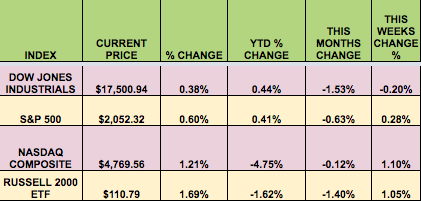

Markets: Except for the Dow, the major indexes snapped their 3-week losing streak, with small caps and NASDAQ stocks far outpacing the S&P 500. It was another up week for Oil, continuing the market-Crude correlation.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Pembina Pipeline(NYSE:PBA), Medley Capital (NYSE:MCC), TESSCO (NASDAQ:TESS), Amec Foster Wheeler(NYSE:AMFW), Brookfield Renewable Energy (NYSE:BEP), Brookfield Infrastructure (NYSE:BIP), Chatham Lodging Trust REIT (NYSE:CLDT), Exelon (NYSE:EXCU), Prospect Capital (NASDAQ:PSEC), S&T Bancorp (NASDAQ:STBA), Equifax (NYSE:EFX), NRG Yield Inc Class C (NYSE:NYLD).

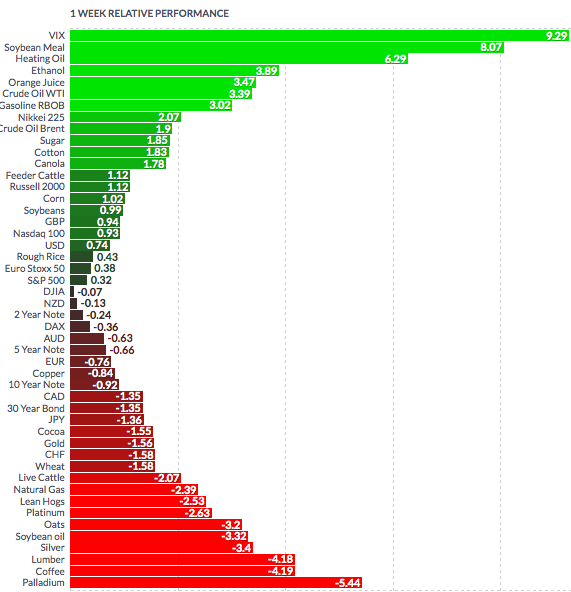

Volatility: The VIX rose 9.1% this week, finishing at $17.35.

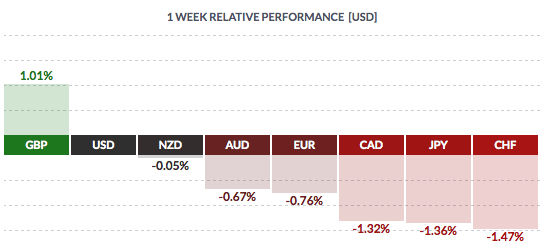

Currency: The dollar rose vs. most major currencies, except the pound, as Fed members and minutes hinted at a possibility of a June rate hike.

Market Breadth: 12 of the Dow 30 stocks rose this week, vs. 7 last week. 55% of the S&P 500 rose this week, vs. 40% last week.

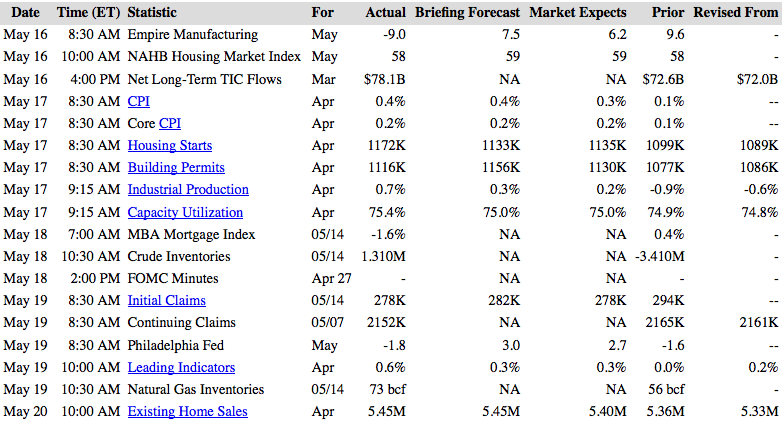

US Economic News: April Housing Starts and Industrial Production surprised to the upside.

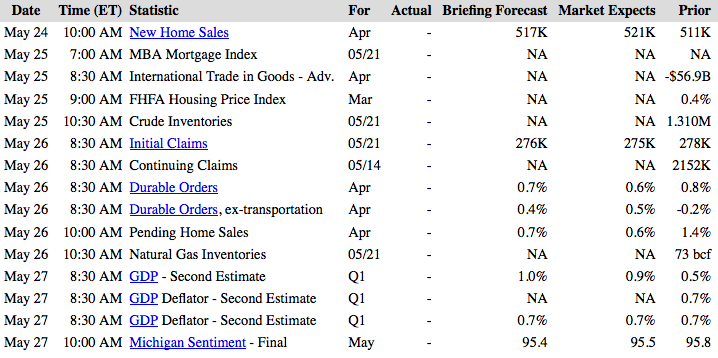

Week Ahead Highlights: Uh oh, 4 Fed members are giving speeches next week – will they spook the market with “sooner than later” rate hike talk? Q1 GDP estimate gets revised, and Consumer Sentiment reading will be issued on Friday.

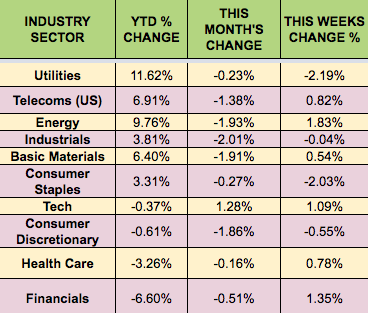

Sectors & Futures:

Energy and Financials led this week, as Utilities trailed, in the wake of renewed rate hike fears.

WTI Crude had an up week..Soybeans led, with Palladium trailing: