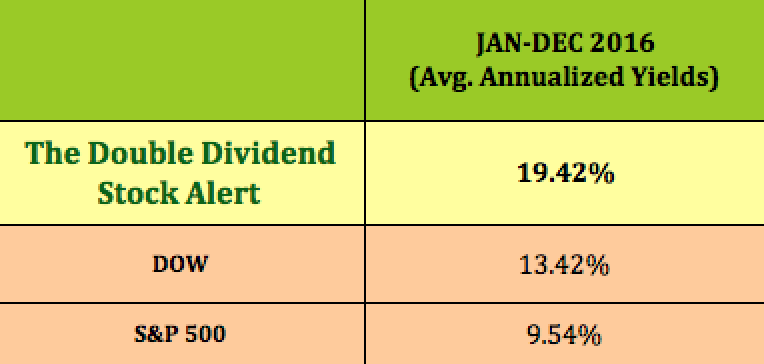

Does Your Portfolio Need Better Yields In 2017?

Check out our returns in 2016:

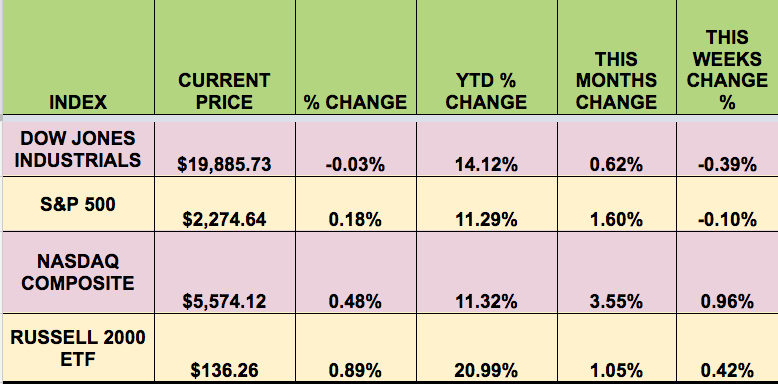

Markets: The NASDAQ continued its winning ways this week, hitting a new record high. It now leads all other indexes by a wide margin so far in these early days of 2017. The DOW and the S&P 500 both gave up a bit of ground, in a week which saw both lower crude oil prices and a falling dollar.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CPTA (NASDAQ:CPTA), FSP (NYSE:FSP), SSW (NYSE:SSW), ACSF (NASDAQ:ACSF).

Volatility: The VIX was virtually flat this week, finishing at $11.23.

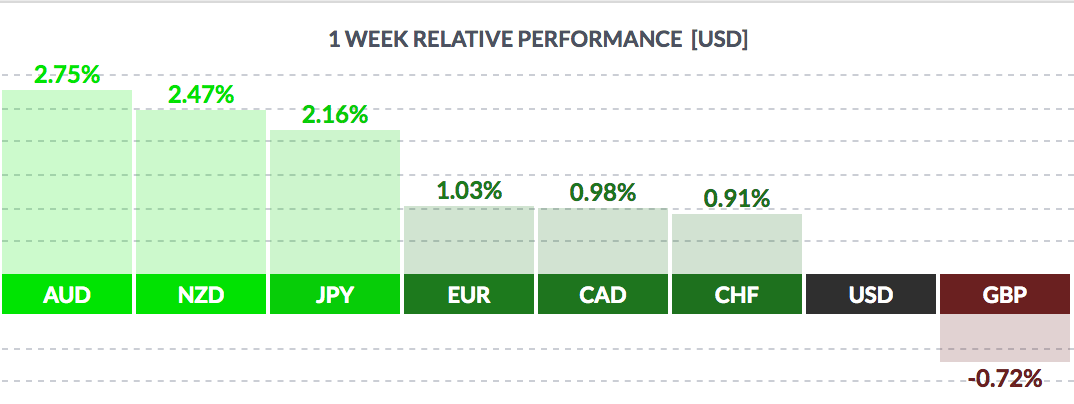

Currency: The USD pulled back again vs. most major currencies, except the pound:

Market Breadth: 9 of the DOW 30 stocks rose this week, vs. 17 last week. 46% of the S&P 500 rose, vs. 70% last week.

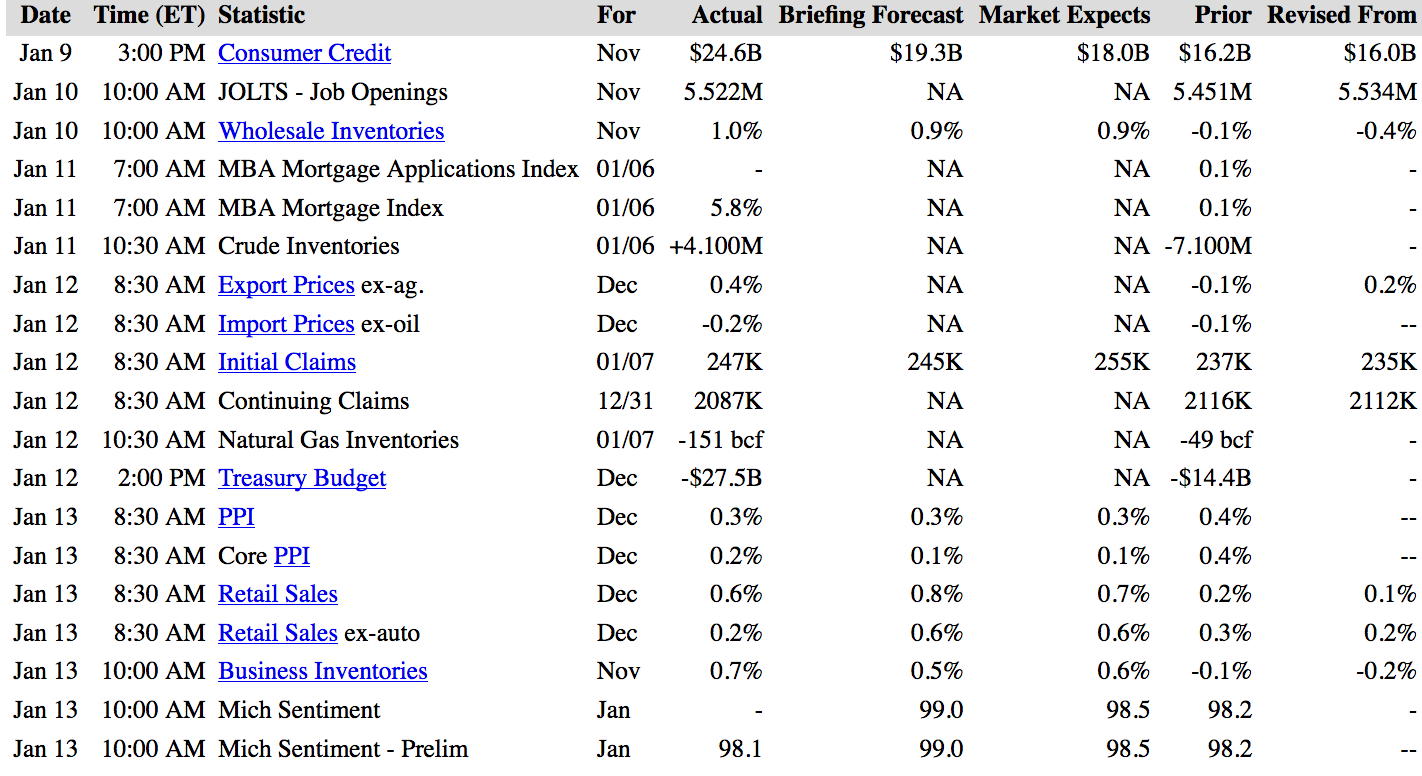

US Economic News: Although the basic Dec. Retail Sales figure rose, it was mainly due to autos and higher gasoline prices – the ex-auto sales figure was only 0.2%, vs. the 0.6% forecasted. Gasoline prices rose 7.8% in Dec.

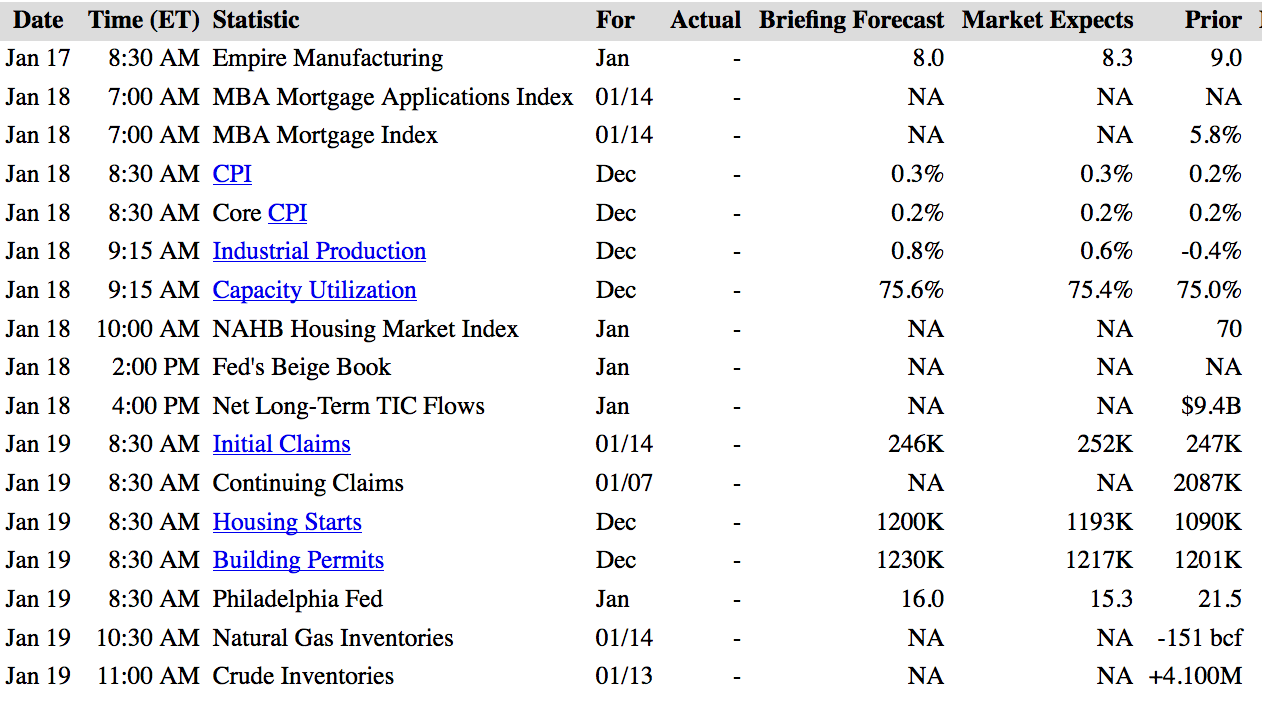

Week Ahead Highlights: It’ll be a short week, with US markets closed on Monday, in observance of the Martin Luther King holiday. Inflation and Housing will be in the spotlight, with CPI, Housing Starts, and Building Permits reports due out.

Q4 ’16 earnings season revs up, with several DOW 30 stocks reporting earnings – GE (NYSE:GE), JPMorgan (NYSE:JPM), Goldman Sachs (NYSE:GS), and United Health. Over 10% of the S&P 500 will also report, including Citibank (NYSE:C), Morgan Stanley (NYSE:MS), KeyCorp (NYSE:KEY), and American Express (NYSE:AXP), among many other financial firms.

Next Week’s US Economic Reports:

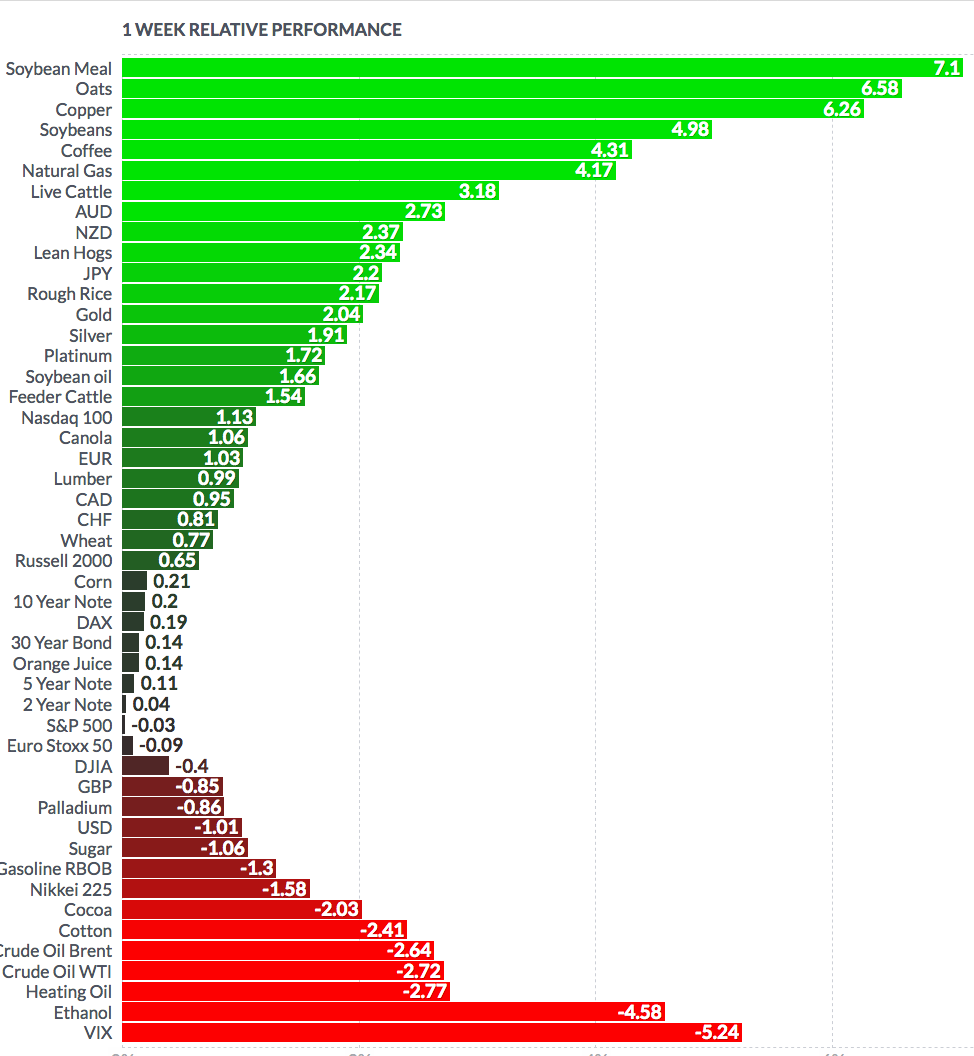

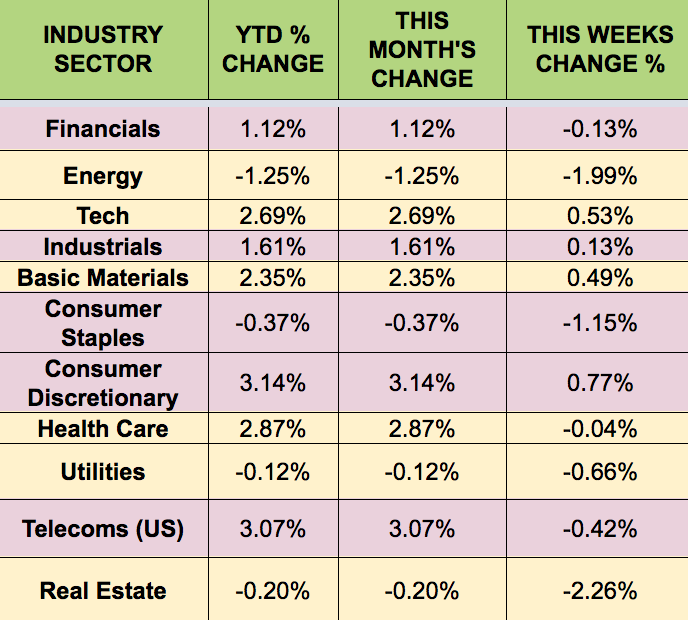

Sectors & Futures:

Even though retail sales figures, (ex-auto), were disappointing, the Consumer Discretionary sector led this week, followed by Tech and Basic Materials, which was helped a bit by a falling dollar. Real Estate and Energy lagged.

Energy futures fell this week, with crude down over 2.7%: