Last week’s review of the macro market indicators noted with July options expiration behind the equity markets continued to look strong, holding at key levels into the heart of earnings season. Elsewhere looked for Gold (GLD) to possibly pause in its downtrend while Crude Oil (USO) pulled back in the uptrend. The US Dollar Index (DXY) continued to consolidate in the uptrend while US Treasuries (TLT) pulled back in broad consolidation.

The Shanghai Composite (ASHR) was building a possible reversal higher after a long pullback and Emerging Markets (EEM) were also starting to show signs of a possible reversal higher. Volatility (VXX) looked to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts showed a mixed big in the short run with the SPDR S&P 500 (NYSE:SPY) moving higher while the iShares Russell 2000 (NYSE:IWM) consolidated its move and the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) digested by moving slightly lower. All three looked great on the longer time frame, so maybe the short term was options expiration games.

The week played out with Gold trading in a 15 range as it paused in its move lower while Crude Oil stalled early then slowly marched higher later in the week. The US Dollar continued to mark time moving sideways while Treasuries were fell back early and then paused. The Shanghai Composite continued its move higher early in the week but gave it up at the end while Emerging Markets continued to move higher.

Volatility held in a tight range again this week at very low levels, keeping the bias higher for equities. The Equity Index ETF’s were mixed though, with the QQQ rising to new all-time highs and the SPY to 6 month highs before both reversed giving back gains late in the week. The IWM stalled Monday near the highs, pulled back and retested then before finishing lower Friday. What does this mean for the coming week? Lets look at some charts.

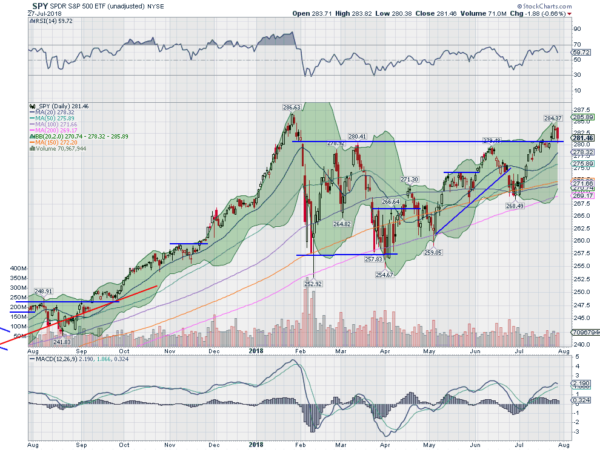

SPY Daily

The SPY was sitting at a six month high and had just filled the gap down from the beginning of February when the week began. It held there Monday but then gapped higher Tuesday and closed at a new 6 month high. It continued higher Wednesday and then digested the move Thursday. Friday it pulled back, filling the recent gap.

The daily chart shows it held over the 6 month resistance on the pullback. It has a RSI pulling back in the bullish zone but strong. The MACD stalled Friday at the June high, but remains far below the January extreme. The lower Bollinger Band® is now shifting higher. So far, just a retest of the breakout.

On the weekly chart a small upper shadow but a positive week. The RSI continues to hold strong in the bullish zone with the MACD crossed up and rising. Now a higher high after a higher low on this timeframe. There is resistance at 238 and 286 with a target on the Measured Move to 290. Support lower sits at 280 and 279 then 277.50 and 274.50. Possible Pause in Uptrend.

SPY Weekly

As the last full week of July ends the equity markets look tired on the shorter timeframe but remain solid on the longer one. Elsewhere look for Gold to consolidate in the downtrend while Crude Oil shows signs of reversing higher at support. The US Dollar Index continues to mark time moving sideways while US Treasuries pullback in consolidation. The Shanghai Composite may be stalling in its bounce in the downtrend while Emerging Markets are building strength for a possible reversal higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are showing a lack of energy or maybe even some weakness in the short term, especially in the QQQ and IWM. All look stronger and remain in the uptrends on the longer timescale. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.