Earnings reports, mostly positive, drove markets out of their narrow Monday range on Tuesday, as the banking and financial sector stocks appeared to shrug off recent legal settlements and report positive earnings. It has been another demonstration of the S&P’s (^GSPC:SNP) ability to turn bad or mixed news into a rally.

‘Substantially stretched’

In her semi-annual testimony before the Senate Banking Committee, Fed Chair Janet Yellen stated in her prepared report that “Valuation metrics in some sectors do appear substantially stretched,” including those in tech and small-caps. (Uber investors, I think this means you.)

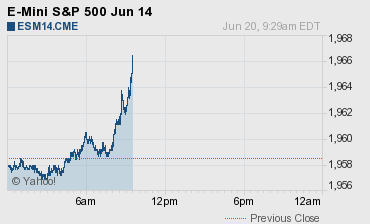

The comment, along with her statement in questioning that “although the economy continues to improve, the recovery is not yet complete” were enough to cause stocks to drop from their morning high. The E-mini S&P 500 futures (ESU14:CME) dropped from 1976.25 to 1962.25 in the hour between 10 and 11 AM ET.

Stocks retraced but closed down from Monday, the S&P E-mini at 1968.00. Then, in what has become a frequent occurrence in the past two weeks, activity in the Globex electronic market overnight (U.S. time) sent the E-mini back up to 1975.75.

If “substantially stretched” was Yellen’s version of Alan Greenspan’s “irrational exuberance,” it would be wise to remember that Greenspan’s remark was followed by the longest economic expansion in U.S. history.

Back and fill

The mainstream media will say that investors were expressing some emotion over Yellen’s comments or concerns about the economy. But we don’t think even the Fed chair has (or wants) that kind of influence over the markets. What we saw was this: A few people did react, then some morning buyers saw the high as a good place to take money off the table. Short sellers came in and then, as the premium expanded, index arbitrage sell programs kicked in and pushed the markets down to support.

It was an example of the news media needing to explain why things happen in the markets, as a function of larger macroeconomic sentiment. But sometimes, it’s just a matter of traders following the price action down and then buying in or out at a good lower price.

Overnight, the Asian markets closed mixed, and in Europe 11 of 13 markets are trading higher. Today’s schedule includes the MBA purchase applications, PPI-FD, Treasury international capital, industrial production, Atlanta Fed business inflation expectations, Housing Market Index, EIA petroleum status report, Beige Book. Dallas Fed President Richard Fisher speaks in Los Angeles on monetary policy and Fed Chair Janet Yellen moves over to the House to continue her semi-annual testimony to Congress. Earnings are expected from Bank of America (NYSE:BAC), PNC Financial Services (NYSE:PNC), U.S. Bancorp (NYSE:USB), Northern Trust (NASDAQ:NTRS), eBay (NASDAQ:EBAY)), and Abbott Laboratories (NYSE:ABT).

Bank of America (NYSE:BAC) reported a 43% drop in Q2 profits, a contrast to the otherwise positive news so far in the banking and financial sectors. B of A just announced a final settlement of their mortgage disputes with AIG.

Our view

Yesterday was a good example of our up a day / down a day price action during the options expiration week ( July 8 -10.6, July 9 +6.6, July 10 -9.4, July 11 +4.6, July 14 +8.60, July 15 -3 handles).

While we are only two days into the expiration week itself, the S&P cash study was correct on both days: good stats on Monday and a higher close, weak stats on Tuesday and a down day.

Today we have a heavy round of economic reports, earnings and Janet Yellen speaking to the House Banking Committee. As I said in yesterday’s video, I do not believe the ESU14 is going to go up or down a lot, but what I noticed again yesterday was when the S&P started to slide, the bears were quick to exploit the down move—and yet the S&P rallied.

Yes, crude was weak and they are shaking out the gold bugs again, but has anything really changed in the S&P? Weak in the first part of the day, rally and then out comes a $1.3bil buy imbalance. I have a question for you: do you think anyone knew they had cash to buy on the close?

Our view is to continue to follow the stats and not to get overly bearish or bullish this week. According to the S&P cash study today is a flip-flop from yesterday; up 17 / down 13 of the last 20.

We lean to buying weakness. I know you can play both sides and that why I am calling for buying the breaks. The algos ran the sell stops yesterday and the algos will run the buy stops today.

Video: Up, Down, and All Around

Monday: up 17 / down 13 of the last 30

Tuesday: up 13 / down 17 of the last 30

Wednesday: up 17 / down 13 of the last 30

Thursday: up 20 / down 10 of the last 30

Friday: up 14 / down 16 of the last 30

Monday after up 8 / down 22 of the last 30

- In Asia 7 of 11 markets closed higher: Shanghai Comp. -0.15%, Hang Seng +0.27%, Nikkei -0.10%.

- In Europe 10 out of 12 markets are trading higher: DAX +1.38%, FTSE +1.00%.

- Fair value: S&P -6.07 , NASDAQ -6.96 , Dow -68.73

- Total volume: 1.9M ESU and 7.2K SPU traded

- Economic and earnings calendar: MBA purchase applications, PPI-FD, Treasury international capital, industrial production, Atlanta Fed business inflation expectations, Housing Market Index, EIA petroleum status report, Beige Book. Dallas Fed President Richard Fisher speaks in Los Angeles on monetary policy and Fed Chair Janet Yellen moves over to the House to continue her semi-annual testimony to Congress. Earnings are expected from Bank of America (NYSE: BAC), PNC Financial Services (NYSE: PNC), U.S. Bancorp (NYSE: USB), Northern Trust (NASDAQ: NTRS), eBay (NASDAQ: EBAY), and Abbott Laboratories (NYSE: ABT).

- E-mini S&P 500 1968.00+9.50 - +0.49%

- Crude 102.15+0.02 - +0.02%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 23474.25-49.029 - -0.21%

- Nikkei 225 15374.86-4.439 - -0.03%

- DAX 9859.27+139.859 - +1.44%

- FTSE 100 6784.67+74.22 - +1.11%

- Euro 1.3527