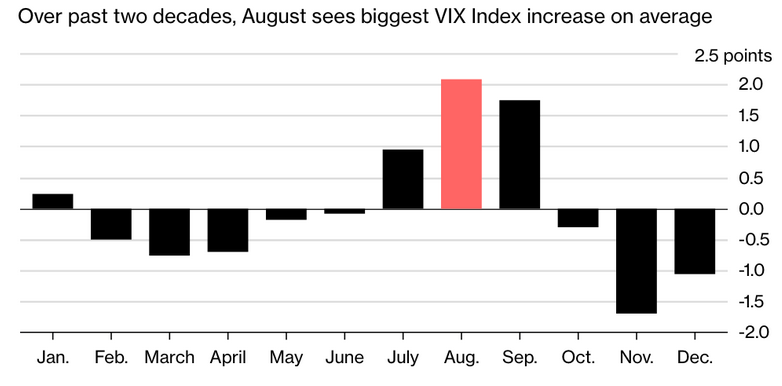

August and September are the 2 most volatile months in the market.

Source: Bloomberg

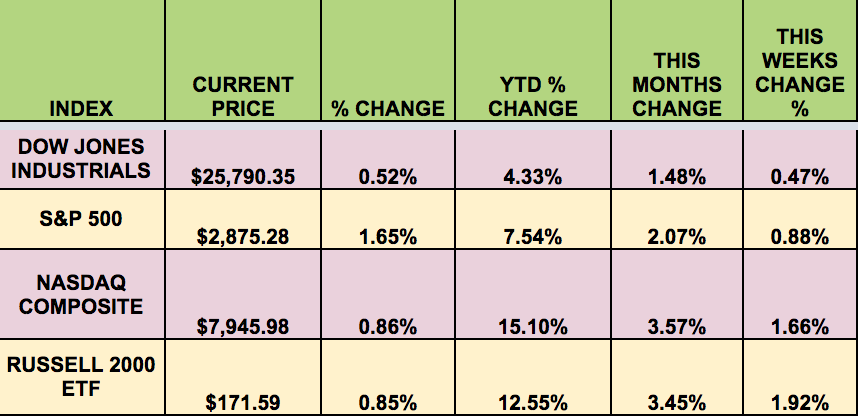

Markets: It was an up week for the market, as tariff war fears subsided a bit, crude oil rallied, and the Fed struck a moderate tone at its annual conference.

The Russell small caps index and the NASDAQ led, while the Dow and S&P 500 also gained.

“Global equity market rose on Friday after Federal Reserve Chairman Jerome Powell expressed no surprises in a key speech outlining a steady course for monetary policy, while oil prices surged on signs Iran sanctions may constrain worldwide supply. The benchmark S&P 500 and the Nasdaq hit all-time highs after Powell’s comments at an annual meeting of central bankers did little to change market expectations of an interest rate hike in September and perhaps again in December.

The dollar weakened as Powell, speaking in Jackson Hole, Wyoming, said a gradual approach of raising rates remains appropriate to protect the U.S. economy and keep job growth as strong as possible with inflation under control.” ~ Reuters

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: American Capital (NASDAQ:ACSF), Spark Energy (NASDAQ:SPKE), AGNC Investment (NASDAQ:AGNC), Atlantica Yield (NASDAQ:AY),Brookfield Renewable Energy Partners (NYSE:BEP), Brookfield Property Partners (NASDAQ:BPY), Colony Northstar Credit Real Estate (NYSE:CLNC), Ellington Financial (NYSE:EFC), Orchid Isla (NYSE:ORC), Prospect Capital Corporation (NASDAQ:PSEC), TerraForm Power (NASDAQ:TERP), Unique Fabricating (NYSE:UFAB), Vermilion Energy (NYSE:VET), NRG Yield (NYSE:NYLD), Pennsylvania RE Investment Trust (NYSE:PEI), Washington Prime Group (NYSE:WPG).

Volatility: The VIX fell 4.1% this week, ending the week at $12.12.

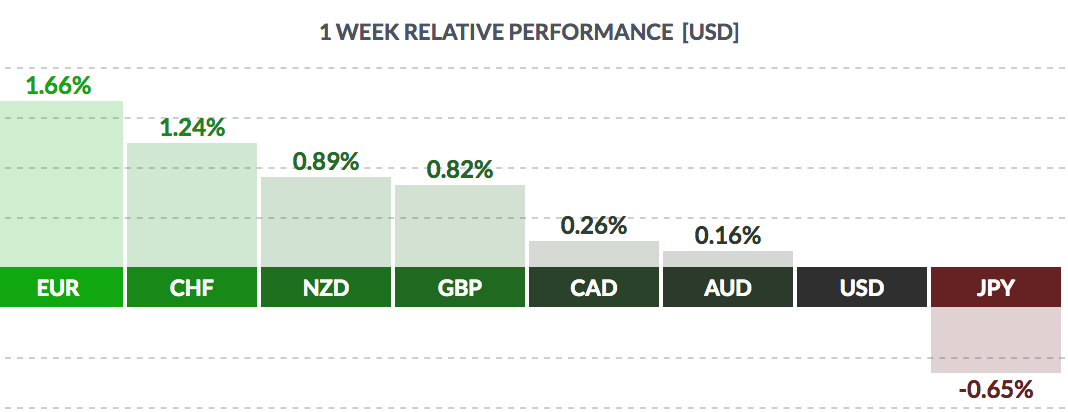

Currency: The US dollar fell vs. most major currencies again this week, but rose vs. the yen.

Market Breadth: 17 of the Dow 30 stocks rose this week, vs. 22 last week. 61% of the S&P 500 rose this week, vs. 67% last week.

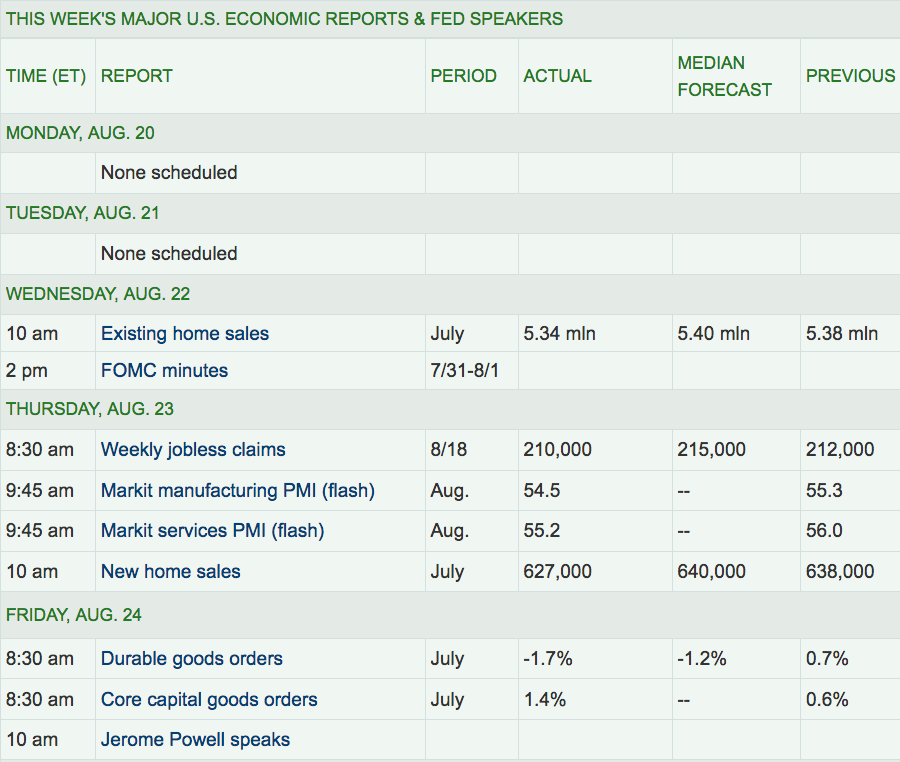

Economic News:

“A broad cross-section of U.S. businesses has a message for the US administration: new tariffs on $200 billion of Chinese imports will force Americans to pay more for items they use throughout their daily lives, from cradles to coffins. Unlike previous rounds of U.S. tariffs, which sought to shield consumers by targeting Chinese industrial machinery, electronic components and other intermediate goods, thousands of consumer products could be directly hit with tariffs by late September.The $200 billion list targets Chinese seafood, furniture and lighting products, tires, chemicals, plastics, bicycles and car seats for babies. “USTR’s proposed tariffs on an additional $200 billion of Chinese imports dramatically expands the harm to American consumers, workers, businesses, and the economy,” the U.S. Chamber of Commerce said in written testimony for the hearing.” (Reuters)

“Power generation from coal dropped nearly 6% from January to May this year compared to the same time period in 2017, according to US government stats. Coal’s biggest rivals are all gaining ground. Natural gas power generation is up 17% this year, while solar has soared 31% and wind has increased 9%.

In 2016, natural gas overtook coal for the first time as America’s source of power generation. Coal fell to an all-time low of 30% of the electricity market last year, down from roughly half a decade ago and nearly 60% three decades ago, according to government statistics. Renewable energy has made inroads thanks to technological advancements and a wave of investment. Solar and wind are increasingly becoming competitive with fossil fuels — a trend that’s expected to continue.” (CNN)

Week Ahead Highlights: It’ll be a Consumer data week, with consumer confidence, spending, and sentiment reports due out, in addition to several housing reports.

Next Week’s US Economic Reports:

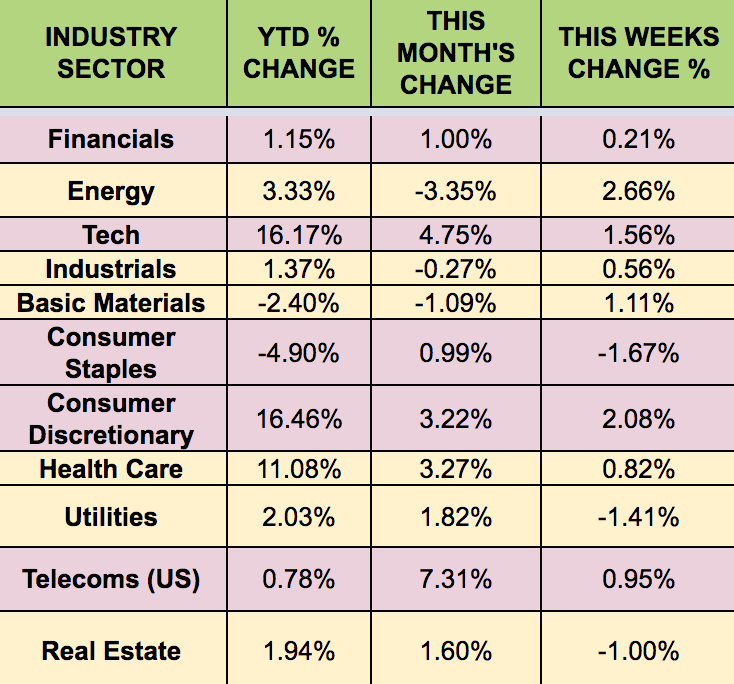

Sectors: The market turned bullish this week, with the Energy sector leading, as oil gained, from potential supply disruptions from Iran, while Consumer Staples and Utilities trailed.

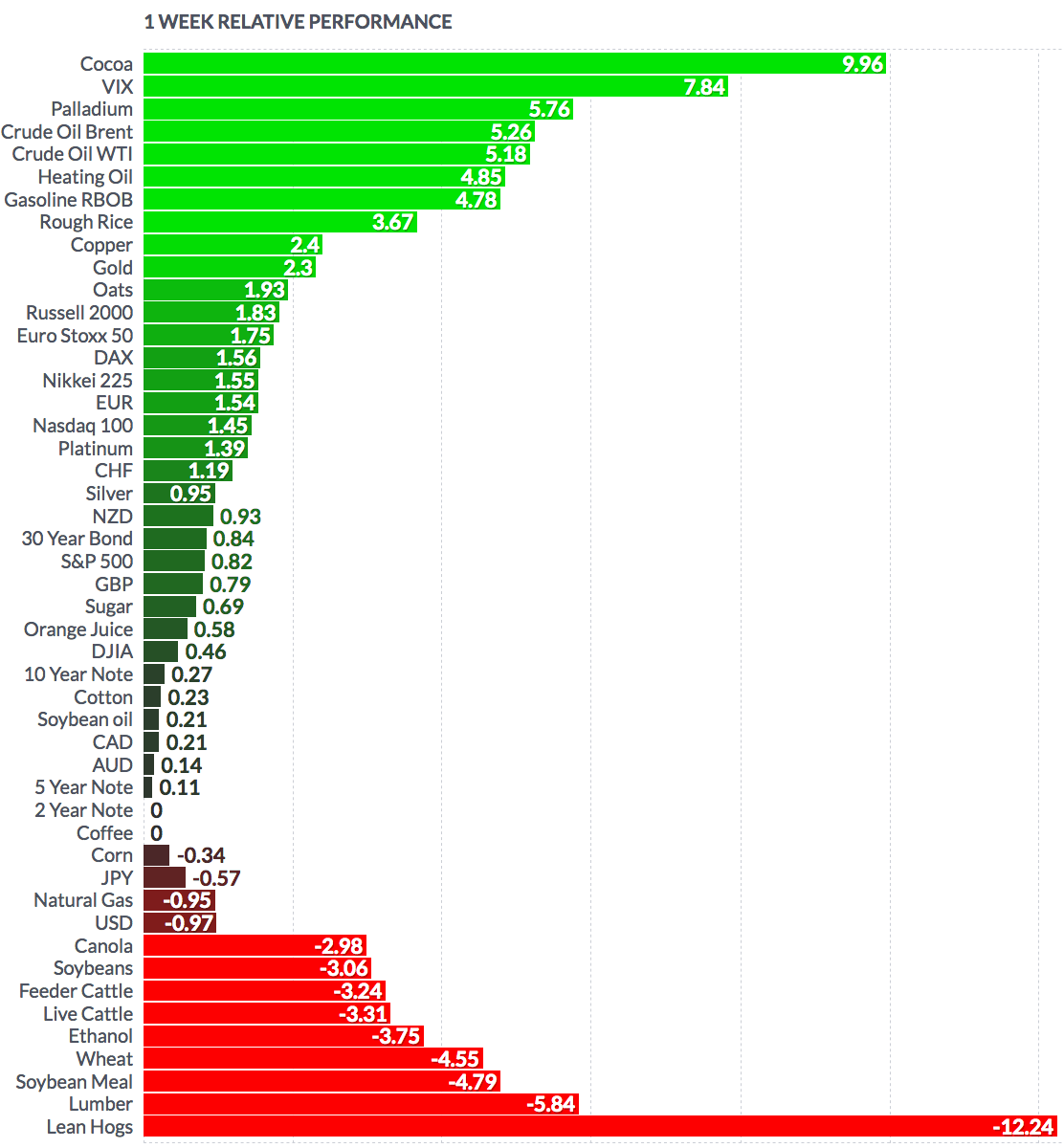

Futures:

“Oil climbed Friday, with U.S. benchmark prices gaining more than 5% for the week on the heels of seven consecutive weekly declines. The market continues to receive reports of lower Iranian oil exports, said James Williams, energy economist at WTRG Economics. As the effect of U.S. sanctions on Iran become reality, they will impact the market, he said. October West Texas Intermediate oil settled at $68.60, up 77 cents on the New York Mercantile Exchange. The contract rose 5.2% for the week.”