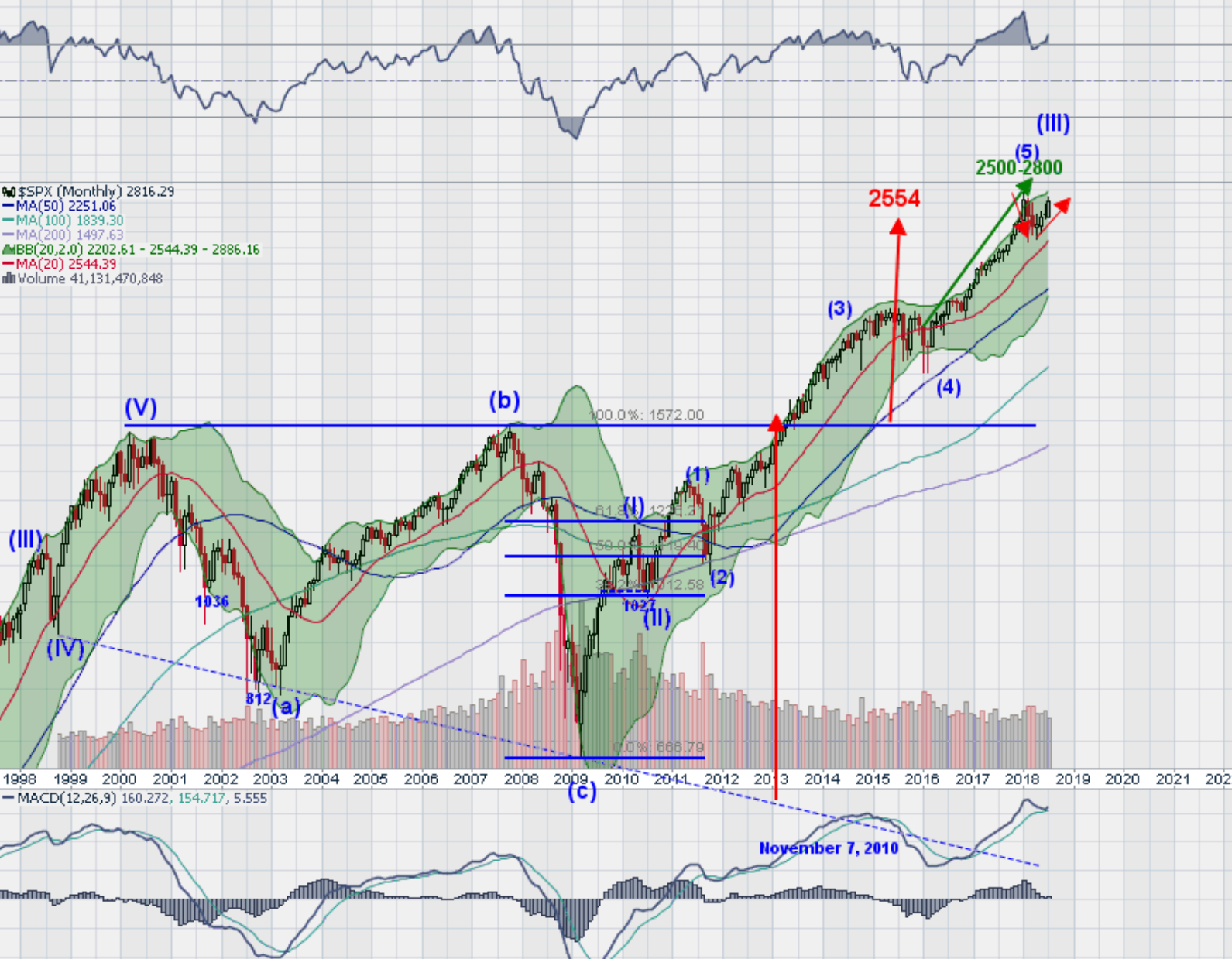

Last week’s review of the macro market indicators noted as the last full week of July ended the equity markets looked tired on the shorter time frame but remained solid on the longer one. Elsewhere looked for Gold (SPDR Gold Shares (NYSE:GLD)) to consolidate in the downtrend while Crude Oil (United States Oil (NYSE:USO)) showed signs of reversing higher at support. The US Dollar Index (DXY) continued to mark time moving sideways while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) pulled back in consolidation.

The Shanghai Composite (Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) was stalling in its bounce in the downtrend while Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) were building strength for a possible reversal higher. Volatility (VXX) looked to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts were showing a lack of energy or maybe even some weakness in the short term, especially in the QQQ and IWM. All looked stronger and remained in the uptrends on the longer timescale.

The week played out with Gold expanding its bottom but drifting lower while Crude Oil met resistance early and fell back but to a higher low. The US dollar broke to the upside, and moved to resistance while Treasuries pushed lower but recovered some late in the week. The Shanghai Composite reversed lower while Emerging Markets met resistance and pulled back but to a higher low.

Volatility dropped to the June low, adding a wind to the backs of equities. The Equity Index ETFs were again mixed, with the IWM and QQQ rising all week after a lower start Monday but the SPY waiting until Thursday to make a move higher. What does this mean for the coming week? Lets look at some charts.

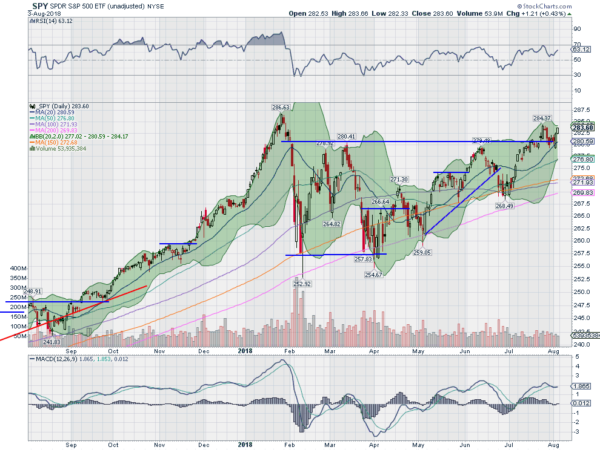

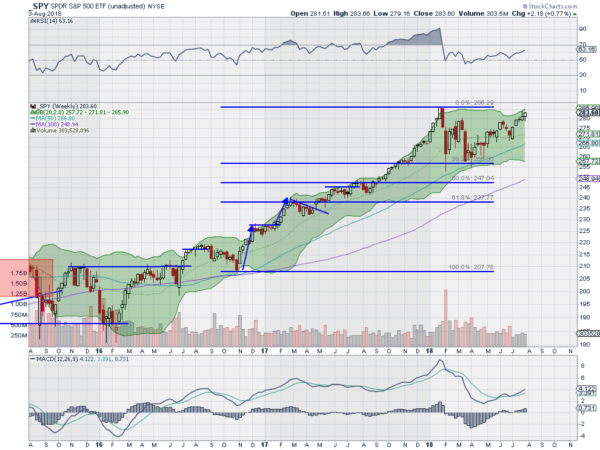

The SPY was pulling back from a push close to the all-time high as the week began. It continued lower Monday and the printed two days inside that candle, holding over the 20 day SMA. Thursday saw a bullish engulfing candle and follow through to the upside Friday to close up on the week. The daily chart shows it nearing the top of tight Bollinger Bands®. The RSI is bullish and turning back higher with the MACD also crossing back up. All suggest more upside in the next week.

The weekly chart shows the 5th straight up week. The RSI on this time frame is rising and bullish with the MACD rising and positive. The Bollinger Bands are also shifted higher. There is resistance at 286 above and a Measured Move to 290. Support lower comes at 283 and 280 then 279 and 277.5 before 274.5. Uptrend.

Heading into the dog days of August the equity markets are looking poised for a move. Elsewhere look for Gold to possibly pause in the downtrend while Crude Oil holds at support in the uptrend. The US Dollar Index is in a possible reversal higher while US Treasuries are pulling back in consolidation. The Shanghai Composite is renewing its downtrend and Emerging Markets are bouncing in a pullback.

Volatility looks to remain very low keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts also show strength with the SPY leading the charge in the short term, the IWM right behind it and the QQQ trying to reverse higher. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.