How is your portfolio handling the up and down market of 2018?

Click here to learn how Selling Options can take advantage of higher Volatility, giving you more downside protection and more income.

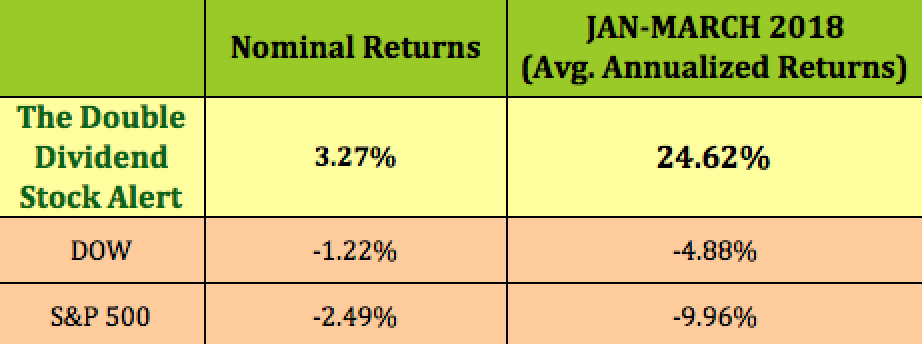

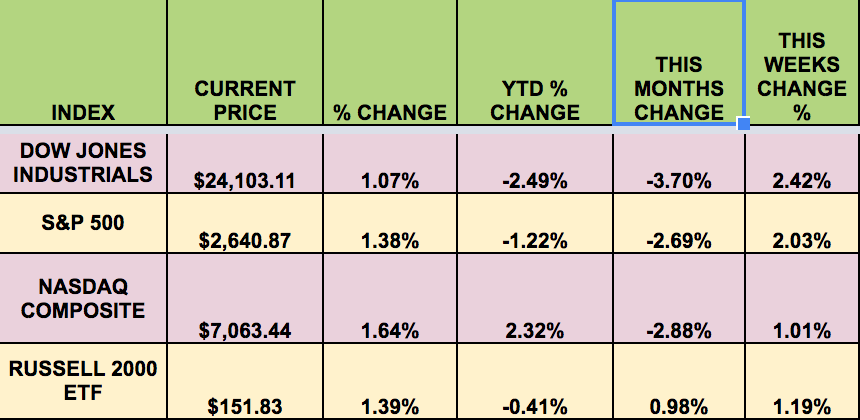

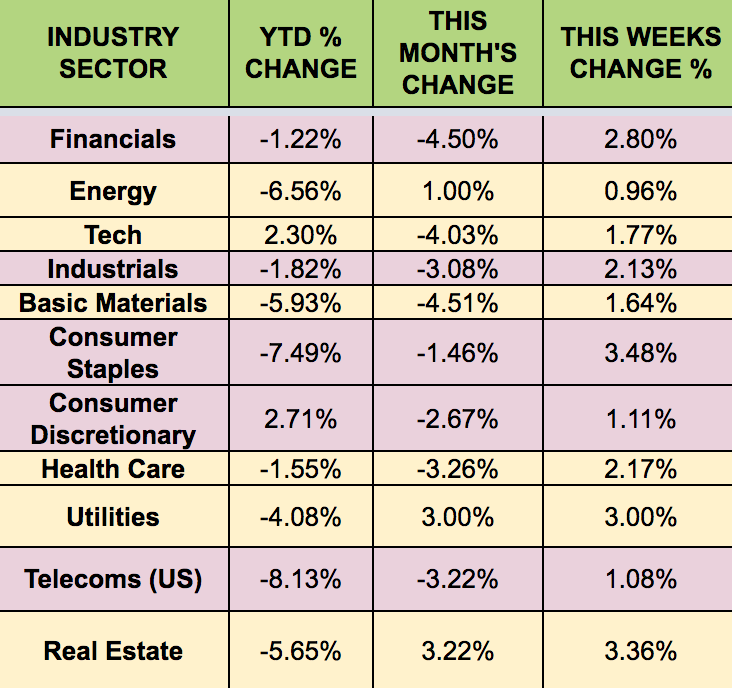

Markets: It was an up week for the market, with all 4 indexes rising, but that didn’t save the DOW, the S&P 500, and the NASDAQ from going negative in March. The DOW, S&P, and the RUSSELL small caps are in the red so far in 2018, with the NASDAQ the only indexes still in positive territory year-to-date.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Apple (NASDAQ:AAPL) Hospitality REIT Inc (NYSE:APLE), 8Point3 Energy Partners LP (NASDAQ:CAFD), DX, Independence Realty Trust Inc (NYSE:IRT), KCAP Financial Inc (NASDAQ:KCAP), Global Net Lease Inc (NYSE:GNL).

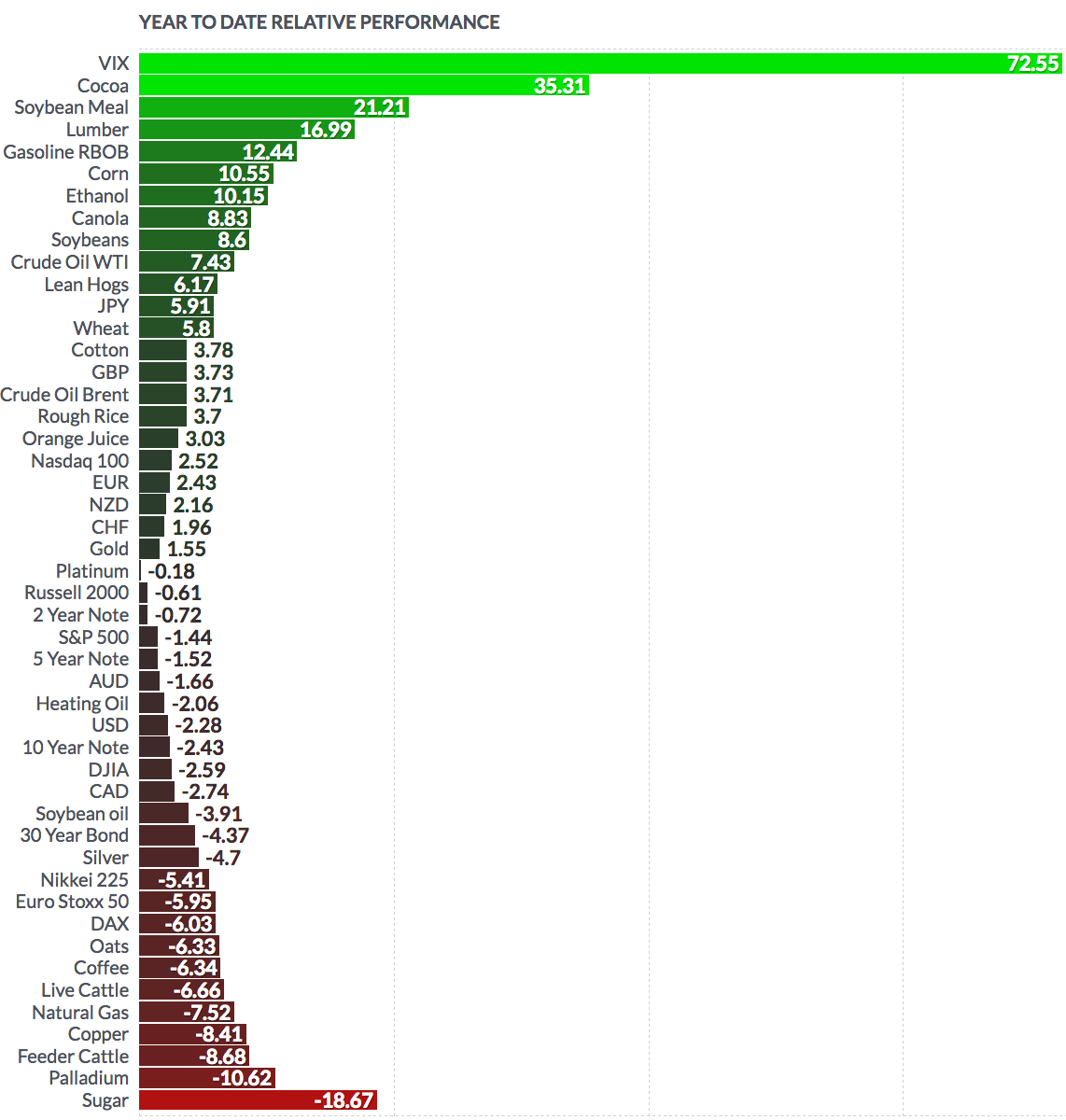

Volatility: Asleep no more, the VIX is up 84% year to date, with a closing price of $19.97 in the past holiday-shortened week. After shooting into the high 40’s in February, it has bounced around mainly in the high teens, sometimes crossing into the plus-20 range.

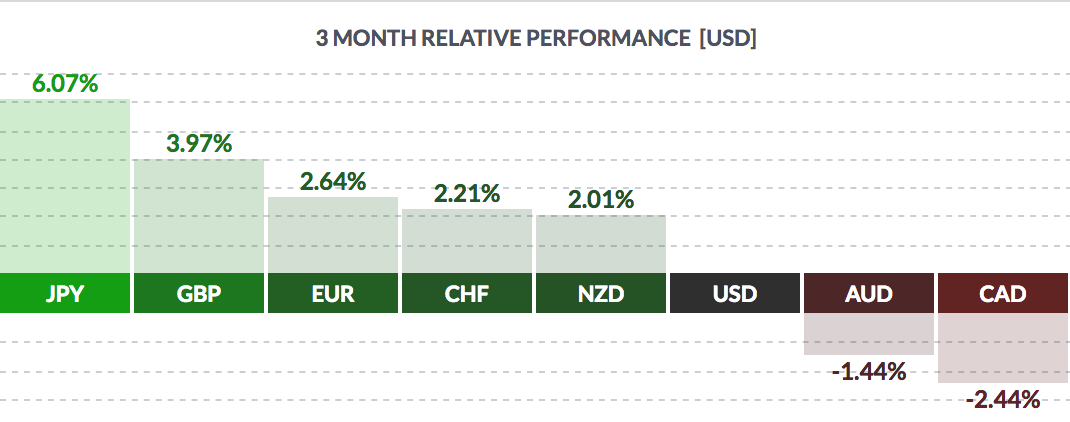

Currency: The USD has fallen vs. most major currencies in 2018, except the Aussie $ and the Canadian Loonie. The Yen has led the pack, rising 6.07% vs. the $.

Market Breadth: Just 10 of the DOW 30 stocks are up year to date. Intel (NASDAQ:INTC) is the best performer so far in 2018, rising 12.8%, and General Electric Company (NYSE:GE) is the worst, falling -22.75%. Only 41% of the S&P 500 is up year to date, led by mostly tech stocks, such as Seagate Technology PLC (NASDAQ:STX) and Micron Technology Inc (NASDAQ:MU); and Consumer Goods stocks, such as Netflix (NASDAQ:NFLX) and Fossil.

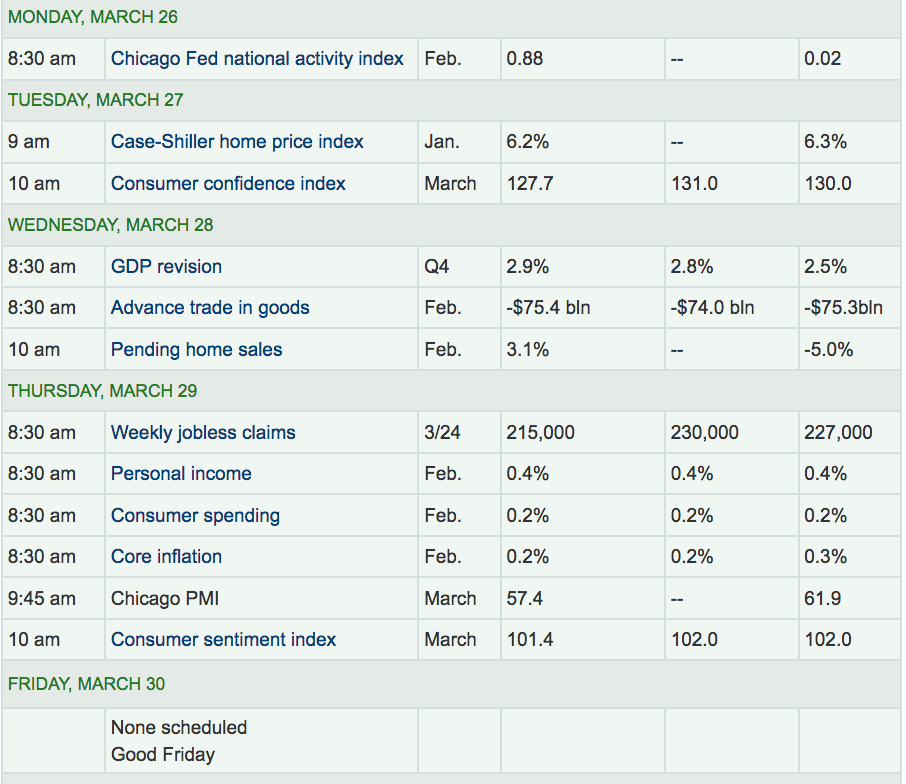

Economic News: Q4 GDP was revised higher, from 2.5% to 2.9%…Core Inflation remained low, at 0.2%, while Personal Income posted a 0.4% gain in Feb.

“A gauge of signed contracts to purchase previously-owned U.S. homes increased in February for the first time in three months, highlighting uneven progress in the industry, according to data released Wednesday from the National Association of Realtors in Washington.

While the month-over-month gain shows demand for housing is still getting support from steady hiring, the market is facing several headwinds. Buyers are up against a persistent shortage of affordable listings to choose from, property prices continue to climb, and mortgage costs are rising. Whats more, the Realtors group expects winter weather to weigh on demand in the Northeast.

The NAR currently projects 2018 home sales will match 2017s 5.51 million. The group expects the median selling price of a previously owned home to increase around 4.2 percent this year after 5.8 percent in 2017.”

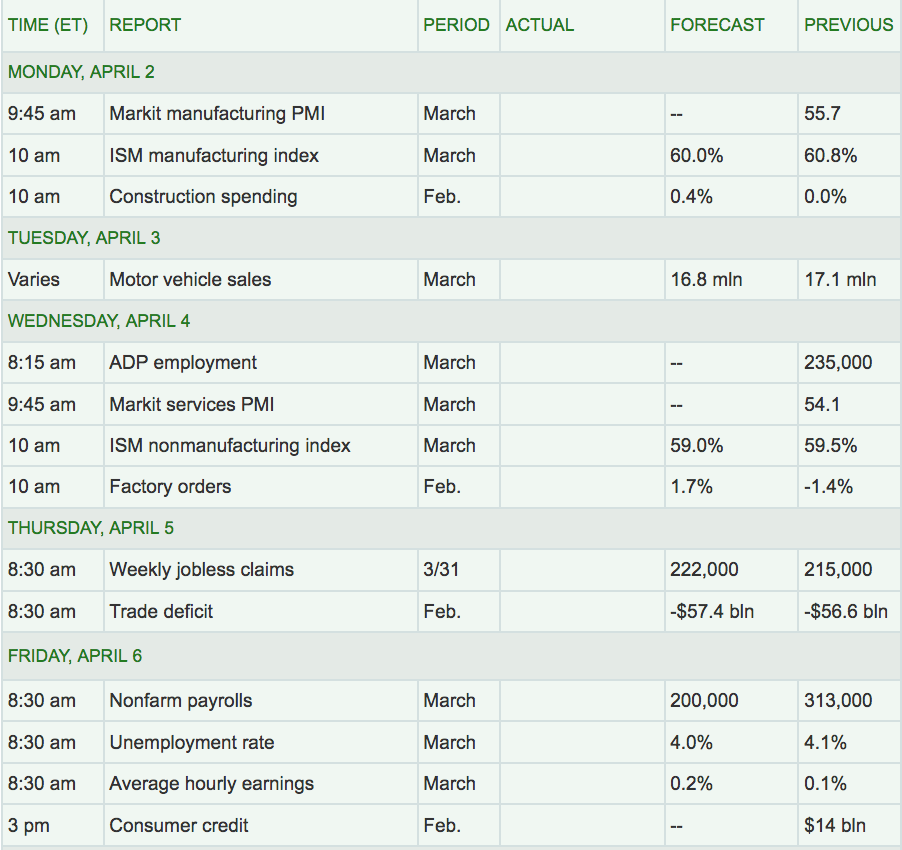

Week Ahead Highlights: “Next week brings the monthly U.S. jobs report, a potential catalyst for further volatility. A strong payrolls report in early February had helped spark the stock sell-off that drove the S&P 500 more than 10% below its Jan. 26 record high.”

“Analysts predict strong results when reporting season starts up next month, with first-quarter S&P 500 profit growth on track to be the highest in seven years, according to Thomson Reuters data. That follows a blockbuster fourth-quarter period, and recent corporate tax cuts that boosted forecasts for all of 2018.”

“With this years sell-off and rising profit forecasts, stocks also are near the cheapest on a price-to-earnings basis that they have been since late 2016. The S&P 500 is trading at about 16.5 times forward earnings, well below the 18.9 level it was at in mid-December, according to Thomson Reuters data.” (Source: Reuters)

Next Week’s US Economic Reports: The March Non-Farm Payrolls Report comes out next Friday am, in addition to the Unemployment Rate. Forecasters are calling for a 200K job creation number.

Sectors: Most sectors fell in March, but the defensive Utilities sector led by far with a 3% gain, as Tech, Financials, and Materials trailed.

Futures:

Oil futures finished lower on Thursday, posting a decline for the week, but a gain for quarter. Geopolitical concerns and optimism surrounding the Organization of the Petroleum Exporting Countries’ efforts to curb production limited oil’s moves for the session. (Source: MarketPulse) WTI Crude futures have risen 7.4% so far in 2018, while Natural Gas futures have fallen -7.52%.