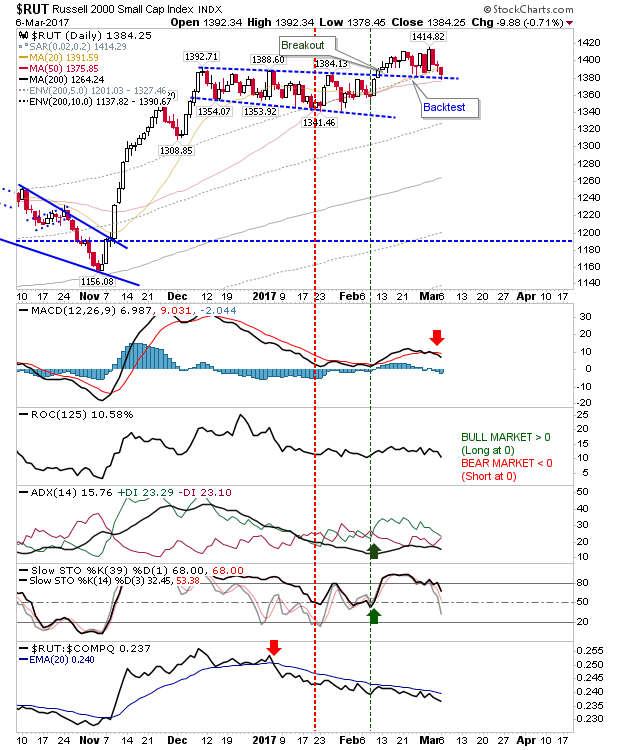

There wasn't a whole lot of change in markets with the Russell 2000 edging back to support. Small Caps remains the most vulnerable to an increase in profit taking with the 50-day MA playing as the last line of support. If there is a loss in such support watch for it to spread to other indices which are holding up better.

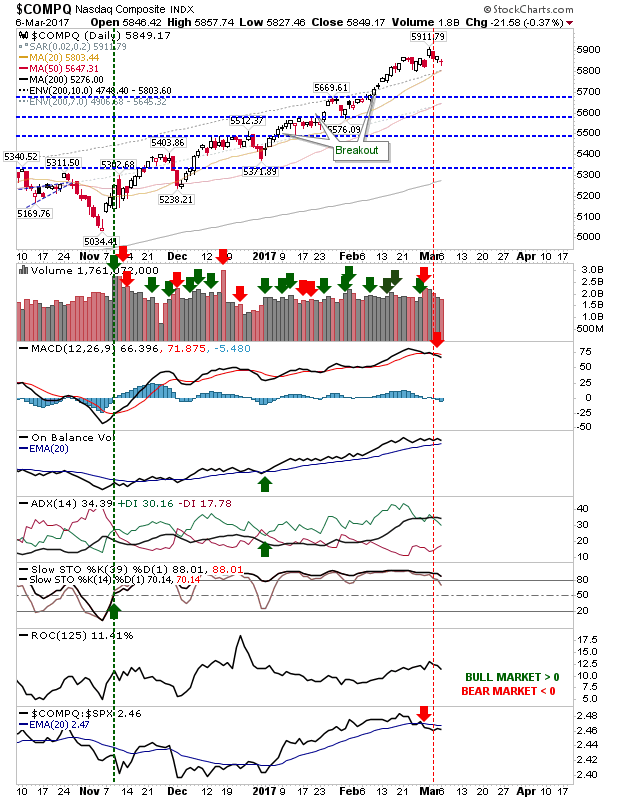

The NASDAQ finished with a narrow range doji just above the 20-day MA. Volume was down, while the MACD and On-Balance-Volume remain in 'sell' mode.

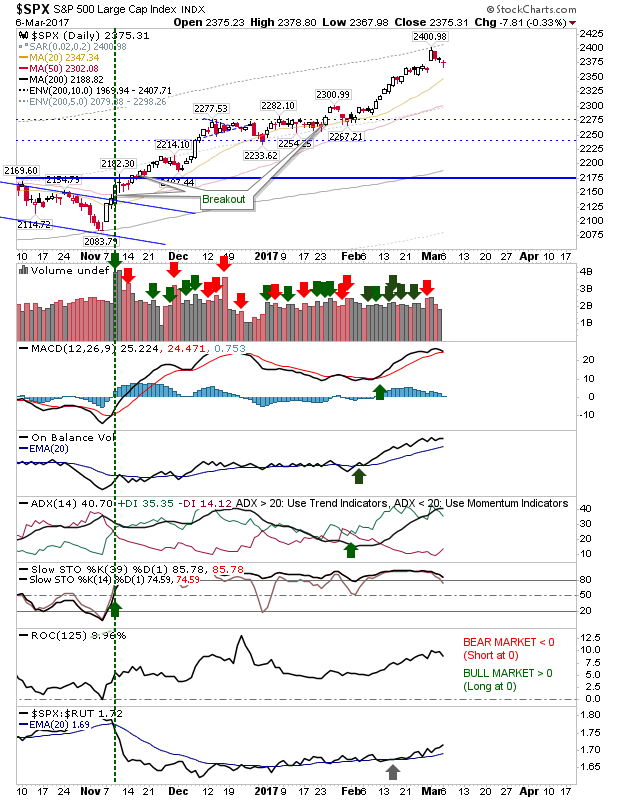

The S&P was another narrow range doji, except without the technical weakness in the NASDAQ.

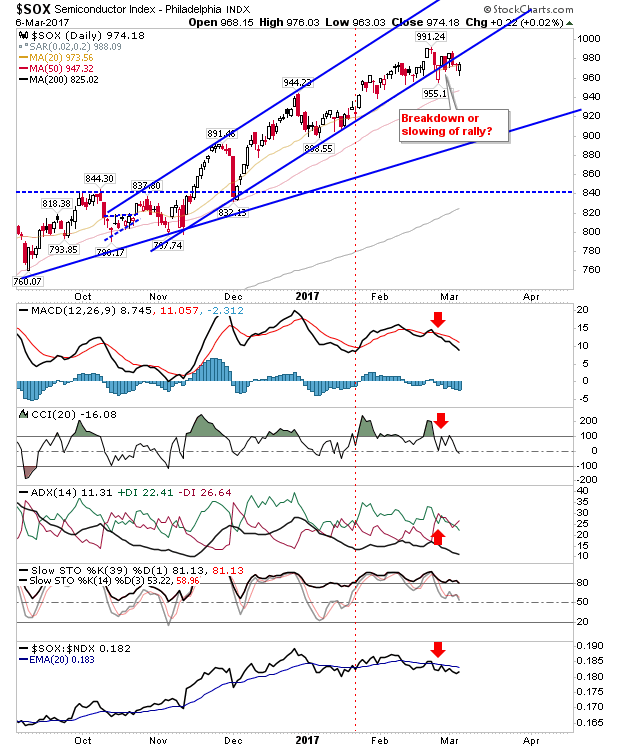

The Semiconductor Index remains outside of the rising channel as it morphs into a trading range.

Will Tuesday offer a more defensive action?