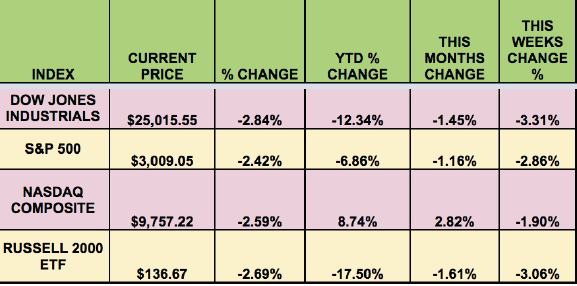

Market Indexes:

The market fell this week, with doubts about Phase 1 of the US-China trade deal, new Fed banking rules, and a surge in new coronavirus cases led to a "risk-off" environment. As usual, the NASDAQ held up the best.

"Wall Street’s major indexes dropped on Friday as the United States set a new record for a one-day increase in coronavirus cases and bank stocks tumbled after the Federal Reserve decided to cap shareholder payouts. " (MarketWatch)

Volatility:

The VIX fell less than 1% this week, ending at $34.73, vs. $35.12 last week.

High Dividend Stocks:

These high yield stocks go ex-dividend next week: AGNC, ARI, BCSF, CGBD, EFC, HCFT, NHI, NLY.

Market Breadth:

9 out of 30 DOW stocks rose this week, vs. 27 last week. 19% of the S&P 500 rose, vs. 90% last week.

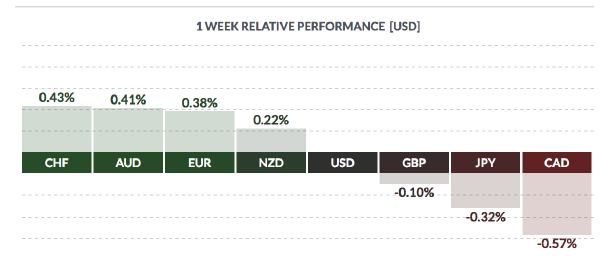

Forex:

The US dollar rose vs. the yen, pound, and Loonie, and fell vs. the Swiss franc, the Aussie and New zealand dollar, and the euro this week.

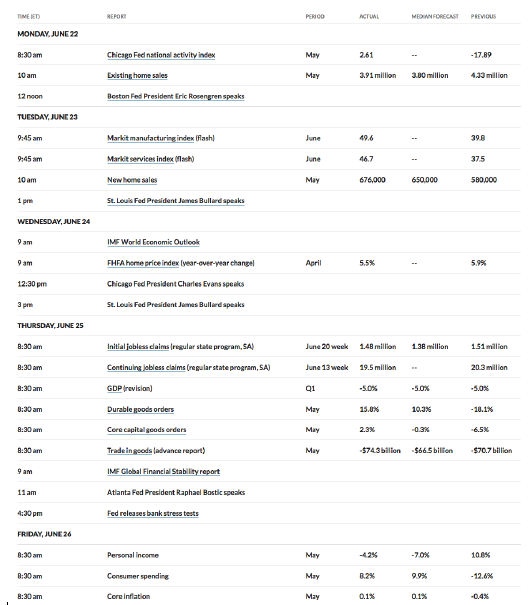

Economic News:

"The pace of contraction in the economy was left at -5% in the first quarter in the final estimate from the Commerce Department on Thursday. Using more complete source data, the government found that consumer spending was weaker than previously estimated. This was offset by upward revisions to business fixed investment. The data for the first was dragged down by the impact from the coronavirus pandemic that hit hard at the end of the period. Federal Reserve officials and private-sector economists have forecast an unprecedented contraction in GDP in the April-June quarter. Economists surveyed by MarketWatch expect a decline at a -29.5% annual rate. The data will be released on July 30." (MarketWatch) "Unemployment claims came in at 1.48 million for the week ending June 20, marking the fourteenth straight week that claims held above one million. Consensus economists had expected new claims to total 1.32 million. Since mid-March, new jobless claims totaled more than 47 million." (Yahoo)

New home sales rose 16.6% to a seasonally adjusted annual rate of 676,000 units in May. New home sales are a leading housing market indicator. April’s sales were revised lower to 580,000 units from the previously reported 623,000 units.

"Existing home sales declined by 9.7% in May over April to a seasonally adjusted annual rate of 3.91 million. In April, existing home sales declined by 17.8% month on month to a seasonally adjusted annual rate of 4.33 million. May’s decline marked the third straight month of month-on-month drops for sales of previously owned homes." (YahooFinance)

"The Federal Reserve Board on Thursday released the results of its stress tests for 2020 and additional sensitivity analyses that the Board conducted in light of the coronavirus event. In aggregate, loan losses for the 34 banks ranged from $560 billion to $700 billion in the sensitivity analysis and aggregate capital ratios declined from 12.0 percent in the fourth quarter of 2019 to between 9.5 percent and 7.7 percent under the hypothetical downside scenarios. Under the U- and W-shaped scenarios, most firms remain well capitalized but several would approach minimum capital levels.

For the third quarter of this year, the Board is requiring large banks to preserve capital by suspending share repurchases, capping dividend payments, and allowing dividends according to a formula based on recent income. The Board is also requiring banks to re-evaluate their longer-term capital plans." (Federal Reserve) Week Ahead Highlights: US markets will be closed on Friday, July 3rd, for Independence Day."

Week Ahead Highlights:

US markets will be closed on Friday, July 3rd, for Independence Day.

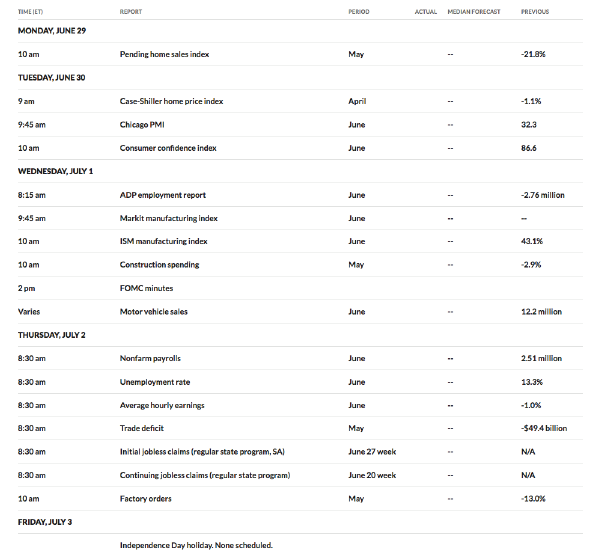

Next Week's US Economic Reports:

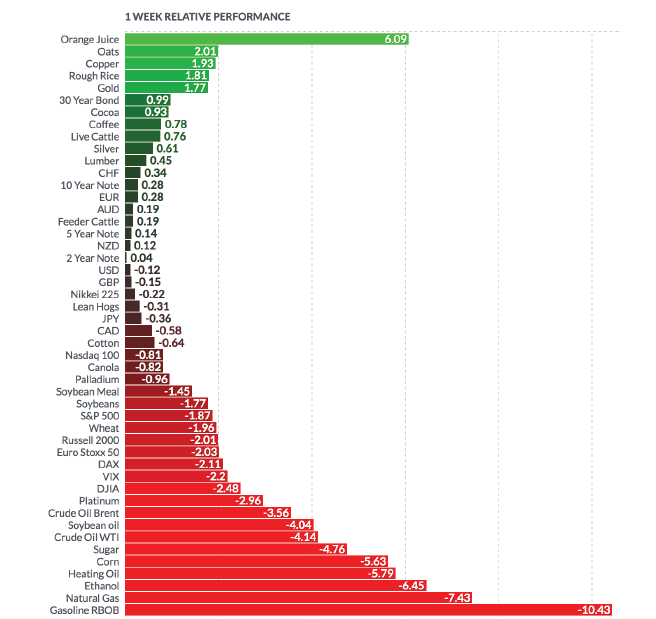

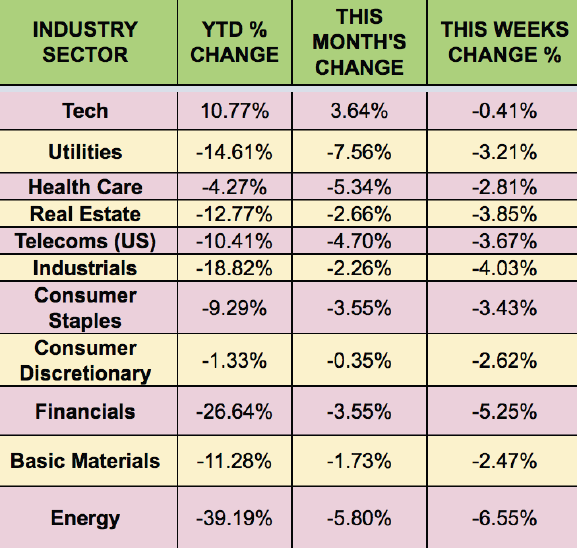

Sectors:

All sectors fell this week, with Tech holding up the best and Energy lagging.

Futures:

Oil fell again this week, due to the recovery being seen as a longer time period, with slower demand gains. WTI fell -4.14% this week, ending at $38.16.