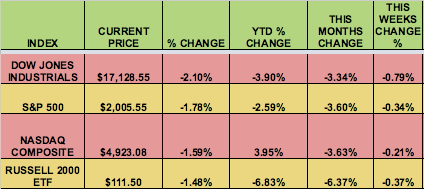

Markets: The market had its second down week in a row this week, buffeted by lower crude prices, reactions to the Fed rate hike, and slowing growth fears. Options expirations also added fuel to the fire. It was the 3rd straight down week for the RUSSELL small caps, and the Dow, S&P 500, and NASDAQ all closed beneath their mid-November lows.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week:

N:LTC, N:PM, N:GTY, O:MERC, N:CM

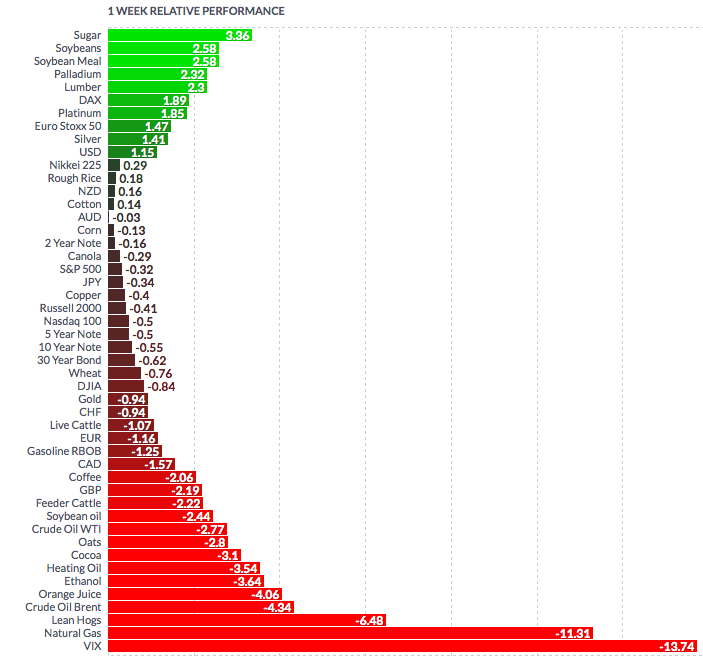

Volatility: The VIX fell 13.7% this week, finishing at $20.40.

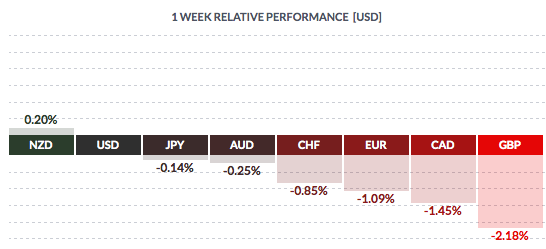

Currency: The US dollar rose vs. most major currencies, except the NZ dollar.

Market Breadth: 15 of the DOW 30 stocks rose this week, vs. 0 last week. 43% of the S&P 500 rose this week, vs. 8% last week. Ironically, even though crude oil prices continued to fall, oil majors Exxon-Mobil (N:XOM), and Chevron (N:CVX) were the 2 biggest gainers in the DOW, fueled by the repeal of the US crude oil export ban.

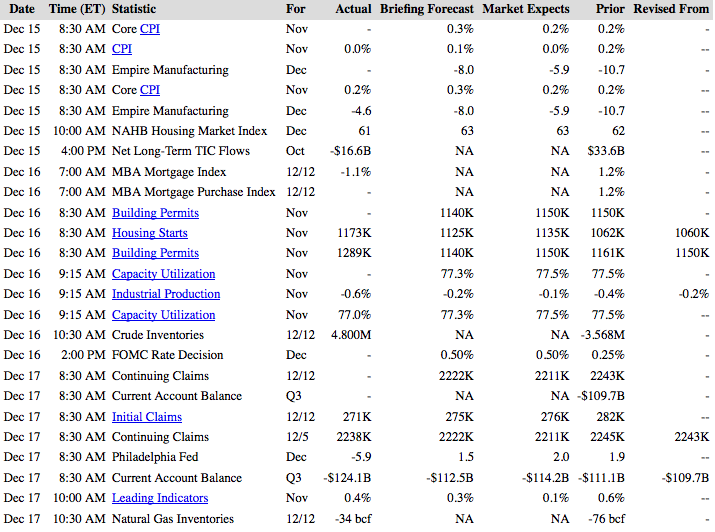

US Economic News: Housing Starts jumped in Nov., while Building Permits hit a 5-month high. Leading Economic Indicators rose more than expected.

Week Ahead Highlights: It’ll be a short week, with US markets closing on Friday for the Christmas holiday. Historically, the 3 days before Christmas have been positive for the market, with all 4 indexes posting gains in this period, from 1984 to 2014. On Tuesday, we’ll get a new estimate for Q3 GDP growth, which may show slightly slower growth than the prior 2.1% estimate.

Next Week’s US Economic Reports:

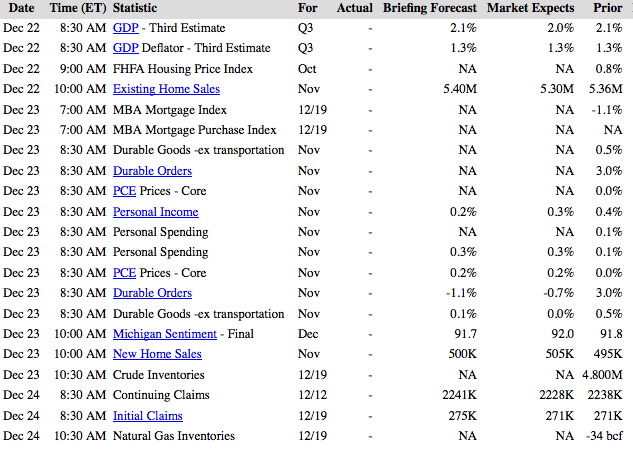

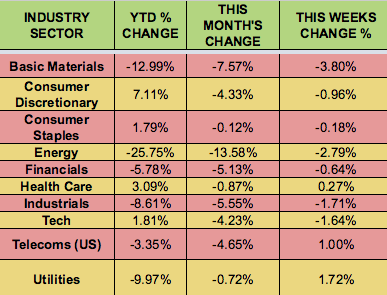

Sectors and Futures:

Utilities led this week, a Basic Materials trailed.

Sugar led this week, with Natural Gas trailing: