Stock Market News – April 27, 2019

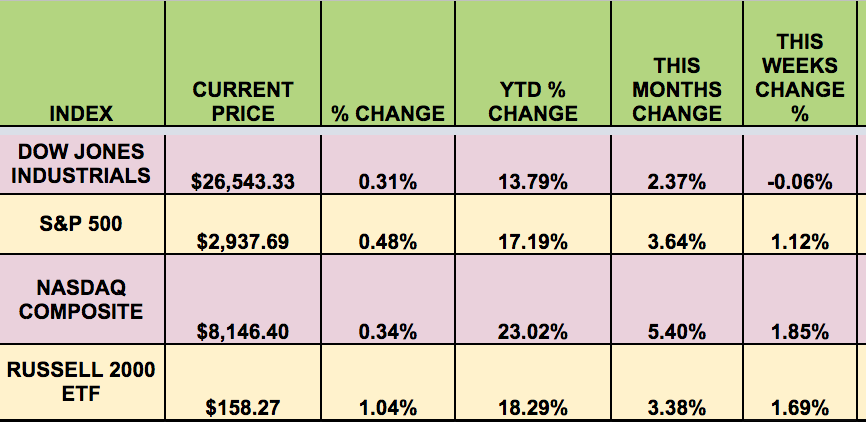

Markets:

It was another mixed week for the market, with the DOW flat, but the S&P 500, the RUSSELL, and the NASDAQ all making good gains.

High Dividend Stocks:

These high yield stocks go ex-dividend next week – PSEC, GLOP.

Market Breadth:

16 out of 30 DOW stocks rose this week, vs. 23 last week. 58% of the S&P 500 rose, vs. 58% last week.

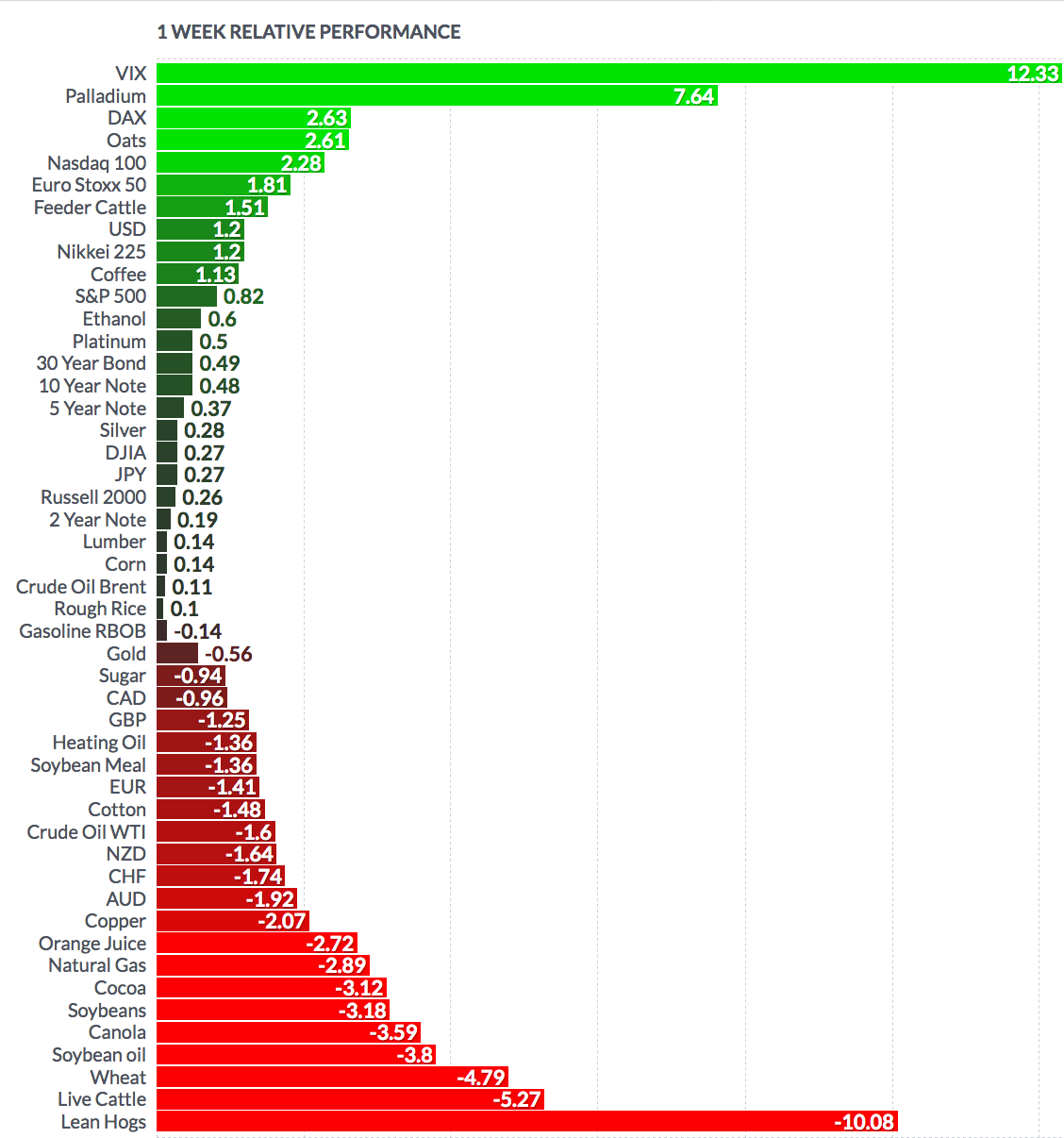

Volatility:

The VIX rose 4.5% this week, ending the week at $12.64.

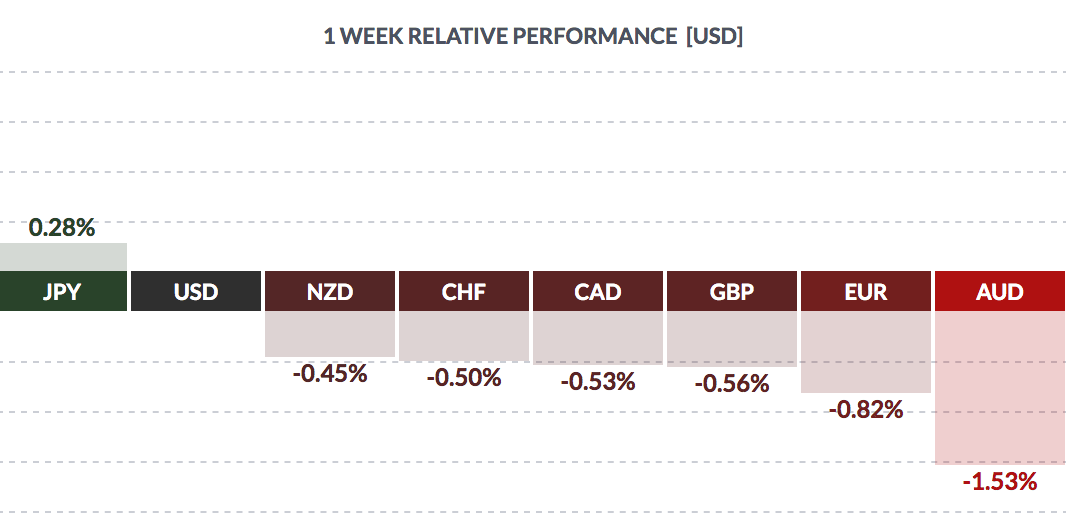

FOREX:

The USD rose versus most major currencies again this week, excepting the yen.

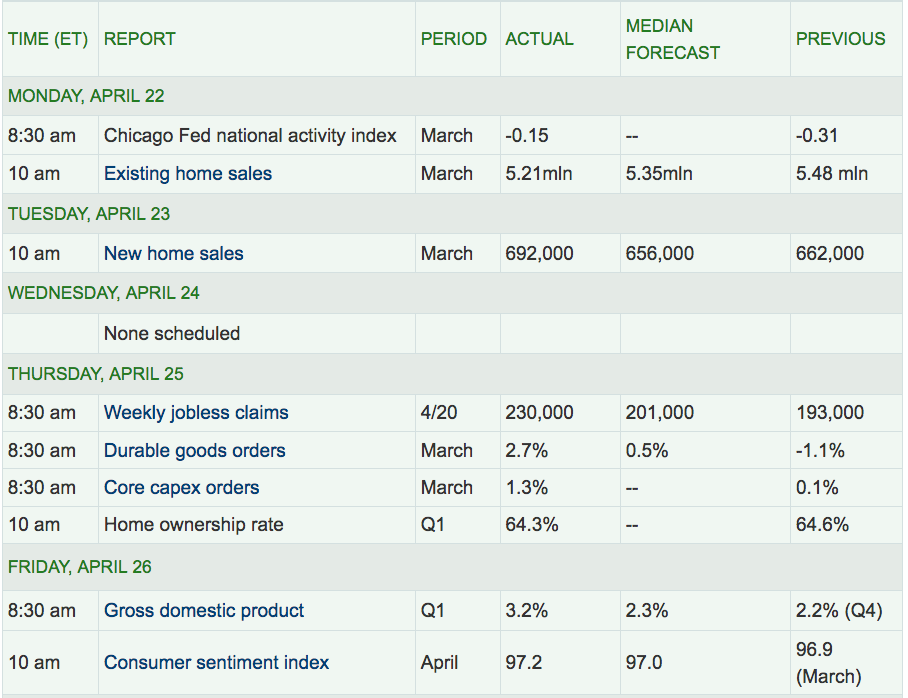

Economic News:

Q1 ’19 GDP growth came in at 3.2%, higher than the 2.3% estimate.

“While gross domestic product surpassed all analyst expectations, kicking off the year with a 3.2 percent advance, more than half the gain came from the volatile trade and inventories components that may soon reverse. Underlying pillars of growth weakened. Consumer spending, the largest chunk of the economy, cooled for the third straight quarter, and nonresidential business investment grew at the second-slowest pace since the last presidential election.

“The thought that the economy’s rate of growth this year will be much slower than last is still right,” said Mark Zandi, chief economist at Moody’s Analytics Inc. “I don’t think we’re going to see an economy that’s nearly as strong as last year because the benefits of those tax cuts are gone.” (Bloomberg)

“Existing-home sales ran at a seasonally adjusted annual 5.21 million rate in March, the National Assoc. of Realtors said Monday. That was 4.9% lower than February’s pace and missed the Econoday consensus of a 5.3 million rate. Sales of previously-owned homes fell more sharply than expected in March as the usual housing headwinds stalked the market. The surge in February was the strongest in nearly four years, and the Realtor lobby group is attributing the March decline to a return to normalcy after that spike. Still, sales were 5.4% lower than a year ago.

At the current pace of sales, it would take 3.9 months to exhaust available supply, still well below the long-time average of 6 months. Properties stayed on the market for an average of 36 days in March, down from 44 days in February but a bit longer than the 30 days averaged last year.”

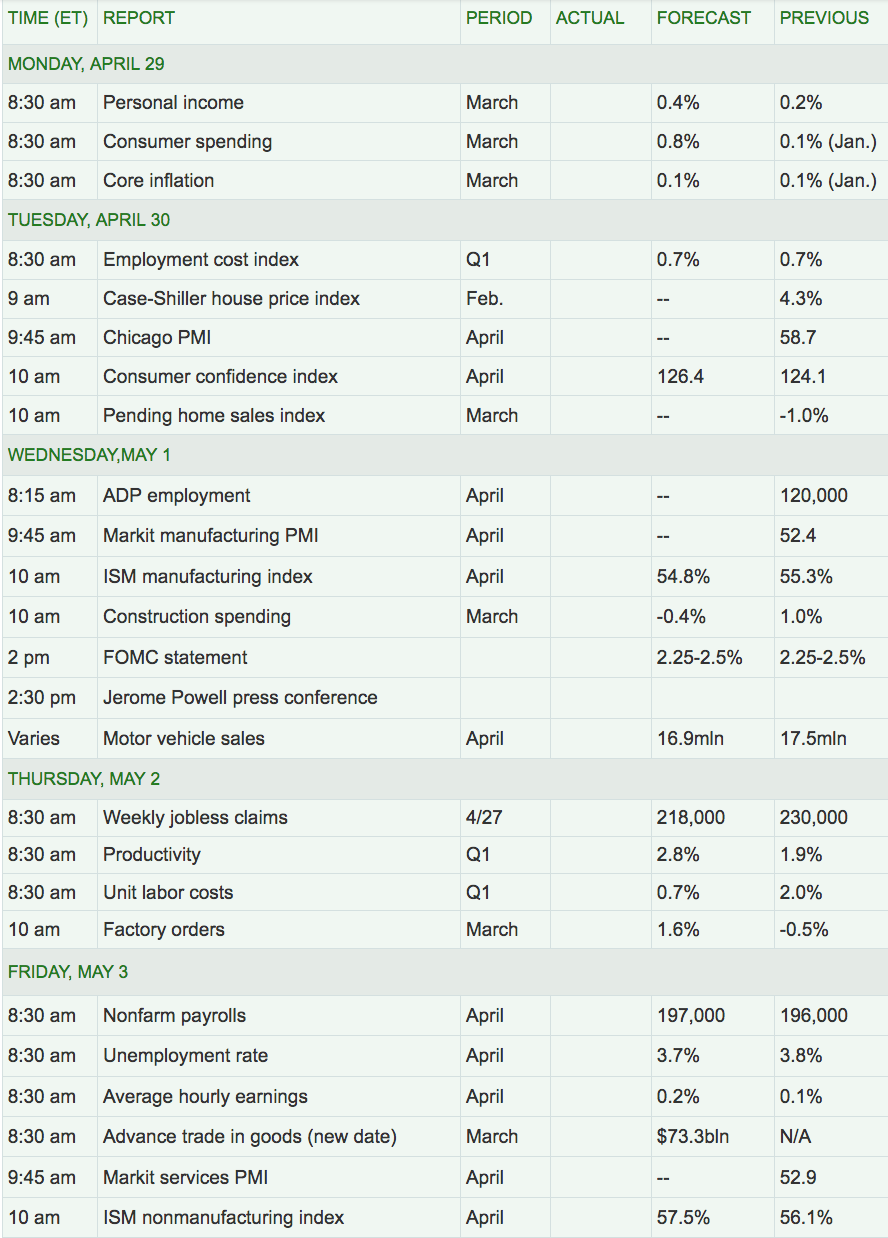

Week Ahead Highlights:

Q1 Earnings season continues, with DOW components reporting, including Apple Inc (NASDAQ:AAPL), PFE (NYSE:PFE), Merck & Company Inc (NYSE:MRK), and McDonald’s Corporation (NYSE:MCD). There will be a flurry of economic reports coming out next week, including the Payrolls report on Friday, in addition to Consumer Spending and Core Inflation.

Next Week’s US Economic Reports:

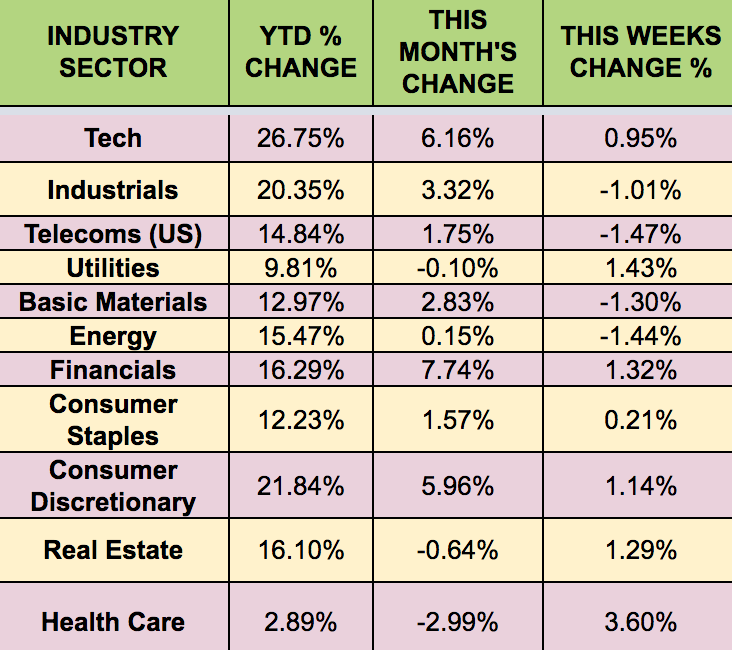

Sectors:

Healthcare bounced back this week, and was the leading sector, while Telecoms lagged.

Futures:

WTI Crude rose -1.6% this week, finishing the week at $62.85, while Natural Gas fell again, down -2.89%.