Last week’s review of the macro market indicators noted Summer had officially begun with the Solstice and left only one week in the second quarter. Stocks looked to enter the last week with a bit of weakness in the short term but remain strong in longer time frames. Elsewhere looked for Gold (GLD) to continue lower while Crude Oil (USO) reversed and resumes the uptrend.

The US Dollar Index (DXY) was pausing in its uptrend while US Treasurys (TLT) continued to mark time moving sideways. The Shanghai Composite (ASHR) and Emerging Markets (EEM) both continued to look weak and ready for more downside. Volatility (VXX) looked to remain subdued keeping the bias higher for the equity index ETFs: SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed consolidation or minor pullbacks in the short term with the IWM and QQQ near all-time highs but the SPY continuing to lag.

The week played out with Gold continuing to move lower, finding support Friday and ending with a small bounce while Crude Oil moved higher all week. The US Dollar bounced around a little but basically was unchanged on the week while Treasuries moved higher after a gap up Wednesday. The Shanghai Composite continued down to the 2016 lows and found support while Emerging Markets also found support mid week and bounced.

Volatility popped Monday but had fallen back near unchanged by the end of the week, keeping the bias higher for equities. The Equity Index ETFs started the week heading lower, but all found their footing Thursday and moved back higher Friday. All 3 finished down for the week, instilling some caution, and the IWM and QQQ printing potential topping candles for the month. What does this mean for the coming week? Let's look at some charts.

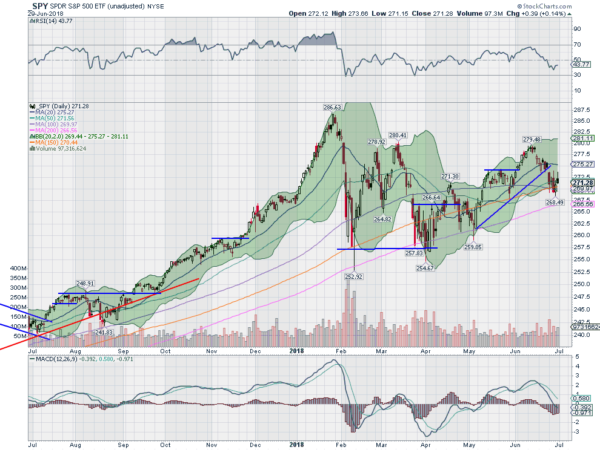

The SPY came into the week after an inside day and with price holding at the 20 day SMA. It gapped down Monday and continued lower to the 50 day SMA. It held there Tuesday, but then pushed lower again Wednesday, settling under the 100 day SMA and at the low of the day. Thursday saw a reversal with a Piercing Line and it confirmed with a higher close Friday. That Friday candle left a lot of questions though.

A long upper shadow and a close at the low of the day hardly seems like bullish confirmation. Neither does the fact that it did not close the gap down. The daily chart does show the RSI bounce off of the lower edge of the bullish zone and it has a MACD starting to level after turning negative. The Bollinger Bands® are mainly running sideways with some room below but much more above.

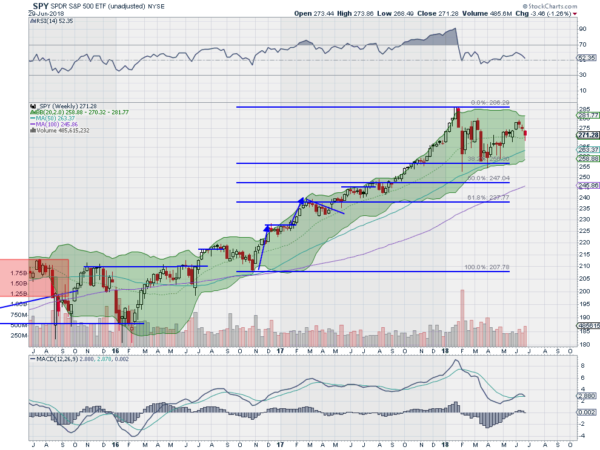

The weekly chart shows a 3 candle pullback from resistance finding support over that of 5 weeks ago. The RSI on this time frame is falling but remains in the bullish zone and over the mid line with the MACD crossing down but positive. There is support lower at 269 and 267.50 then 265 and 262.50 followed by 260 and 258. Resistance above sits at 272.50 and 274.50 then 277.50 and 279 before 280. Continued Consolidation.

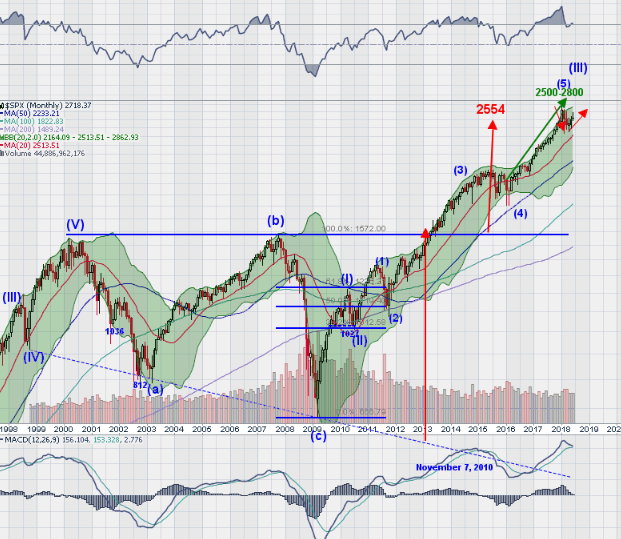

As we close the books on the 2nd Quarter and prepare for a holiday shortened 4th of July week, equity markets look to have run out of gas. Maybe the short week will re-energize them. All there indexes had a positive quarter with the IWM just out pacing the QQQ, 7.9% to 6.5% and the SPY gaining 3.1%. The QQQ won the month up 0.9% to the 0.6% for the IWM and the SPY eked out a 0.1% gain. The monthly candles all look toppy with long upper shadows, while the quarterly candles are all looking strong.

Elsewhere Gold looks as it may pause in its downtrend while Crude Oil continues to race higher. The US Dollar Index is pausing in its uptrend while US Treasuries are on the edge of a break out to the upside. The Shanghai Composite may be ready to pause in its downtrend while Emerging Markets are setting up for a possible reversal higher. Volatility looks to remain low but above recent levels keeping the wind at the backs of the equity markets but the breeze blowing softer.

The equity index ETFs SPY, IWM and QQQ, all had a mixed week with early signs of strength Friday fading into the close, leaving questions about the short term. The longer weekly time frame was much less troublesome showing consolidation for the SPY continuing and the IWM and QQQ digesting recent moves higher. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.