Investing.com’s stocks of the week

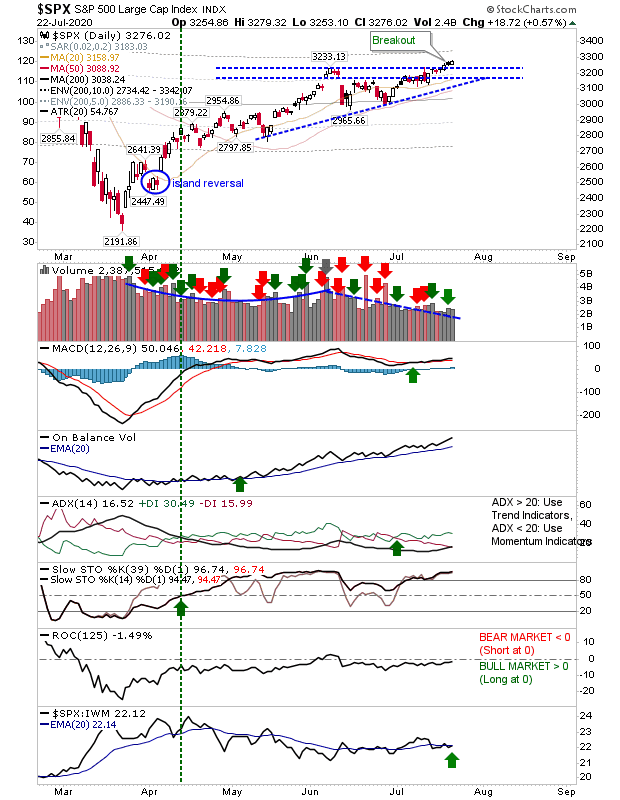

The S&P didn't break resistance with any great fanfare yesterday, and the move lacked volume, but a breakout is a breakout. Technicals are in good shape with bullish momentum particularly strong, and a three month rising accumulation trend.

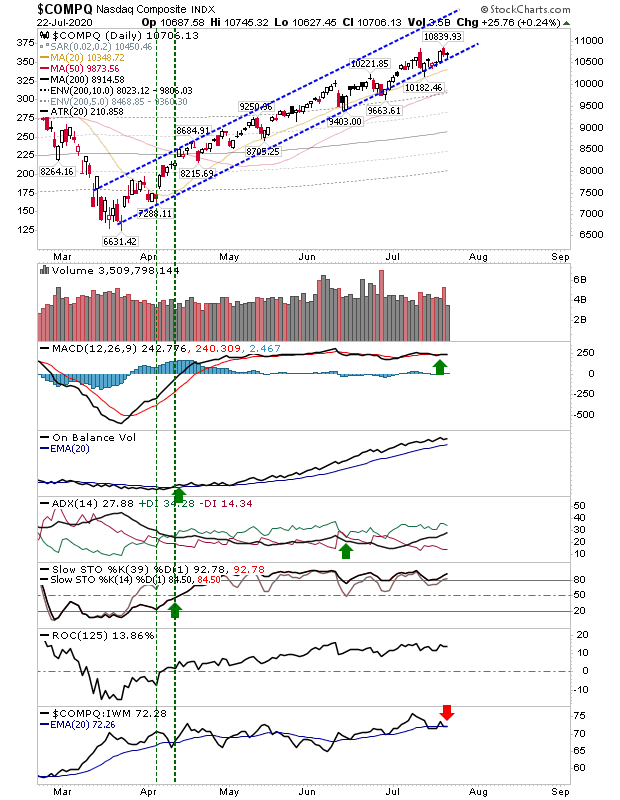

The NASDAQ is riding along channel support albeit closer to a breakdown than a breakout. The MACD has flat-lined, although the last signal was a 'buy' trigger. The index is underperforming relative to the Russell 2000 which is a concern given how far behind the Russell 2000 is from marking new all-time highs.

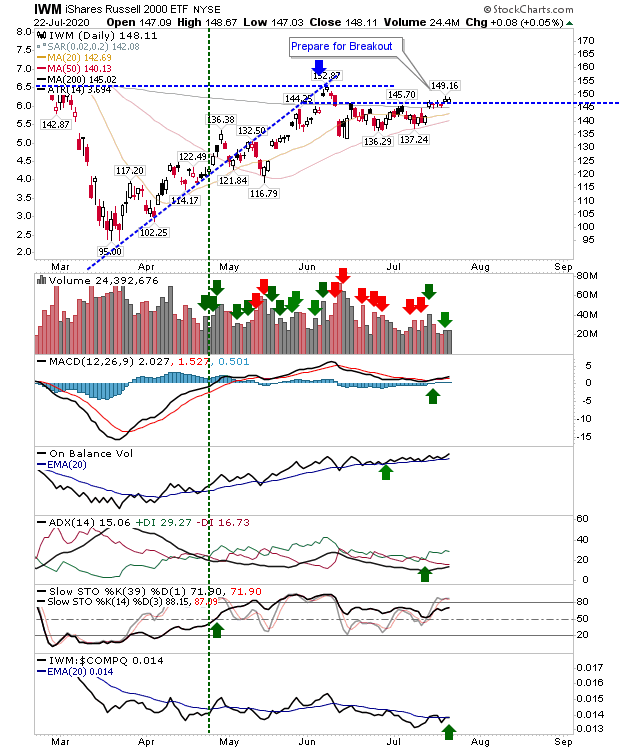

Speaking of the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)), it managed a small base breakout but it hasn't cleared resistance of the June swing high. Trading volume was light, but technicals are net positive and while stochastics are not overbought they have held above the bullish mid-line.

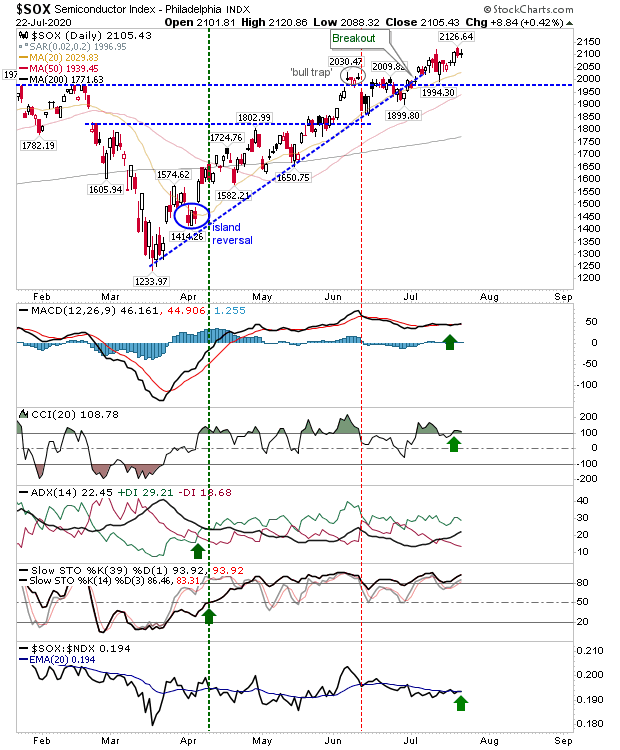

The Semiconductor Index did little yesterday but it has the strongest breakout of the lead indices. Not surprisingly, technicals are net positive.

While we had breakouts in indices yesterday I wouldn't call them substantial moves past resistance. Breakouts should occur with fanfare and what we have seen in the S&P and Russell 2000 wouldn't classify as such. These aren't the kind of moves which encourage buying but there is no reason not to hold existing positions.