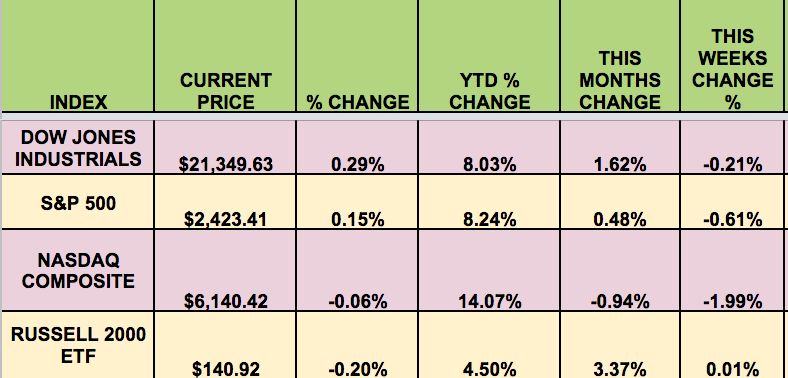

Markets: The market hit a rough patch this week, with the NASDAQ falling 1.99%, the S&P 500 down .61%, the Dow off by .21%, and the Russell small caps flat. Small caps led in June, up 3.37%, followed by the DOW, which rose 1.62%; the S&P was up .48% in June with the Tech-heavy NASDAQ trailing, down -.94%, as investors rotated out of Tech stocks.

The NASDAQ has been 2017’s winner so far, up 14%, with the DOW and the S&P both up around 8%. Small caps have trailed, up 4.5% at the halfway mark. Corporate profits rose 11.5% in Q1 2017.

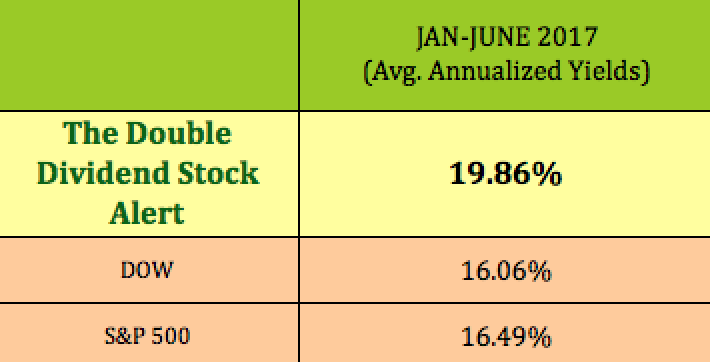

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: BRX (NYSE:BRX), KIM, LOAN (NASDAQ:LOAN).

Volatility: The VIX rose 12% this week, finishing at $11.18.

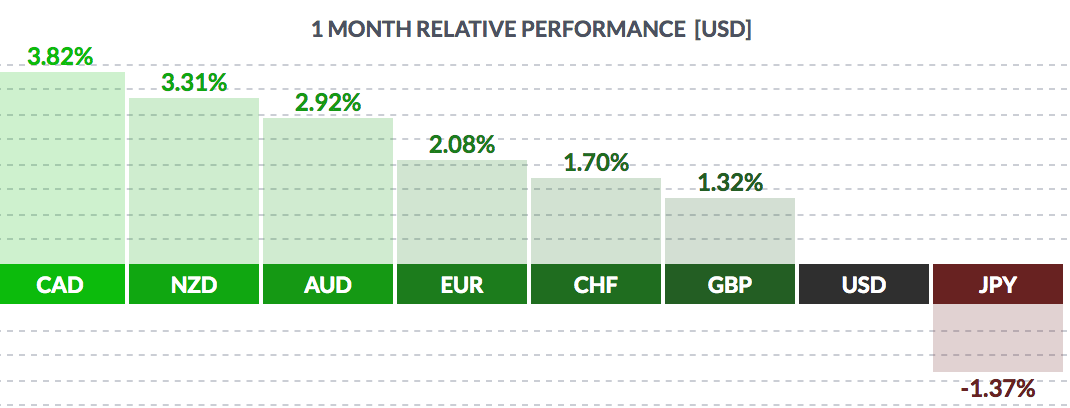

Currency: The dollar fell vs. most other major currencies in June, except for the yen:

Market Breadth: 17 of the DOW 30 stocks rose in June, and 23 out of 30 have risen year to date. 51% of the S&P 500 rose in June, and 70% have risen year to date..

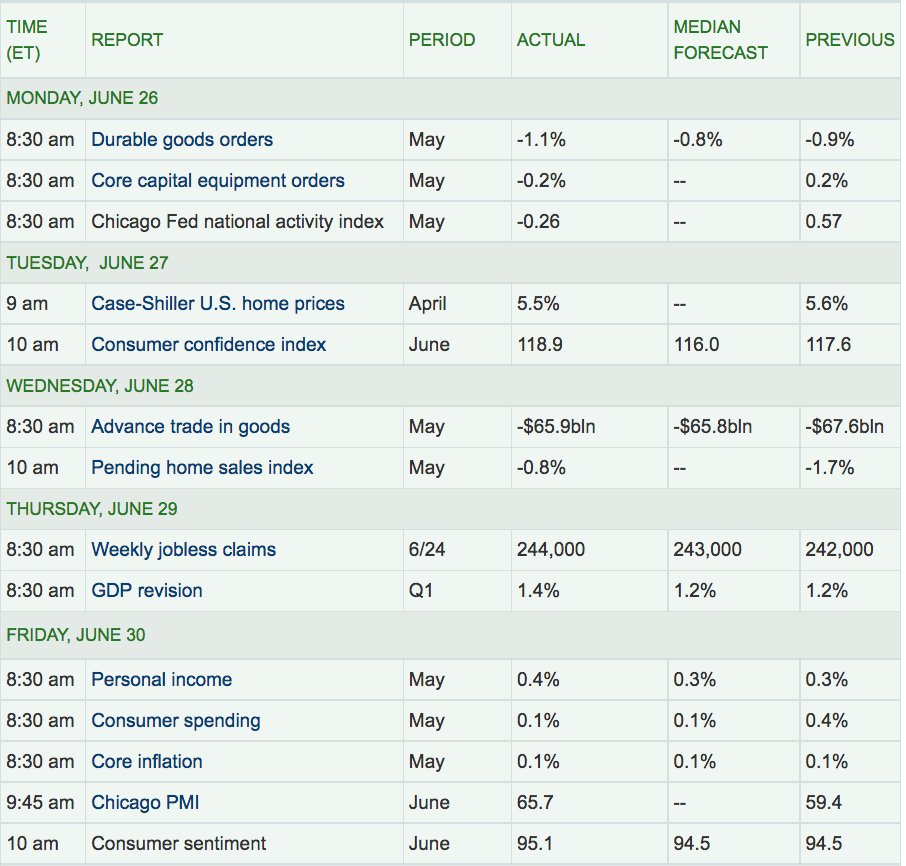

Economic News: 34 of the big US banks passed the Fed’s capital deployment tests this week. Q1 US GDP was revised upward, to 1.4%, from 1.2%. Core inflation remained tame, at just 0.1%. Pending Home Sales fell for the 3rd straight month.

The Senate delayed voting on the Republican Healthcare bill until after the July 4th recess, due to poor support.

Week Ahead Highlights: We may see the Senate vote on their highly controversial Healthcare bill. Both Fed Chair Yellen and ECB Chief Draghi will give speeches in Europe next week. Big banks will see if their capital plans are approved on Wed.

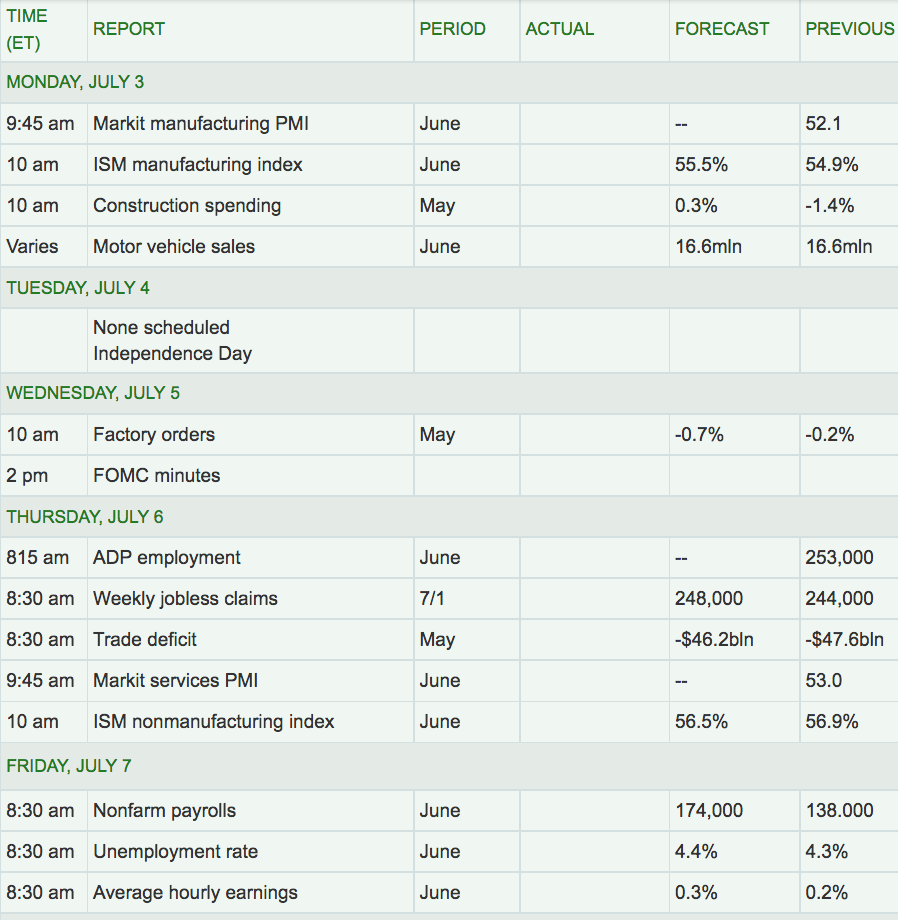

Next Week’s US Economic Reports: On Friday, the Non-Farm Payroll Report and the Unemployment Rate for June will be issued. It’ll be a holiday-shortened week, with US markets closing at 1pm on Monday, and not reopening until Wednesday, in observance of the July 4th holiday.

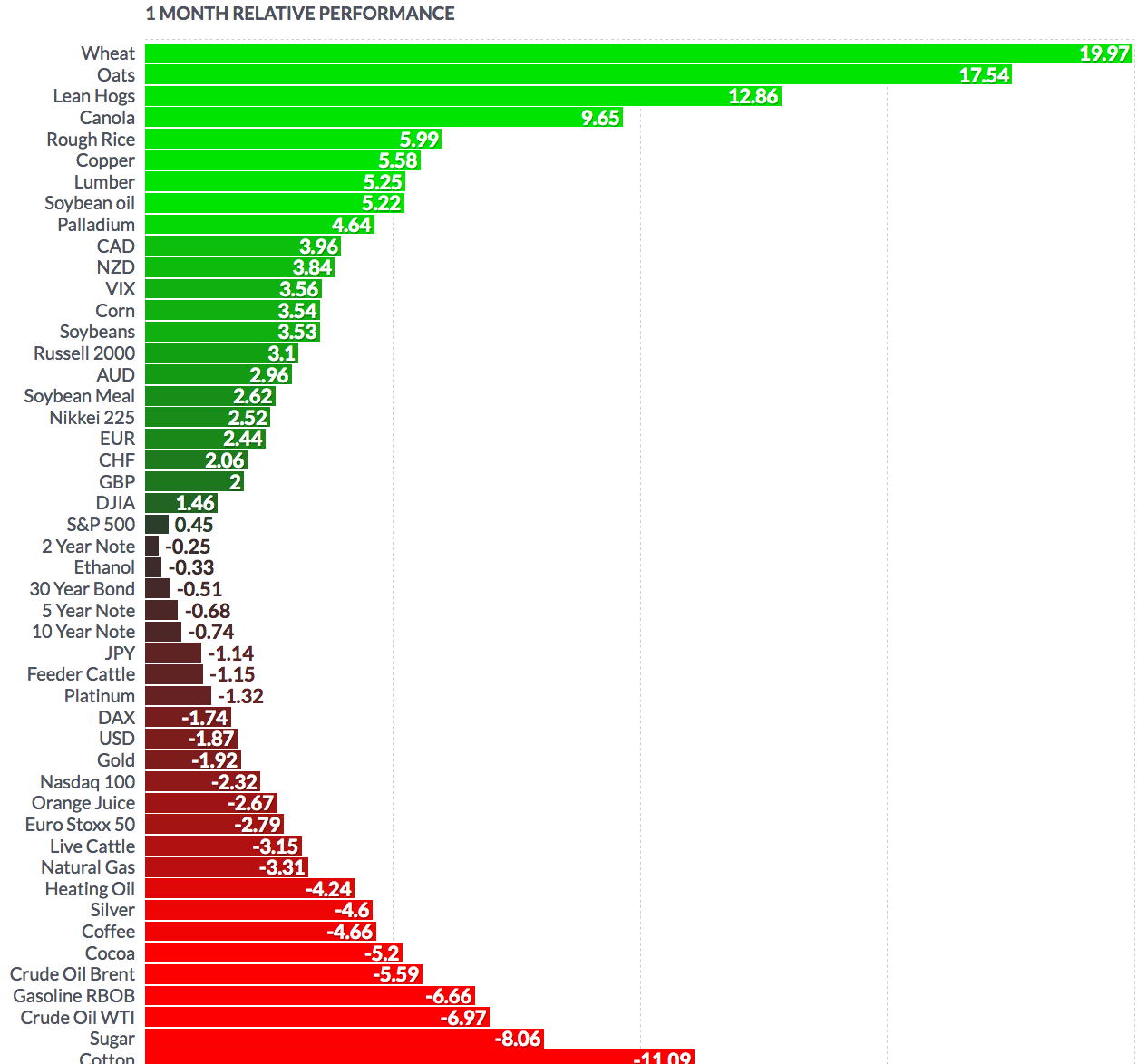

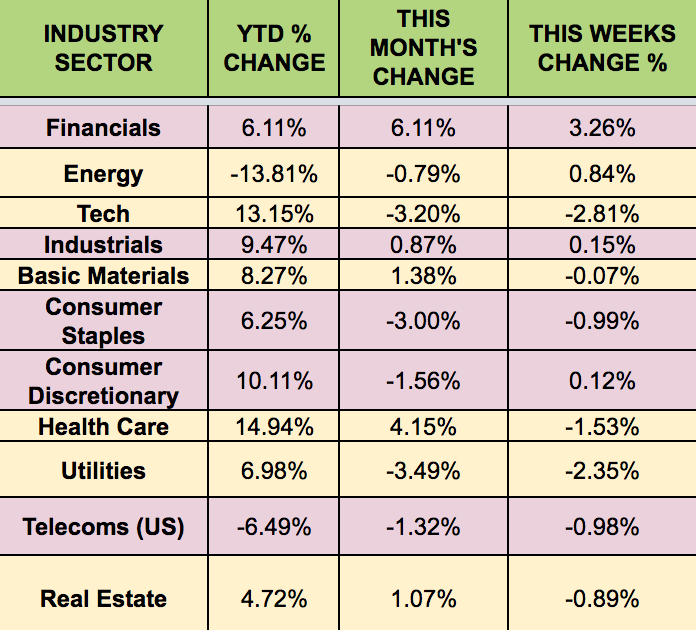

Sectors & Futures: Financials led this week, as big banks passed the Fed’s capital deployment test, as Tech and Utilities trailed. The Financial and Healthcare sectors led in June, while Utilities and Tech lagged. Healthcare is now the leading sector year to date in 2017, with the Energy sector trailing.

WTI Crude futures fell -7% in June, with oil hitting a 7-week low. Natural Gas also fell -3.31% in June this week. WTI Crude has fallen over 13%, and Natural Gas has fallen over 18% year to date: