Stock Market News May 25, 2019

Markets:

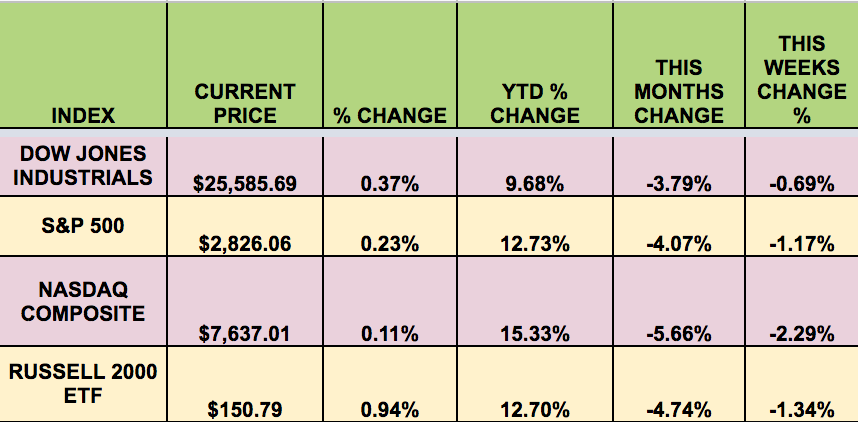

Market indexes fell this week, pressured by ongoing trade war rhetoric, and falling oil prices, which posted their biggest weekly drop of the year, due to concerns about rising inventories and worries about the global economy. The DJI held up the best but still fell -.89%, while the S&P fell -1.17%. The NASDAQ trailed, losing -2.29%, and the Russell small caps lost -1.34%. This was the DOW’s longest weekly losing streak since 2011.

“The United States needs to correct its wrong actions if it wants to continue negotiations with China to end a damaging tariff war, China’s Commerce Ministry said on Thursday, adding that talks should be based on mutual respect.

The United States has escalated trade frictions greatly, and increased chances of a global economic recession, spokesman Gao Feng said at a weekly briefing, adding that Beijing will take necessary steps to safeguard Chinese firms’ interests.”

High Dividend Stocks:

These high yield stocks go ex-dividend next week - SIX, AYR, BEP, BPR, BPY, CLDT, CLNC, EFC, SPKE, CWEN, PEI, TERP.

Market Breadth:

11 out of 30 DOW stocks rose this week, vs. 14 last week. 38% of the S&P 500 rose, vs. 38% last week.

Volatility:

The VIX rose 3% this week, ending the week at $16.45.

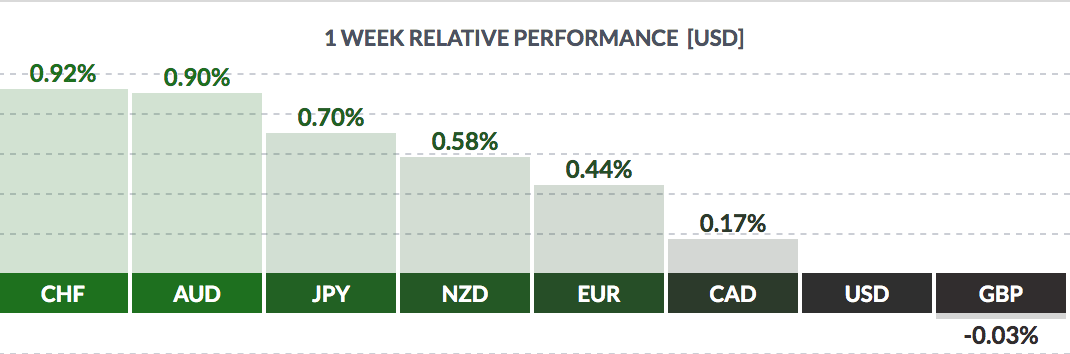

FOREX:

The USD fell versus most major currencies once this week.

Economic News:

“U.K. Prime Minister Theresa May announced her resignation, after her deals to usher Britain out of the European Union failed and she lost the confidence of her political inner circle. May’s planned resignation — she will stay on until a replacement is found — comes nearly three years after the U.K. voted to leave the bloc back in late June.

The premier delivered an emotional resignation speech in front of 10 Downing St “It is now clear to me that it is in the best interest of the country for a new prime minister,” she said. Her decision puts in further turmoil Britain’s exit plan, raising questions about how quickly they can cobble together a government in time to meet an Oct. 31 EU deadline or ask for an extension.

Former foreign secretary, Boris Johnson, and ex-Brexit secretary Dominic Raab, are considered to be the likely successors to May, only the second woman to be prime minister in the U.K. Another woman, former House of Commons leader, Andrea Leadsom, could also be in the running for the job.” (MarketWatch)

Week Ahead Highlights:

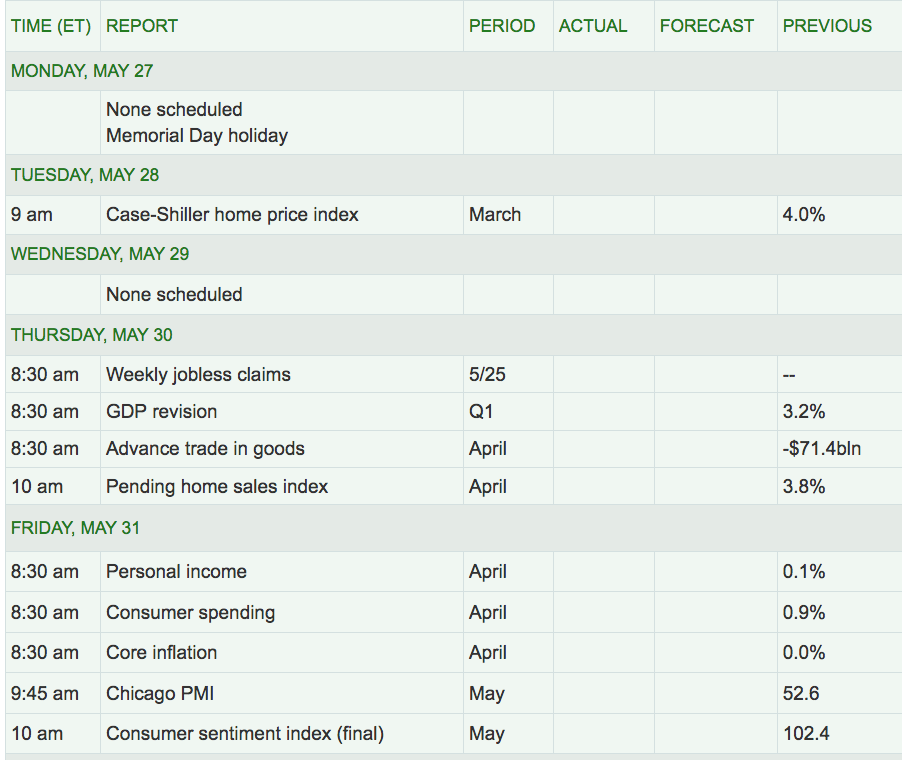

It’ll be a shortened week, with US markets closed Monday for the Memorial Day holiday. The revised Q1 GDP report will come out on Thursday.

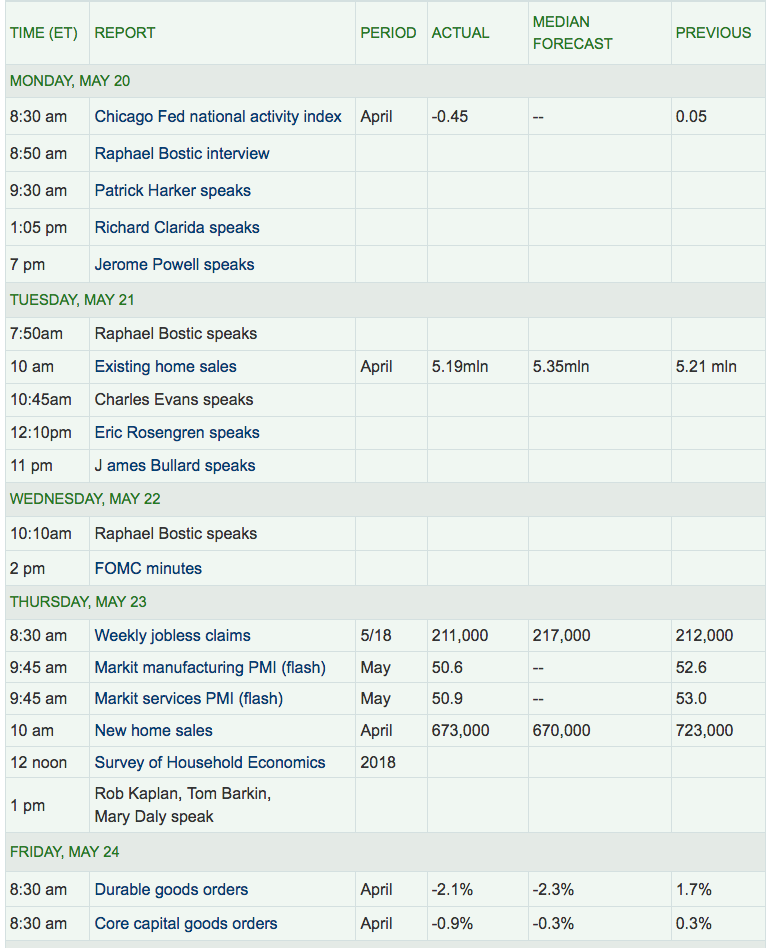

Next Week’s US Economic Reports:

Sectors:

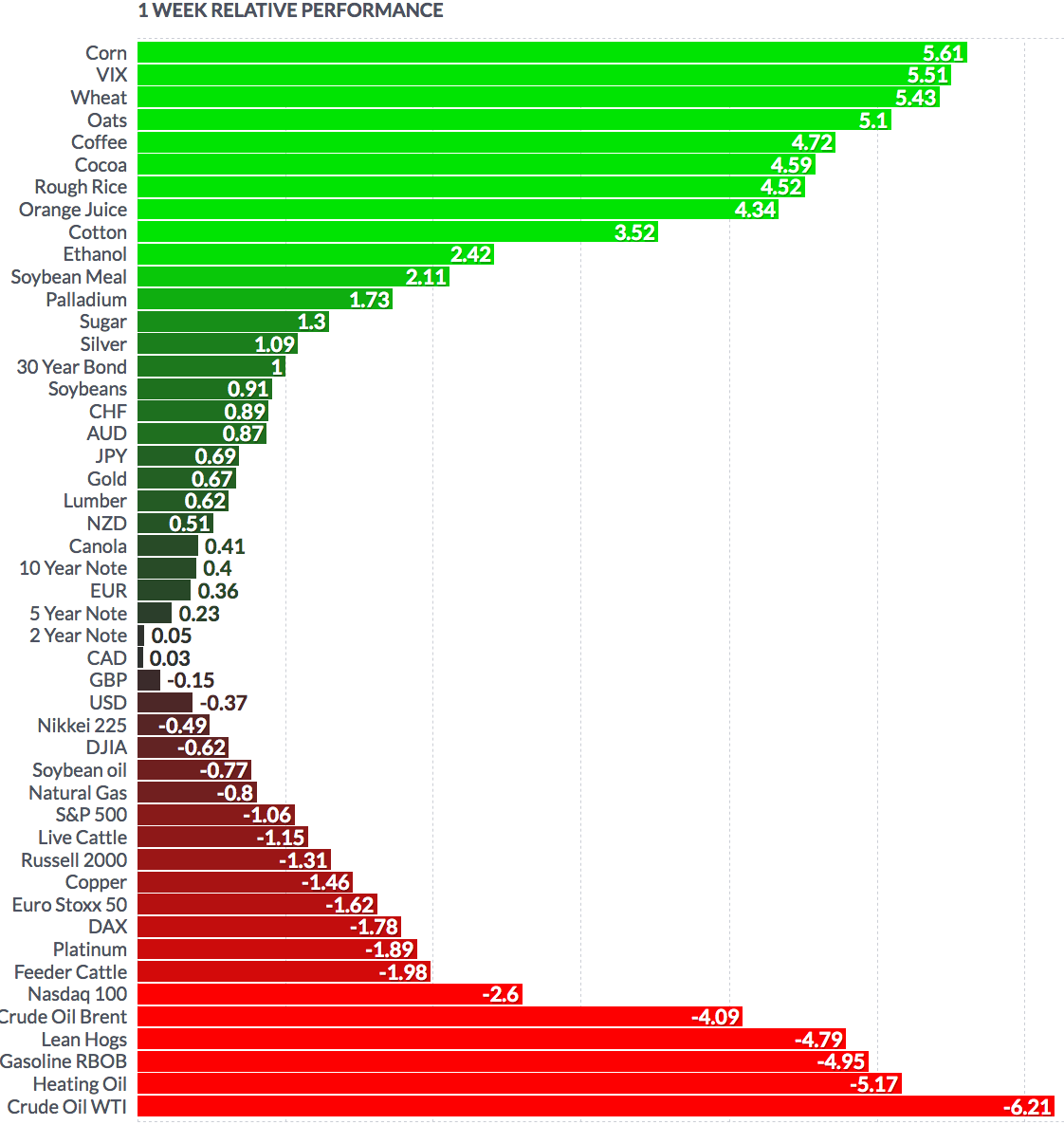

Utilities and Healthcare led this week, with Energy lagging.

Futures:

WTI Crude fell -6.21% this week, finishing the week at $59.02, its lowest close since late March, and its worst week of 2019, while Natural Gas rose -.8%.

“The U.S. oil benchmark on Thursday tumbled nearly 3%, taking the contract to its lowest level since late March as a broad aversion to assets perceived as risky gripped global markets, also knocking down equities. The day’s early action follows a 2.7% skid for the commodity that represented its largest single-session dollar and percentage drop since May 2.”