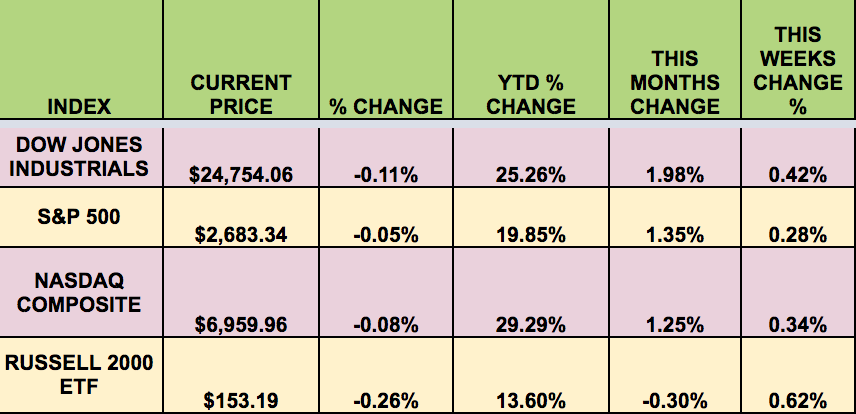

Markets: It was a mixed week again- with 3 out of 4 indexes gaining for the week and hitting record highs, as the Tax Bill was passed. The DOW and the S&P 500 led, and the NASDAQ gained, but the Russell Small Caps actually lost ground again this week.

“The Dow Jones Industrial avg. did something on Monday, it has never done in its 121-year history. The 30-stock average is now up more than 5,000 points in a year, marking its biggest annual-points gain ever. This following a 200-point rally Monday which sent it to an all-time high. Most of the big point moves are in recent years for an obvious reason: the Dow is much bigger than it was decades ago. So investors should keep this point move in perspective.

Jonathan Krinsky, chief market technician at MKM Partners, noted the spread between the Dow’s price and its 200-day moving average a key technical indicator was about 13 percent. “It’s getting a bit extended, but I think it has more room to run.”

He said that some of the indicators on the S&P 500 which typically matches the Dow’s performance on a yearly basis are reaching extreme “overbought” territory.

Wall Street is generally bullish on stocks heading into next year, but do not expect a repeat of this year. Strategists, on average, expect a 5% gain on the S&P 500.”

The Bitcoin bubble may have started to burst – it lost 25% of its value this week.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: MFA, WHLR, Alcentra Capital Corp (NASDAQ:ABDC), AGNC Investment Corp (NASDAQ:AGNC), AHP, Blackstone (NYSE:BX) Mortgage Trust Inc (NYSE:BXMT), CBL, CGBD, Chimera Investment Corporation (NYSE:CIM), CLNS, CMO, US Dollar Index Futures, IRT, Ellington Residential Mortgage (NYSE:EARN), GECC, American Capital Mortgage Investment (NASDAQ:MTGE), MITT, ORC, PLYM, PSEC, SCM, STB, STWD, VER,

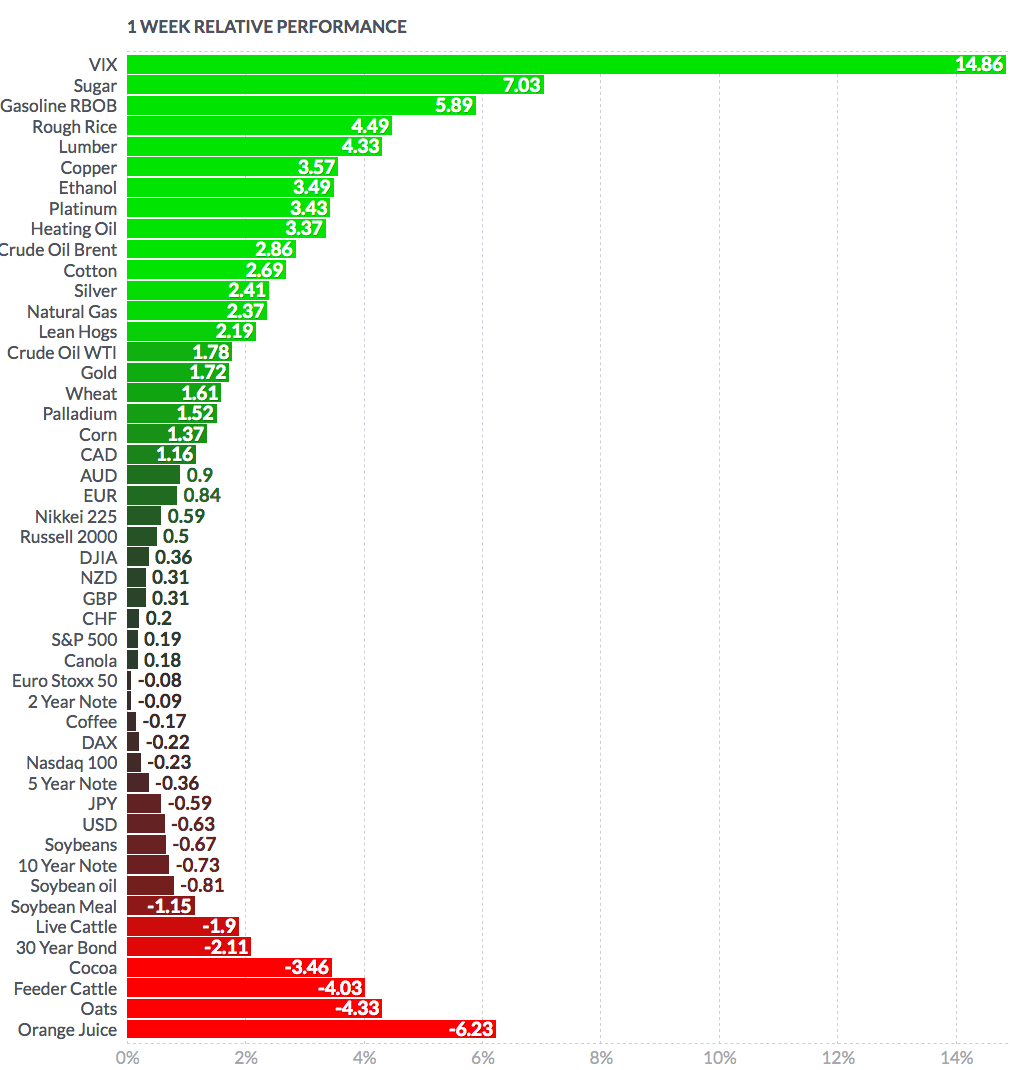

Volatility: The VIX rose 4.76% this week, ending at $9.90.

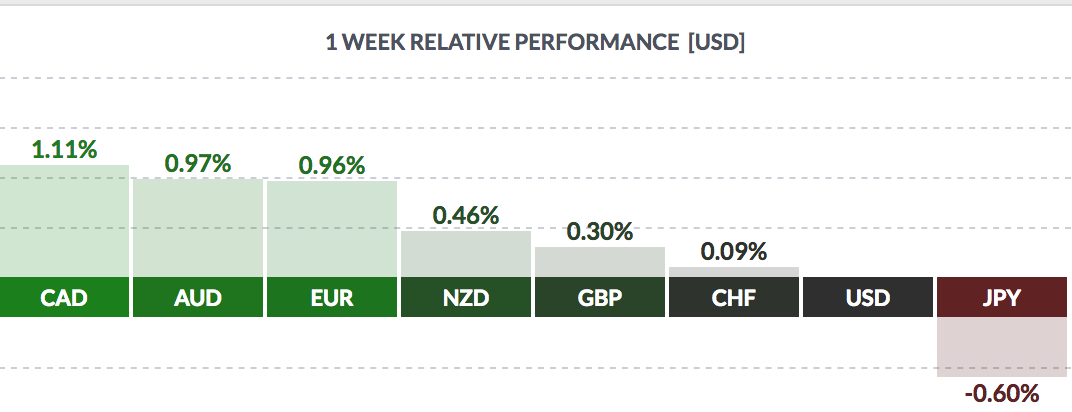

Currency: The US Dollar fell vs. most major currencies this week, except the Yen.

Market Breadth: 18 of the DOW 30 stocks rose this week, vs. 24 last week. 57% of the S&P 500 rose, vs. 47% last week.

Economic News: New home sales rose to 733k, above the 650k forecast. The 17.5% increase is the largest monthly change in 25 years. Q3 GDP came in at 3.2%, slightly lower than Q2 at 3.3%.

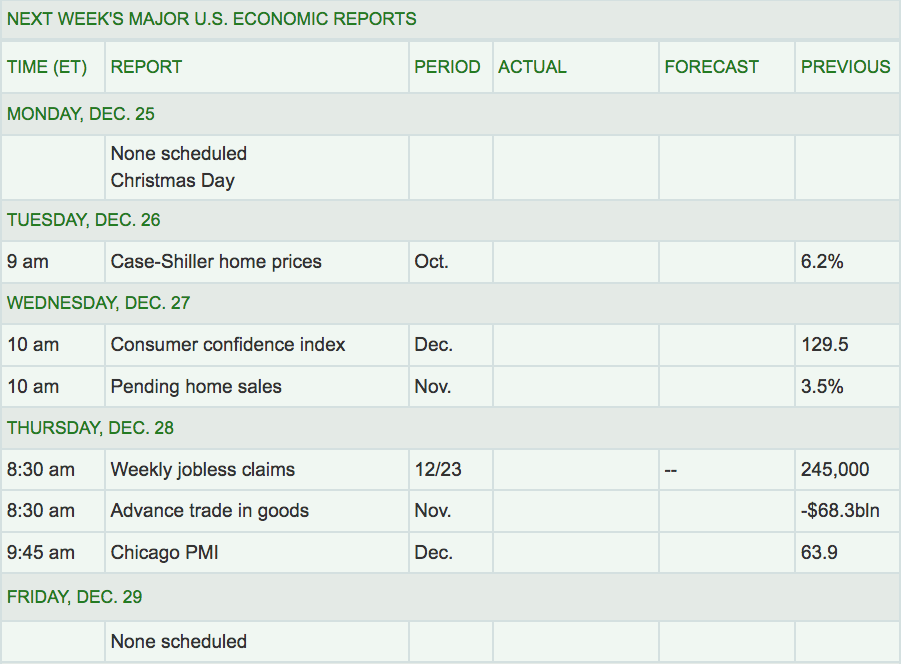

Week Ahead Highlights:It’ll be short week, with US markets closed on Monday for the Christmas holiday.

Next Week’s US Economic Reports: It’ll be a very light data week, but we’ll get an update on Consumer Confidence, and some Housing data.

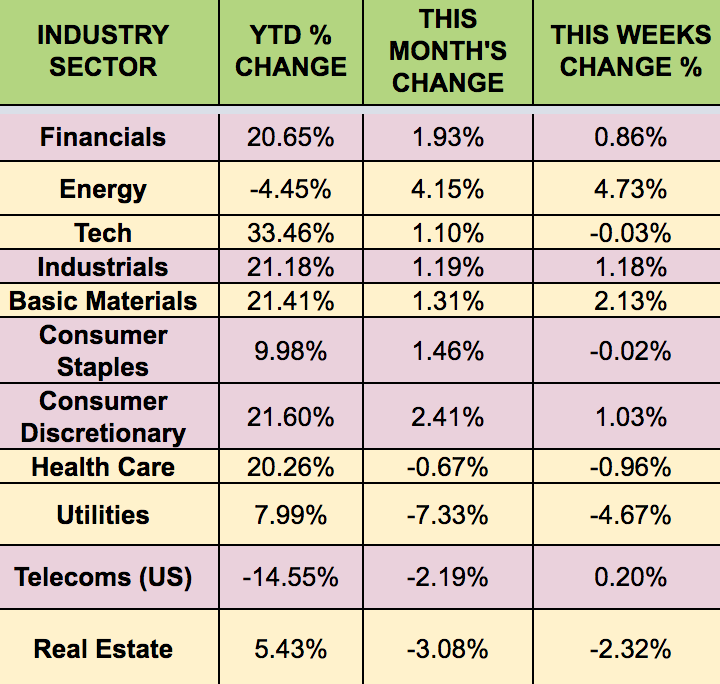

Sectors: The Energy sector had one of its best weeks this year, and led this week, with Utilities trailing again. Utilities are out of favor, due to rising interest rates.

Futures: Crude Oil WTI Futures gained 1.78% this week, and Natural gas rose 2.37%.