Last week’s review of the macro market indicators noted as September Options Expiration came to a close that the equity markets looked strong but with some short term rotation to small caps. Elsewhere looked for Gold ($GLD) to pause in the pullback in its uptrend while Crude Oil ($USO) continued higher. The US Dollar Index continued to lose ground while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) paused in their uptrend.

The Shanghai Composite and iShares MSCI Emerging Markets (NYSE:EEM) were marking time short term as they continued to grind through resistance in long term uptrends. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed strength in the longer time frame for all three. In the short term the IWM was benefiting from some rotation, seemingly at the expense of the QQQ and SPY (NYSE:SPY).

The week played out with Gold not only pausing but pulling back under 1300 while Crude Oil consolidated over 50. The US Dollar held steady while Treasuries moved lower, but not by much. The Shanghai Composite continued to mark time, moving sideways, while Emerging Markets drifted slightly higher.

Volatility held tight to the 10 level, keeping the bias higher for equities for a second week in a row. The Equity Index ETF’s did show some investor rotation on the week, with the SPY and QQQ rolling slightly lower while the IWM pushed up to its all-time high. What does this mean for the coming week? Lets look at some charts.

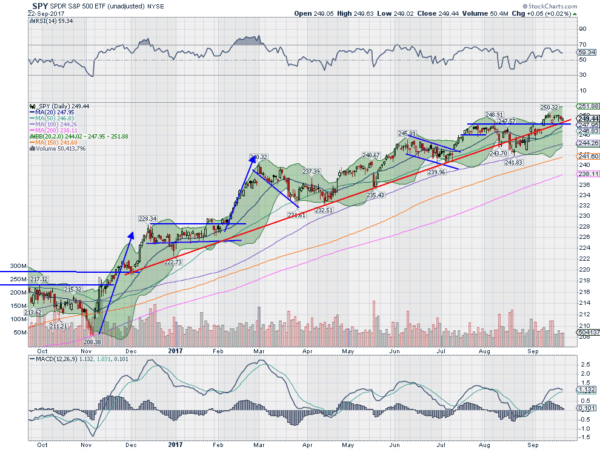

SPY Daily

The SPY came into the week just off of all-time highs after going ex-dividend at the end of the previous week. Monday saw a move higher to close the open gap and then it stayed in a tight range all week. It ended the week slightly lower after staying in a range of less than 2 points all week. This suggests perhaps another week of sideways tight range motion into the end of the quarter. The daily chart shows the RSI holding in the bullish zone with the MACD leveling.

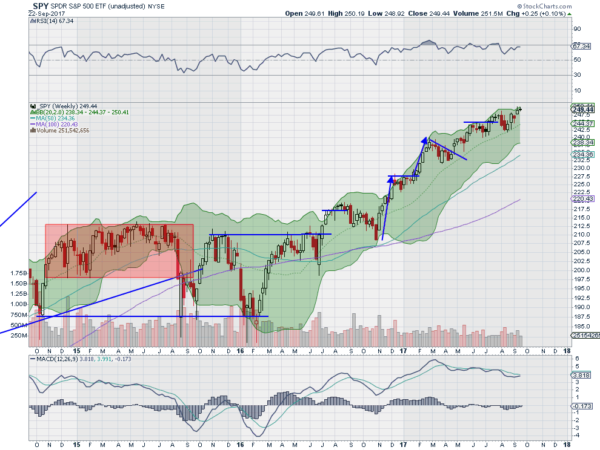

Moving to the longer weekly chart the doji suggests indecision. This will likely increase the volume on the reversal callers. The RSI is strong though and bullish with the MACD about to cross up. There is no resistance over 250.20 and support lower sits at 248 and 246 followed by 245 and 244. Continued Uptrend.

SPY Weekly

As the calendar turns to fall equity markets continue to look strong on longer timeframes but with some short term rotation out of the Nasdaq 100 and into the Russell 2000 as the end of the 3rd quarter approaches. Elsewhere look for Gold to continue its pullback while Crude Oil pauses in its uptrend. The US Dollar Index also is moving sideways but in its downtrend while US Treasuries see their uptrend at risk.

The Shanghai Composite is marking time in its uptrend while Emerging Markets slowly grind higher. Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The IWM is leading the charge now, disregarding the old adage to sell Rosh Hashanah, with the SPY consolidating and the QQQ looking a little tired. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.