Last week’s review of the macro market indicators noted heading into the last days of October and the last full week before the midterm elections, stocks had been rocked. The S&P 500 and Nasdaq 100 had dropped more than 10% from their highs at the end of September with the Russell 2000 more than 15% off its high. Elsewhere looked for Gold (GLD (NYSE:GLD)) to pause in its uptrend while Crude Oil (USO (NYSE:USO)) paused in its downtrend. The US Dollar Index(DXY) was meeting resistance in its short term uptrend while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) were digesting their run lower.

The Shanghai Composite (ASHR) was searching for a bottom but Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) were continuing to the downside. Volatility looked to remain elevated and possibly rise further keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). Their charts looked like they agreed with that, all 3 in solid short term downtrends and now downtrends on the intermediate timeframe as well. .

The week played out with Gold not only pausing but falling back before a strong finish to the week while Crude Oil resumed its move lower. The US Dollar met resistance at a retest of the August highs while Treasuries continued their fall to fresh 4 year lows. The Shanghai Composite found its bottom and bounced while Emerging Markets made a new 18 month low before a seriously strong bounce.

Volatility started to settle in and fall back but reversed Friday at a higher low. This put some late week pressure on stocks after an early week tailwind. The Equity Index ETF’s started the week with a downward move and then reversed with a strong 3 day move up, holding there after the non-farm payroll report Friday. A mid day mention of the “T’ word, tariffs, saw some gains evaporate the rest of the day. What does this mean for the coming week? Lets look at some charts.

SPY (NYSE:SPY) Daily, SPY

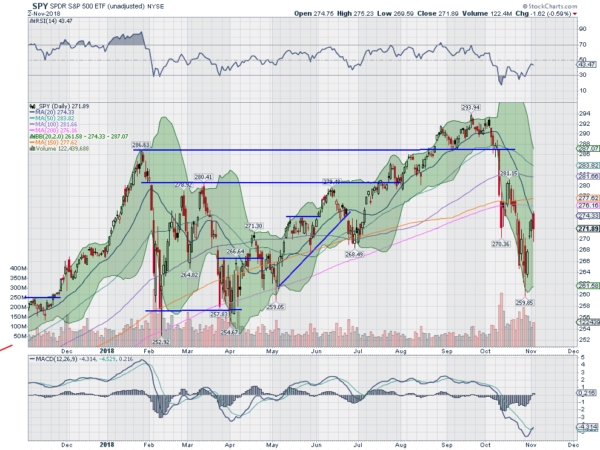

The SPY had printed a long legged doji in the downtrend as the week began. Monday it probed lower, touching the lower Bollinger Band® before recovering some off the drop. Tuesday it leapt higher and then gapped up and continued Wednesday and Thursday. Friday it gapped higher at the open again, touching the 20 day SMA, and then reversed and closed the gap into the afternoon.

The daily chart shows it closing under the 200 day SMA, although not by much. The RSI is trending higher but remains in the bearish zone with the MACD crossed up. Mixed signals with a positive momentum divergence.

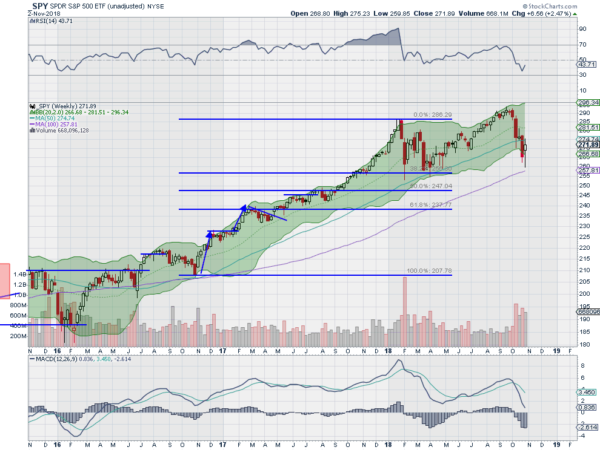

On the weekly chart the tighter body candle with long lower shadow might bode as a Hammer reversal candle should it be confirmed with a higher close next week. The RSI is turning back up after a brief dip into the bearish zone while the MACD is driving lower and near a cross to negative. There is support at 271.40 and 269 then 265 and 263 before 262. Resistance higher sits at 272.50 and 274.50 ten 276 and 277.50 before 279. Possible Reversal in Downtrend.

As November begins the equity markets found support and bounced ahead of the elections Tuesday. Elsewhere look for Gold to move higher in the short term while Crude Oil continues to pullback in its uptrend. The US Dollar Index is in a short term uptrend while US Treasuries are dropping lower. The Shanghai Composite and Emerging Markets are looking like they may be ready to reverse their downtrends.

Volatility remains elevated but has settled back into the teens keeping some pressure on equities but less than recently allowing some upward movement. The equity index ETF’s SPY, IWM and QQQ reacted with positive weeks, the IWM the strongest. They are all showing signs they may reverse higher as well. That is good news as it was the IWM that led all markets lower. The new week should be interesting. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.