Last week’s review of the macro market indicators noted as the October Options Expiry passed equities saw a week of failed hopes as they rose off of the lows only to fall back by the end of the week. Elsewhere looked for Gold (GLD (NYSE:GLD)) to move higher while Crude Oil (USO (NYSE:USO)) continued lower in the short term. The US Dollar Index (DXY) showed no signs of moving out of consolidation while US Treasuries (TLT) were moving back lower. The Shanghai Composite (ASHR) continued to look awful as it made new 4 year lows while Emerging Markets (EEM) were pausing in their downtrend.

Volatility (VXX) pulled back slightly but remained above the longer term steady levels, keeping some pressure on the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). Their charts still showed damage and little effort to get out of it. Short run reversals at the end of the week were likely bring on more bearish sentiment over the weekend.

The week played out with Gold moving higher, but slowly, while Crude Oil consolidated before another move lower. The US Dollar moved slightly higher in its consolidation range while Treasuries found their footing and started back higher. The Shanghai Composite found support and bounced higher while Emerging Markets resumed their move lower.

Volatility picked up out of sideways movement and rose to the high from earlier in the month, keeping the headwinds on equities. The Equity Index ETF’s reacted by moving lower with a strong move lower mid week and then retest of the lows before bouncing Friday. What does this mean for the coming week? Lets look at some charts.

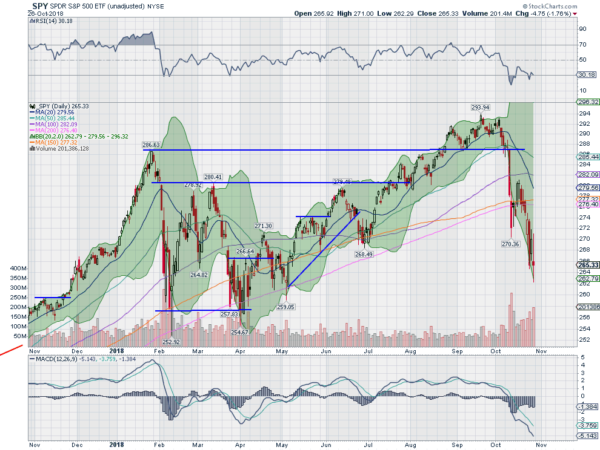

SPY (NYSE:SPY) Daily, SPY

The SPY came into the week holding at the 200 day SMA after a small bounce. It leaked below Monday and then gapped down to open Tuesday. Despite recovering most of that drop it had a really bad Wednesday, driving lower all day with a bearish Marubozu candle. Thursday then printed an inside day adding a little calm.

But it ended the week with a wild ride Friday. First it was down nearly 3% then working its way back to positive on the day only to drop back and finish the day lower, but nearly unchanged on the day. This was down nearly 4% on the week. The daily chart shows the RSI turning back down to oversold levels in the bearish zone with the MACD well below the February lows, approaching the February 2016 lows.

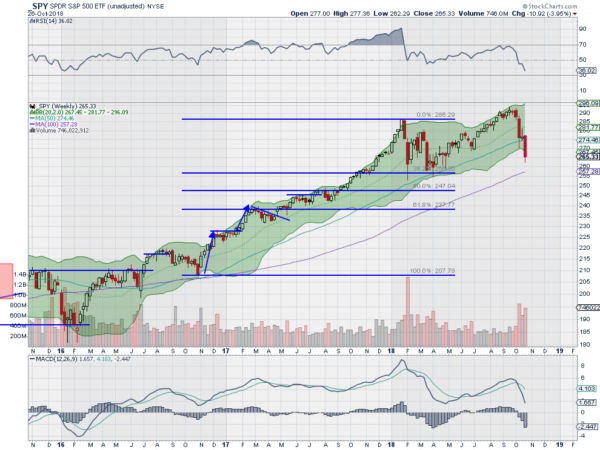

The weekly chart shows SPY with a long drop following the doji last week. It closed below the 50 week SMA for the first time since February 2016. It has a RSI in the bearish zone with the MACD falling but still positive. There is resistance at 269 and 271.40 followed by 272.50 and 274.50 before 277. Support lower comes at 265 and 263 then 262 and 261 before 257. Downtrend.

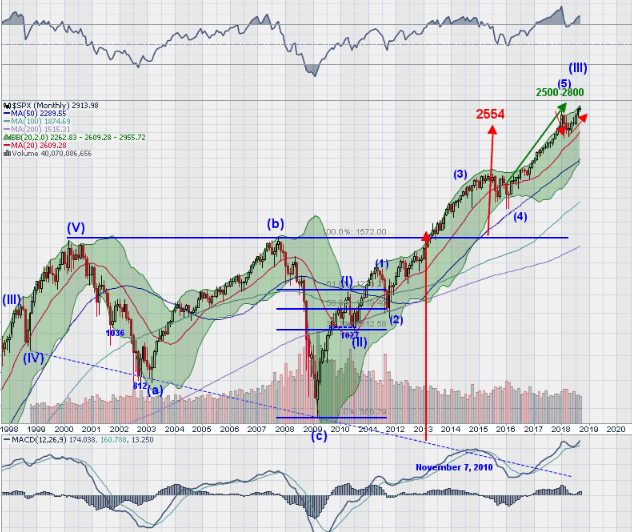

Heading into the last days of October and the last full week before the midterm elections, stocks have been rocked. The S&P 500 and Nasdaq 100 have dropped more than 10% from their highs at the end of September with the Russell 2000 more than 15% off its high. Elsewhere look for Gold to pause in its uptrend while Crude Oil pauses in its downtrend. The US Dollar Index is meeting resistance in its short term uptrend while US Treasuries are digesting their run lower.

The Shanghai Composite is searching for a bottom but Emerging Markets are continuing to the downside. Volatility looks to remain elevated and possibly rise further keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts look like they agree with that, all 3 in solid short term downtrends and now downtrends on the intermediate timeframe as well. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.