Last week’s review of the macro market indicators noted that heading into July options expiration week there had been a shift in short term leadership in the equity markets back to the PowerShares QQQ Trust (NASDAQ:QQQ) from the iShares Russell 2000 (NYSE:IWM) with the SPY continuing to improve. Elsewhere looked for Gold (GLD) to continue lower while Crude Oil (USO) consolidated in its uptrend. The US Dollar Index (DXY) continued to pause in its uptrend while US Treasuries (TLT) continued to move higher.

The Shanghai Composite (ASHR) might be building a bottom after a long drop and Emerging Markets (EEM) were showing signs of a possible reversal to the upside after their long drop. Volatility (VXX) looked to be back at extreme low levels and holding keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all looked strong on the longer time frame with the QQQ leading the charge. On the shorter time frame signs of a pause were showing in the IWM while the SPY and QQQ were continuing higher.

The week played out with Gold continuing lower early and then finding support late in the week while Crude Oil fell out of consolidation but recovered by week’s end. The US Dollar tested a move higher but retreated Friday while Treasuries reversed to the downside. The Shanghai Composite consolidated the recent gains before rising Friday while Emerging Markets held their gains from the prior week.

Volatility held in a tight range, mostly below the teens, keeping the bias higher for equities. The Equity Index ETF’s reacted in mixed fashion, with the IWM rising near all-time highs but the SPY flat and the QQQ giving up a small bit off ground. What does this mean for the coming week? Lets look at some charts.

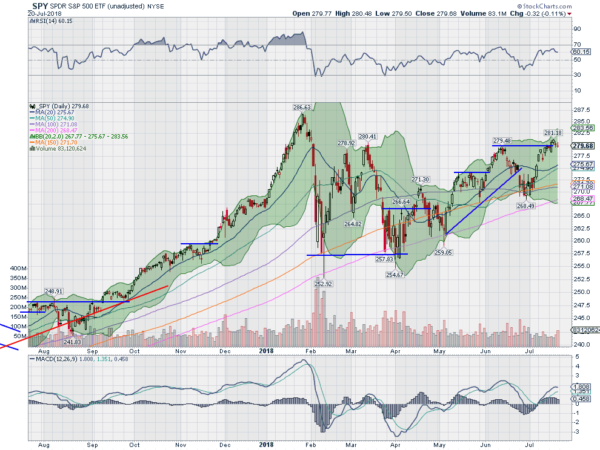

SPY Daily

The SPY entered the week having just pushed above the June high and at its highest close since February 1st. It paused there with an inside day Monday before a bullish engulfing candle Tuesday pushed it to a higher high and closed the February 1st gap down. It made another higher high Wednesday before digesting the recent gains the rest of the week. This continues the uptrend off of the April low. The daily chart shows the Bollinger Bands® opened to the upside to allow a move up with the MACD stalling at a lower higher. The RSI is pausing at 60, entering the bullish zone. It is a bit extended from the 20 day SMA.

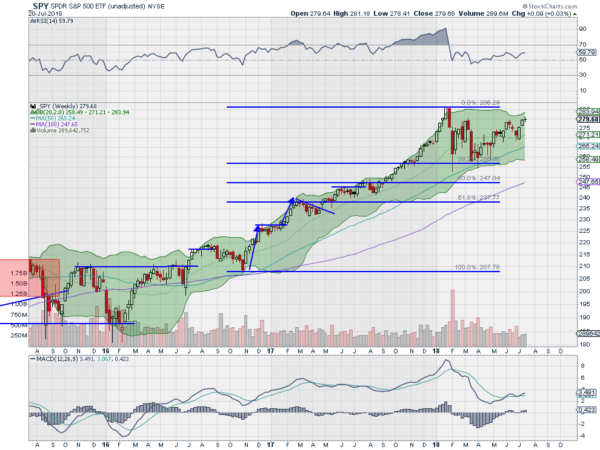

The weekly timeframe shows it printing a doji star at a six month high close. The Bollinger Bands® have shifted higher on this timeframe allowing for a move higher. The SMA’s are trending up as well. The RSI is holding in the bullish zone with the MACD rising after crossing up and positive. There is resistance higher at 280 and 283 then 286. Support lower sits at 279 and 277.50 then 274.50 and 272.50. Uptrend.

SPY Weekly

With July options expiration behind the equity markets continue to look strong, holding at key levels into the heart of earnings season. Elsewhere look for Gold to possibly pause in its downtrend while Crude Oil pulls back in the uptrend. The US Dollar Index continues to consolidate in the uptrend while US Treasuries pull back in broad consolidation. The Shanghai Composite is building a possible reversal higher after a long pullback and Emerging Markets are also starting to show signs of a possible reversal higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show a mixed big in the short run with the SPY moving higher while the IWM consolidates its move and the QQQ digests moving slightly lower. All three look great on the longer timeframe, so maybe the short term was options expiration games. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.