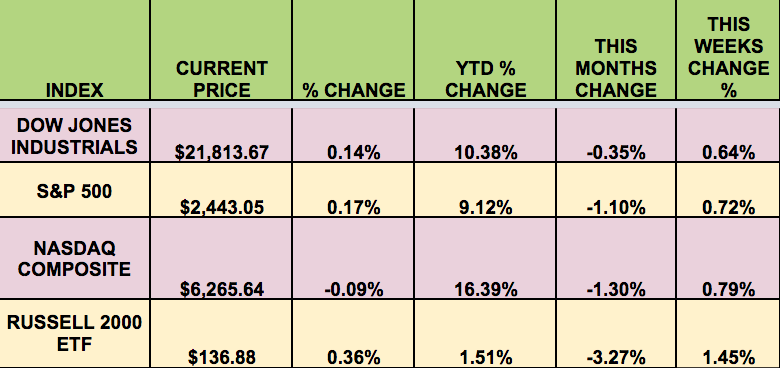

Markets: The market eked out a gain and stopped its 2-week skid, aided Friday by no rate hike comments by Fed Chief Yellen at her Jackson Hole speech.

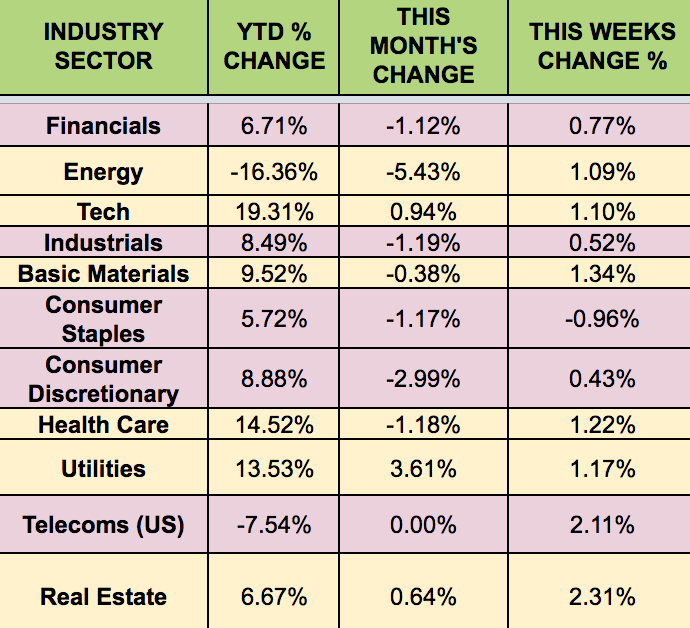

The RUSSELL flip-flopped, and led this week, although they’re still down -3.27% for the month. The S&P 500, DOW and NASDAQ all had similar gains. The S&P is still within 1.5% of its all time highs.

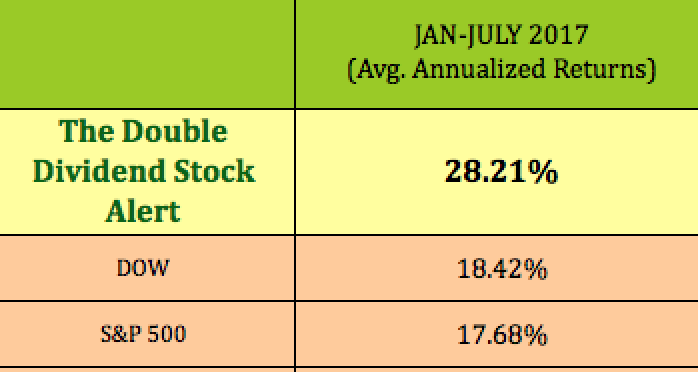

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: AGNC (NASDAQ:AGNC), BEP (NYSE:BEP), CLDT (NYSE:CLDT), CRT (NYSE:CRT), IRT (NYSE:IRT), JMP (NYSE:JMP), MTR (NYSE:MTR), NDRO (NYSE:NDRO), PBT (NYSE:PBT), PSEC (NASDAQ:PSEC), STB (TO:STB), SJT (NYSE:SJT), UFAB (NYSE:UFAB), TSLX (NYSE:TSLX), ANF (NYSE:ANF), BGFV (NASDAQ:BGFV), EFC (NYSE:EFC), GCI (NYSE:GCI), PEI (NYSE:PEI), WPG (NYSE:WPG), RGC (NYSE:RGC), GBDC (NASDAQ:GBDC), IGD (NYSE:IGD).

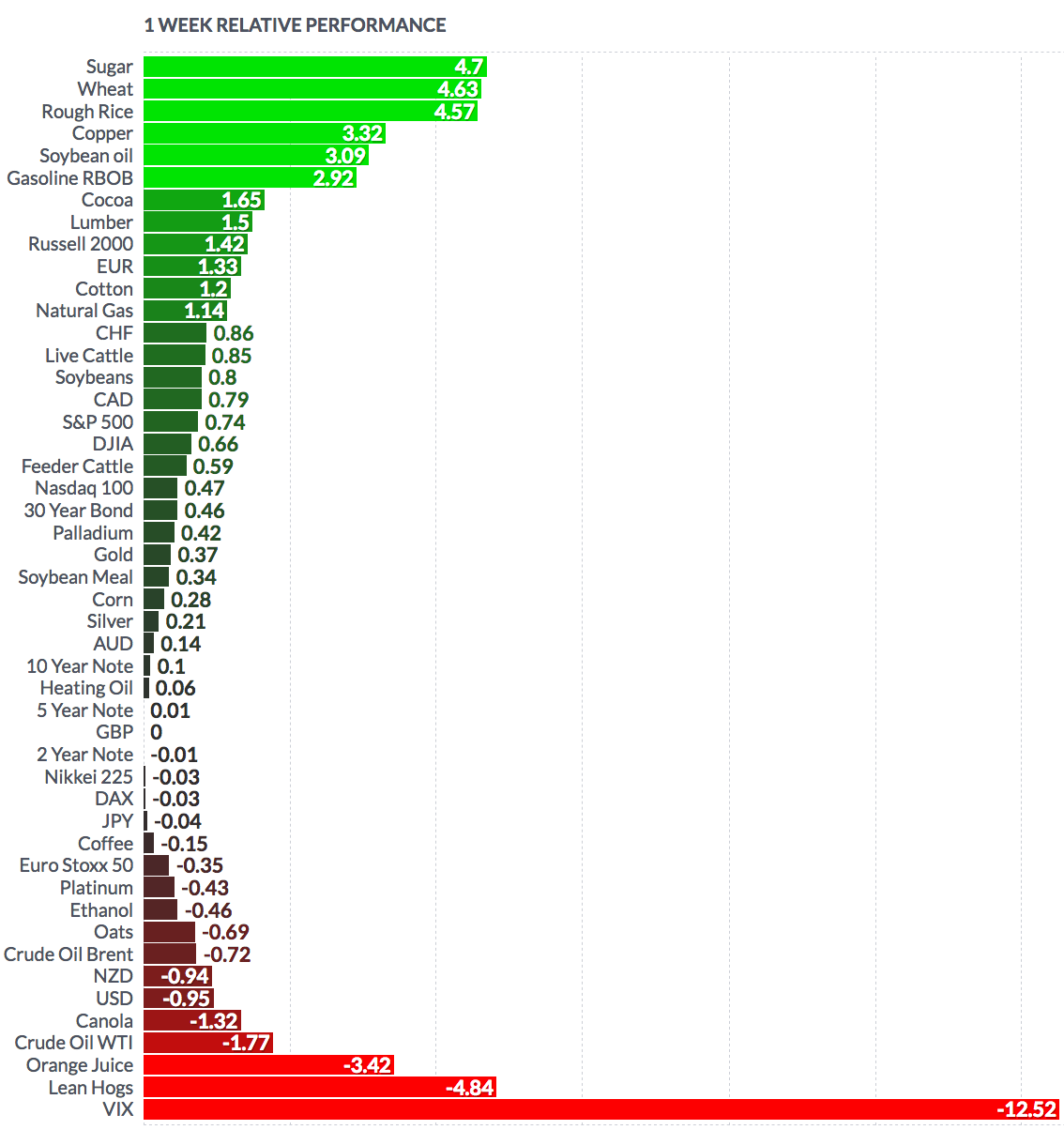

Volatility: The VIX fell 26% this week, and finished at $11.23.

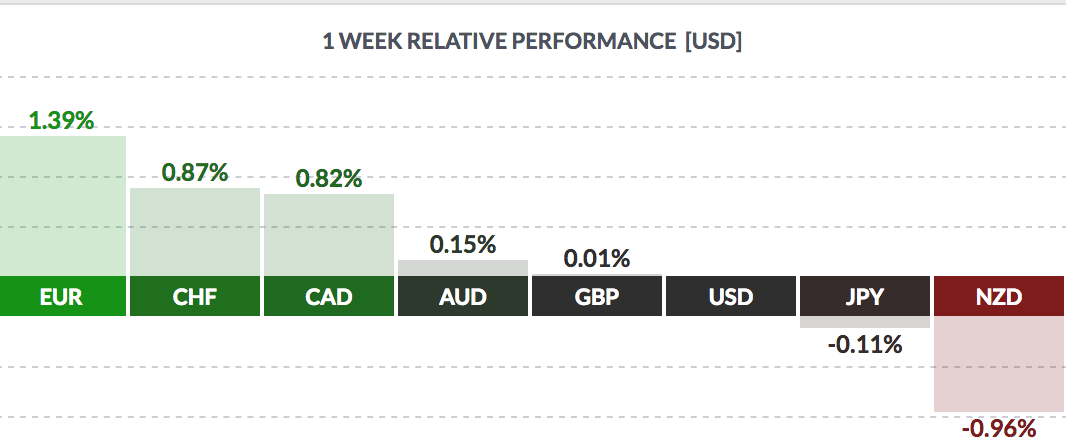

Currency: The dollar rose vs. the NZ dollar and the yen, but fell vs. other major currencies this week.

Market Breadth: 21 of the Dow 30 stocks rose this week, vs. 12 last week. 75% of the S&P 500 rose, vs. 44% last week.

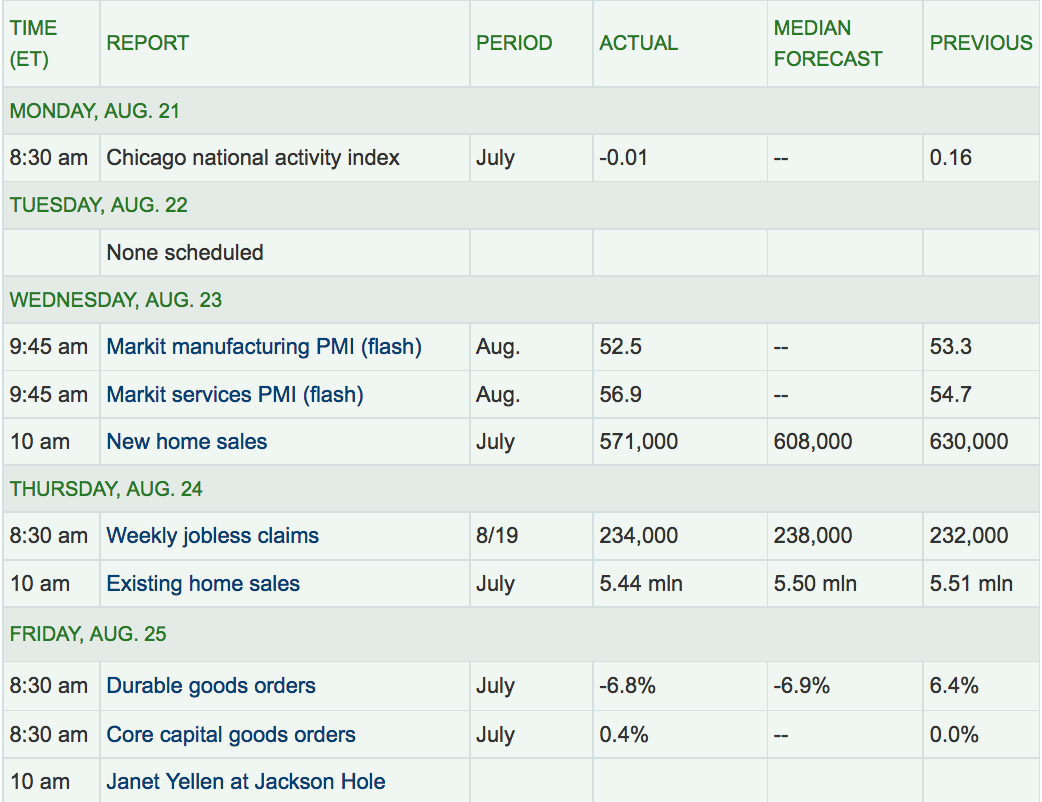

Economic News: New and Existing Home Sales fell in July, and both were below forecasts. Weekly jobless claims remain near historic lows.

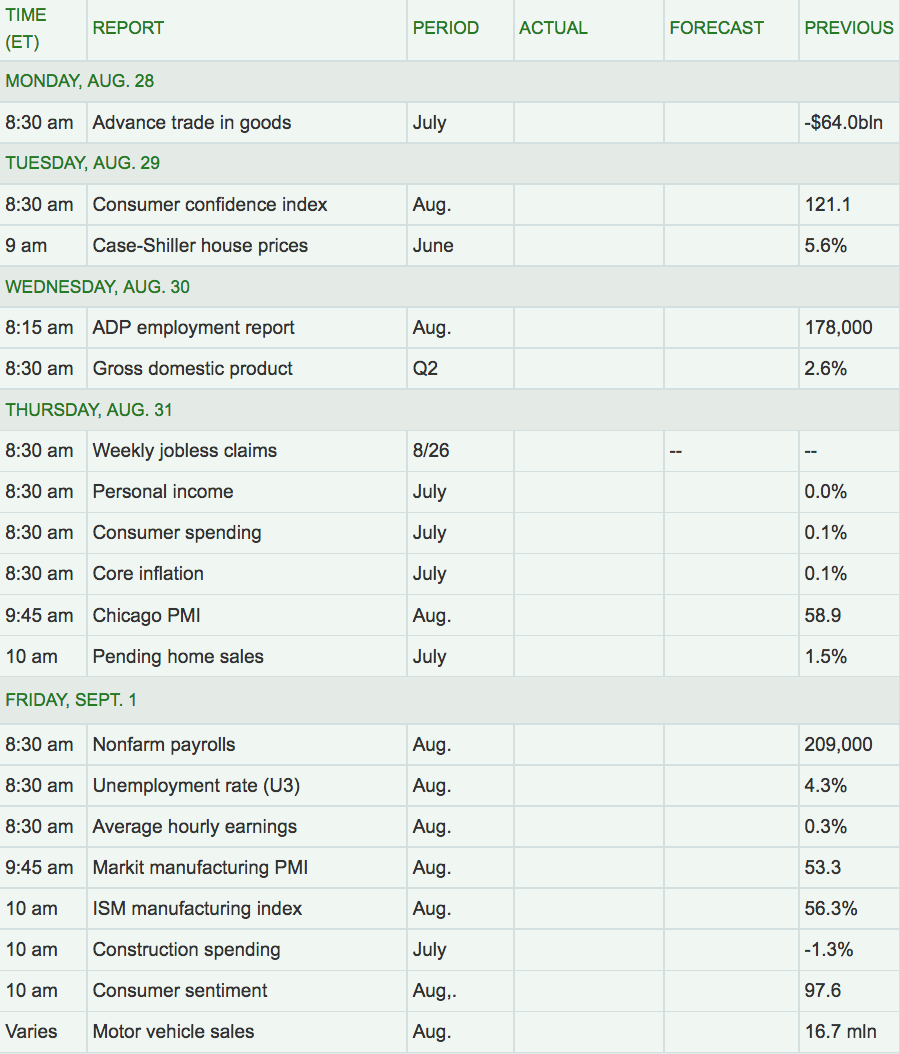

Week Ahead Highlights: We’ll get the Non-Farm Payrolls Report for August and Unemployment Rate on Friday, which could roil markets, if the job numbers miss forecasts by a wide margin.

Next Week’s US Economic Reports: There will also be several consumer-based economic reports next week: Consumer Spending, ADP Employment, Consumer Sentiment and Confidence, plus Core Inflation, and Personal Income, a Fed favorite.

Sectors: The Real Estate and Telecoms sectors led this week, with Consumer Staples trailing.

Futures: Natural Gas futures rose 1.14% this week, while Crude Oil WTI fell -1.77%.