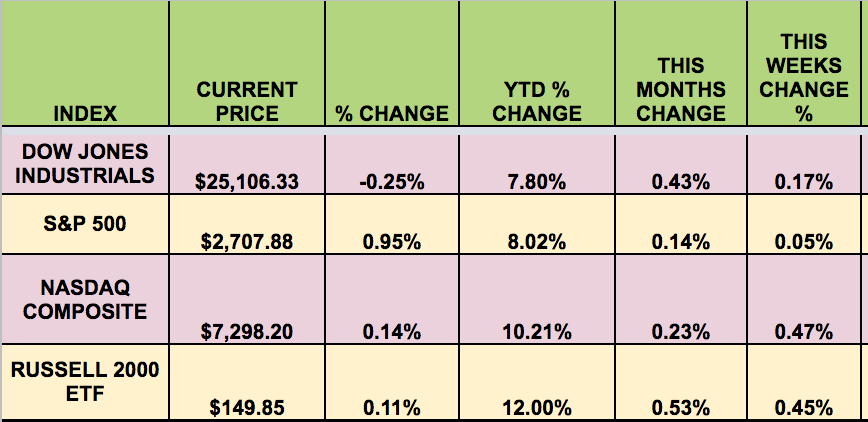

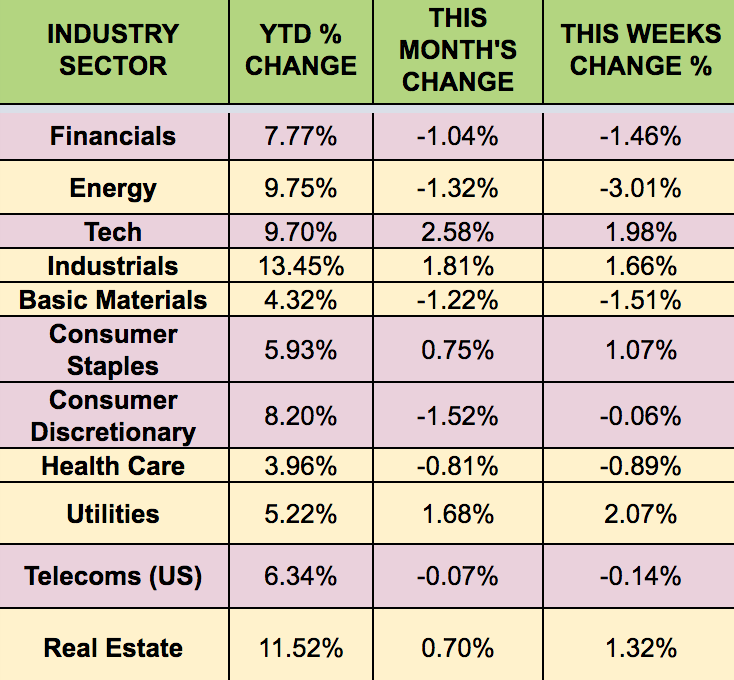

Markets: It was a mixed week, with the DOW and S&P flat, as the NASDAQ and the Russell small caps gained ~.5%.

After lurching into Christmas, U.S. stocks had staged an almost uninterrupted rebound in 2019 before hitting a wall this week and ending virtually flat. It happened against a worrisome backdrop in which skeptical analysts have cut estimates for first-quarter profit growth below zero for the first time in three years.

No problem, say the bulls. Valuations are reasonable. Earnings for the full year are still predicted to climb 5.4 percent. But a concern lurks for anyone who has followed markets for very long: Wall Street’s near-perfect record of over-estimating growth. Short declines in profits have a habit of turning into long ones. And most of this year’s gains expected are clustered precariously at its end. (Bloomberg)

Stocks sank on Thursday as worries that the United States and China would not be able to reach a trade deal before the March 1st deadline increased concerns about slowing global economic growth. (NY Times).

High Dividend Stocks: These high yield stocks go ex-dividend next week – DX, IVZ, ARR, EVA, LKSD, SXCP.

Volatility: The VIX fell -2.6% this week, ending at $16.14.

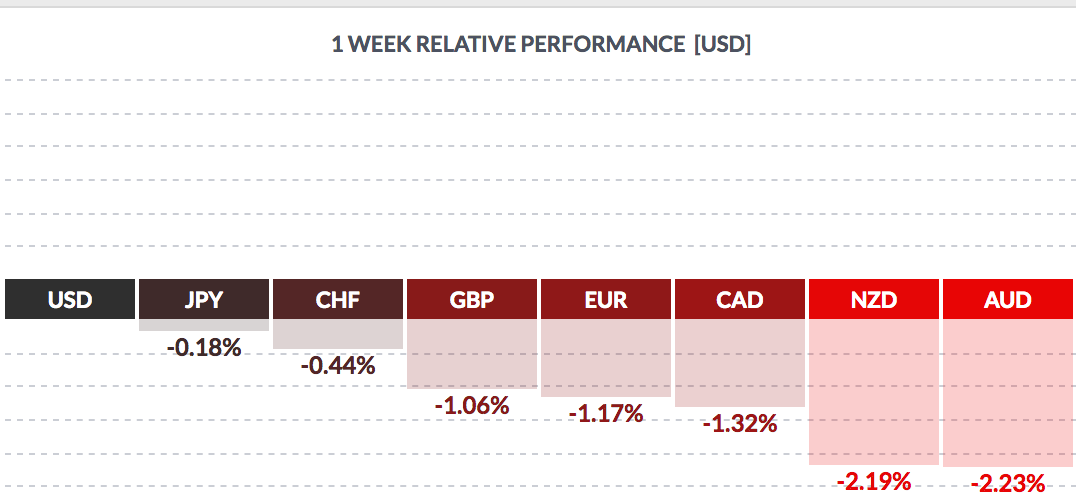

Currency: The U.S. rose vs. most major currencies this week.

Market Breadth: 15 DOW 30 stocks fell this week, vs. 21 rising last week. 56% of the S&P 500 rose this week, vs. 78% rising last week.

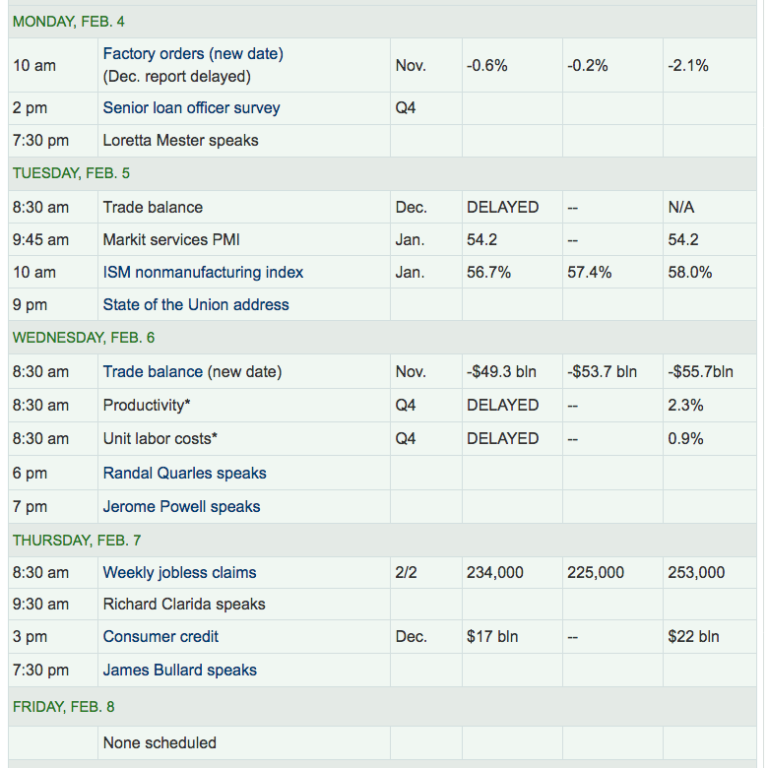

Economic News:

Australia’s dollar won the wooden spoon among Group-of-10 currencies last year, beating its New Zealand cousin in a race to the bottom. This year the contest is a race to the top.

Both commodity currencies are rallying in 2019 after the Federal Reserve turned dovish and as China introduces a slew of measures to bolster flagging growth. The Aussie and kiwi have both strengthened about 3 percent since the start of January, after sliding 9.7 percent and 5.3 percent respectively in 2018.

The first half of February will go a long way to proving if the Aussie or kiwi is the real deal, with interest-rate decisions from the two central banks along with the Australia central bank’s quarterly assessment of economic conditions and key New Zealand job data....

The Aussie may get a further leg-up if the RBA gives out any further hawkish signals in this Tuesday’s policy statement. For the kiwi, any improvement in employment and wage data on Thursday would back up recent gains in business sentiment, and possibly herald a more positive tone when policymakers meet on Feb. 13. (Bloomberg)

ISM non-manufacturing. the index came in at 56.7 for January, below expected 57.1.

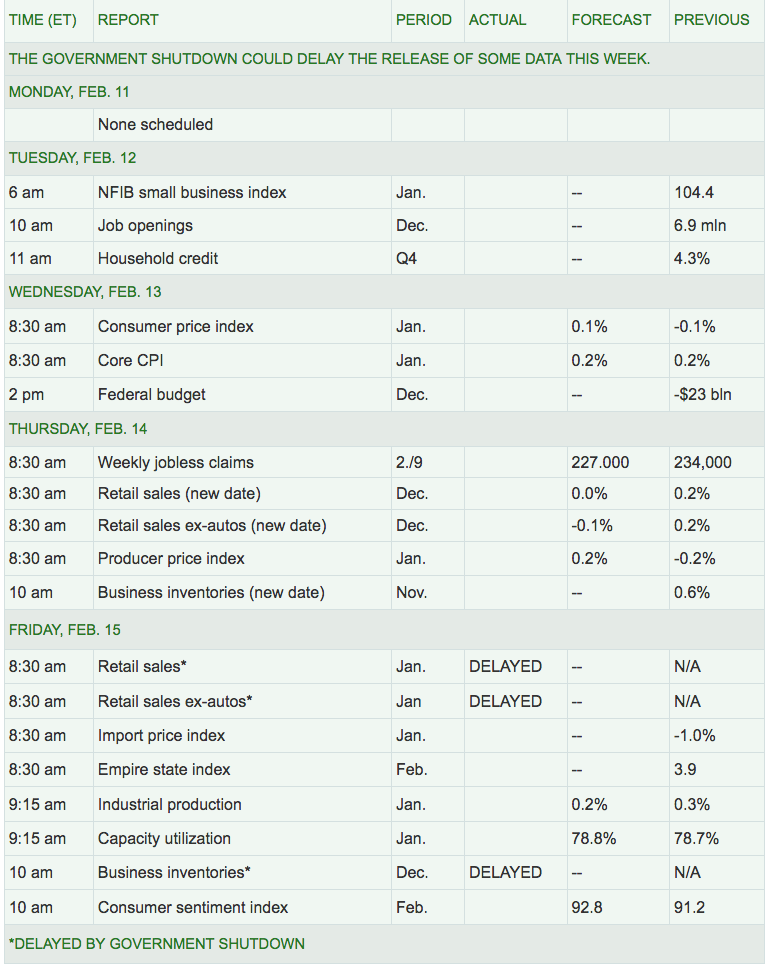

Week Ahead Highlights:

Trade talks are the biggest event of the week ahead for markets, and investors are watching for signs of progress, ahead of a March 1 deadline on new tariffs. The fourth quarter earnings season continues to roll on with about 60 S&P 500 companies reporting, including Coke, Pepsi and Cisco (NASDAQ:CSCO). (CNBC)

Next Week’s U.S. Economic Reports:

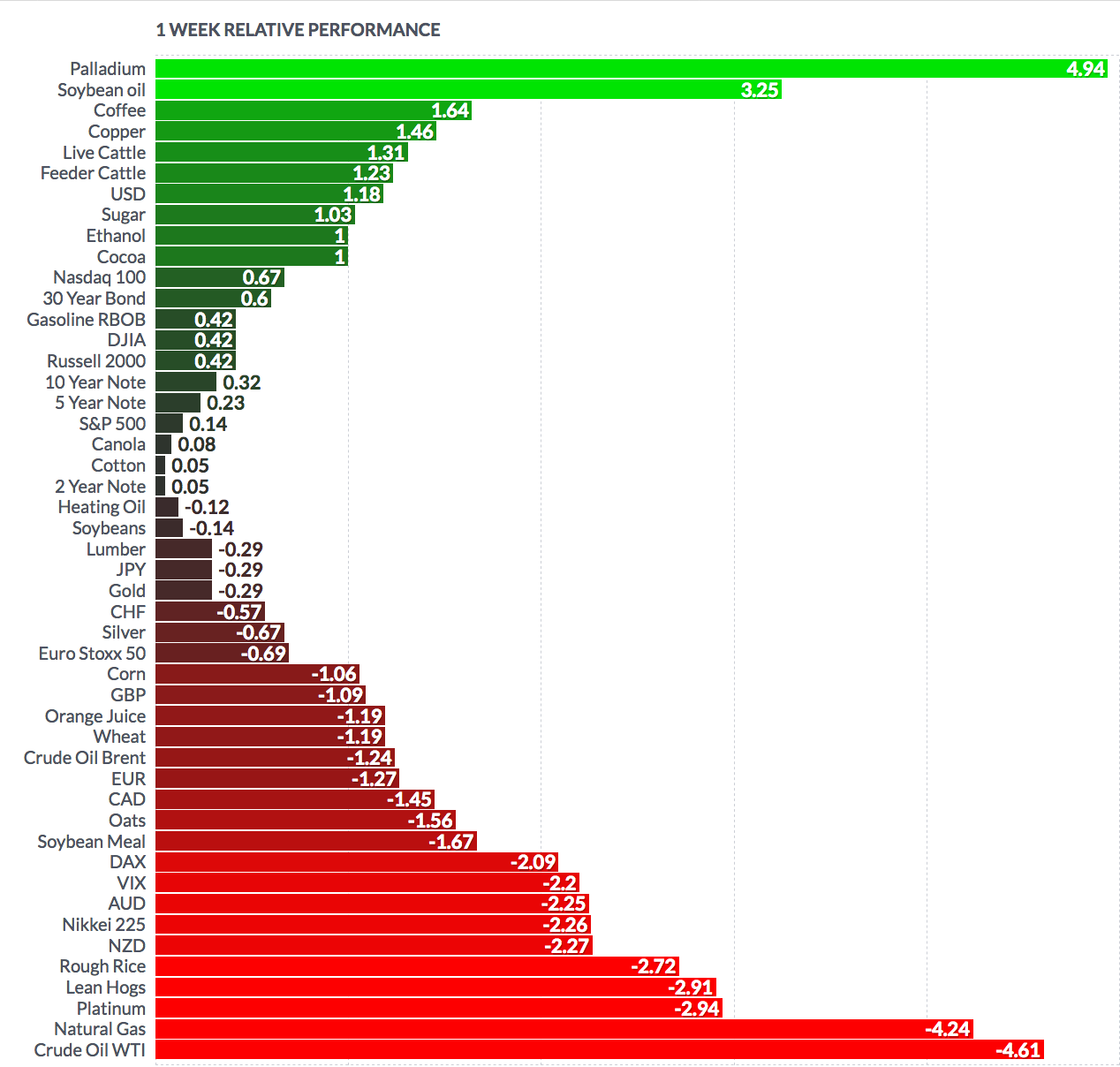

Sectors: Utilities led the pack this week, with Energy trailing, as investors turned defensive.

Futures:

WTI Crude fell -4.6% this week, finishing the week at $52.71, while Natural Gas fell -4.2%.