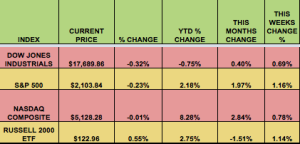

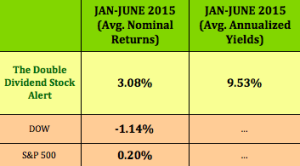

Markets: The NASDAQ and the S&P 500 both had solid gains in July, while the DOW gained just .40%, and the RUSSELL small caps retreated. Year-to-date, the DOW large caps are still in the red, and the NASDAQ leads by a wide margin.

Volatility: After rising to 16.27 on Monday, due to US market reactions from the Chinese market selloff, the VIX fell 12% this week, ending at 12.12.

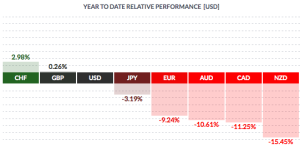

Currency: The US dollar has made large gains vs. most major currencies year-to-date, excepting the pound and the Swiss franc. The NZ dollar has had a very poor performance vs. the US dollar.

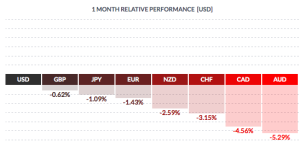

The US dollar gained vs. most major currencies in July:

Market Breadth: 23 DOW stocks rose this week, vs. 5 last week. 71% of the S&P 500 stocks rose this week, vs. 23% last week.

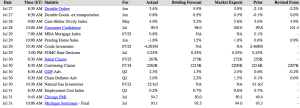

US Economic News: Consumer Confidence sank to 90.93, its biggest monthly drop since Aug. 2011. The FED kept its rate at .25, as expected.

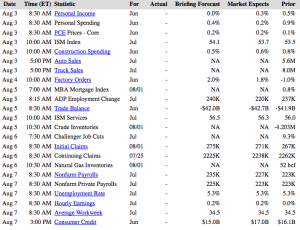

Week Ahead Highlights: Non-Farm Payrolls and the unemployment figure come out on Friday…ADP releases its employment report on Wednesday.

Next Week’s US Economic Reports:

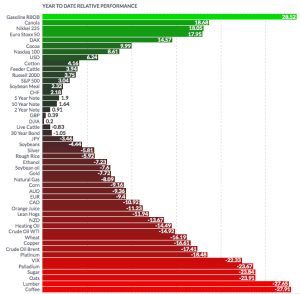

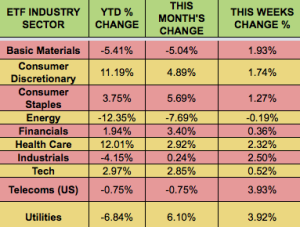

Sectors and Futures:

Consumer Staples led in July, while Energy trailed.

Gasoline futures have led in 2015, while coffee futures have lagged.