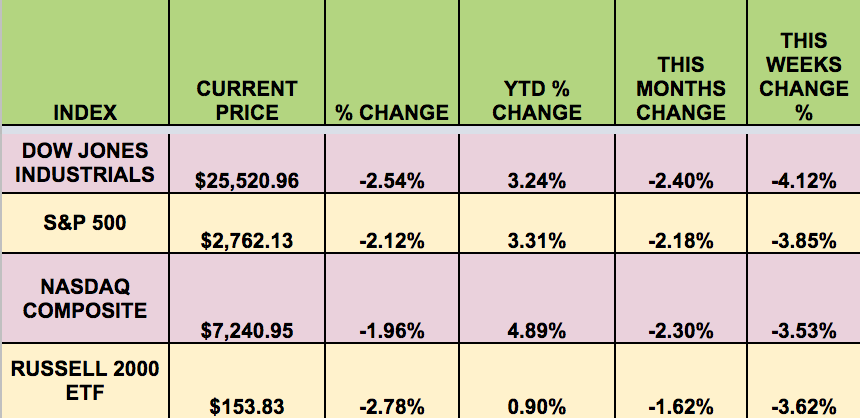

Markets: It was down week, with all 4 indexes losing ground, due to investor fears about rising interest rates. “Average hourly earnings for US workers were 2.9% higher in January than the previous year, the fastest annual increase in years. Economists often view rising wages as an early indication of inflationary pressure. If faster price increases do begin to emerge, the Fed could try to head them off with more aggressive rate action”. (NY TImes) Softer energy prices also put pressure on energy-related stocks on Friday.

Apple (NASDAQ:AAPL) beat estimates when it reported Thursday after the market close, but its guidance disappointed investors, who sent the stock down -4.34% on Friday. This put pressure on the S&P and the DOW, as Apple is a major component of both indices.

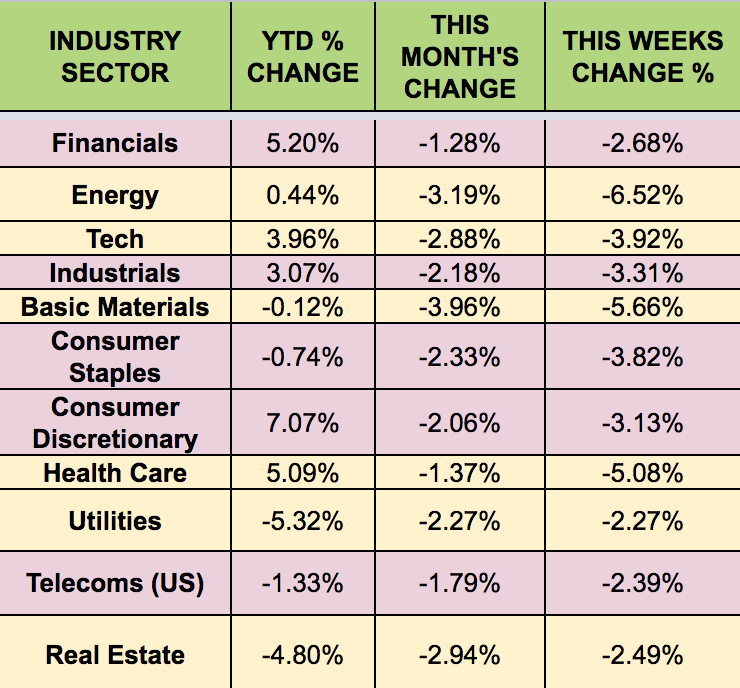

The nearly $1 trillion decline in market value this past week followed a record-setting month of inflows into equities in January. All 11 stock sectors fell this week, and 36.2% of the S&P 500 stocks fell at least 5%.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: NGL Energy Partners LP (NYSE:NGL), Suburban Propane Partners LP (NYSE:SPH), Genco Shipping & Trading Ltd (NYSE:GNK), BELO.

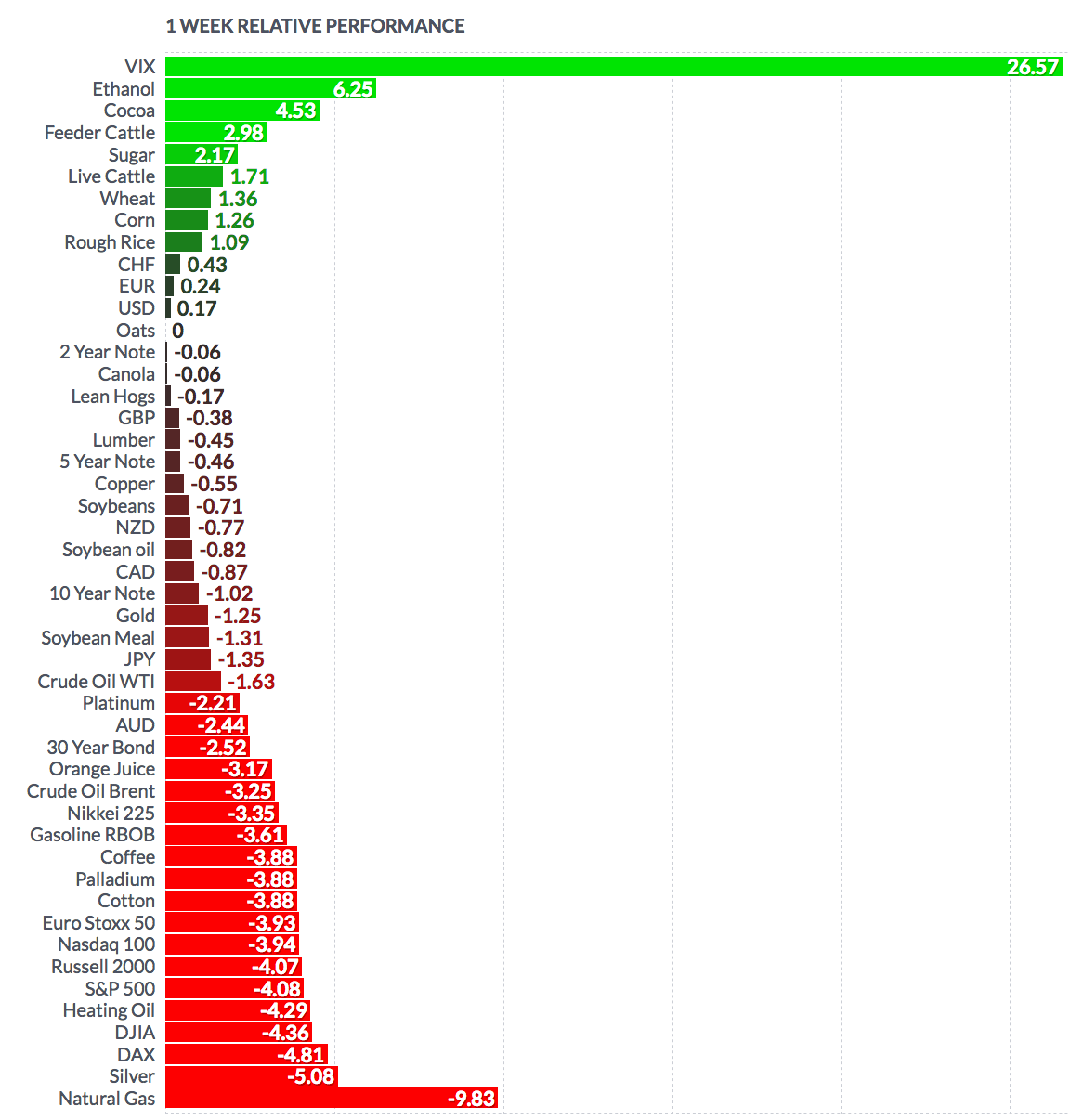

Volatility: The VIX rose 53% this week, ending at $17.21, its highest point since October 2016.

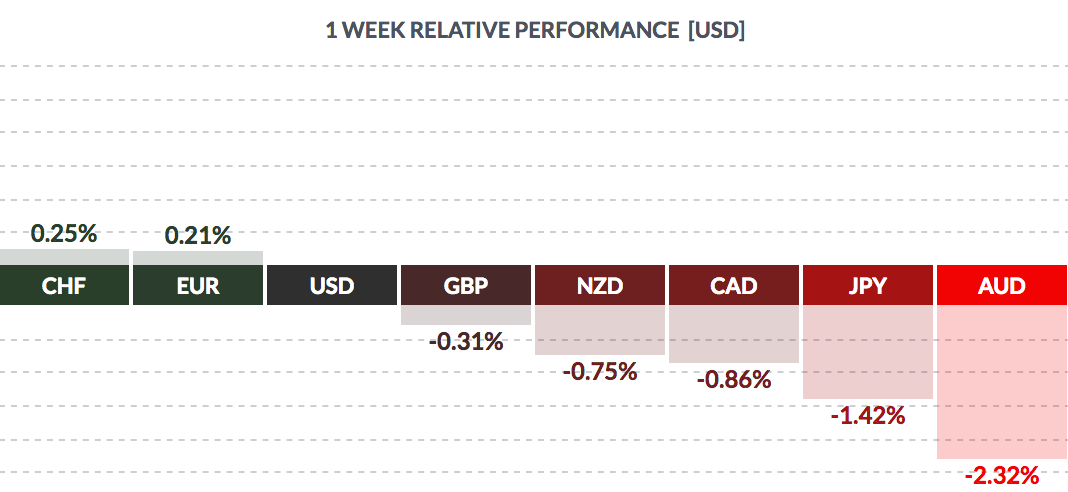

Currency: The USD rose vs. most major currencies this week, except the Euro and the Swiss Franc.

Market Breadth: In one of the worst weeks we’ve seen for market breadth in years, only 1 of the DOW 30 stocks rose this week, vs. 23 last week. Only 8% of the S&P 500 rose, vs. 77% last week.

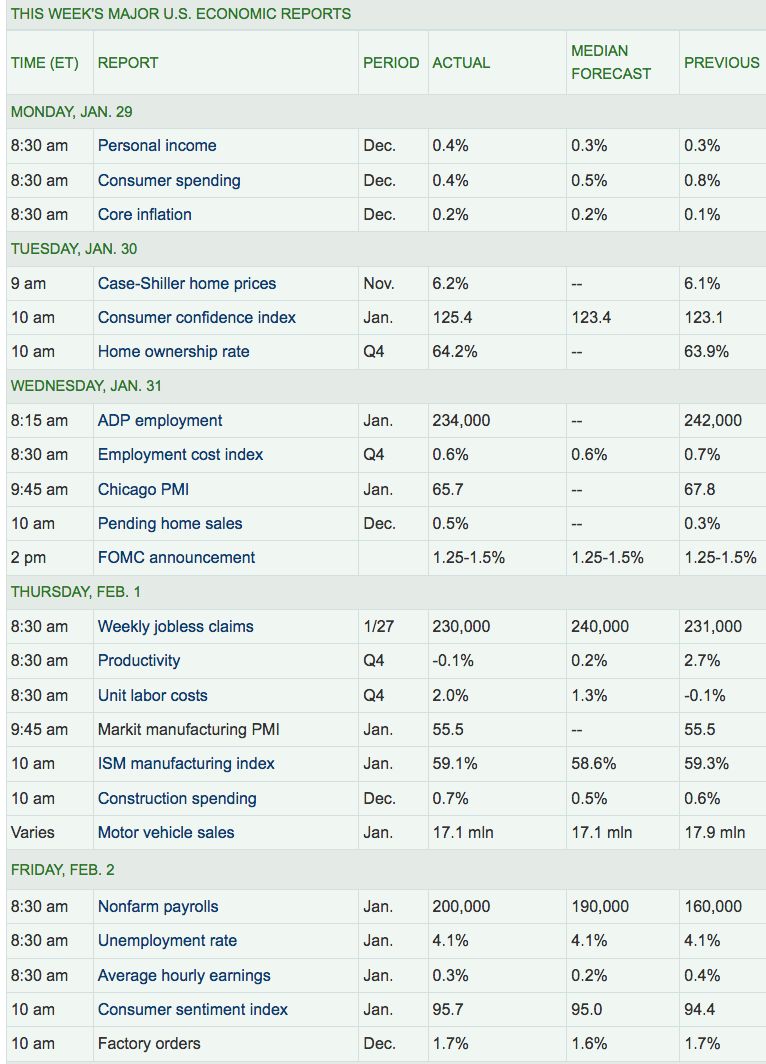

Economic News: Non-farm payrolls rose to 200k, vs. last month’s 148k above the 175k forecast.The Unemployment Rate stayed at 4.1%. November payrolls were revised down by 24K. Avg. Hourly earnings surpassed forecasts, as did unit labor costs.

“The U.S. tax bill signed into law in December will have a limited effect on the U.S. economy, as companies are unlikely to spend their tax savings on growth initiatives while the tax cut for the wealthy will not trickle down.

That’s according to Moody’s Investors Service in an FAQ on the credit impact of the tax bill published Thursday, which warns of a number of negative consequences for federal debt, local governments, utilities and homeowners.

“We do not expect a meaningful boost to business investment because U.S. nonfinancial companies will likely prioritize share buybacks, M&A and paying down existing debt”, said Moody’s analysts led by Rebecca Karnovitz. “Much of the tax cut for individuals will go to high earners, who are less likely to spend it on current consumption”.

“More than three-quarters of the $1.1 trillion in individual tax cuts will go to people who earn more than $200,000 a year in taxable income, who constitute only about 5% of all taxpayers”, said Karnovitz.

The tax bill will significantly reduce the tax intake of the federal government in the next 10 years in the scope of 1% of GDP on average, Moody’s estimates.

“As a result of the legislation, we expect deficits to widen faster than under our pre-passage baseline, resulting in faster accumulation of federal debt, a component of general government debt”, said Karnovitz.

“Wider deficits and higher borrowing needs will come as the Federal Reserve moves to normalize interest rates after the long period of ultralow rates that followed the financial crisis of 2008, and the Great Recession that followed it. “This will increase the effective cost of debt for the government faster than we previously expected, accelerating deterioration in debt affordability”, said Karnovitz.”

“At the levels of state and local government, it will have the effect of increasing political resistance to tax increases, as taxpayers lose their state and local property and mortgage tax deductions. That means state and local governments in higher-tax areas will struggle to pay for services.

Taxpayers losing the SALT deduction will likely reduce their discretionary spending, shrinking sales-tax revenue, which is an important component of state revenue, accounting for 40% on average, according to the National Association of State Budget Officers.

“Home prices will likely be hurt, too, as the lower cap on the mortgage-interest deduction reduces the tax incentive for home ownership at the higher end of the housing market.” (Source: MarketWatch)

Week Ahead Highlights: Q4 earnings season, with 20% of the S&P 500 reporting, including Bristol-Myers Squibb Company (NYSE:BMY), Chevron (NYSE:CVX), Philip Morris International Inc (NYSE:PM), CVS Health Corp (NYSE:CVS), Walt Disney Company (NYSE:DIS), and General Motors Company (NYSE:GM).

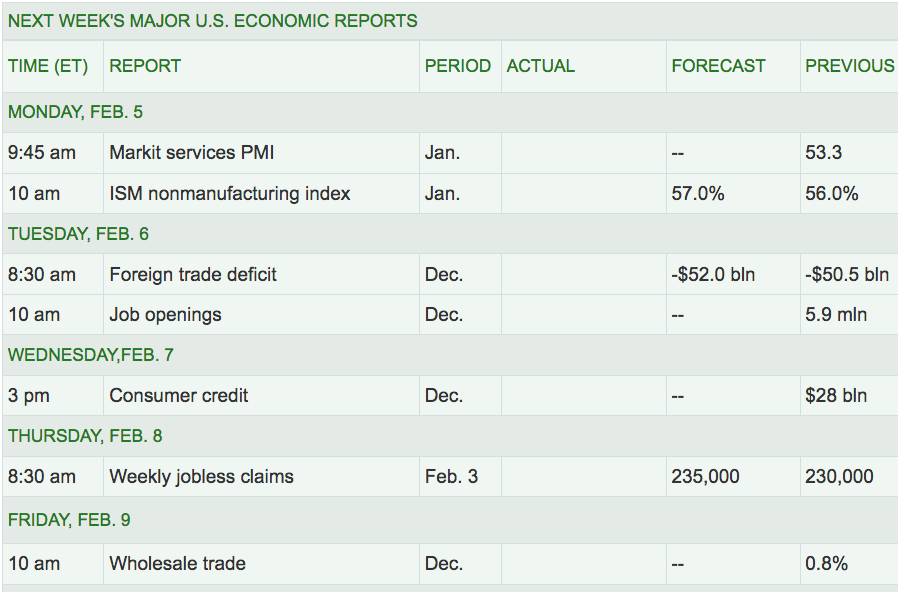

Next Week’s US Economic Reports:

Sectors: It was a broad-based rout this week, with all sectors losing ground. Energy and Basic Materials were the hardest hit.

Futures: Crude Oil WTI Futures fell -1.6%, and Natural Gas futures fell -9.8% this week.