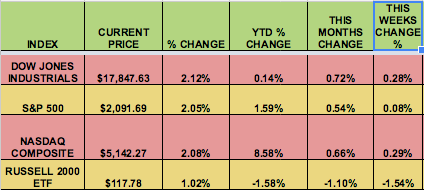

Markets: A strong US jobs report sent stocks soaring Friday, and saved the market from a big down week. The Dow and NASDAQ led for the week, with the Russell small caps negative, and the S&P flat.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week – Triangle Capital Corporation (N:TCAP), Medical Properties Trust Inc (N:MPW), Outfront Media Inc (N:OUT), Ship Finance International Ltd (N:SFL), Garrison Capital Inc (O:GARS), OneBeacon Insurance Group Ltd (N:OB), Rogers Communications Inc (N:RCI), TELUS Corporation (N:TU), Williams Companies Inc (N:WMB), US Global Investors Inc (O:GROW), KKR Income Opportunities Fund (N:KIO), Raymond James Financial (N:RJF, Stonewall Resources Ltd (AX:SWJ), American Financial Group AFGE (N:AFGE), Preferred Apartment Communities Inc (N:APTS), Frontier Communications Corporation (O:FTR), Garmin Ltd (O:GRMN), Herculese Technology Growth Capital (N:HTGY), Communications Systems Inc (O:JCS), KCAP Financial Inc (O:KCAP), Main Street Capital (N:MSCA).

Volatility: The VIX ended the week down 2%, at $14.81, after rising as high as $19.35 on Thursday’s big down day.

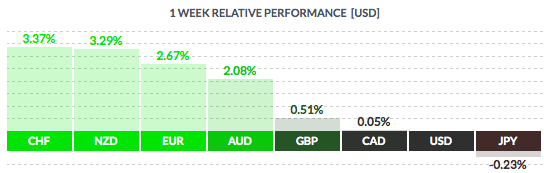

Currency: The USD, the euro, the British pound, and the yen will have to make room for the Chinese renminbi – starting in Oct. 2016, the IMF will include the RMB as part of its basket of reserve currencies. The euro faces the biggest reduction in the amount of its currency to be held in this basket. This move is a major stepping stone for China, which has long sought to gain ascendancy for its currency in world markets.

On Friday, the euro posted its biggest gain vs. the USD since May, after news of the ECB’s new monetary easing plan fell short of expectations. The USD fell vs. most major currencies except the yen.

Market Breadth: 21 of the Dow 30 stocks rose this week, vs. 13 last week. 49% of the S&P 500 rose this week, vs. 59% last week.

US Economic News: The Unemployment Rate remained at 5%, but the Non-Farm Payrolls report surprised to the upside, giving the Fed more fuel to raise rates at its Dec. 15-16 meeting. September’s and October’s reports were also revised upwards by a total of 35,000 jobs, making the 3-month avg. 218,000 jobs/month.

The Fed will have a new “Emergency Lending” rule, which restricts its ability to bail out major banks, such as Wells Fargo), Bank of America), JPMorgan Chase, Goldman Sachs, and others. Moody's downgraded the credit worthiness of the major banks, which now have less of a safety net.

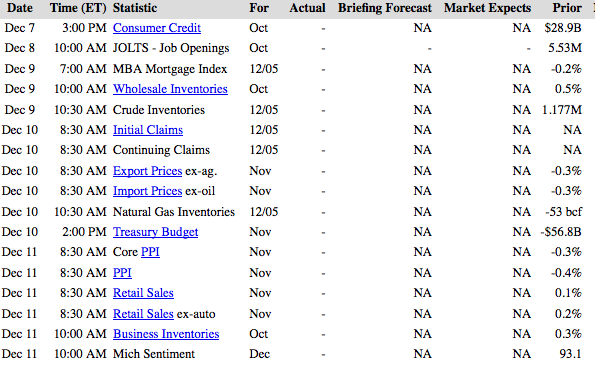

Week Ahead Highlights: Retail Sales and Consumer Sentiment reports coming out next Friday will be in the spotlight, giving clues about consumers’ willingness to spend in this holiday season.

Next Week’s US Economic Reports:

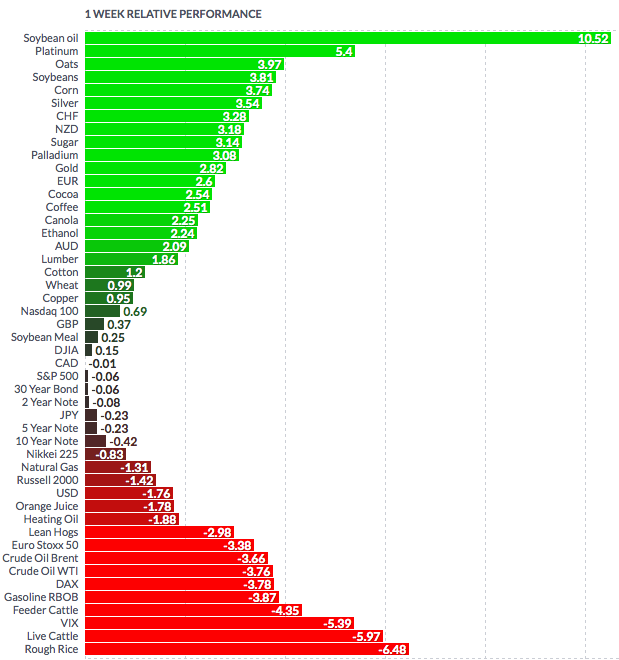

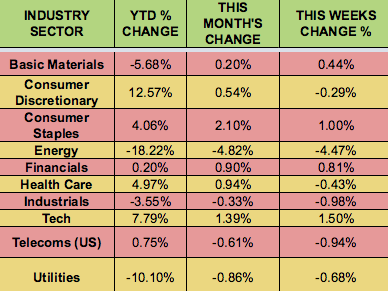

Sectors and Futures:

Tech led this week, as Energy trailed, in the wake of negative news from OPEC.

Crude Oil took a hit this week, after OPEC didn’t cut production plans at its Friday meeting. Soybean Oil led this week, with Rough Rice trailing: