Last week’s review of the macro market indicators noted with June options expiration and the June FOMC meeting behind it, the market could look forward to slow summer trading and the next quarter’s earnings season. As it did, equity markets continue to look strong. Elsewhere looked for Gold (GLD) to resume its move lower while Crude Oil (USO) turned lower as well. The US Dollar Index (DXY) continued to strengthen while US Treasuries (TLT) consolidated in the channel that has held then all year.

The Shanghai Composite (ASHR) was making multi year lows and looking weak with Emerging Markets (EEM) on the verge of turning a digestive bull flag into a bearish reversal. Volatility (VXX) looked to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts were a bit mixed with the IWM and then the QQQ leading in the shorter time frame as the SPY continued to struggle at the March highs. But on the longer time frame all looked strong, still the IWM leading with the QQQ close behind and the SPY dragging up the rear.

The week played out with Gold continuing to move lower while Crude Oil found its footing and rebounded back over resistance Friday. The US Dollar held steady on the week while Treasuries marked time, moving mainly sideways. The Shanghai Composite continued lower to 2 year lows while Emerging Markets continued to move lower, down to 9 month lows.

Volatility got a little bit frisky, moving higher, but remained at low levels. This resulted in the Equity Index ETF’s tapping the brakes on the week, with the SPY and QQQ retreating slightly late in the week and the IWM stalling at all-time highs. What does this mean for the coming week? Lets look at some charts.

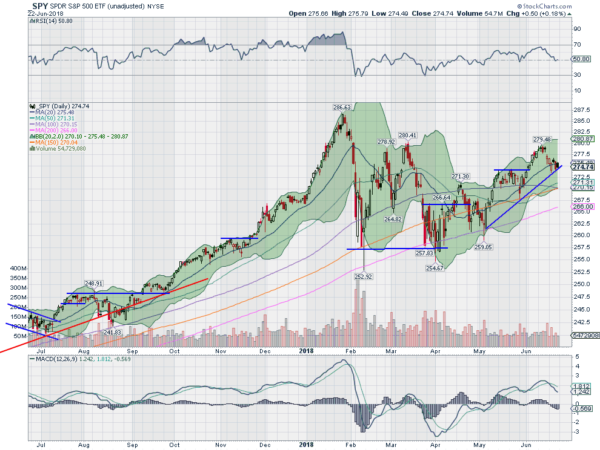

SPY Daily

The SPY was pulling back from a higher high when the week began. It continued with hollow red candles Monday and Tuesday to the 20 day SMA. It basically held around the 20 day SMA the rest of the week. The daily chart shows price back retesting the May resistance area and rising trend support. The RSI is holding at the mid line on a pullback with the MACD falling but positive.

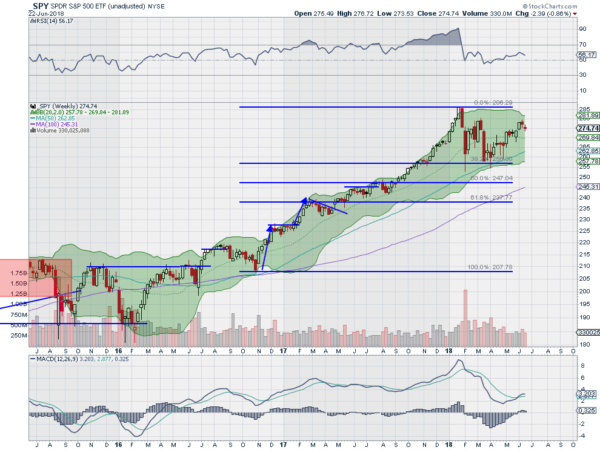

The longer weekly chart printed a tight body candle, giving up a little ground. The RSI is turned lower but in the bullish zone with the MACD crossed up and now flat. There is resistance above at 277.50 and 279 then 280 and 2983 before 286. Support lower comes at 274.50 and 272.50 then 271.40 and 269. Consolidation in Short Term Uptrend.

SPY Weekly

Summer has officially begun with the Solstice Thursday and there is only one week left in the second quarter. Stocks look to enter the last week with a bit of weakness in the short term but remain strong in longer time frames. Elsewhere look for Gold to continue lower while Crude Oil reverses and resumes the uptrend. The US Dollar Index is pausing in its uptrend while US Treasuries continue to mark time moving sideways.

The Shanghai Composite and Emerging Markets both continue to look weak and ready for more downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show consolidation or minor pullbacks in the short term with the IWM and QQQ near all-time highs but the SPY continuing to lag. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.