at restaurants and on accommodation, building a strong base for the economy heading into the third quarter, while inflation rose moderately. Other data on Tuesday showed employers boosting benefits for workers in the second quarter, but wage growth slowed down. With savings at lofty levels and lower taxes increasing take-home pay for some workers, consumer spending is likely to remain strong this year and allow the Federal Reserve to continue gradually raising interest rates.

Prices continued to steadily rise last month. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components gained 0.1 percent in June. It had risen by 0.2 percent in the prior month ... Factory growth stuttered across the world in July, heightening concerns about the global economic outlook as an intensifying trade conflict between the United States and China sent shudders through trading partners. Global economic activity remains healthy, but it has already passed its peak, according to economists polled by Reuters last month. They expect protectionist policies on trade, which show no signs of abating, to tap the brakes. But slowing growth, wilting confidence, and trade war fears are not likely to deter major central banks from moving away from their ultra-loose monetary policies put in place in the wake of the 2008 financial crisis.

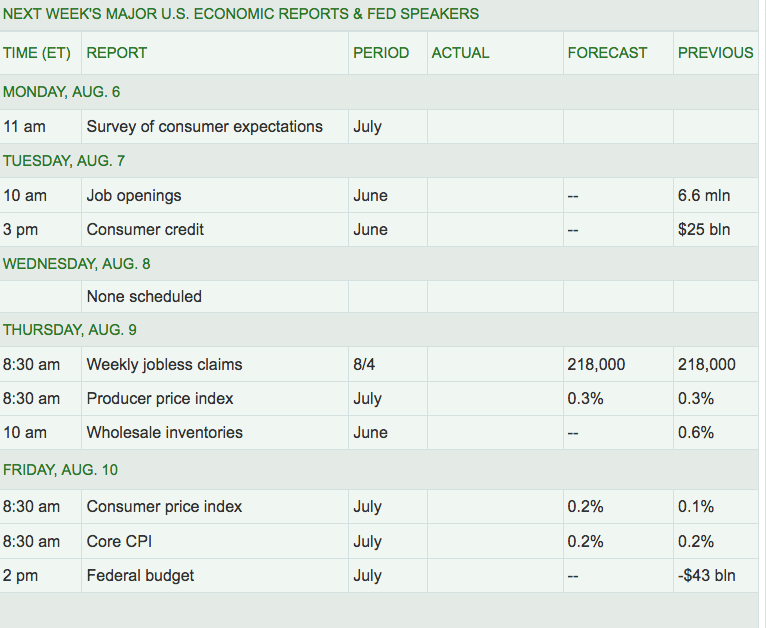

Week Ahead Highlights: It’ll be a light week for economic reports, but we’ll get a peek at how inflation is faring, with the CPI due out, in addition to some consumer-based data. Q2 ’18 Earnings season continues, with 1 Dow stock, Disney reporting. 20% of the S&P 500 will report, including CVS, EMR, MAR, OXY, and SO.

Next Week’s US Economic Reports:

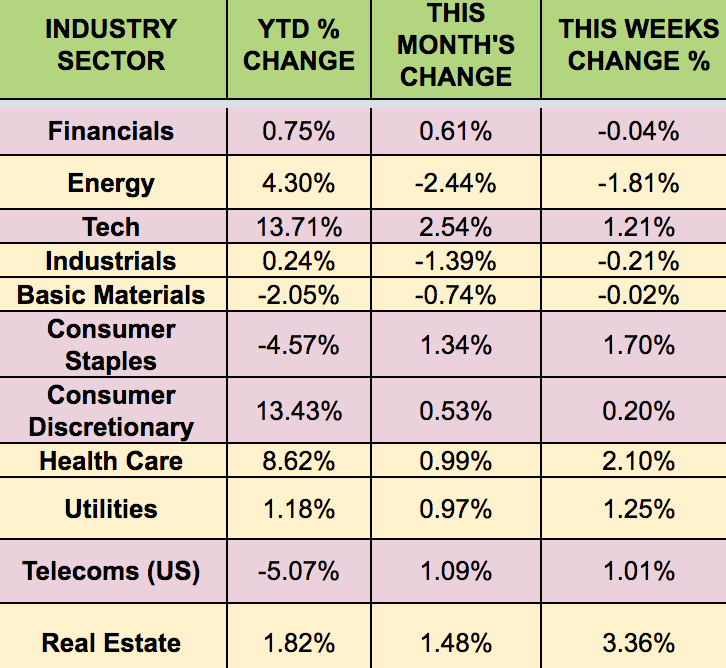

Sectors: The Real Estate sector led this week, with Energy trailing.

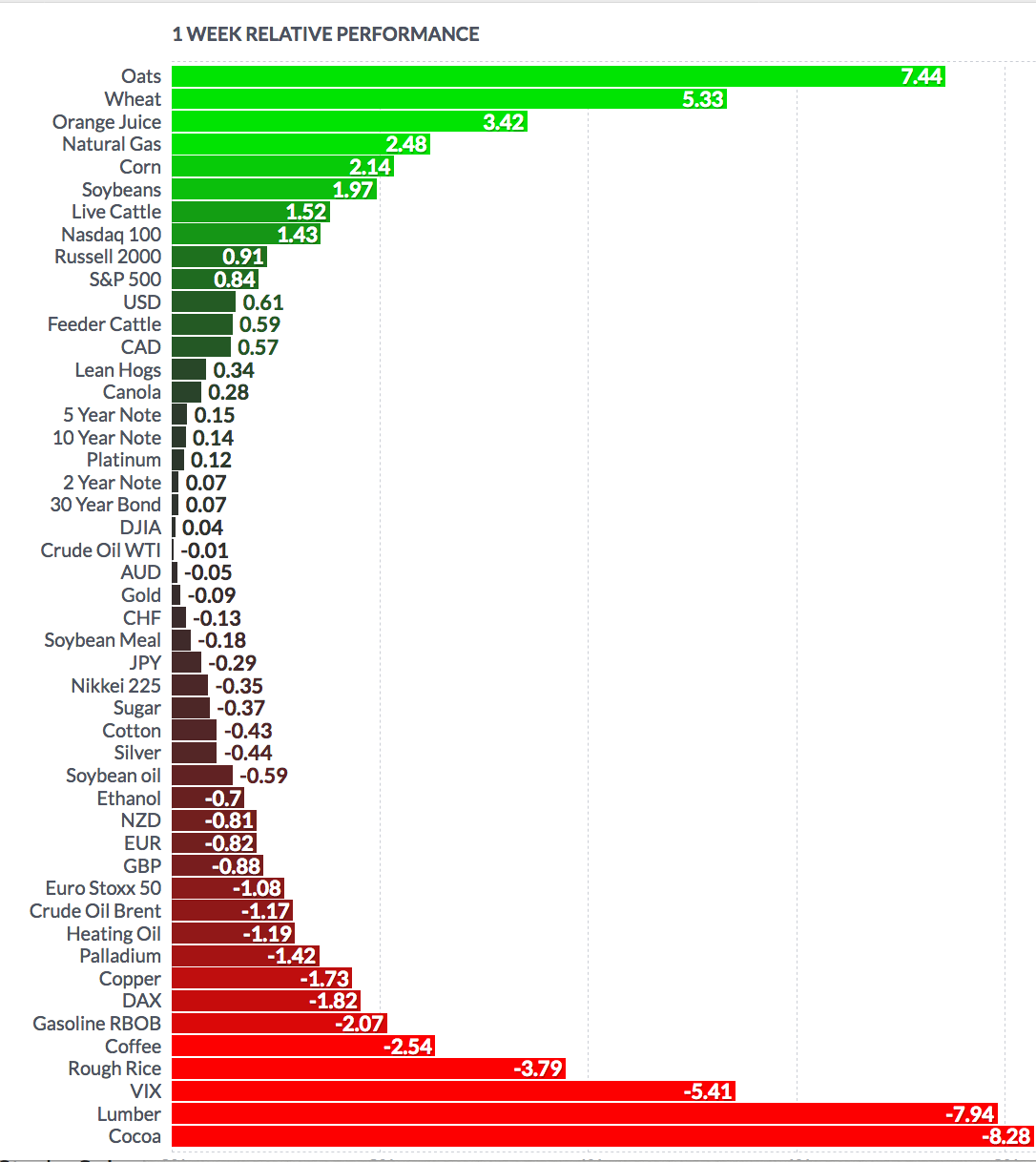

Futures:

WTI Crude finished the week at $69.04, with WTI futures up 1.14%. Natural Gas Futures 1.02%: