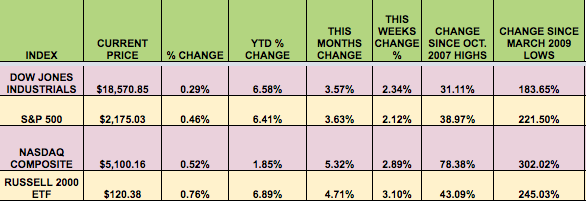

Markets: US indexes hit all-time highs this past week, in spite of Crude Oil falling -5%, with the Dow extending its string of up days to 9. The S&P also closed at an all-time high, $2175.03, and is up 221.5% since the March 2009 lows.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: American Capital Agency Corp (NASDAQ:AGNC), Ardmore Shipping (NYSE:ASC), Ciner Resources LP (NYSE:CINR), Franklin Universal Closed Fund (NYSE:FT), Genesis Energy LP (NYSE:GEL), Independence Realty Trust Inc (NYSE:IRT), Plains All American Pipeline LP (NYSE:PAA), Prospect Capital Corporation (NASDAQ:PSEC), Student Transportation Inc. (NASDAQ:STB), TransMontaigne Partners LP (NYSE:TLP), Liberty All Star Equity Closed Fund (NYSE:USA), Omega Healthcare Investors Inc (NYSE:OHI), Whitestone REIT (NYSE:WSR).

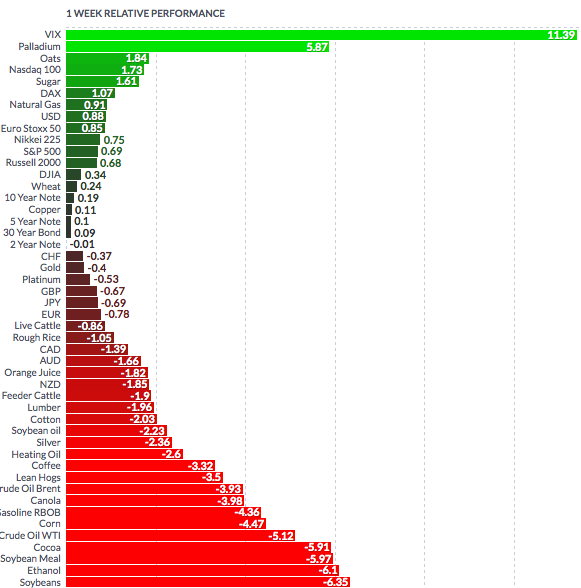

Volatility: The VIX rose 11.2% this week, finishing at $15.40.

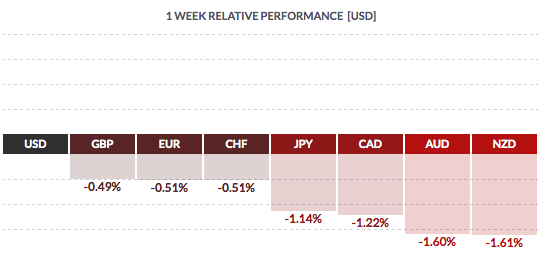

Currency: The USD had a strong week, rising vs. most major currencies.

Market Breadth: 14 of the Dow 30 stocks rose this week, vs. 28 last week. 62% of the S&P 500 rose this week, vs. 74% last week.

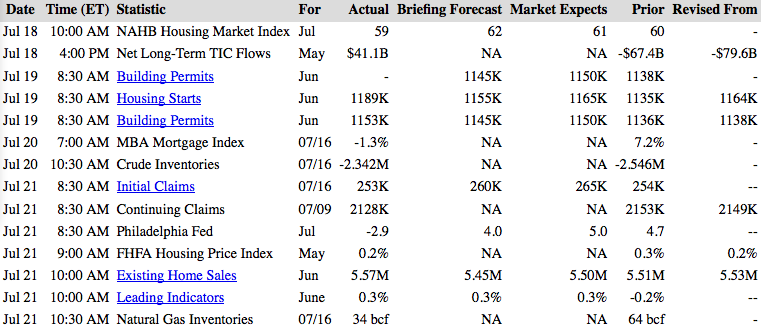

US Economic News: Housing Starts, Building Permits, and Existing Home sales all surprised to the upside. Housing Starts are now at a 1.19M annual rate, above the 1M threshold seen as a key to a healthy Housing industry.

Week Ahead Highlights: Tech stocks will be in the spotlight next week, with Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), and Facebook (NASDAQ:FB) all reporting. Nearly 40% of all S&P 500 firms will be reporting.

So far, 54% of reporting companies have beaten revenue estimates, and analysts have adjusted upward their overall earnings growth expectations to -3%, from a previous -4.5% forecast.

The Fed holds its rate meeting on Tuesday and Wednesday – there are low expectations for a rate hike, with futures markets indicating the next hike may not be until March 2017, just in time to welcome in the next US President.

The Democratic Convention will be held next week in Philadelphia.

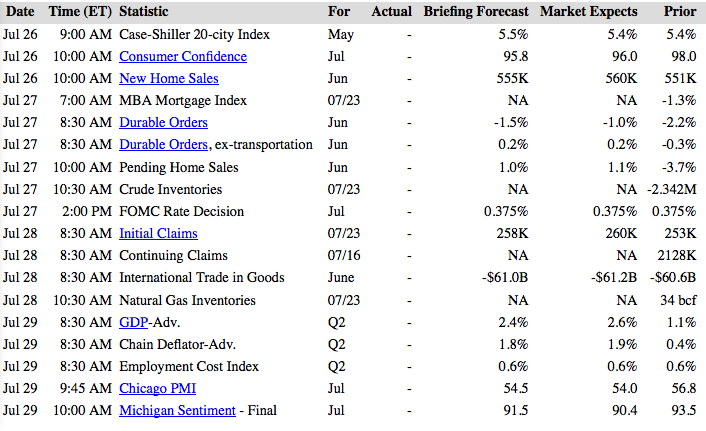

Next Week’s US Economic Reports:

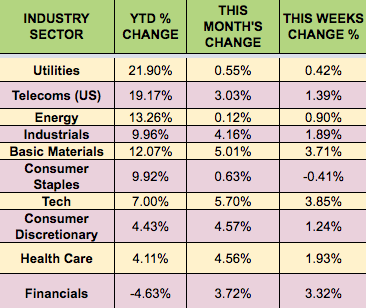

Sectors & Futures:

Tech led this week, as Consumer Staples trailed. Basic Materials were also up 3.71%, in spite of a strong dollar.

Palladium led this week, with Soybeans trailing. West Texas Crude Oil fell -5.12%: