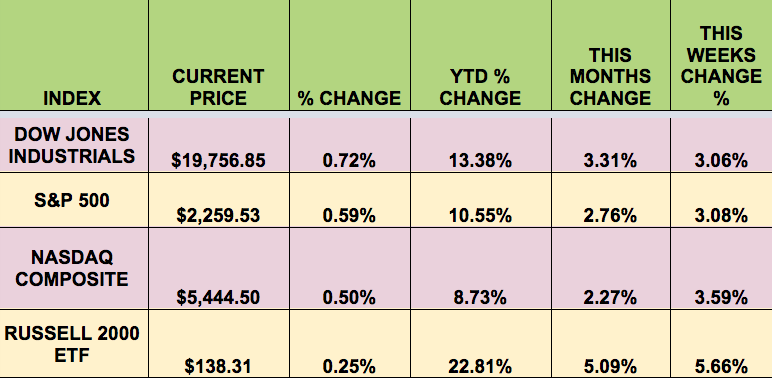

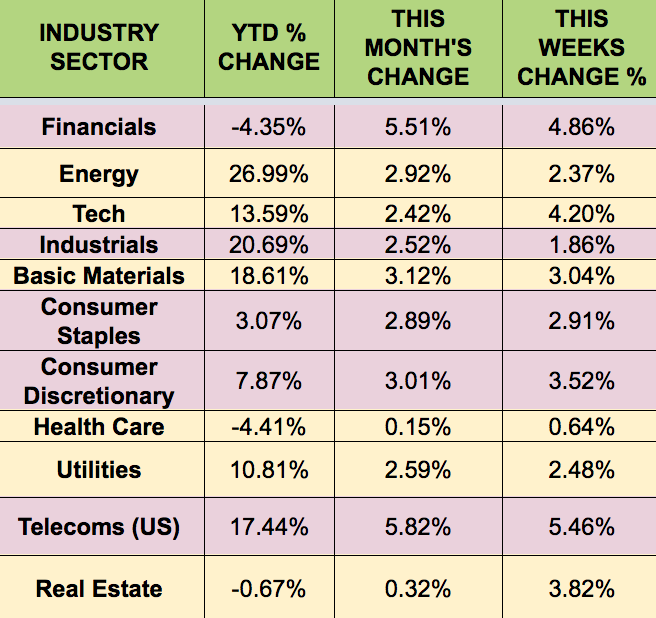

Markets: The market bounced back strongly this week, with all 4 indexes making big gains. The Dow, S&P 500, NASDAQ, and the Russell 2000 all made new all-time highs. Even more impressive was that all sectors shared in the rally, even the beleaguered Health Care and Real Estate sectors. The lagging Tech sector also joined in.

Following last week’s OPEC production cut, the number of active U.S. rigs drilling for oil climbed by 21 to 498 rigs this week – the highest level since January.

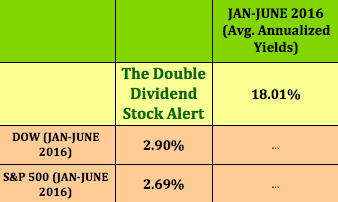

High Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: (NYSE:GES), (NYSE:NNA), (NYSE:APTS), (NASDAQ:ARCC), (NYSE:ARR), (NASDAQ:FTR), (NYSE:IRM), (NASDAQ:MRCC), (NYSE:NMFC), (NYSE:OAKS), (NYSE:RWT), (NASDAQ:OFS), (NASDAQ:TICC), (NASDAQ:BKCC), (NASDAQ:HRZN), (NASDAQ:GAIN), (NASDAQ:GLAD), (NASDAQ:GOOD).

GE (NYSE:GE) raised its quarterly dividend by 4.3% to 24 cents a share from 23 cents a share. The new dividend will be payable Jan. 25 to shareholders of record on Dec. 27. At the current stock price of $31.59, up 0.2%, the new annual dividend rate implies a dividend yield of 3.10%, compared with the aggregate dividend yield for the Dow Jones Industrial Average of 2.34%.

Coty raised its dividend by 82%, moving to a quarterly payout. The annual dividend of 50 cents a share implies a dividend yield of 2.62% at Coty’s recent price of $19.07.

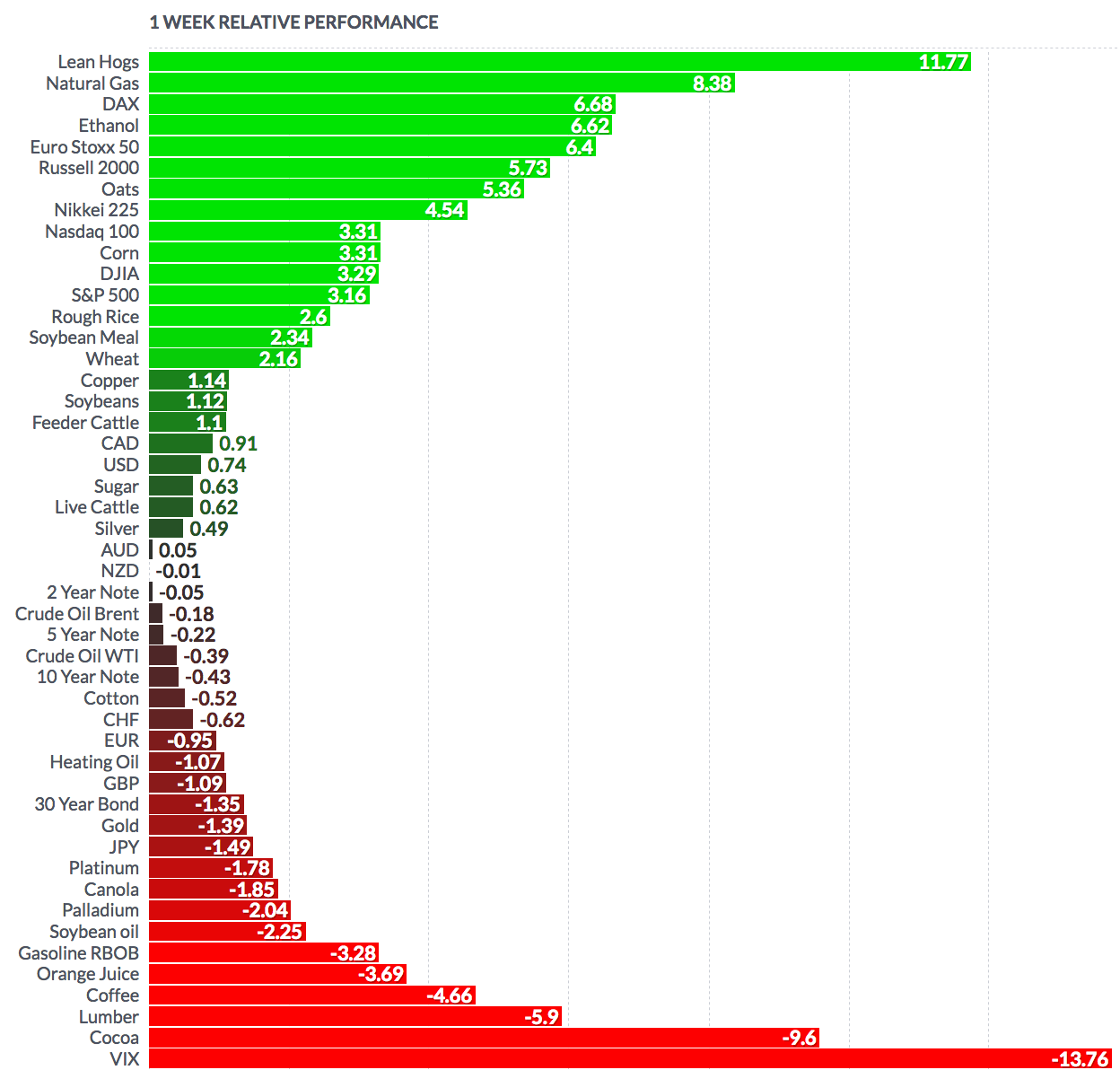

Volatility: The VIX fell 17% this week, finishing at $11.75, its lowest point since August.

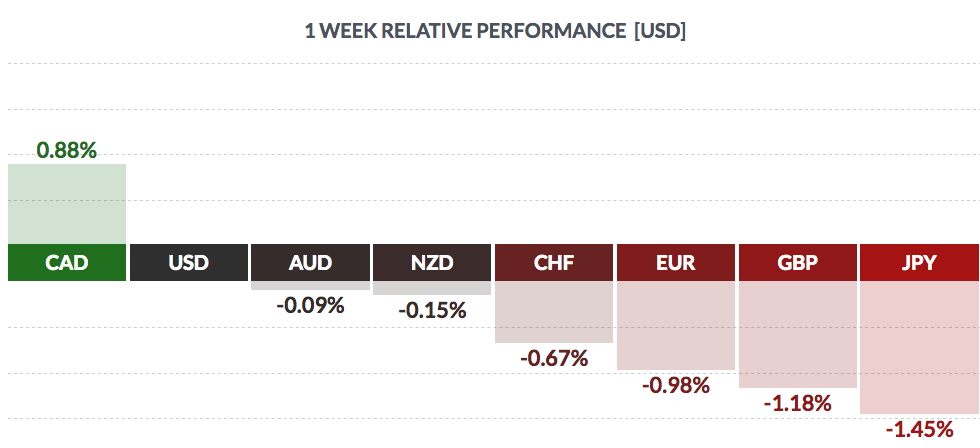

Currency: The dollar rose vs. most major currencies this week, except the Canadian dollar, which gained in the wake of last week’s OPEC production cut agreement.

Market Breadth: 28 of the DOW 30 stocks rose this week, vs. 7 last week. 91% of the S&P 500 rose this week, vs. 34% last week.

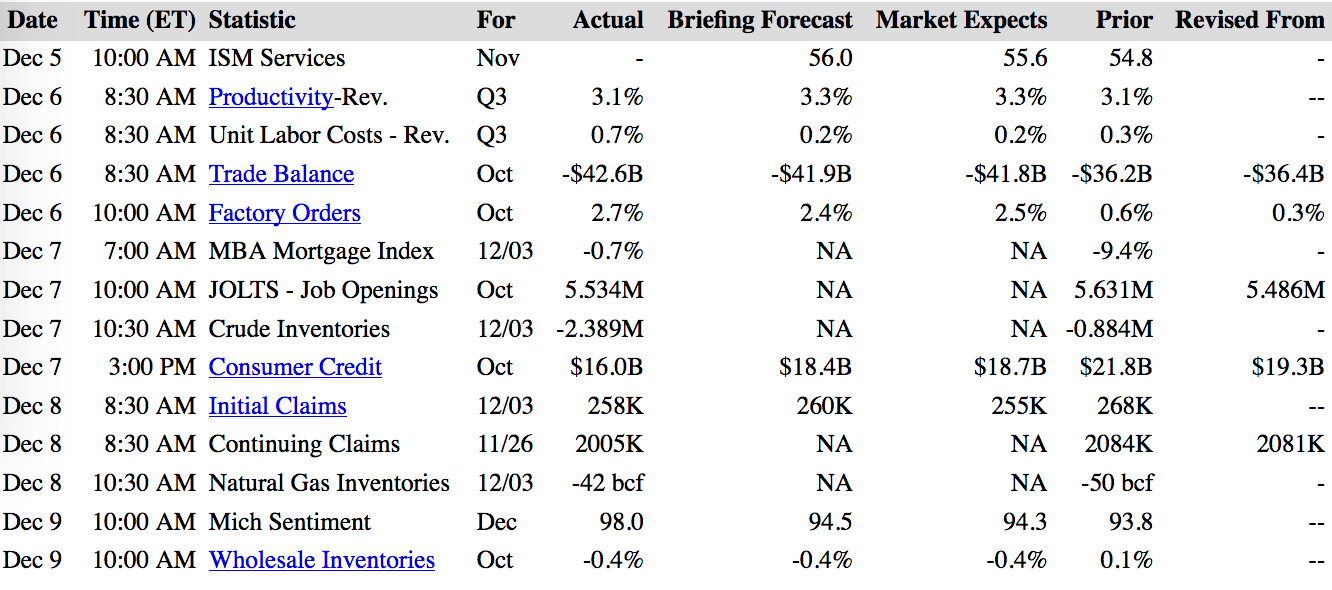

US Economic News: The preliminary consumer confidence index for December rose to 98, the highest reading since January 2015, and is nearing its highest level since 2004.

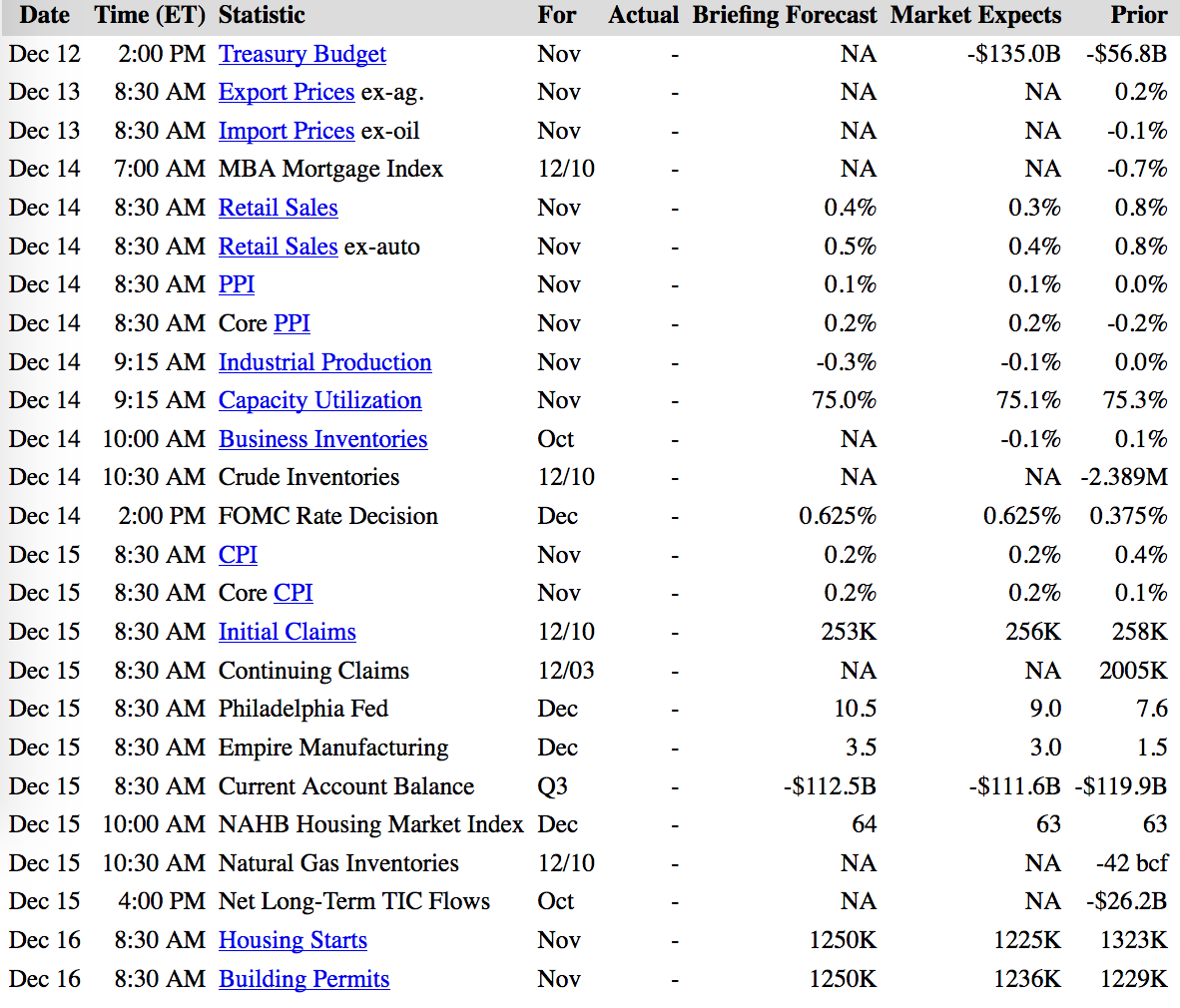

Week Ahead Highlights: The Fed holds its meeting, and will probably announce a rate hike on Wed – the 1st since last December. It’ll also be a heavy data week, with a spotlight on November Retail Sales, which should have had a bump up from Black Friday and Cyber Monday sales. The CPI will give us a new reading on inflation – a small rise to 0.2% is expected from the previous 0.1% reading in October.

Sectors & Futures: The Financial and Tech sectors led this week, as all sectors gained – HealthCare trailed.

Natural Gas has another good week, on colder weather forecasts, while crude oil was nearly flat. Lumber futures trailed: