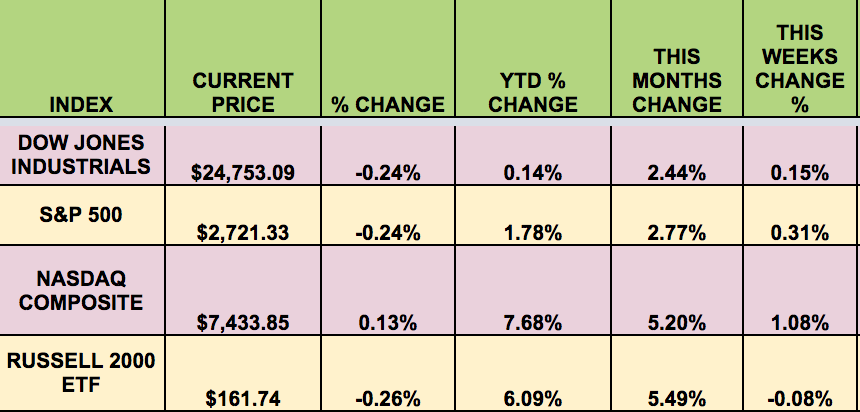

Markets: It was a flat week for the Dow; the S&P was up a bit, and the Russell small caps trailed. The NASDAQ led, with a 1.08% gain. Crude oil fell on Friday, due to OPEC talk of raising production levels. N. Korea tensions arose again, as talks were cancelled.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: AGNC, AY, BEP, CLDT, CLNC, ORC, SPKE, UFAB, BGFV, EFC, PEI, WSR.

Volatility: The VIX was down 1.9% this week, ending the week at $13.17.

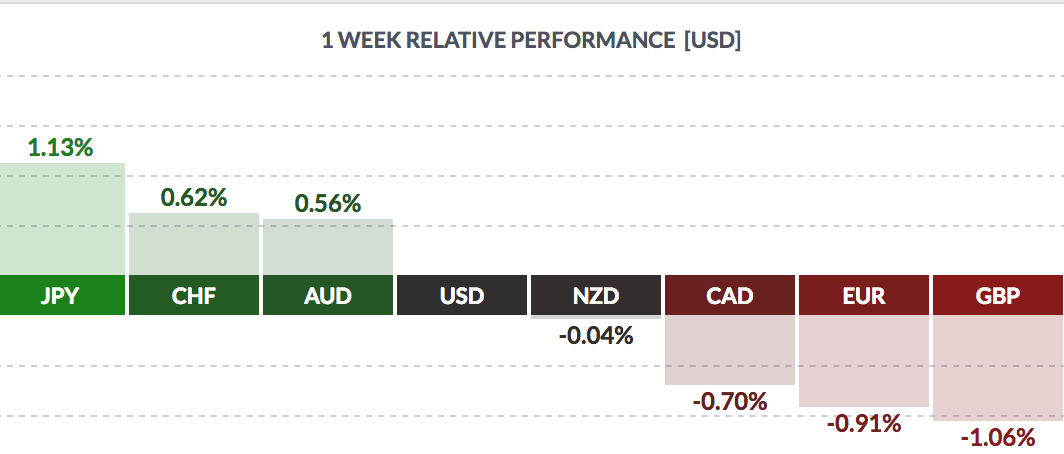

Currency: The dollar had a mixed week, rising vs. the Loonie, the euro, the pound, and the NZD, but falling vs. yen, the Swiss franc, and the Aussie.

Market Breadth: 15 of the DOW 30 stocks rose this week, vs. 13 last week. 54% of the S&P 500 rose this week, vs. 48% last week.

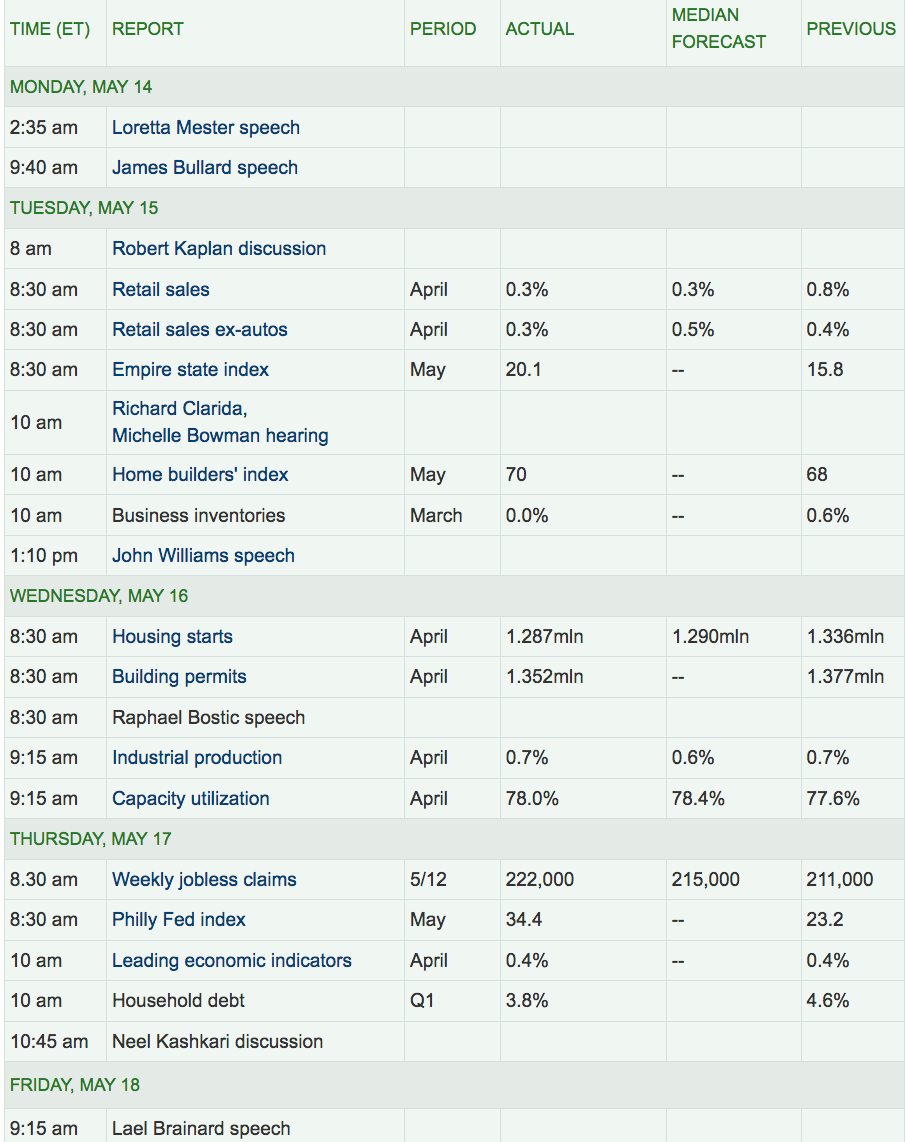

Economic News: Housing Starts and Building Permits fell in April, as higher rates, higher prices, and lack of inventory continued to dampen the Housing industry.

U.S. central bankers said “it would likely soon be appropriate” to increase the benchmark policy rate, according to a record of their May 1-2 meeting released Wednesday, confirming investor expectations for a move next month. Beyond that, officials “expressed a range of views on the amount of further policy firming that would likely be required. (Bloomberg)

The Fed will consider a proposal to modify the “Volcker Rule” banning proprietary trading by banks at a May 30 meeting of its board, the central bank announced Wednesday.

Federal regulators are expected to announce changes easing some of the rule’s requirements, amid complaints from banks they are too onerous and confusing. The rule, created as part of the 2010 Dodd-Frank financial reform law, bars banks from using funds protected by deposit insurance to make profit-seeking trades if not directed by clients. (CNBC)Russia and Japan have warned they could retaliate against U.S. tariffs on steel and aluminum by imposing sanctions worth almost $1 billion combined, filings published by the World Trade Organization showed on Tuesday. Russia said the U.S. plan would add duties of $538 million to its annual exports and Japan put the sum at $440 million, and both said they had the right to impose equal costs on U.S. exports. Neither named the U.S. products that they might target. The documents from Russia and Japan, following similar filings last week by the European Union and China, notified the United States of the cost of its tariff plan, based on 2017 exports. (Reuters)

Federal Reserve officials signaled they are set to raise interest rates at their meeting in June, but sent no clear message on whether they’d hike one or two more times this year following that move.

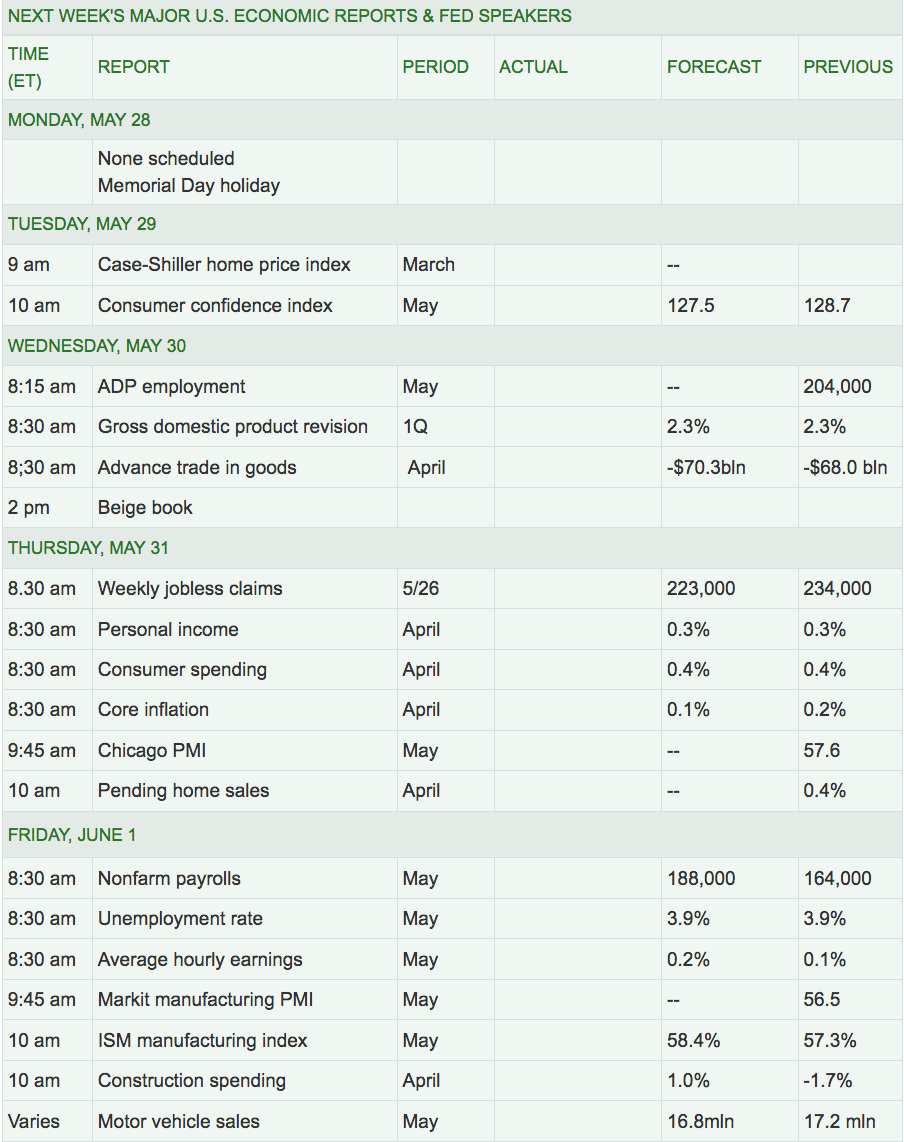

Week Ahead Highlights: It’ll be a short week, with US markets closed for Monday’s Memorial Day holiday.

Next Week’s US Economic Reports: The Non-Farm Payrolls report and the Unemployment Rate for May comes out next Friday, following the SDP employment report on Wednesday. Economists are forecasting a 188K rise in jobs for May, roughly in line with trailing monthly averages. A blowout number could fan increased rate hike pace fears, due to inflationary concerns.

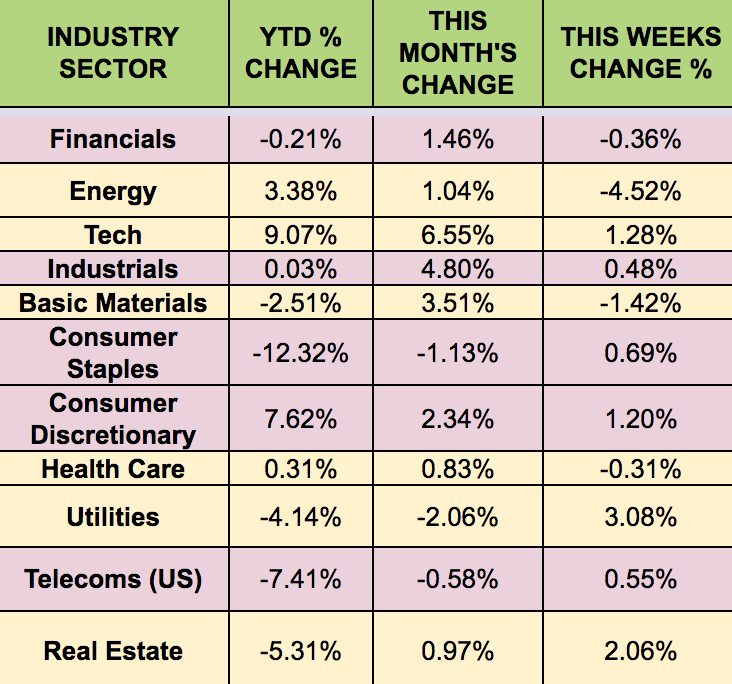

Sectors: The defensive Utilities Select led this week, while Energy stocks trailed.

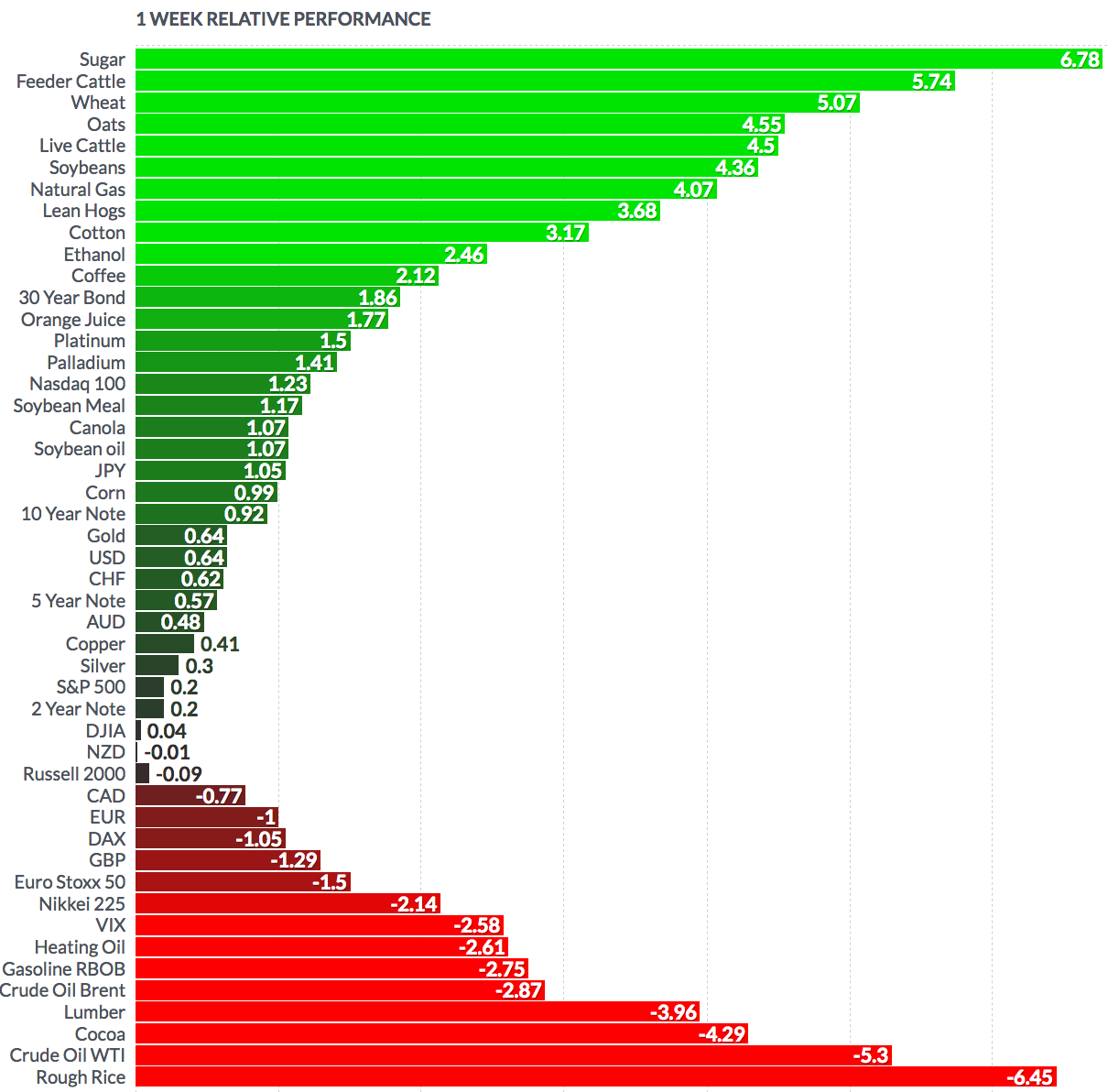

Futures:

WTI Crude futures fell -5.3% this week, while Natural Gas futures rose 4%.

WTI Crude finished the week down, at $67.58/barrel, its lowest price in 3 weeks.

“Energy ministers from Saudi Arabia, the United Arab Emirates and Russia are meeting in St. Petersburg to consider ways to boost output for the first time 2016, when they began cutting production by 1.8 million barrels/day. The meeting comes ahead of the official OPEC meeting next month."

Saudi Energy Minister Khalid al-Falih told Bloomberg there would likely be a gradual increase in production in the second half of the year as worries from consumers about the price “is a concern to us.” Saudi Arabia and its Gulf allies only want to raise output by 300,000 barrels per day, but Russia favors raising production by 800,000 bpd.” (IBD).