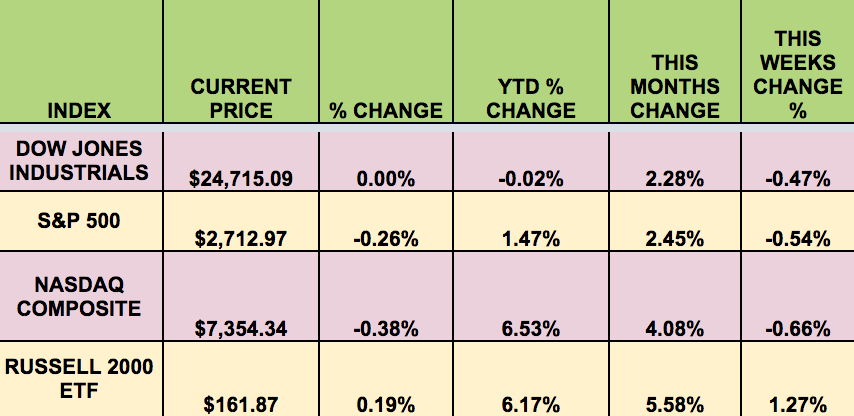

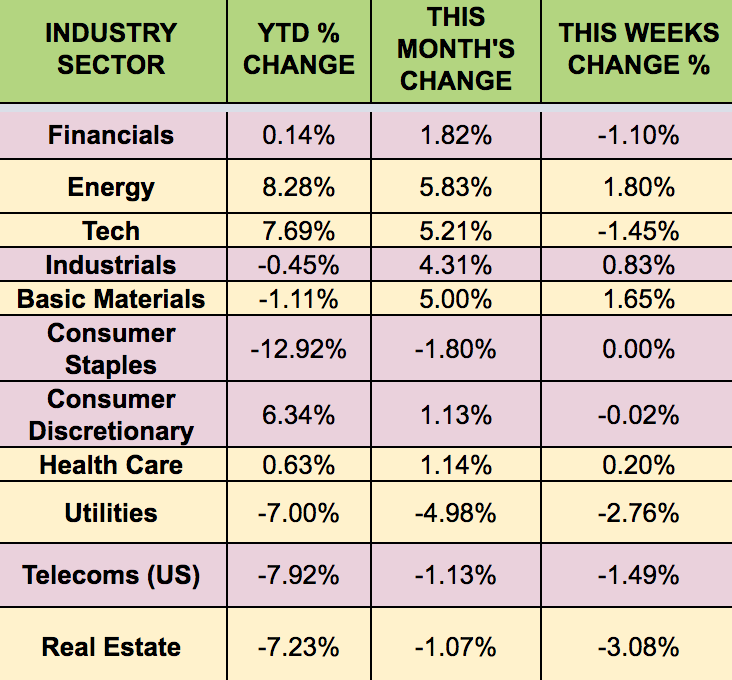

Markets: It was a down week for the Dow, S&P and the NASDAQ, with only the Russell small caps up this week. Wall Street slipped on Friday, weighed down by financials and as Alphabet (NASDAQ:GOOGL) and Applied Materials (NASDAQ:AMAT) led technology stocks lower, although losses were limited as industrial shares gained on signs of progress in Sino-U.S. trade talks.

“U.S. indexes dropped on Tuesday as investors were worried about a lack of progress in U.S.-China trade talks and assessed U.S. retail sales data that showed moderate gains last month. The United States and China are still “very far apart” on resolving trade frictions, U.S. Ambassador to China Terry Branstad said, as a second round of high-level talks were set to begin in Washington.

Adding to the trade woes, Mexico’s economy minister Ildefonso Guajardo said he does not expect to meet a deadline this Thursday to reach a new North American Free Trade Agreement that could be presented to the U.S. Congress.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: ADES, SNMP, ENBL, OCIP, SUNS, PBI, SNP.

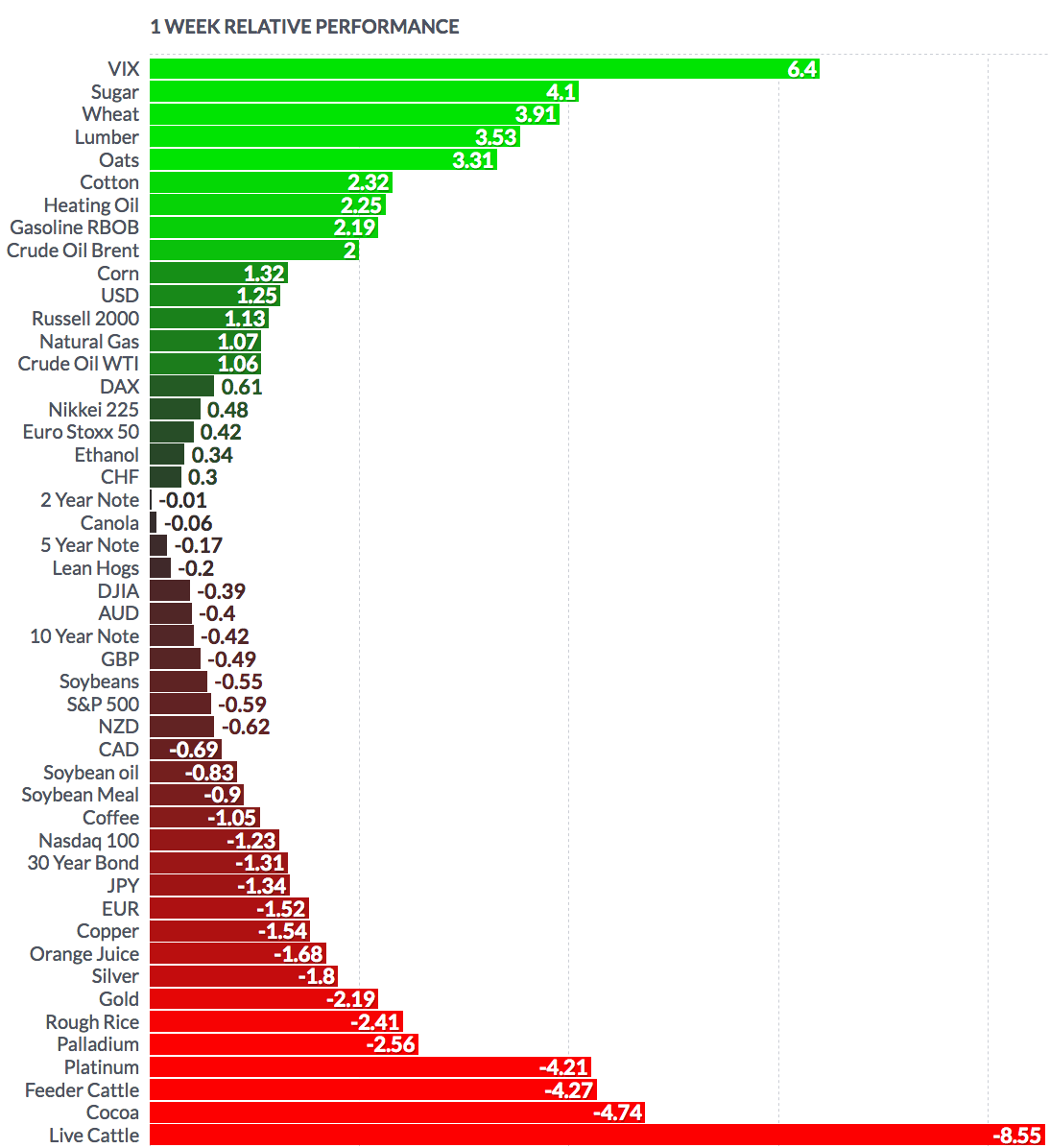

Volatility: The VIX was up 6% this week, ending the week at $13.42.

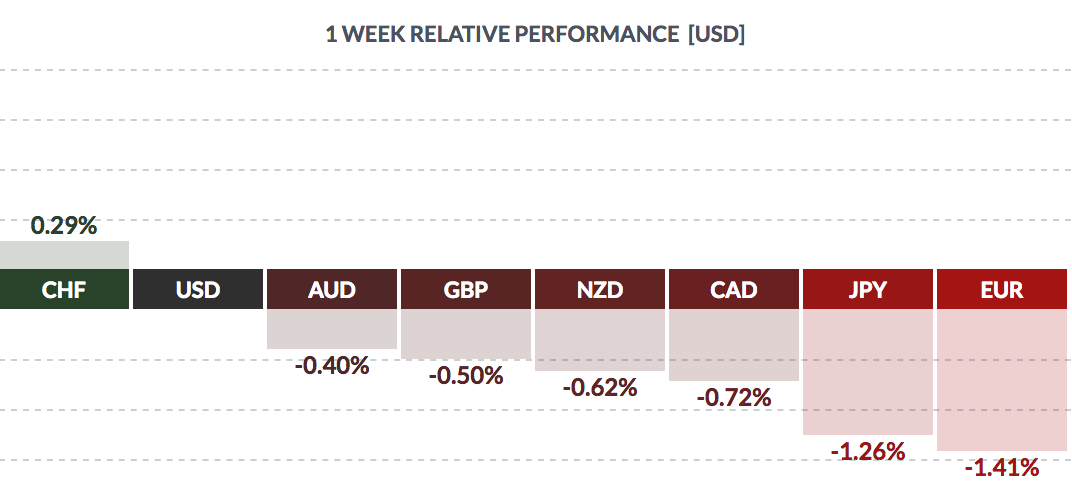

Currency: The dollar rose vs. most major currencies once again this week, excepting the Swiss Franc.

Market Breadth: 13 of the DOW 30 stocks rose this week, vs. 10 last week. 48% of the S&P 500 rose this week, vs. 38% last week.

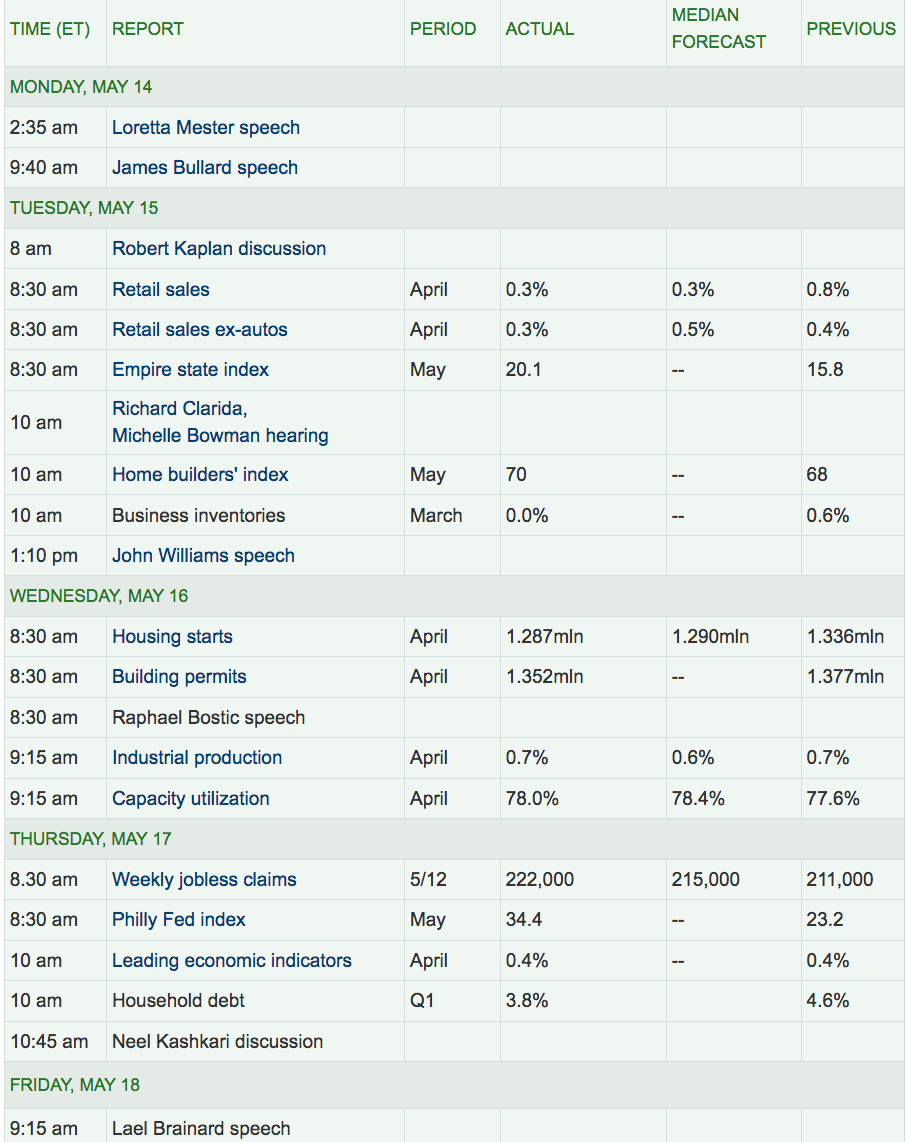

Economic News: Retail Sales ex-Autos were below forecasts for April, rising 0.3%, vs. the 0.5% forecast. Housing Starts were ~ in line with forecasts. The Empire State Index rose 20.1% in May, vs. 15.8% in April.

“HSBC Holdings) said on Monday it has performed the world’s first trade finance transaction using a single blockchain platform, in a push to boost efficiency in the multi-trillion-dollar funding of international trade. HSBC and Dutch bank ING completed the deal for Cargill last week when a shipment of soybeans was transported from Argentina to Malaysia via the global commodities trader’s Geneva and Singapore subsidiaries, the British lender said in a statement.” (Reuters)

“U.S. retail sales increased a moderate 0.3 percent in April, compared with an upwardly revised 0.8 percent surge in March, as rising gasoline prices weighed on discretionary spending, the Commerce Department said. (Reuters)

“”A NY Fed report shows that American home equity has recently recovered, but much of this household wealth is more likely to be held by older, high-credit-score borrowers less exposed to financial shocks. Homeownership among younger borrowers and Americans with lower credit scores has been declining, as tight lending standards have made it difficult for them to tap credit. Household wealth has moved away from these groups.” (WSJ)

Week Ahead Highlights: Q1 ’18 earnings season winds down, with less than 5% of the S&P 500 reporting.

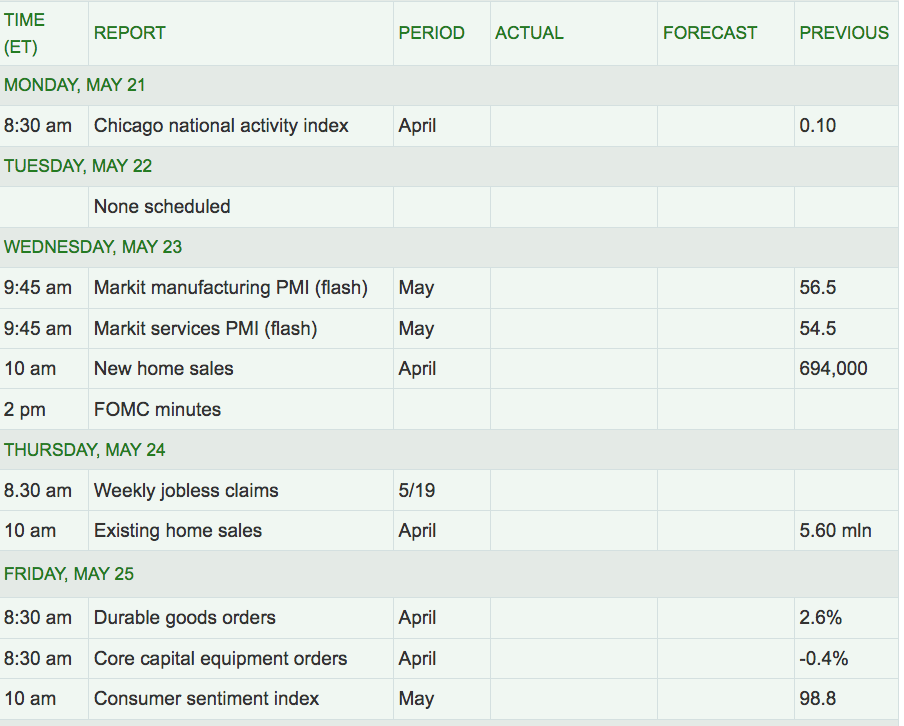

Next Week’s US Economic Reports: New and Existing Home Sales reports are due out next week, which should shed light on recent housing trends, in light of rising rates. We’ll also see the FOMC’s meeting minutes, which may give further insight into future rate rises.

Sectors: The Energy and Basic Materials sectors led this week, powered by continuing higher Crude Oil prices, while Real Estate) and Utilities trailed.

WTI Crude futures rose 1.06% this week, while Natural Gas futures rose 1.07%.

WTI Crude finished the week above $71, at $71.48/barrel.