Stock Market News

Markets:

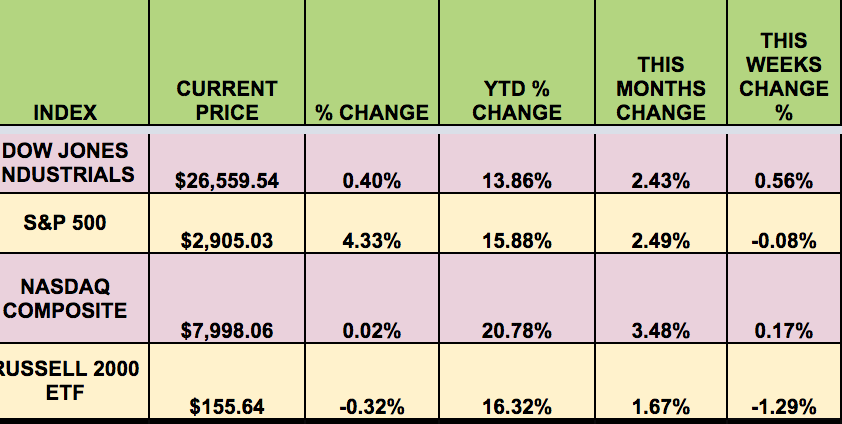

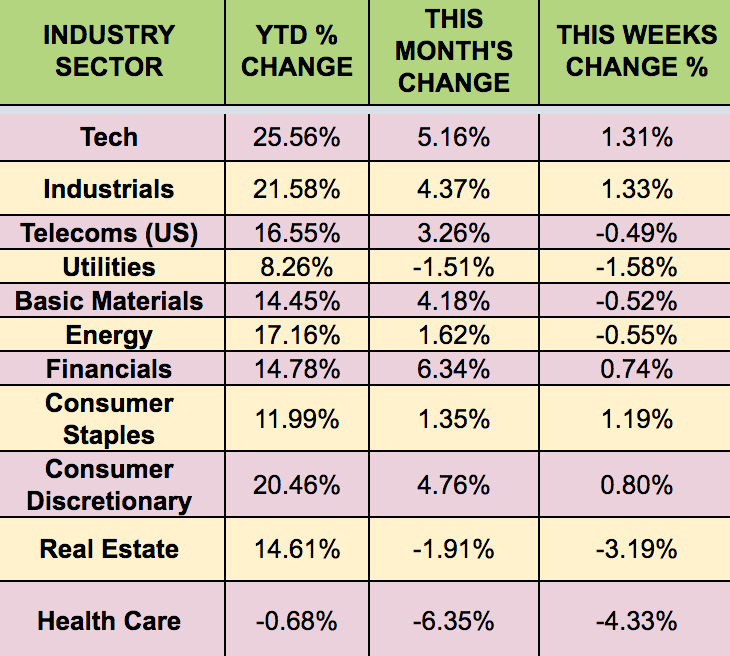

It was a short, but mixed week for the market, with the DOW up .56%, and the S&P 500 slightly down. The RUSSELL trailed again, falling -1.29%, and the NASDAQ had a small .17% gain. The market was held back by lagging healthcare stocks, which fell after several news stories surfaced detailing future potential overhauls to the US healthcare system.

High Dividend Stocks:

These high yield stocks go ex-dividend next week – OFS Credit Company Inc (NASDAQ:OCCI), ING Group NV ADR (NYSE:ING).

Market Breadth:

23 out of 30 DOW stocks rose this week, vs. 20 last week. 58% of the S&P 500 rose, vs. 28% last week.

Volatility:

The VIX rose .06% this week, ending the week at $12.09.

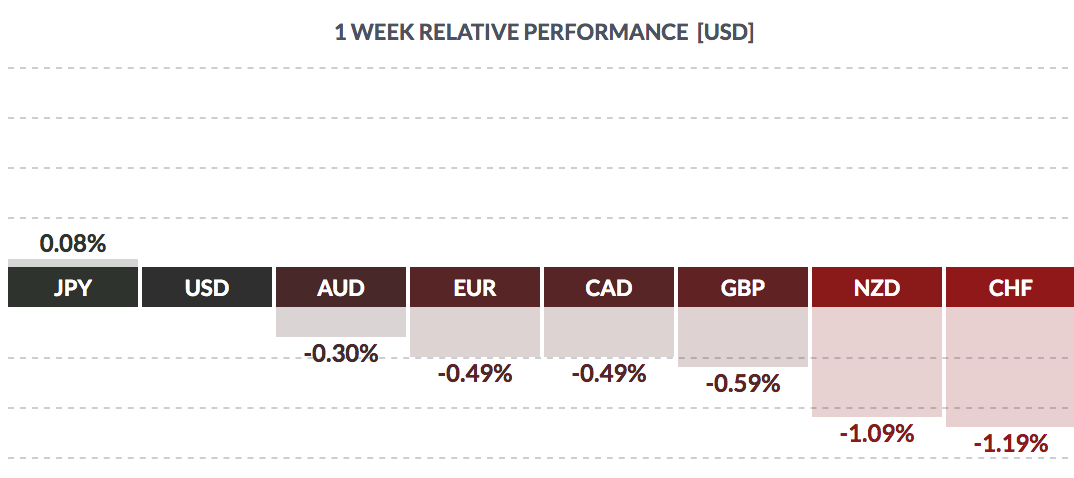

FOREX:

The USD rose vs. most major currencies this week, excepting the yen.

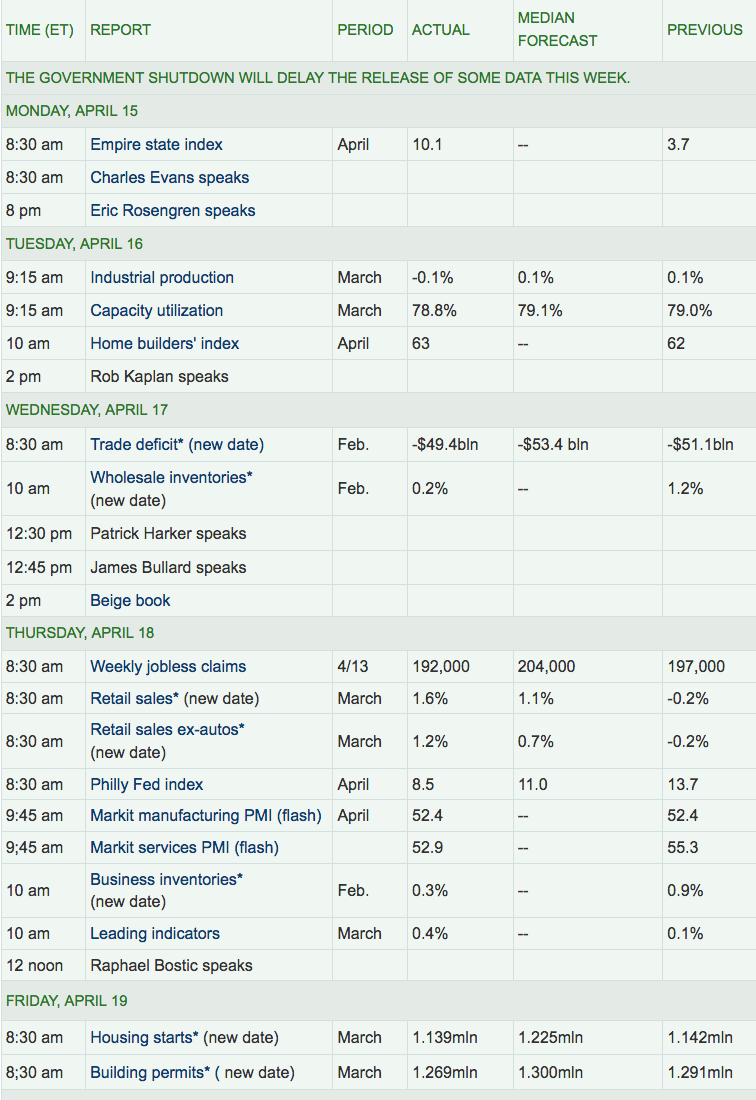

Economic News:

“U.S. homebuilding dropped to a near two-year low in March, pulled down by persistent weakness in the single-family unit segment, suggesting the housing market continued to struggle despite falling mortgage rates. The second straight monthly decline in homebuilding reported by the Commerce Department on Friday probably reflected in part massive flooding in the Midwest, with housing starts in the region plunging to levels last seen in early 2015.

Housing starts fell 0.3 percent to a seasonally adjusted annual rate of 1.139 million units last month, the lowest level since May 2017. Data for February was revised down to show homebuilding tumbling to a pace of 1.142 million units instead of the previously reported 1.162 million-unit rate. A sharp pickup in home construction appears unlikely. Building permits fell 1.7 percent to a rate of 1.269 million units in March, the lowest in five months. It was the third straight monthly decrease in permits.”

Week Ahead Highlights:

Q1 Earnings season gets into high gear, with 11 DOW components reporting, including PG, XOM, CVX, BA, KO, CAT, V, T, and INTC.

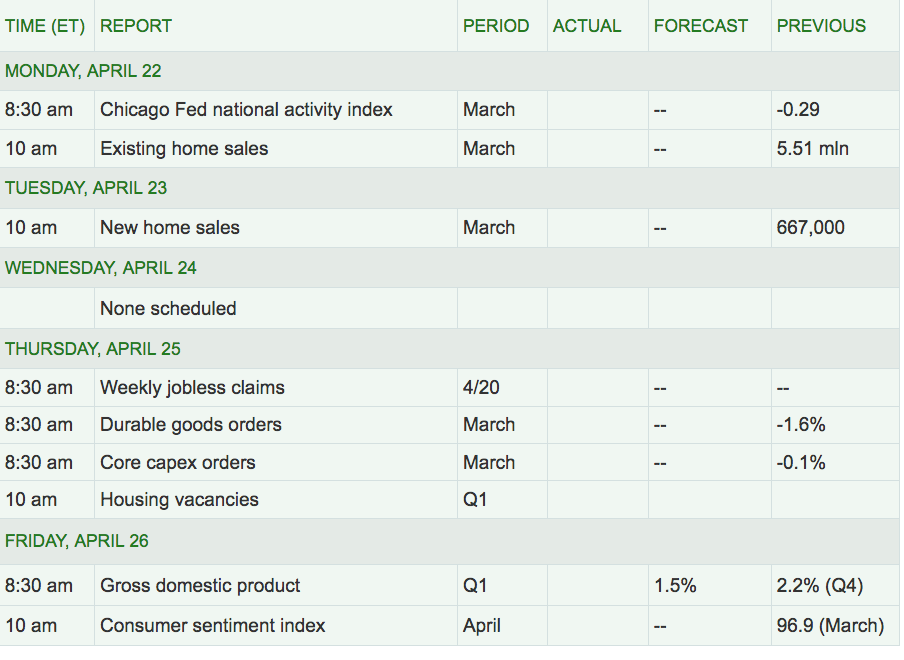

Next Week’s US Economic Reports:

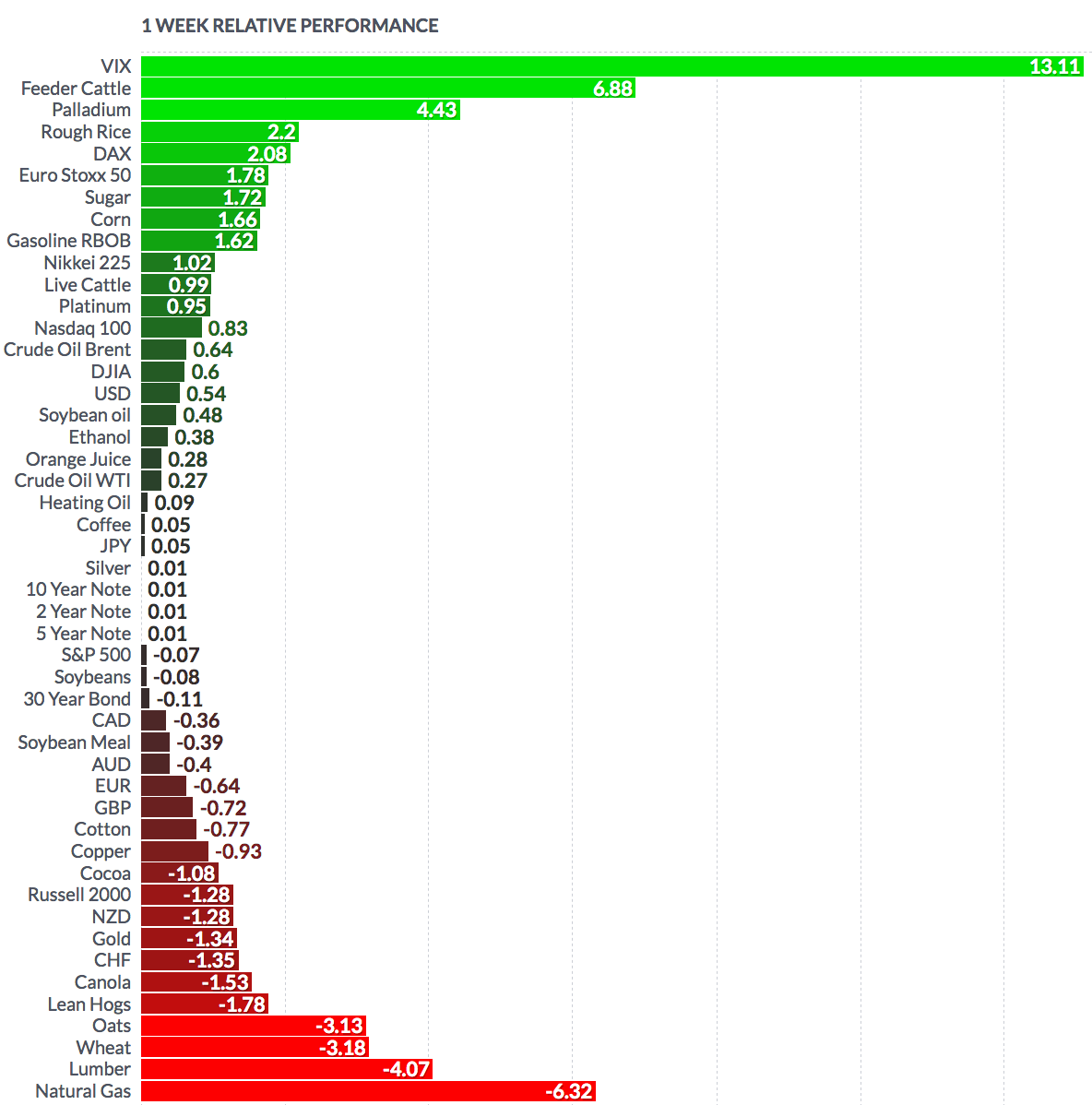

FUTURES:

WTI Crude rose .27% this week, finishing the week at $64.06, while Natural Gas fell again, down -6.32%.