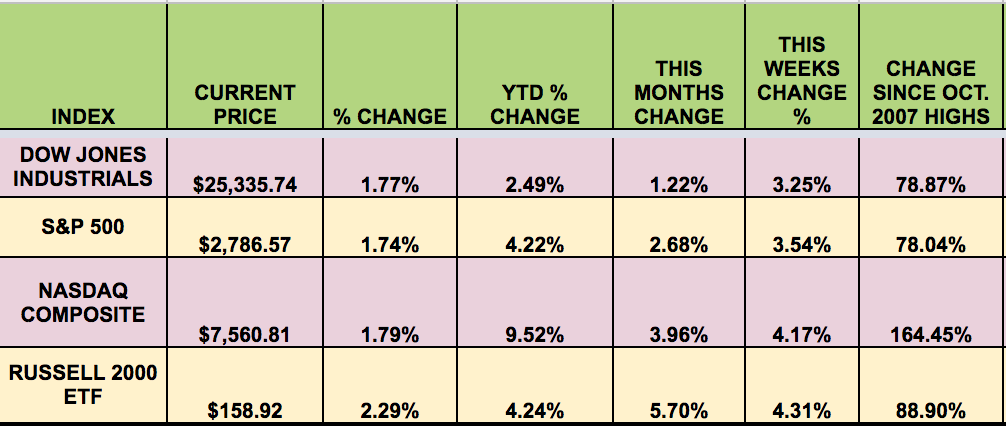

Markets: It was a big up week for the market, with all the Dow Jones and S&P 500 indexes rising over 3%, and the NASDAQ and Russell 2000 rising over 4%. Half of the week’s gains for the DOW and the S&P came on Friday, buoyed by a strong Nonfarm Payrolls Report.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: DEA, NEWM, TCAP, SALM, AJX, APTS, ARR, ESND, IRM, MPW, OAKS, RWT, SOHO, TSLX, DDR, FTAI, MRCC, TCPC, TICC, SFL.

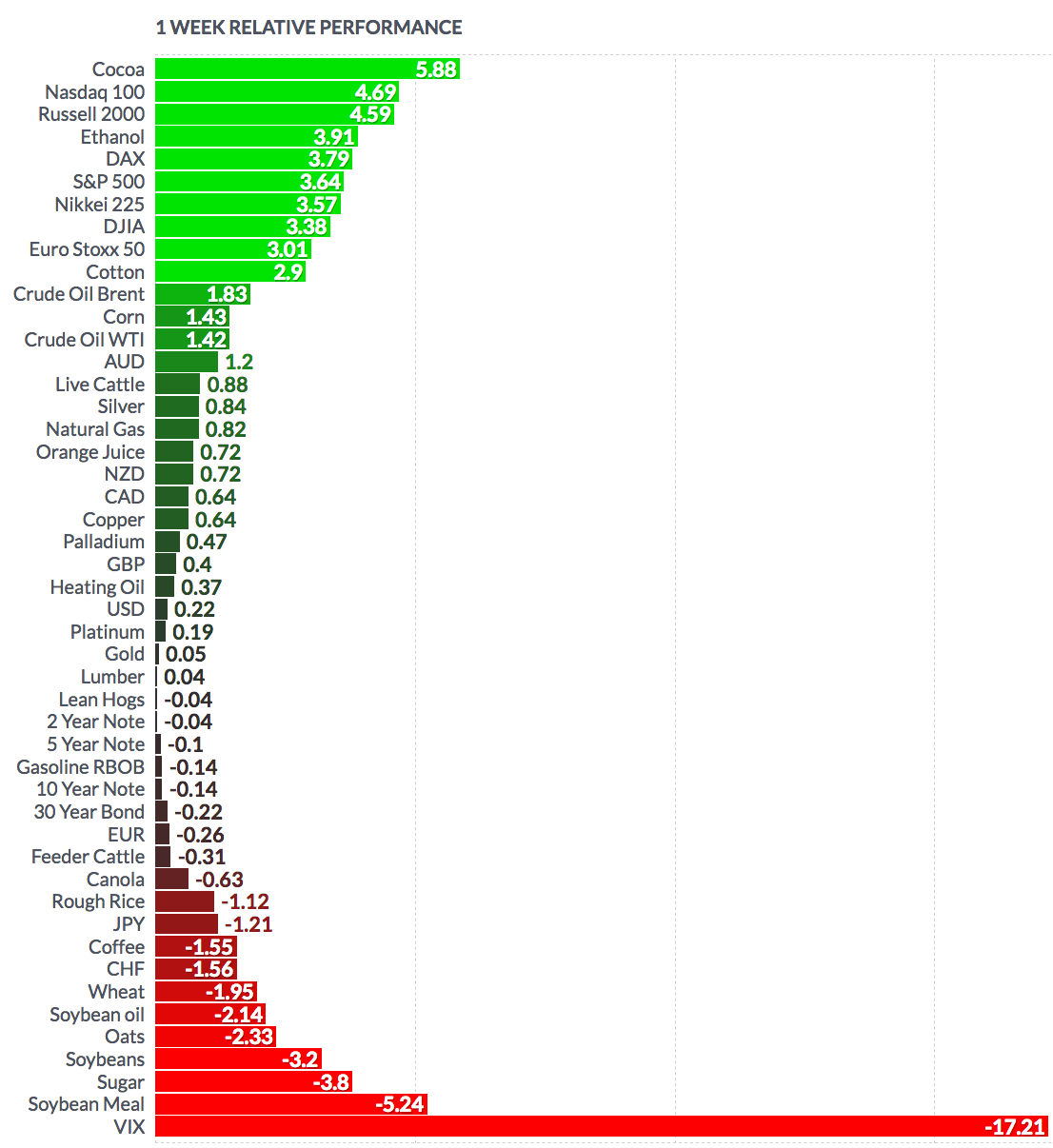

Volatility: The VIX fell 25% this week, ending at $14.64.

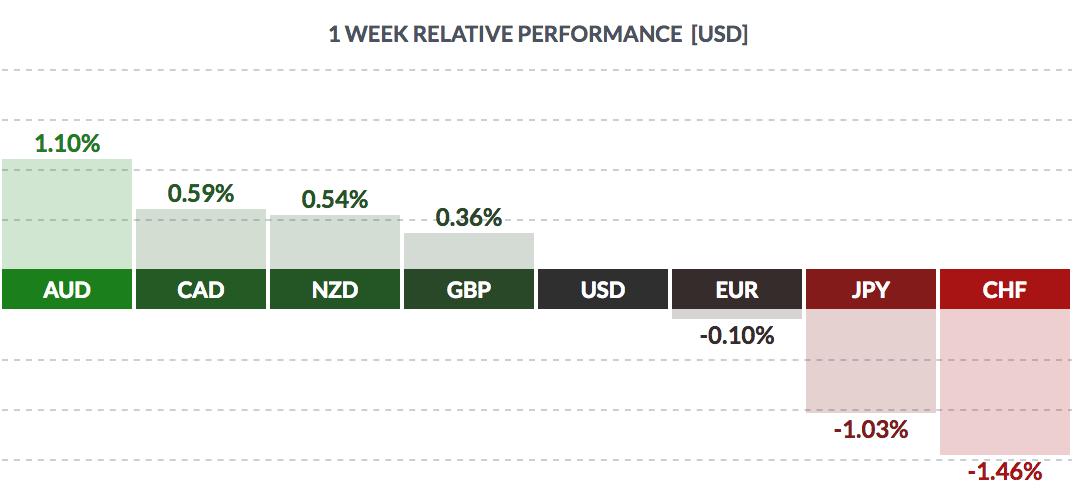

Currency: The dollar fell vs. most major currencies this week, except the yen and the Swiss franc.”The dollar broke away from the losses it suffered late Tuesday following reports that Cohn will be leaving his role as the head of the National Economic Council. Cohn is seen as the driving force behind US corporate tax cuts that were signed into law last year. (Cohn resigned late Tuesday.)

But Cohn opposed the plan to impose tariffs on global steel and aluminum imports into the US The European Union said Wednesday it has been circulating a provisional list of US products it could hit with levies to counteract US tariffs.

Market Breadth: In a strong week for market breadth, 28 of the DOW 30 stocks rose this week, vs. 3 last week. 88% of the S&P 500 rose, vs. 19% last week.

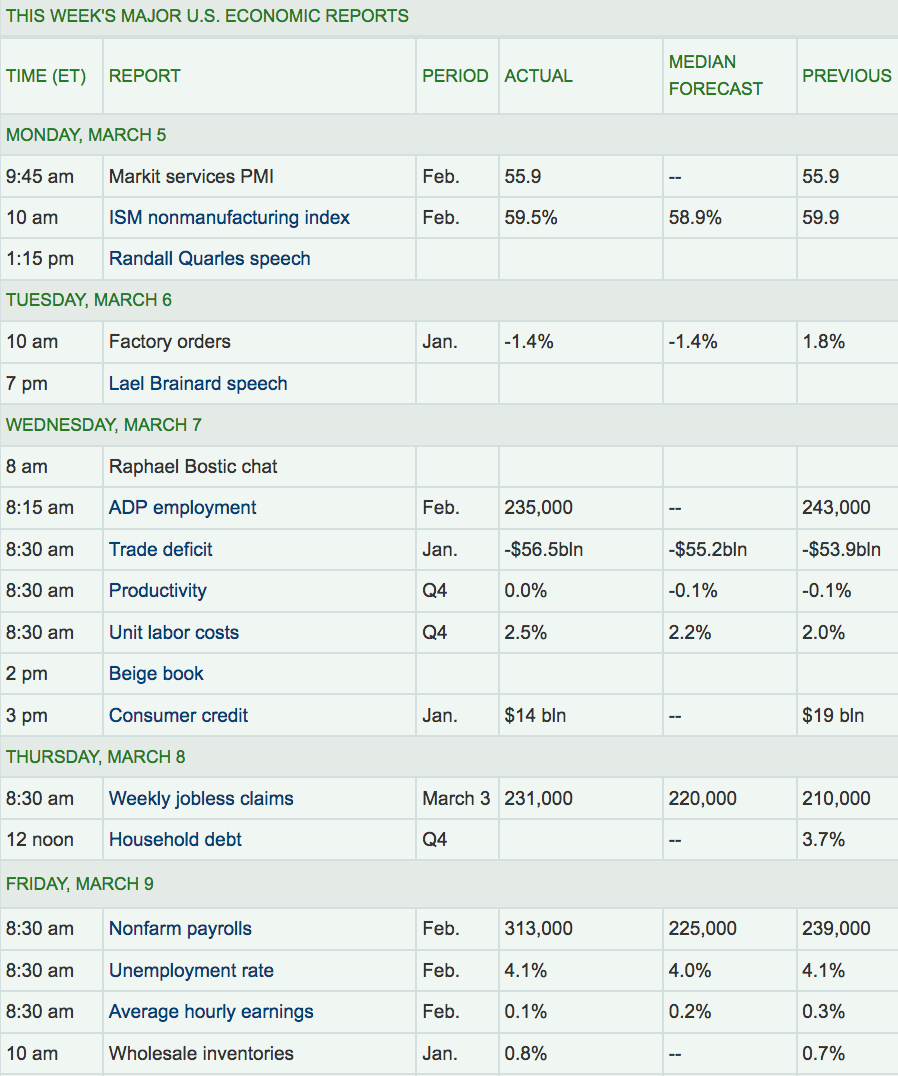

Economic News: US steel tariffs were announced this week, set to go into effect in 2 weeks. Here’s what happened the last time the US imposed steel tariffs, which was done by G.W. Bush in 2002:

The Bush administration withdrew the tariffs in December 2003, about 21 months after they were imposed, but not without a cost. The Consuming Industries Trade Action Coalition found that 200,000 US workers in manufacturing industries lost their jobs as a result of the tariffs.

The US added 313,000 new jobs in February, the biggest gain in a year and a half and clear evidence that a strong economy has plenty of room to keep expanding.The increase in hiring easily blew past the 222,000 forecast of economists polled by MarketWatch. Job gains in January and December were also much stronger than initially reported.

Despite the big increase in hiring, wage growth did not keep up. Hourly pay rose 4 cents to $26.75 an hour, but the yearly increase in wages tapered off. The 12-month increase in pay slipped to 2.6% from a revised 2.8% in January. Still, the strong report makes it a virtual lock the Federal Reserve will raise interest rates when senior officials meet this month. The unemployment rate was unchanged at 4.1%.

The economy added 54,000 more jobs in January and December than previously reported. Altogether, the economy has gained an average of 242,000 new jobs in the past three months. That’s much stronger than the 182,000 monthly average in 2017. Yet even as the unemployment rate falls and firms complain more loudly about a shortage of skilled workers, they still aren’t really laying out the red carpet for new or old employees.

The amount a worker earns per hour has been rising gradually in the past few years, but wage gains still trail the 3% to 4% annual increases that typically prevail at the height of an economic boom (Source: MarketWatch).

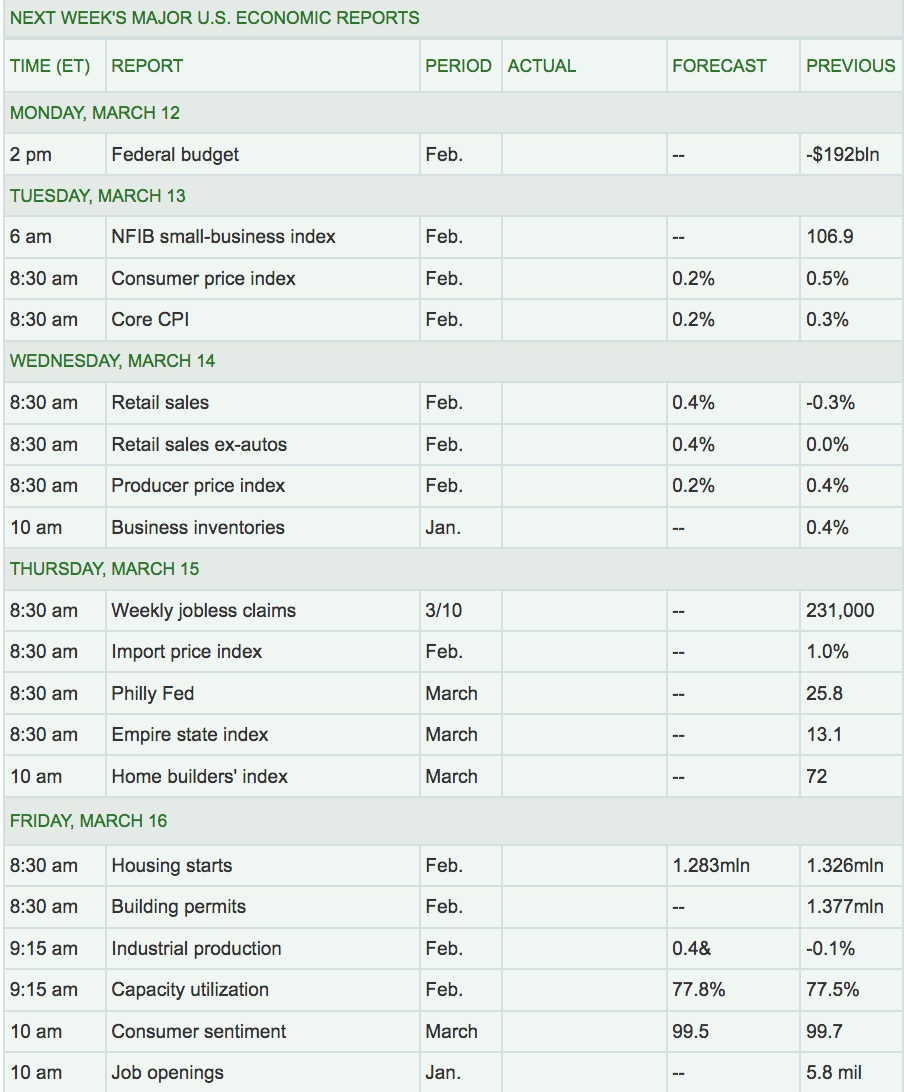

Week Ahead Highlights: There will be more pushback against the steel and aluminum tariffs next week, as economists and investors weigh in against the potentially disastrous effects of a global trade war.

The prospect of import tariffs could damage the US economy by raising costs for US manufacturers and consumers, while prompting its trading partners to impose their own levies on US exporters, increasing their costs also and sapping overseas demand.

Daniel Pinto, a co-president at JPMorgan Chase, said in an interview with Bloomberg on Thursday that the US equities could fall by between 20 and 40% over the next three years if a global trade war breaks out. (Source: Reuters)

Next Week’s US Economic Reports: There will be several Housing-related reports due out next week, in addition to Retail sales for February.

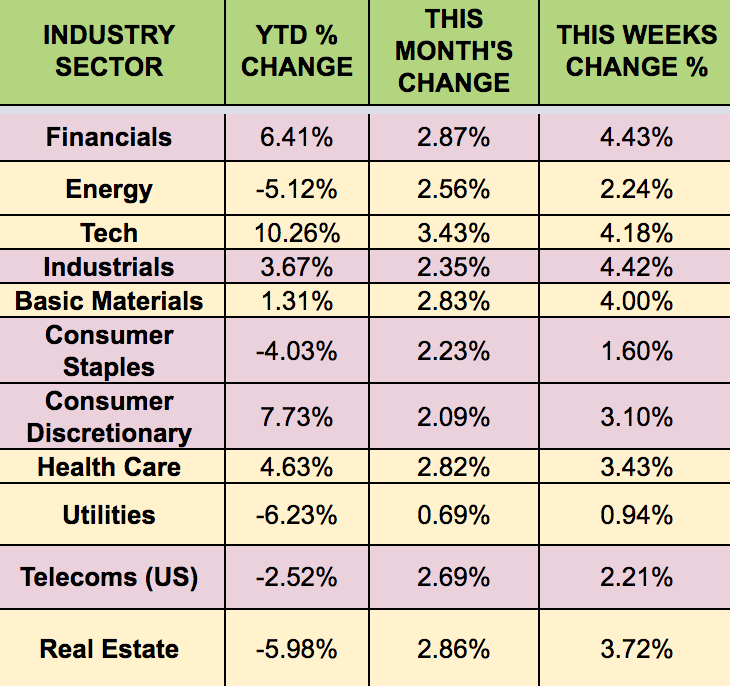

Sectors: Industrials led this week, as all sectors gained ground, with Utilities trailing.

Futures: Crude Oil WTI Futures rose 1.42%, while Natural Gas Futures rose .82%.

“American light crude shipments to Asia will reach almost 1.3 million barrels a day in the next five years from almost nothing in 2016, according to Wood Mackenzie Ltd. This will allow Asian refiners to fill up 40 percent of additional spot demand with US shale. Just about two years after lifting the ban for US Crude exports, oil varieties ranging from West Texas Intermediate to Thunderhorse and Mars Blend have reached Asia, making it the biggest buyer of American oil.”